Taiwan Drones Market Size, Share, Trends and Forecast by Type, Component, Payload, Point of Sale, End-Use Industry, and Region, 2025-2033

Taiwan Drones Market Overview:

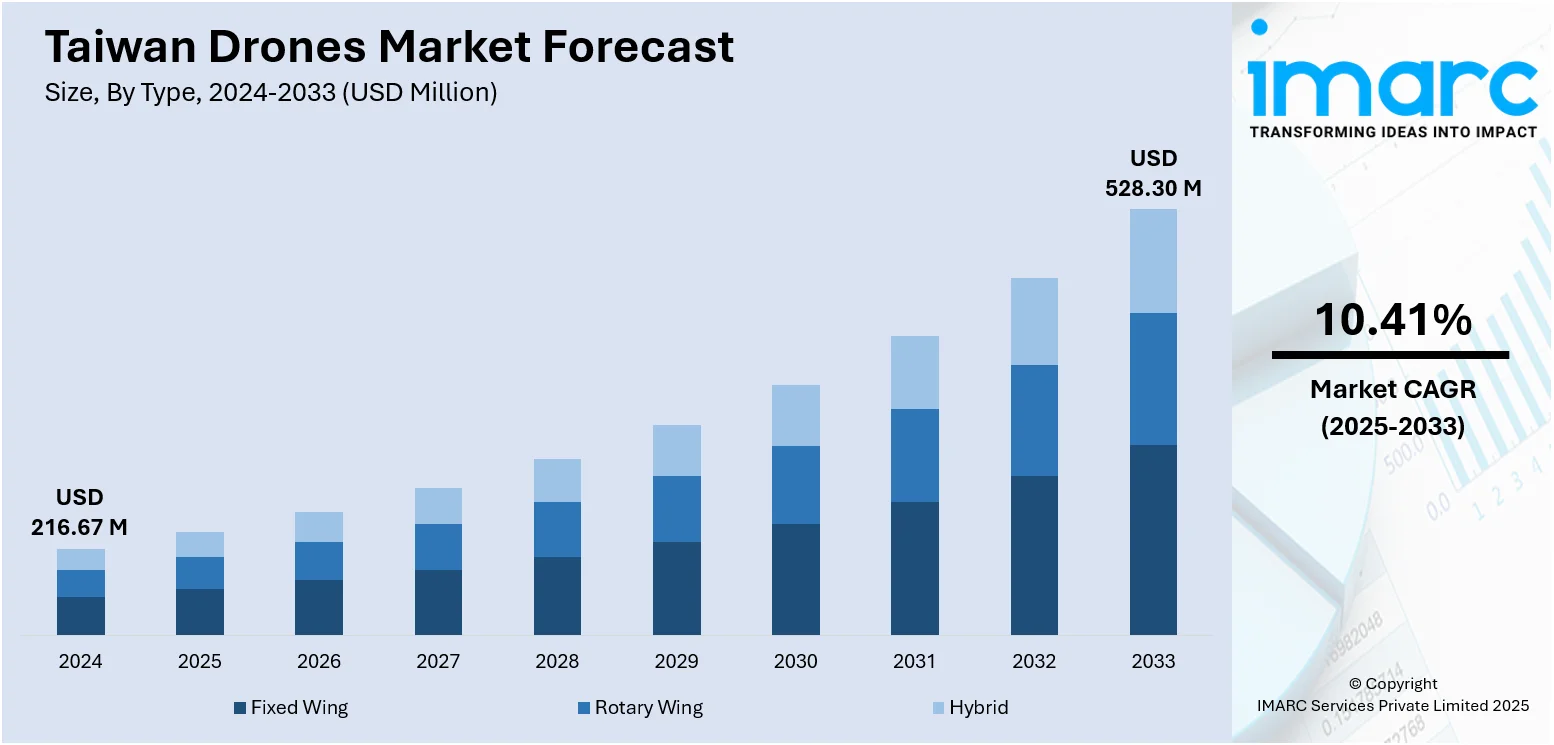

The Taiwan drones market size reached USD 216.67 Million in 2024. Looking forward, the market is expected to reach USD 528.30 Million by 2033, exhibiting a growth rate (CAGR) of 10.41% during 2025-2033. The market is spurred by demand from agriculture, industrial inspection, and national defense. Government promotion of smart farming and infrastructure surveillance drives additional take-up of drones. Increasing geopolitical tensions have further spurred investment in surveillance and defense-grade drones. Taiwan's strong electronics manufacturing sector and university-driven R&L programs facilitate fast innovation and domestic production of drone equipment, leading to gradual expansion in Taiwan drones market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 216.67 Million |

| Market Forecast in 2033 | USD 528.30 Million |

| Market Growth Rate 2025-2033 | 10.41% |

Taiwan Drones Market Trends:

