Taiwan Advertising Market Size, Share, Trends and Forecast by Type and Region, 2025-2033

Taiwan Advertising Market Overview:

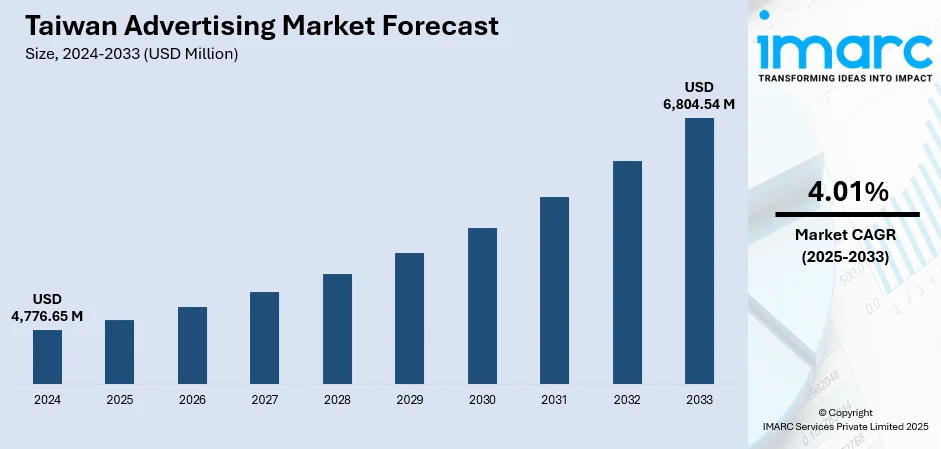

The Taiwan advertising market size reached USD 4,776.65 Million in 2024. The market is projected to reach USD 6,804.54 Million by 2033, exhibiting a growth rate (CAGR) of 4.01% during 2025-2033. The market is evolving with the growth of digital platforms and changing consumer habits. Internet channels like social media, search, and mobile advertising are growing, but traditional media is either flat or negative. Brands leverage technology and local content to connect with their audiences effectively in all regions. The market is also adopting influencer marketing as well as other forms of interactive content. As online trends keep on expanding, they are likely to be an active player in determining the Taiwan advertising market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,776.65 Million |

| Market Forecast in 2033 | USD 6,804.54 Million |

| Market Growth Rate 2025-2033 | 4.01% |

Taiwan Advertising Market Trends:

Strengthened Regulation of Keyword Advertising Practices

In February 2025, Taiwan’s Fair-Trade Commission introduced new guidelines targeting keyword advertising, marking a significant update in how online marketing practices are regulated. These guidelines aim to address misleading ad placements, especially where advertisers use competitor names or trade dress in ways that could mislead consumers. The policy clarifies that such tactics may violate fair competition laws if they deceive users into believing they’re interacting with another business. The regulation reflects a broader shift toward tighter oversight in digital spaces as advertising continues to transition to digital platforms. Brands and agencies are now expected to adopt stricter compliance practices when designing search-driven campaigns, ensuring clear disclosure and accurate representation. For marketers, this means reviewing ad strategies, especially around branded keyword targeting, to avoid regulatory scrutiny. The introduction of this rule underscores Taiwan’s increasing commitment to transparency and consumer protection in digital media. As these standards are enforced, they are likely to influence both campaign design and compliance practices. These changes are also a strong signal of Taiwan advertising market growth, as maturing digital ecosystems prompt more structured governance.

To get more information on this market, Request Sample

Mandatory Anti‑Fraud Measures Shape Digital Advertising Landscape

In 2025, Taiwan enacted new anti‑fraud regulations under the Fraud Crime Hazard Prevention Act, imposing strict obligations on online advertising platforms operating domestically. These rules require platforms to remove fraudulent ads within 24 hours of notification, verify advertiser identities regularly, and publish annual transparency reports detailing removed ads and sponsor information. Platforms must also clearly label sponsored content, disclose advertiser and sponsor credentials, and flag AI-generated or deepfake materials. Non-compliance could result in substantial fines and access restrictions, heightening the risk for digital operators. This shift signals a more accountable ecosystem, where advertisers, platforms, and agencies must strengthen internal fraud-control protocols, audit ad content rigorously, and ensure accurate identity and sponsorship disclosure. The new threshold for removal time and verification frequency reflects growing regulatory momentum targeting deceptive online promotional practices. As Taiwan’s digital ad ecosystem matures, these measures are reshaping expectations around trust, transparency, and responsibility in campaign delivery. These measures are reshaping expectations around trust, transparency, and responsibility in campaign delivery, highlighting key Taiwan advertising market trends.

