Taiwan ATM Market Size, Share, Trends and Forecast by Solution, Screen Size, Application, ATM Type, and Region, 2025-2033

Taiwan ATM Market Overview:

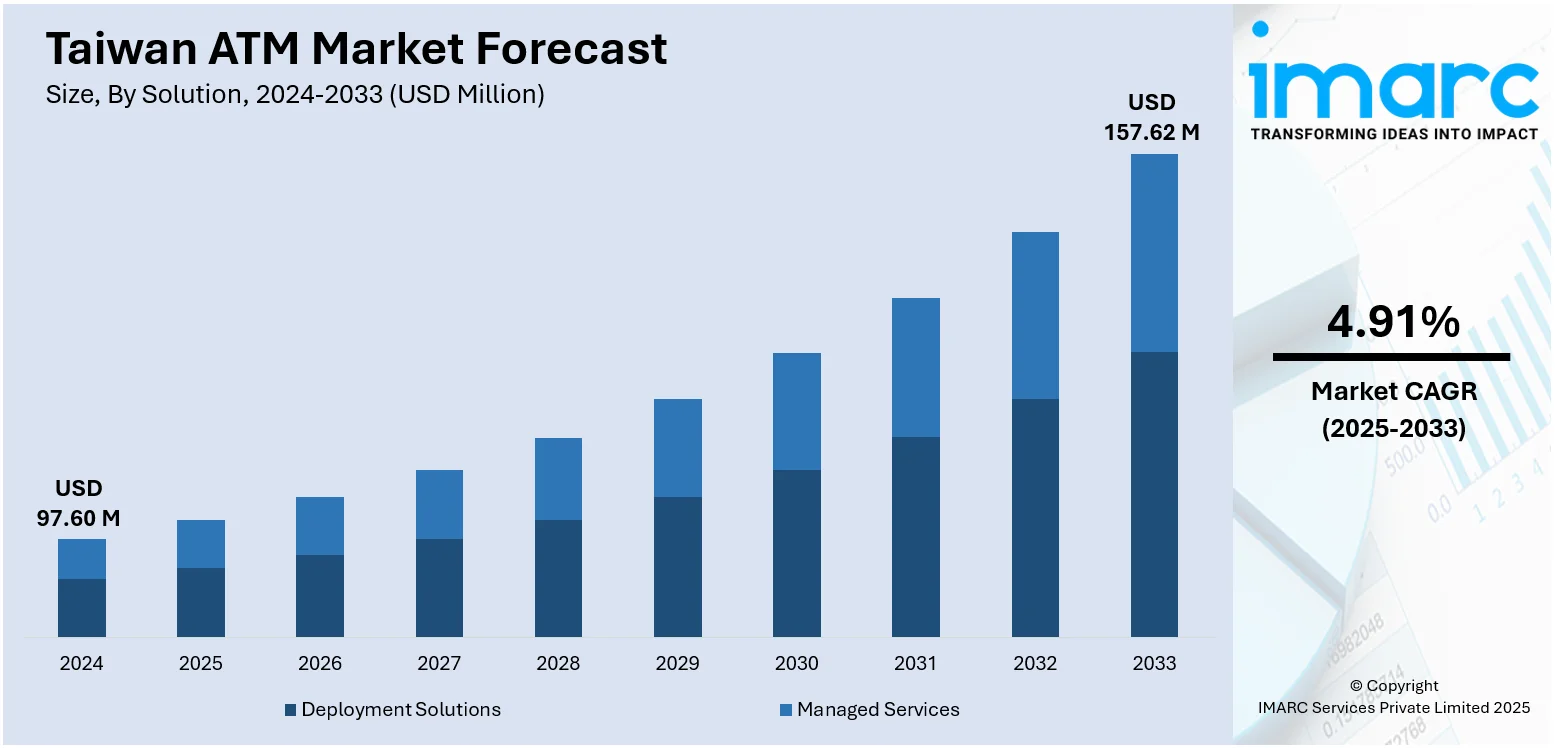

The Taiwan ATM market size reached USD 97.60 Million in 2024. Looking forward, the market is expected to reach USD 157.62 Million by 2033, exhibiting a growth rate (CAGR) of 4.91% during 2025-2033. The market is driven by expansion in cashless transactions, demand for advanced ATMs, and increasing financial inclusion initiatives. Payments through contactless means, integration of mobile banking, and advanced security components are propelling the Taiwan ATM market share considerably.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 97.60 Million |

| Market Forecast in 2033 | USD 157.62 Million |

| Market Growth Rate 2025-2033 | 4.91% |

Taiwan ATM Market Trends:

