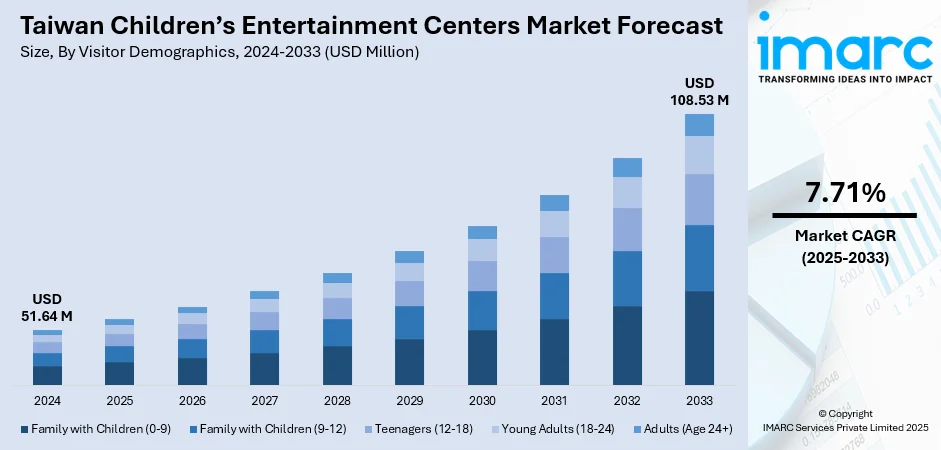

Taiwan Children’s Entertainment Centers Market Size, Share, Trends and Forecast by Visitor Demographics, Facility Size, Revenue Source, Activity Area, and Region, 2025-2033

Taiwan Children’s Entertainment Centers Market Overview:

The Taiwan children’s entertainment centers market size reached USD 51.64 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 108.53 Million by 2033, exhibiting a growth rate (CAGR) of 7.71% during 2025-2033. Rising disposable income, dual-income households, and increased focus on child development are some of the factors contributing to the Taiwan children’s entertainment centers market share. Urbanization boosts access, while digital integration and themed attractions enhance appeal. Government support for family recreation and growing tourism also drive market expansion across Taiwan’s metro and regional areas.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 51.64 Million |

| Market Forecast in 2033 | USD 108.53 Million |

| Market Growth Rate 2025-2033 | 7.71% |

Taiwan Children’s Entertainment Centers Market Trends:

Growing Focus on Family-Friendly Entertainment Spaces

Children’s entertainment is becoming a key feature in large retail environments across Taiwan. New developments are blending shopping, dining, and interactive experiences tailored for families. These spaces often include dedicated zones for kids, immersive play centers, and a variety of leisure options that go beyond traditional retail. The aim is to create all-in-one destinations where families can spend extended time together. Major cities are seeing more of these formats emerge, with consistent expansion in both offerings and locations. This approach reflects a shift in how developers prioritize family engagement, making children's experiences a core part of modern retail environments rather than an add-on. The concept is gaining ground and influencing how future developments are planned. These factors are intensifying the Taiwan children’s entertainment centers market growth. For example, in March 2025, Mitsui Fudosan confirmed the grand opening of Mitsui Shopping Park LaLaport TAIPEI NANGANG. The facility features around 280 shops, including LOPIA supermarket and KidZania entertainment center. With cinemas and restaurants set to open by 2026, the total will reach 300 outlets. This marks Mitsui’s second LaLaport in Taiwan and strengthens its retail presence across Taipei, Taichung, and Tainan.

To get more information on this market, Request Sample

Entertainment-Driven Retail Formats Redefining Family Outings

In Taiwan, children’s entertainment centers are shaping how families interact with retail environments. These spaces are no longer confined to traditional play zones; they’re being integrated into shopping complexes as core features that influence layout, tenant mix, and customer flow. Parents increasingly prefer destinations where children can engage in hands-on, educational, or role-play experiences, allowing adults time to relax, dine, or browse. This demand is encouraging developers to design malls as family-friendly hubs where convenience and entertainment intersect. Weekends, in particular, see higher foot traffic in locations that offer kid-focused experiences alongside supermarkets, restaurants, and casual retail. Operators are leveraging these patterns to boost repeat visits and lengthen dwell time. The inclusion of branded children’s attractions within malls also builds early loyalty and fosters a sense of familiarity with the location. As this model proves effective in cities like Taipei, Taichung, and Tainan, more developments are likely to follow suit. The format reflects a broader shift toward spaces that cater to full-family needs, turning a simple shopping trip into a multi-activity outing anchored by meaningful, child-friendly experiences.

Taiwan Children’s Entertainment Centers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on visitor demographics, facility size, revenue source, and activity area.

Visitor Demographics Insights:

- Family with Children (0-9)

- Family with Children (9-12)

- Teenagers (12-18)

- Young Adults (18-24)

- Adults (Age 24+)

The report has provided a detailed breakup and analysis of the market based on the visitor demographics. This includes family with children (0-9), family with children (9-12), teenagers (12-18), young adults (18-24), and adults (age 24+).

