Taiwan Duty-Free and Travel Retail Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Taiwan Duty-Free and Travel Retail Market Overview:

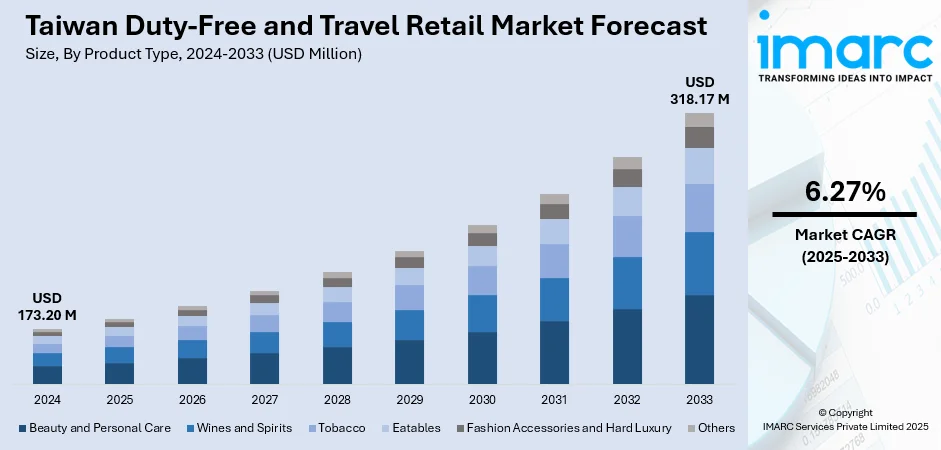

The Taiwan duty-free and travel retail market size reached USD 173.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 318.17 Million by 2033, exhibiting a growth rate (CAGR) of 6.27% during 2025-2033. Rising inbound tourism, strong airport infrastructure, increased consumer demand for luxury goods, strategic airport retail placement, growth in digital duty-free platforms, and supportive government policies boosting travel and retail sectors post-COVID recovery are some of the factors contributing to the Taiwan duty-free and travel retail market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 173.20 Million |

| Market Forecast in 2033 | USD 318.17 Million |

| Market Growth Rate 2025-2033 | 6.27% |

Taiwan Duty-Free and Travel Retail Market Trends:

Airport Retail Spaces as Cultural Gateways

In Taiwan, retail development within airports is evolving beyond shopping to create immersive, culturally meaningful environments. Recent enhancements to airport facilities focus on integrating local heritage, elevating traveler experiences through curated dining, retail, and public services. These initiatives support tourism by positioning airports as welcoming entry points that reflect national identity. Collaboration between government and private operators is also gaining momentum, reshaping duty-free zones into thoughtfully designed, multi-functional spaces that serve both commercial and cultural purposes. This approach not only attracts international visitors but also boosts domestic pride and engagement, creating a distinct sense of place. As competition between airports intensifies, Taiwan is leaning into design and service innovation to differentiate itself in the global travel retail space. These factors are intensifying the Taiwan duty-free and travel retail market growth. For example, in June 2025, Ever Rich Duty Free completed its Terminal 2 Concourse C Duty Free and Public Services Project at Taoyuan International Airport. The five-year project enhances retail, dining, and public amenities, reflecting a traveler-focused and culturally rooted design. It also introduces a new standard for private-public partnerships in Taiwan, strengthening Taoyuan Airport’s reputation as a premium cultural and commercial travel hub.

To get more information on this market, Request Sample

Locally Rooted Premium Product Collaborations

Taiwan’s travel retail environment is seeing a shift toward exclusive, culturally anchored collaborations that spotlight local craftsmanship. Recent product launches tied to traditional distilling methods and agricultural rhythms reflect a growing focus on authenticity and heritage. These limited-edition offerings, available only through duty-free channels, serve dual purposes: they attract global travelers looking for meaningful souvenirs and strengthen Taiwan’s cultural identity abroad. Emphasizing seasonal ingredients like sorghum and symbolic design elements, such releases connect deeply with Taiwan’s natural and artisanal roots. This approach not only elevates the perception of domestic brands but also distinguishes Taiwan’s travel retail scene with offerings that are unique, story-driven, and not easily found elsewhere, reinforcing its appeal in a competitive regional market. For instance, in April 2025, Everrich Duty Free partnered again with Kinmen Kaoliang Liquor to launch Time Collection 6.56 Batch No.2 and 6.61 Batch No.2, available exclusively in Everrich stores. Building on last year’s limited-edition releases, the new expressions highlight Taiwan’s craftsmanship and seasonal sorghum cycle. The green-labelled 6.56 symbolizes rebirth, offering a soft woody aroma and smooth finish. The collaboration continues to promote Taiwan’s cultural identity through its duty-free and travel retail presence.