Adoption of Contactless Payments and Digital Integration

The imperative of seamless and secure payment processes is moving Taiwan's ATM industry towards adopting contactless and digital technologies. Increasing adoption of mobile payments and e-wallets has made banks shift their ATMs to incorporate features such as contactless card readers and phone connectivity. This digital transformation reflects the consumer desire to have quicker and more secure transactions. With the growth in the usage of mobile wallets, banks are integrating them into the platforms of ATMs so that money can be transferred directly from digital wallets to ATMs for the withdrawal of cash. This blending of digital platforms is one of the key factors fuelling Taiwan's ATM market growth, positioning ATMs as multi-channel points of access in a more digitalized banking sector. For instance, in March 2024, Taiwan's Financial Supervisory Commission (FSC) introduced new digital asset regulations to enhance protection for investors. The draft bill will regulate digital asset markets, address fraud risks, and impose penalties on unlicensed virtual asset service providers. Taiwan aims to safeguard the stability of its financial system while overseeing crypto activities.

To get more information on this market, Request Sample

Expansion of ATM Networks in Underserved Areas

To address the needs of underserved and rural populations, Taiwan's financial institutions are expanding their ATM networks to reach more remote areas. For instance, the Ministry of Digital Affairs (moda) in Taiwan announced that from April 10, 2025, over 26,000 ATMs across 15 financial institutions will be available for citizens to withdraw NT$6,000 cash, 24/7. The ministry provided ATM location data for public use and welcomed non-governmental developers to create maps, enhancing accessibility. This initiative is part of a broader effort to increase financial inclusion and provide convenient access to banking services for individuals who may not have easy access to branches. The expansion into rural regions and non-traditional locations, such as retail stores and transportation hubs, is expected to drive further adoption of ATM services. With more strategic placements and increasing usage, this trend is crucial for Taiwan ATM market growth, offering greater access to financial services while reducing reliance on physical branches.

Taiwan ATM Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on solution, screen size, application, and ATM type.

Solution Insights:

- Deployment Solutions

- Onsite ATMs

- Offsite ATMs

- Work Site ATMs

- Mobile ATMs

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the solution. This includes deployment solutions (onsite ATMs, offsite ATMs, work site ATMs, and mobile ATMs) and managed services.

Screen Size Insights:

- 15" and Below

- Above 15"

A detailed breakup and analysis of the market based on the screen size have also been provided in the report. This includes 15" and below and above 15".