Agricultural Modernization and High-Tech Farming Integration

The market for drones in Taiwan is changing fast as the island seeks agricultural modernization and high-tech farming integration, most notably in such provinces as Yunlin and Chiayi, which are famous for rice, fruit orchards, and tea cultivation. Local agriculturalists are using drones with multispectral cameras and thermal imaging to track crop health, identify pests, and streamline irrigation in difficult terrain. Tea plantation foothills and terraced slopes benefit from the precise aerial application of fertilizers or targeted insecticide treatment offered by drones, minimizing labor expense and environmental influence. In addition, Taiwan's Smart Agriculture government-backed programs have promoted drone deployment on pilot farms, integrating UAV information with IoT sensors in soil and microclimate observation. Precision spraying and remote field analysis are becoming increasingly popular in greenhouses across Taichung and Miaoli, where controlled environments take advantage of UAV-assisted humidity and disease control. This overlap of conventional farming with unmanned aerial systems makes Taiwan a testing ground for drone-powered agricultural efficiency and sustainability aligned with its topographically diverse farmland, which also supports the Taiwan drones market growth and development.

To get more information on this market, Request Sample

Industrial Inspection and Smart Infrastructure Management

Taiwan's robust industrial foundation, ranging from semiconductor fabs in Hsinchu Science Park to giant power plants and seacoast ports, has driven the demand for drones in facility inspection and infrastructure monitoring. For upkeep of biotech campuses and high-tech plants, drones with thermal or LiDAR sensors carry out structural inspection, roof and exterior surveys, and sense overheating areas without disrupting operations. Taiwanese electronics producers and industrial companies also employ UAVs for the management of solar panel arrays and wind turbine platforms, especially in offshore farms off Penghu and offshore industrial parks. Maritime or island power installations are aided by drones for vortex or corrosion inspection where there is limited access on the surface. Urban planning organizations in Taipei and Kaohsiung use drones to inspect aging bridges, detect river embankment instability, and aid flood control readiness. The synergy of advanced manufacturing, high-density infrastructure, and disaster resilience makes this inspection and infrastructure-management trend very robust in Taiwan's drone sector.

Security, Border Surveillance, and Defensive Innovation

Geopolitical factors and national security needs are having deep impacts on Taiwan's market trends in drones. With tensions continuing across the Taiwan Strait, national defense plans now include more usage of UAVs for coastal and maritime monitoring of eastern and western seaboards. Taiwanese security forces and coastal patrols employ drones to monitor prospective incursions, observe vessel movement, and assist search and rescue efforts in open seas. Parallel to this, Taiwan’s homegrown drone startups and defense contractors are innovating in counter‑drone systems and anti‑jam communication platforms suited to island defense. Large public events and high-density urban gatherings in places like Taipei’s Xinyi district deploy drone surveillance and crowd-monitoring tools integrated into urban control networks. In partnership with institutions such as National Cheng Kung University, local scientists have been working on drone platforms that can function in signal-jamming conditions and employ mesh-network communication. Such integration of defense research, civilian security usage, and national development is a characteristically Taiwanese trend combining military-strength UAV design with wider civilian applicability.

Taiwan Drones Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, payload, point of sale, and end-use industry.

Type Insights:

- Fixed Wing

- Rotary Wing

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the type. This includes fixed wing, rotary wing, and hybrid.

Component Insights:

- Hardware

- Software

- Accessories

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and accessories.

Payload Insights:

- <25 Kilograms

- 25-170 Kilograms

- >170 Kilograms

A detailed breakup and analysis of the market based on the payload have also been provided in the report. This includes <25 Kilograms, 25-170 Kilograms, and >170 Kilograms.

Point of Sale Insights:

- Original Equipment Manufacturers (OEM)

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the point of sale. This includes original equipment manufacturers (OEM) and aftermarket.

