Taiwan Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel, Industry Vertical, and Region, 2025-2033

Taiwan Commercial Insurance Market Overview:

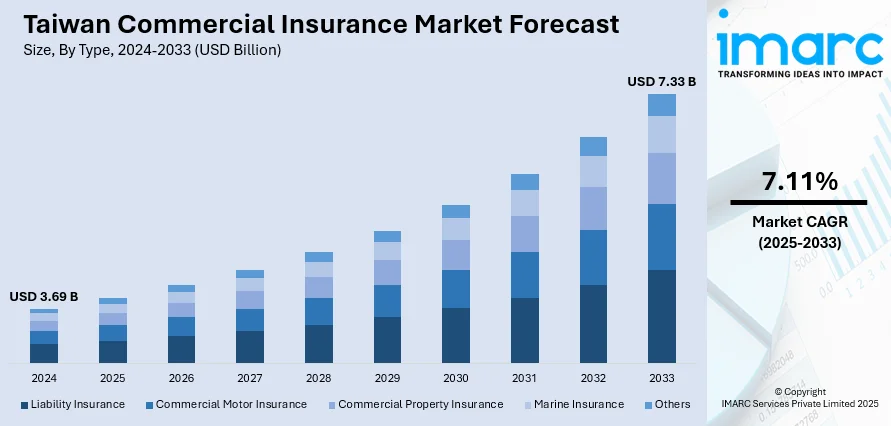

The Taiwan commercial insurance market size reached USD 3.69 Billion in 2024. The market is projected to reach USD 7.33 Billion by 2033, exhibiting a growth rate (CAGR) of 7.11% during 2025-2033. The market is expanding with growing adoption of digital insurance platforms and advanced risk management solutions. Moreover, increasing focus on disaster preparedness and cybersecurity protection continues to strengthen Taiwan commercial insurance market share across diverse business sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.69 Billion |

| Market Forecast in 2033 | USD 7.33 Billion |

| Market Growth Rate 2025-2033 | 7.11% |

Taiwan Commercial Insurance Market Trends:

Digital Transformation Driving Insurance Growth

Taiwan's commercial insurance industry is experiencing a robust digitalization, with companies quickly moving to online channels for policy choice, claims handling, and customer service. The use of artificial intelligence, cloud computing, and big data is allowing insurers to offer personalized solutions and improve risk analysis. Mobile apps and web portals are increasingly being used by small- and medium-sized businesses to access cheap and transparent insurance solutions. The shift also decreases administrative lags, enhances claim settlement effectiveness, and enables insurers to cover a greater pool of customers. The COVID-19 pandemic boosted this shift, as firms gave top priority to remote management of policies and virtual services. In addition, insurers are implementing automated underwriting tools and predictive technologies to lower the cost of operations and enhance decision-making. The efficiency, accessibility, and personalization of digital platforms is driving more companies to purchase commercial insurance. As Taiwan solidifies its role as a technology-based economy, the use of digital-first insurance services is likely to grow even further, making digitalization one of the strongest forces driving the long-term development of commercial insurance business.

To get more information on this market, Request Sample

Expanding Focus on Comprehensive Risk Coverage

The demand for advanced risk coverage is gaining momentum in Taiwan’s commercial insurance market as businesses face rising uncertainties. Frequent natural disasters, including earthquakes and typhoons, have prompted companies to secure policies that ensure business continuity and financial protection. At the same time, increasing exposure to cyberattacks, data theft, and supply chain disruptions has made risk management a top priority for many organizations. Export-oriented companies and multinational firms are particularly investing in broader policies covering liability, business interruption, and cybersecurity. Regulatory authorities are also encouraging businesses to maintain strong compliance standards, which has accelerated the adoption of structured risk coverage solutions. High-value industries such as electronics, healthcare, and manufacturing are further driving the demand for specialized insurance products tailored to their operational risks. To meet these requirements, insurers are expanding offerings with sector-specific coverage and integrated risk management services. This evolution marks a shift from basic protection to strategic planning, as organizations aim to build resilience and safeguard long-term growth. Growing awareness about operational vulnerabilities and the rising importance of financial security are expected to keep risk management solutions at the center of Taiwan’s commercial insurance expansion.

Taiwan Commercial Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, enterprise size, distribution channel, and industry vertical.

Type Insights:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes liability insurance, commercial motor insurance, commercial property insurance, marine insurance, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

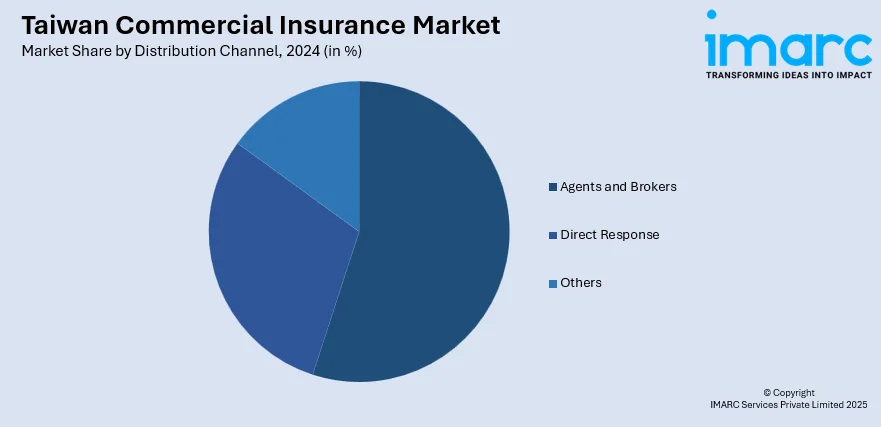

Distribution Channel Insights:

- Agents and Brokers

- Direct Response

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes agents and brokers, direct response, and others.

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes transportation and logistics, manufacturing, construction, it and telecom, healthcare, energy and utilities, and others.

Regional Insights:

- Northern Taiwan

- Central Taiwan

- Southern Taiwan

- Eastern Taiwan

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Taiwan, Central Taiwan, Southern Taiwan, and Eastern Taiwan.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Taiwan Commercial Insurance Market News:

- August 2025: IXT partnered with Richmond Insurance Brokers to launch Taiwan’s first digital commercial insurance platform, integrating products from major insurers and cybersecurity risk assessment tools. This development enhanced accessibility for SMEs, streamlined policy processes, and significantly strengthened Taiwan commercial insurance market growth.

- April 2025: Taiwan’s Financial Supervisory Commission proposed regulatory amendments to launch digital insurers, requiring 20% innovation-driven premiums, easing entry rules, and expanding review committees. This initiative boosted InsurTech adoption, fostered competition, and supported the long-term growth of Taiwan commercial insurance market development.

Taiwan Commercial Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | Northern Taiwan, Central Taiwan, Southern Taiwan, Eastern Taiwan |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Taiwan commercial insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Taiwan commercial insurance market on the basis of type?

- What is the breakup of the Taiwan commercial insurance market on the basis of enterprise size?

- What is the breakup of the Taiwan commercial insurance market on the basis of distribution channel?

- What is the breakup of the Taiwan commercial insurance market on the basis of industry vertical?

- What is the breakup of the Taiwan commercial insurance market on the basis of region?

- What are the various stages in the value chain of the Taiwan commercial insurance market?

- What are the key driving factors and challenges in the Taiwan commercial insurance market?

- What is the structure of the Taiwan commercial insurance market and who are the key players?

- What is the degree of competition in the Taiwan commercial insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Taiwan commercial insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Taiwan commercial insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Taiwan commercial insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)