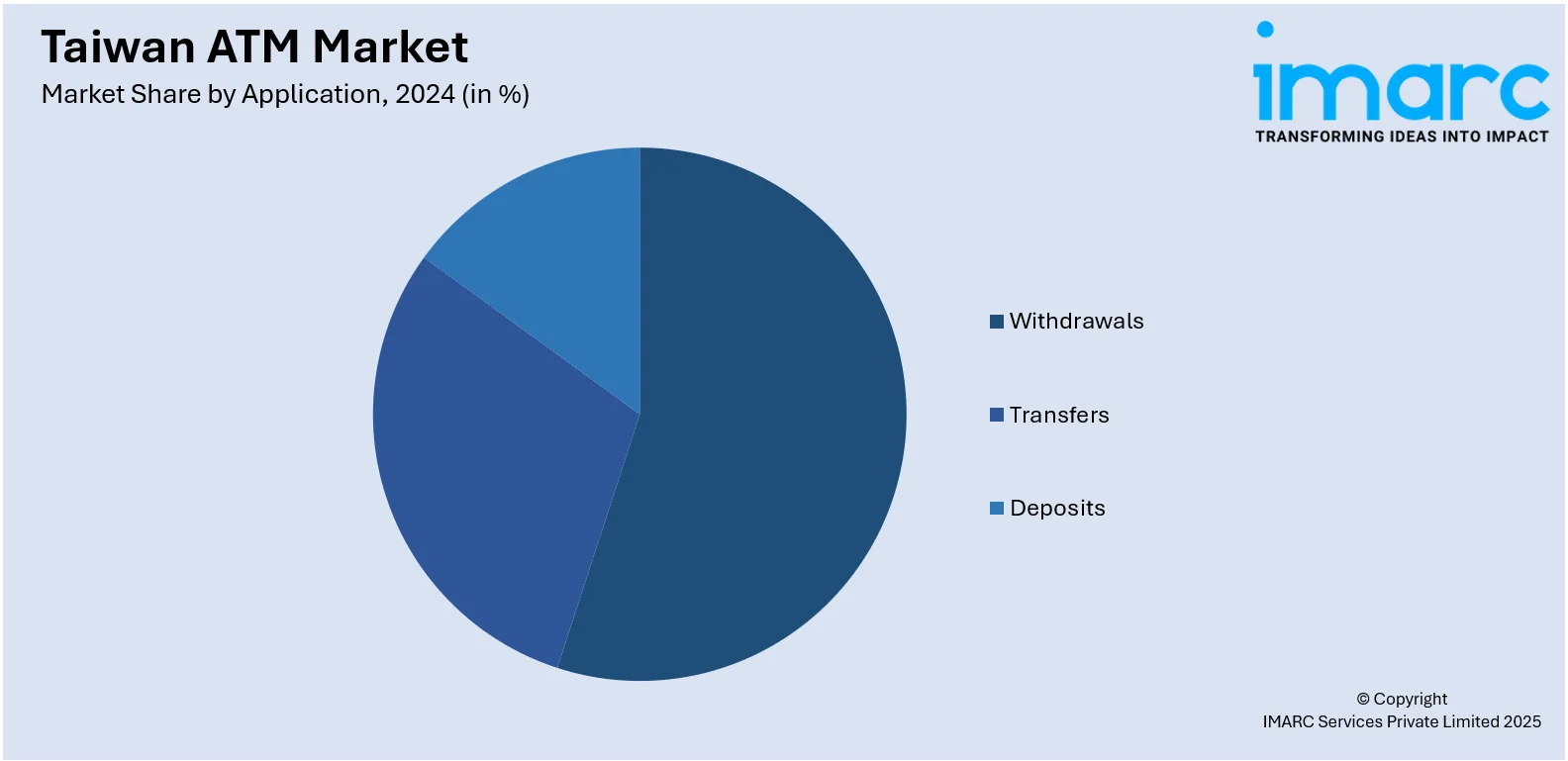

Application Insights:

- Withdrawals

- Transfers

- Deposits

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes withdrawals, transfers, and deposits.

ATM Type Insights:

- Conventional/Bank ATMs

- Brown Label ATMs

- White Label ATMs

- Smart ATMs

- Cash Dispensers

A detailed breakup and analysis of the market based on the ATM type have also been provided in the report. This includes conventional/bank ATMs, brown label ATMs, white label ATMs, smart ATMs, and cash dispensers.

Regional Insights:

- Northern Taiwan

- Central Taiwan

- Southern Taiwan

- Eastern Taiwan

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Taiwan, Central Taiwan, Southern Taiwan, and Eastern Taiwan.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Taiwan ATM Market News:

- In May 2025, Chunghwa Post announced new anti-fraud measures for ATM services, effective July 19, 2025. Transfer accounts will now take two days to activate, allowing customers time to prevent scams. Additionally, the daily withdrawal limit will be reduced from NT$150,000 to NT$100,000 to increase account security.

- In April 2025, Tainan, Taiwan, is launching an AI-driven facial recognition system at ATMs to combat fraud, particularly targeting "money mules" who conceal their identities with masks or helmets. This system will prompt users to remove coverings, with alarms sounding if a face is unregistered within 10-15 seconds. The initiative aims to reduce ATM fraud without blocking transactions, serving as a deterrent.

Taiwan ATM Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Screen Sizes Covered | 15" and Below, Above 15" |

| Applications Covered | Withdrawals, Transfers, Deposits |

| ATM Types Covered | Conventional/Bank ATMs, Brown Label ATMs, White Label ATMs, Smart ATMs, Cash Dispensers |

| Regions Covered | Northern Taiwan, Central Taiwan, Southern Taiwan, Eastern Taiwan |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Taiwan ATM market performed so far and how will it perform in the coming years?

- What is the breakup of the Taiwan ATM market on the basis of solution?

- What is the breakup of the Taiwan ATM market on the basis of screen size?

- What is the breakup of the Taiwan ATM market on the basis of application?

- What is the breakup of the Taiwan ATM market on the basis of ATM type?

- What is the breakup of the Taiwan ATM market on the basis of region?

- What are the various stages in the value chain of the Taiwan ATM market?

- What are the key driving factors and challenges in the Taiwan ATM market?

- What is the structure of the Taiwan ATM market and who are the key players?

- What is the degree of competition in the Taiwan ATM market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Taiwan ATM market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Taiwan ATM market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Taiwan ATM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)