Taiwan Carbon Black Market Size, Share, Trends and Forecast by Type, Grade Wise Application, and Region, 2025-2033

Taiwan Carbon Black Market Overview:

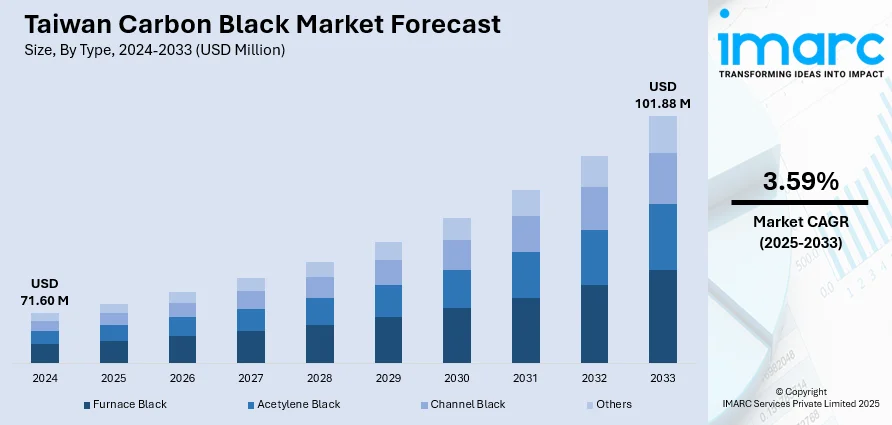

The Taiwan carbon black market size reached USD 71.60 Million in 2024. Looking forward, the market is projected to reach USD 101.88 Million by 2033, exhibiting a growth rate (CAGR) of 3.59% during 2025-2033. The market is driven by Taiwan’s strategic focus on semiconductor packaging, automotive rubber, and specialty polymer applications. Ongoing demand for high-spec plastics, cable sheathing, and composite materials is reinforced by Taiwan’s innovation-led industrial base. As high-end manufacturing expands across sectors, carbon black remains an essential input, further augmenting the Taiwan carbon black market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 71.60 Million |

| Market Forecast in 2033 | USD 101.88 Million |

| Market Growth Rate 2025-2033 | 3.59% |

Taiwan Carbon Black Market Trends:

Semiconductor-Adjacent Demand in Plastics and Packaging

Taiwan’s global dominance in semiconductor manufacturing has indirect but significant spillover effects on specialty packaging, ESD (electrostatic discharge) protection, and cleanroom-grade polymers, all key applications for specialty carbon black. Carbon black is widely used in conductive masterbatches and anti-static compounds for plastic trays, reels, wafer carriers, and cleanroom containers that transport sensitive chips. These require consistent electrical conductivity, color stability, and low ionic contamination. Taiwan’s plastics industry has evolved to meet strict semiconductor-grade packaging specifications, with manufacturers in Taichung, Hsinchu, and Kaohsiung optimizing carbon black loading to achieve both mechanical and electrostatic shielding performance. In this context, demand for low-residue, high-purity carbon black grades has intensified, especially from midstream suppliers to TSMC and other foundries. Taiwan carbon black market growth is being accelerated by the country’s leadership in electronics, which has elevated requirements across polymer packaging and adjacent cleanroom logistics segments.

To get more information on this market, Request Sample

Growth in Tire Manufacturing and Automotive Rubber Applications

Although not a major global tire exporter, Taiwan sustains a steady domestic demand for tires and rubber components driven by a strong motorcycle market, aftermarket automotive segment, and light vehicle assembly. Carbon black is a cornerstone raw material for tires, providing wear resistance, tensile strength, and thermal durability. Taiwanese producers such as Cheng Shin Rubber and Federal Tire maintain consistent demand for carbon black to support both local consumption and niche export products. The country’s advanced quality control processes and material testing protocols ensure that only high-dispersion, low-contaminant carbon blacks are used, particularly for performance-oriented two-wheeler and scooter tires. Additionally, Taiwan’s small but growing presence in EV component manufacturing is fostering demand for weather- and ozone-resistant rubber parts like seals, hoses, and grommets, applications that depend on optimized carbon black reinforcement. This sustained need across varied rubber segments underscores the material’s strategic value to Taiwan’s automotive and industrial sectors.