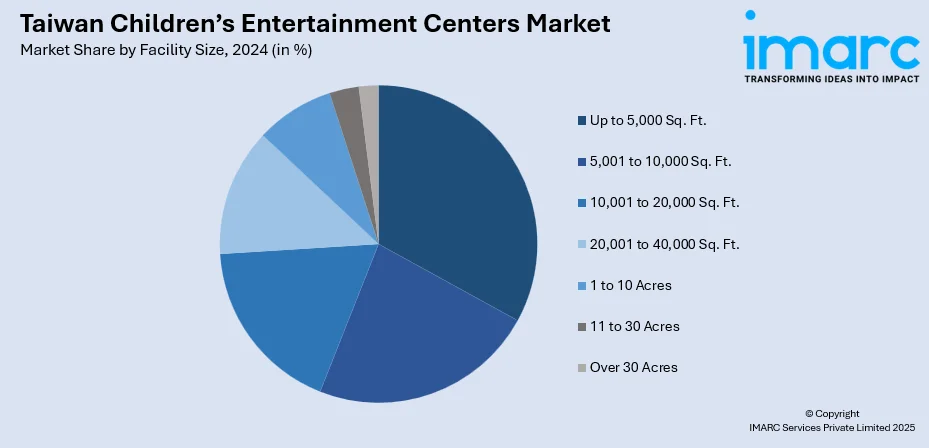

Facility Size Insights:

- Up to 5,000 Sq. Ft.

- 5,001 to 10,000 Sq. Ft.

- 10,001 to 20,000 Sq. Ft.

- 20,001 to 40,000 Sq. Ft.

- 1 to 10 Acres

- 11 to 30 Acres

- Over 30 Acres

The report has provided a detailed breakup and analysis of the market based on the facility size. This includes up to 5,000 sq. ft., 5,001 to 10,000 sq. ft., 10,001 to 20,000 sq. ft., 20,001 to 40,000 sq. ft., 1 to 10 acres, 11 to 30 acres, and over 30 acres.

Revenue Source Insights:

- Entry Fees and Ticket Sales

- Food and Beverages

- Merchandising

- Advertising

- Others

The report has provided a detailed breakup and analysis of the market based on the revenue source. This includes entry fees and ticket sales, food and beverages, merchandising, advertising, and others.

Activity Area Insights:

- Arcade Studios

- AR and VR Gaming Zone

- Physical Play Activities

- Skill/Competition Games

- Others

A detailed breakup and analysis of the market based on the activity area have also been provided in the report. This includes arcade studios, AR and VR gaming zone, physical play activities, skill/competition games, and others.

Regional Insights:

- Northern Taiwan

- Central Taiwan

- Southern Taiwan

- Eastern Taiwan

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Taiwan, Central Taiwan, Southern Taiwan, and Eastern Taiwan.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Taiwan Children’s Entertainment Centers Market News:

- In August 2025, Taipei Performing Arts Center announced its upcoming children’s highlight: “The Very Hungry Caterpillar Show,” set for December 19–21. Performed in English with 75 vibrant puppets, the show adapts Eric Carle’s beloved books. This move signals a growing push in Taiwan’s children’s entertainment market, with the center aiming to offer high-quality, engaging theatrical experiences that blend international appeal with local creative energy.

Taiwan Children’s Entertainment Centers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Visitor Demographics Covered | Family with Children (0-9), Family with Children (9-12), Teenagers (12-18), Young Adults (18-24), Adults (Age 24+) |

| Facility Sizes Covered | Up to 5,000 Sq. Ft., 5,001 to 10,000 Sq. Ft., 10,001 to 20,000 Sq. Ft., 20,001 to 40,000 Sq. Ft., 1 to 10 Acres, 11 to 30 Acres, Over 30 Acres |

| Revenue Sources Covered | Entry Fees and Ticket Sales, Food and Beverages, Merchandising, Advertising, Others |

| Activity Areas Covered | Arcade Studios, AR and VR Gaming Zone, Physical Play Activities, Skill/Competition Games, Others |

| Regions Covered | Northern Taiwan, Central Taiwan, Southern Taiwan, Eastern Taiwan |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Taiwan children’s entertainment centers market performed so far and how will it perform in the coming years?

- What is the breakup of the Taiwan children’s entertainment centers market on the basis of visitor demographics?

- What is the breakup of the Taiwan children’s entertainment centers market on the basis of facility size?

- What is the breakup of the Taiwan children’s entertainment centers market on the basis of revenue source?

- What is the breakup of the Taiwan children’s entertainment centers market on the basis of activity area?

- What is the breakup of the Taiwan children’s entertainment centers market on the basis of region?

- What are the various stages in the value chain of the Taiwan children’s entertainment centers market?

- What are the key driving factors and challenges in the Taiwan children’s entertainment centers market?

- What is the structure of the Taiwan children’s entertainment centers market and who are the key players?

- What is the degree of competition in the Taiwan children’s entertainment centers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Taiwan children’s entertainment centers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Taiwan children’s entertainment centers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Taiwan children’s entertainment centers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)