Expansion of Programmatic Advertising

In 2025, the advertising space in Taiwan is seeing a notable rise in the use of programmatic advertising. Programmatic advertising is driven by AI platforms that execute real-time buys of digital ad inventory, allowing marketers to target specific audiences with high accuracy. The method offers significant advantages over traditional practices by allowing the optimization of budget allocation, dynamic, and scalable campaign management. The rise of programmatic advertising in Taiwan is fueled by the development of data analytics, more precise audience segmentation, and expanding internet and mobile penetration. Advertisers can deliver targeted and relevant content across several channels including social media, video streaming, and mobile apps. The trend towards automation and data-based marketing is worldwide but of most relevance in Taiwan's tech-savvy and digitally active citizenry. Since more and more companies are embracing programmatic methods, it is likely to be the key driver in Taiwan's digital advertising market, contributing heavily towards the growth. This shift underscores the prominence of agility, real-time data, and consumer-centric campaigns for growth in today's marketing.

Taiwan Advertising Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type.

Type Insights:

- Television Advertising

- Print Advertising

- Newspaper Advertising

- Magazine Advertising

- Radio Advertising

- Outdoor Advertising

- Internet Advertising

- Search Advertising

- Display Advertising

- Classified Advertising

- Video Advertising

- Mobile Advertising

- Cinema Advertising

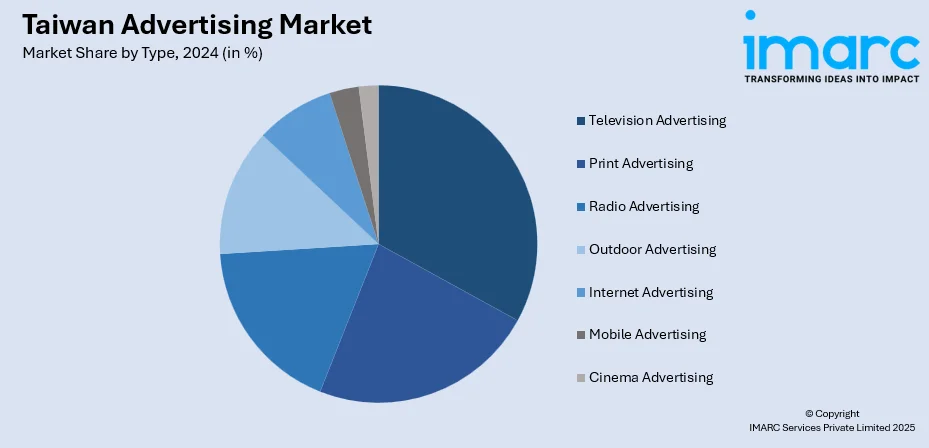

The report has provided a detailed breakup and analysis of the market based on the type. This includes television advertising, print advertising (newspaper advertising and magazine advertising), radio advertising, outdoor advertising, internet advertising (search advertising, display advertising, classified advertising, and video advertising), mobile advertising, and cinema advertising.

Regional Insights:

- Northern Taiwan

- Central Taiwan

- Southern Taiwan

- Eastern Taiwan

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Taiwan, Central Taiwan, Southern Taiwan, and Eastern Taiwan.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Taiwan Advertising Market News:

- April 2025: Taiwan-based TNL Mediagene formed through the merger of Taiwan’s The News Lens Co. and Japan’s Mediagene Inc. is set to launch Business Insider Taiwan in summer 2025. This new Mandarin-language edition is aimed at global Chinese-speaking audiences and builds on the success of Business Insider Japan. The platform will offer editorial coverage of business, technology, and innovation, alongside advertising solutions, video distribution, subscription services, and data analytics. This launch underscores Taiwan’s growing influence as a regional digital media hub.

Taiwan Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Regions Covered | Northern Taiwan, Central Taiwan, Southern Taiwan, Eastern Taiwan |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Taiwan advertising market performed so far and how will it perform in the coming years?

- What is the breakup of the Taiwan advertising market on the basis of type?

- What is the breakup of the Taiwan advertising market on the basis of region?

- What are the various stages in the value chain of the Taiwan advertising market?

- What are the key driving factors and challenges in the Taiwan advertising market?

- What is the structure of the Taiwan advertising market and who are the key players?

- What is the degree of competition in the Taiwan advertising market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Taiwan advertising market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Taiwan advertising market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Taiwan advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)