Taiwan Duty-Free and Travel Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Beauty and Personal Care

- Wines and Spirits

- Tobacco

- Eatables

- Fashion Accessories and Hard Luxury

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes beauty and personal care, wines and spirits, tobacco, eatables, fashion accessories and hard luxury, and others.

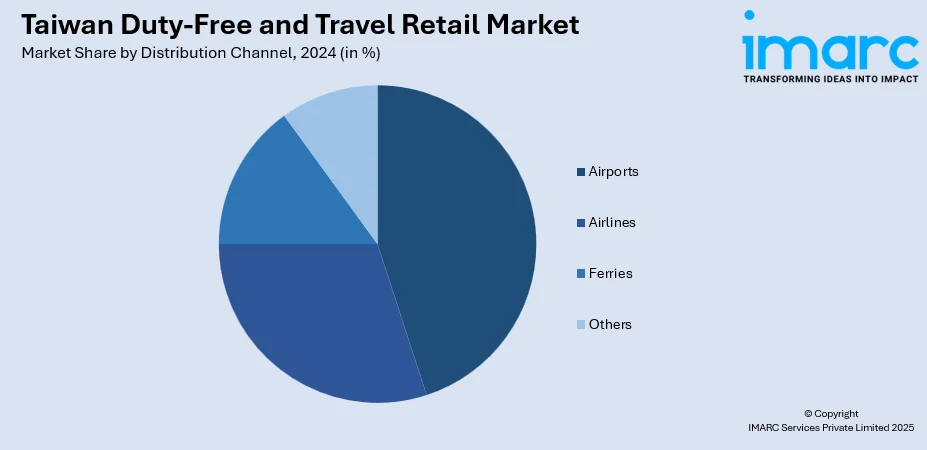

Distribution Channel Insights:

- Airports

- Airlines

- Ferries

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes airports, airlines, ferries, and others.

Regional Insights:

- Northern Taiwan

- Central Taiwan

- Southern Taiwan

- Eastern Taiwan

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Taiwan, Central Taiwan, Southern Taiwan, and Eastern Taiwan.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Taiwan Duty-Free and Travel Retail Market News:

- In July 2025, Lotte Duty Free launched LINE Pay Taiwan across all its South Korean stores in July, easing payments for Taiwanese tourists. Taiwan was South Korea’s third-largest visitor market in Q1 2024, supporting a 30 percent year-on-year surge in Lotte sales. Taiwanese tourists, mainly leisure travelers, had ranked fourth in spending. A special LINE Pay promotion ran through 30 September, underscoring Taiwan’s growing influence in the regional duty-free and travel retail market.

Taiwan Duty-Free and Travel Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Beauty and Personal Care, Wines and Spirits, Tobacco, Eatables, Fashion Accessories and Hard Luxury, Others |

| Distribution Channels Covered | Airports, Airlines, Ferries, Others |

| Regions Covered | Northern Taiwan, Central Taiwan, Southern Taiwan, Eastern Taiwan |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Taiwan duty-free and travel retail market performed so far and how will it perform in the coming years?

- What is the breakup of the Taiwan duty-free and travel retail market on the basis of product type?

- What is the breakup of the Taiwan duty-free and travel retail market on the basis of distribution channel?

- What is the breakup of the Taiwan duty-free and travel retail market on the basis of region?

- What are the various stages in the value chain of the Taiwan duty-free and travel retail market?

- What are the key driving factors and challenges in the Taiwan duty-free and travel retail market?

- What is the structure of the Taiwan duty-free and travel retail market and who are the key players?

- What is the degree of competition in the Taiwan duty-free and travel retail market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Taiwan duty-free and travel retail market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Taiwan duty-free and travel retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Taiwan duty-free and travel retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)