Demand from Functional Coatings, Inks, and Composite Materials

Taiwan’s export-driven manufacturing economy includes robust production of industrial coatings, flexible packaging inks, and fiber-reinforced composites, each incorporating carbon black for performance, opacity, and UV protection. In architectural and marine coatings, carbon black is used in anticorrosive primers and high-durability black finishes, supporting the country’s shipbuilding and infrastructure industries. Printing inks for high-speed flexible packaging, used in food, electronics, and pharmaceuticals, also rely on specialty carbon black for uniformity and rich pigmentation. Moreover, Taiwan’s expanding use of carbon black in thermoplastic composites and cable jacketing reflects rising demand for functional additives in the electrical and electronics sector. Composite applications are particularly relevant in lightweighting for industrial equipment and transport components. As Taiwan continues to push high-spec manufacturing in both export and domestic sectors, specialty carbon black will remain integral to achieving the optical, mechanical, and protective properties these advanced formulations require.

Taiwan Carbon Black Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and grade wise application.

Type Insights:

- Furnace Black

- Acetylene Black

- Channel Black

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes furnace black, acetylene black, channel black, and others.

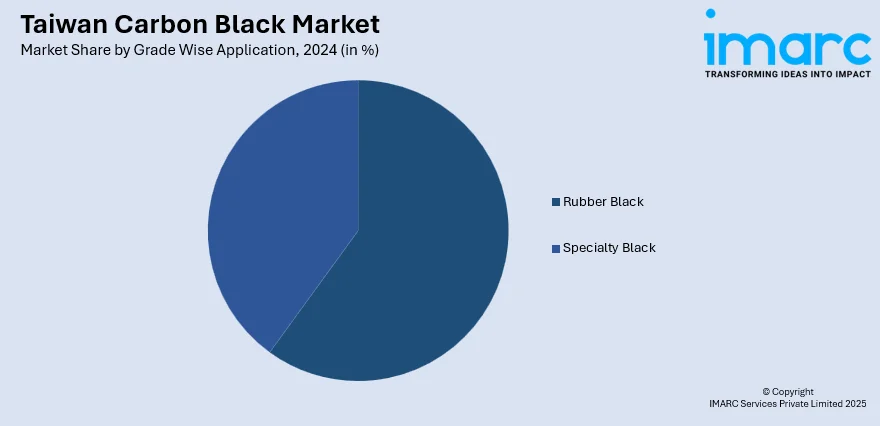

Grade Wise Application Insights:

- Rubber Black

- Tire Treads

- Inner Liner and Tubes

- Conveyor Belts

- Hoses

- Others

- Specialty Black

- Plastics

- Ink and Toners

- Paint and Coatings

- Wires and Cables

- Others

The report has provided a detailed breakup and analysis of the market based on the grade wise application. This includes rubber black (tire treads, inner liner and tubes, conveyor belts, hoses, and others) and specialty black (plastics, ink and toners, paint and coatings, wires and cables, and others).

Regional Insights:

- Northern Taiwan

- Central Taiwan

- Southern Taiwan

- Eastern Taiwan

The report has also provided a comprehensive analysis of all major regional markets. This includes Northern Taiwan, Central Taiwan, Southern Taiwan, and Eastern Taiwan.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Taiwan Carbon Black Market News:

- In July 2025, CSRC launched new products such as “Satin Black JE6900” (high-conductivity carbon black for wires/cables) and “Continex CC503X” (sustainable, circular carbon black). They are working with major industry partners, like Maxxis, for incorporating sustainable carbon black in tires. CSRC is also in early-stage development of single-wall carbon nanotubes for use in lithium battery applications.

Taiwan Carbon Black Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Acetylene Black, Channel Black, Others |

| Grade Wise Applications Covered |

|

| Regions Covered | Northern Taiwan, Central Taiwan, Southern Taiwan, Eastern Taiwan |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Taiwan carbon black market performed so far and how will it perform in the coming years?

- What is the breakup of the Taiwan carbon black market on the basis of type?

- What is the breakup of the Taiwan carbon black market on the basis of grade wise application?

- What is the breakup of the Taiwan carbon black market on the basis of region?

- What are the various stages in the value chain of the Taiwan carbon black market?

- What are the key driving factors and challenges in the Taiwan carbon black market?

- What is the structure of the Taiwan carbon black market and who are the key players?

- What is the degree of competition in the Taiwan carbon black market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Taiwan carbon black market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Taiwan carbon black market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Taiwan carbon black industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)