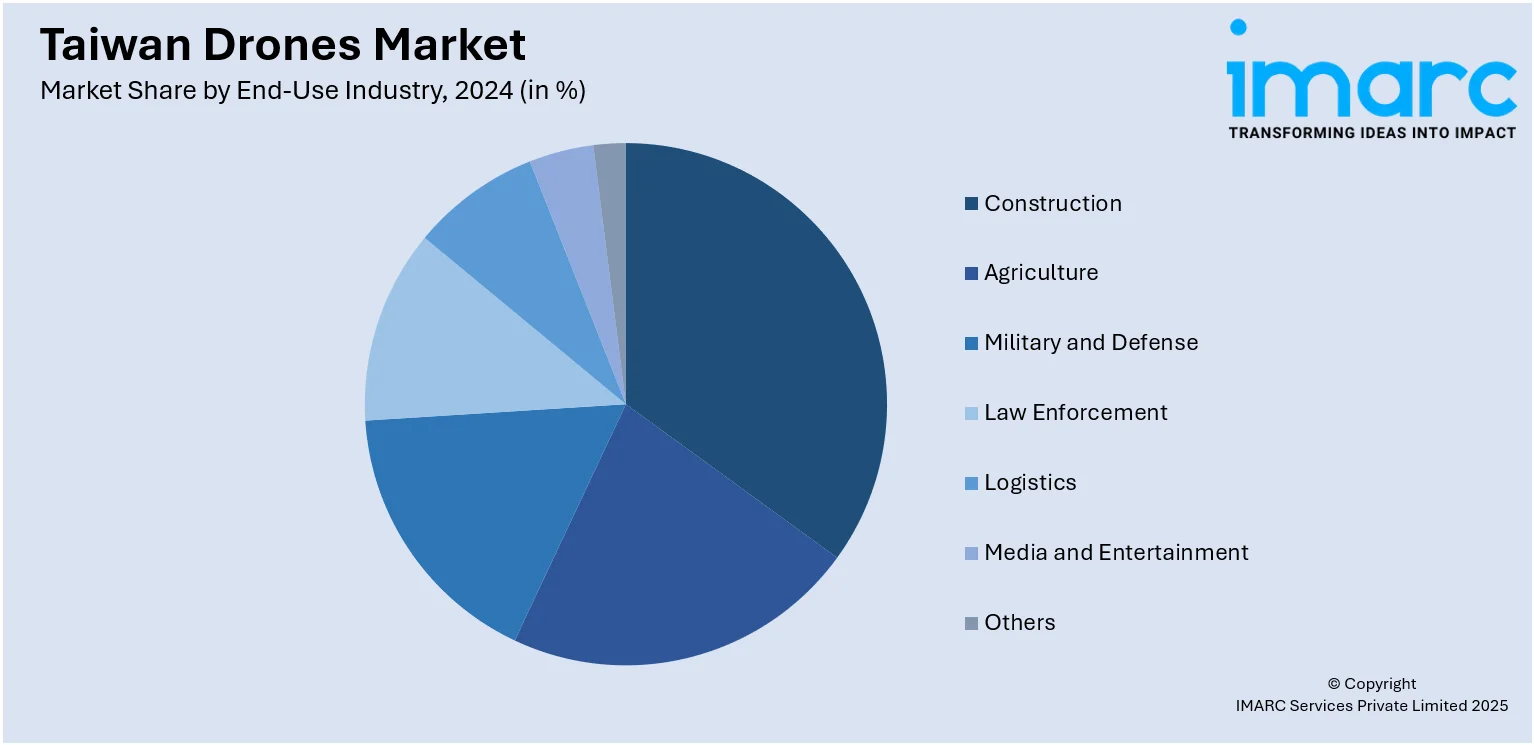

End-Use Industry Insights:

- Construction

- Agriculture

- Military and Defense

- Law Enforcement

- Logistics

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes construction, agriculture, military and defense, law enforcement, logistics, media and entertainment, and others.

Regional Insights:

- Northern Taiwan

- Central Taiwan

- Southern Taiwan

- Eastern Taiwan

The report has also provided a comprehensive analysis of all the major regional markets, which includes Northern Taiwan, Central Taiwan, Southern Taiwan, and Eastern Taiwan.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Taiwan Drones Market News:

- In August 2025, it was reported that Taiwan's National Chung-Shan Institute of Science and Technology (NCSIST) signed a memorandum of understanding with the US defense company Anduril for acquiring a command-and-control system along with unmanned aerial systems (UAS). The agreement focuses on Anduril’s Lattice software-driven command and control decision-making system. In July, the company received a $99.6-million contract to spearhead a consortium in creating a next-generation command and control (NGC2) prototype for the US Army. The NGC2 aims to facilitate quicker, more unified decision-making throughout the service by aiding in sensor-to-shooter data merging and decision-making resources for mechanized platforms.

- In June 2025, Taiwan intended to trial a locally developed kamikaze sea drone later this month as it aims to enhance its naval defenses amid increasing pressure from mainland China. The ship – designed under the project name "Kuai Chi Project" by the National Chung-Shan Institute of Science and Technology (NCSIST), Taiwan’s leading arms manufacturer – will face combat readiness assessments later this month prior to additional testing later in the same year.

Taiwan Drones Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing, Rotary Wing, Hybrid |

| Components Covered | Hardware, Software, Accessories |

| Payloads Covered | <25 Kilograms, 25-170 Kilograms, >170 Kilograms |

| Points of Sales Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| End-Use Industries Covered | Construction, Agriculture, Military and Defense, Law Enforcement, Logistics, Media and Entertainment, Others |

| Regions Covered | Northern Taiwan, Central Taiwan, Southern Taiwan, Eastern Taiwan |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Taiwan drones market performed so far and how will it perform in the coming years?

- What is the breakup of the Taiwan drones market on the basis of type?

- What is the breakup of the Taiwan drones market on the basis of component?

- What is the breakup of the Taiwan drones market on the basis of payload?

- What is the breakup of the Taiwan drones market on the basis of point of sale?

- What is the breakup of the Taiwan drones market on the basis of end-use industry?

- What is the breakup of the Taiwan drones market on the basis of region?

- What are the various stages in the value chain of the Taiwan drones market?

- What are the key driving factors and challenges in the Taiwan drones market?

- What is the structure of the Taiwan drones market and who are the key players?

- What is the degree of competition in the Taiwan drones market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Taiwan drones market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Taiwan drones market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Taiwan drones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)