Taiwan Electric Two-Wheeler Market Size, Share, Trends and Forecast by Vehicle Type, Battery Type, Voltage Type, Peak Power, Battery Technology, Motor Placement, and Region, 2025-2033

Taiwan Electric Two-Wheeler Market Overview:

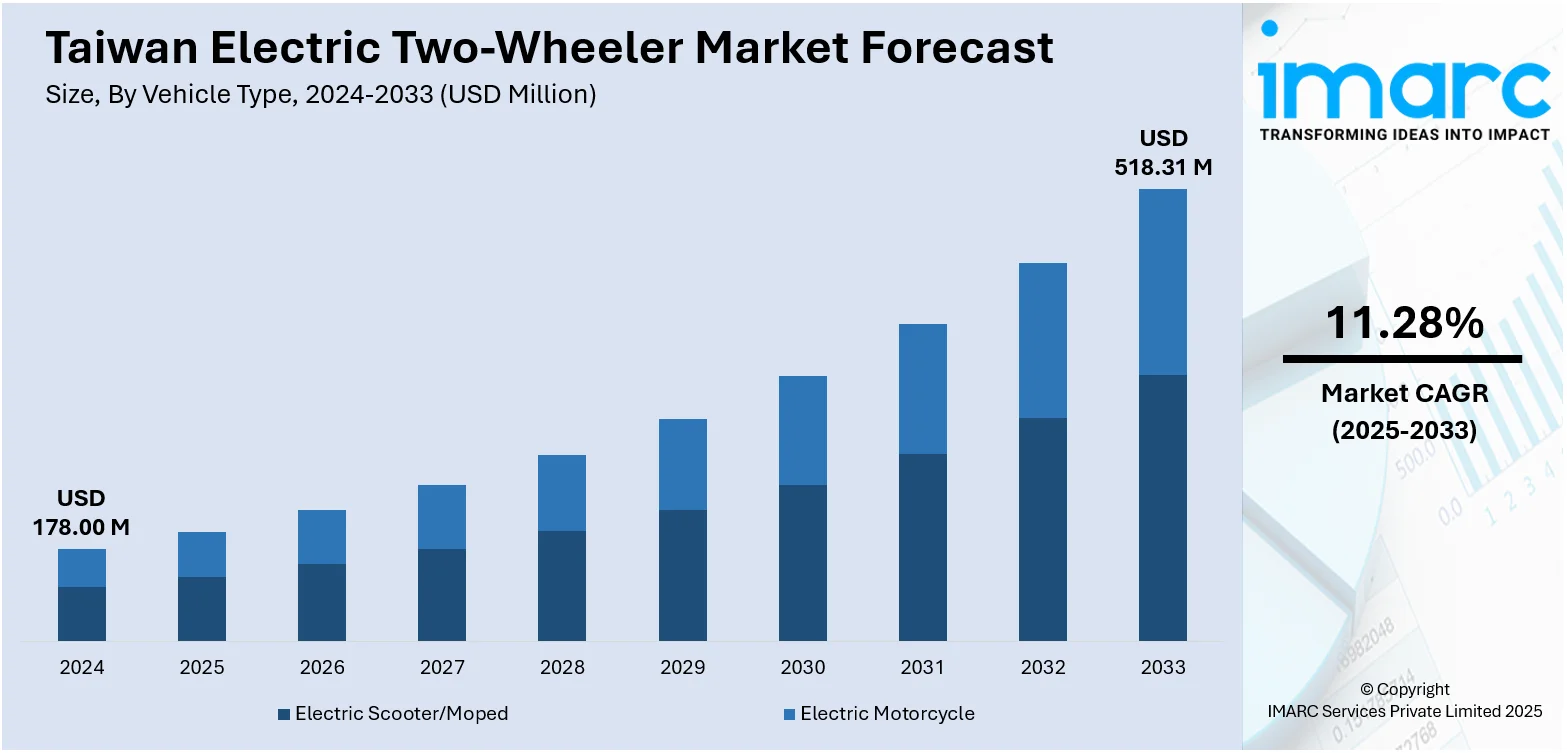

The Taiwan electric two-wheeler market size reached USD 178.00 Million in 2024. The market is projected to reach USD 518.31 Million by 2033, exhibiting a growth rate (CAGR) of 11.28% during 2025-2033. The market includes strong government incentives, such as subsidies and tax breaks, rising environmental awareness, and strict emission regulations. The island’s dense urban areas and short commuting distances make electric scooters ideal for daily transportation. Additionally, advancements in battery technology and the expansion of charging and battery-swapping infrastructure, led by companies like Gogoro, enhance convenience and consumer adoption. Growing fuel costs and the increasing popularity of smart mobility solutions also accelerate Taiwan electric two-wheeler market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 178.00 Million |

| Market Forecast in 2033 | USD 518.31 Million |

| Market Growth Rate 2025-2033 | 11.28% |

Taiwan Electric Two-Wheeler Market Trends:

Government Incentives and Regulations

The Taiwanese government has a very important role in encouraging electric two-wheelers through a wide array of incentives and regulation. Subsidies are provided for buying electric scooters, particularly for the replacement of old gasoline-powered vehicles. These cost subsidies cut down considerably on the initial expense for customers, making electric options more appealing. The government also enforces stricter emission standards and lays down long-term targets for the withdrawal of fossil fuel vehicles, compelling manufacturers and consumers to turn to cleaner options. The local governments further encourage the shift by providing tax rebates, free parking, and lower registration prices for electric scooters. All these policy initiatives have helped provide an encouraging environment for the electric two-wheeler sector to flourish. By integrating ecological ambitions with economic gain, Taiwan has been able to successfully promote rapid adoption of electric vehicles, and hence government intervention is a key driver of Taiwan electric two-wheeler market growth.

To get more information on this market, Request Sample

Urbanization and Suitable Infrastructure

Taiwan’s high population density and compact cities like Taipei and Kaohsiung make electric two-wheelers an ideal transport solution. With heavy traffic and limited parking, residents prefer lightweight, agile vehicles that fit urban lifestyles. Electric scooters perfectly meet these needs, especially as public and private sectors expand supporting infrastructure. Gogoro, for instance, serves over 500,000 monthly users with nearly 11,000 battery cabinets across 2,240+ locations, offering convenient battery-swapping that eliminates charging delays. These stations are often within 500 meters of riders in major cities, reducing range anxiety and maximizing daily usability. The integration of this infrastructure into daily routines enhances practicality and consumer confidence. As urban populations grow and environmental concerns intensify, electric two-wheelers present a clean, efficient, and cost-effective mobility option. This alignment of urban needs, convenience, and infrastructure development is a key driver that accelerates the adoption of electric scooters in Taiwan’s evolving transportation landscape.

Advancements in Technology and Local Innovation

Technological innovation is a major driver of Taiwan electric two-wheeler market trend, led by companies like Gogoro. These firms are producing advanced electric scooters that often outperform gasoline models in speed, efficiency, and user features. Gogoro’s battery-swapping ecosystem powers around 12 million swaps per month, showcasing its scalability and consumer trust. Innovations like the “Swap & Go” system eliminate charging wait times, making battery replacement quick and hassle-free. Additionally, smart features such as app integration, GPS tracking, and customizable ride modes enhance safety and user experience. Improvements in motor performance and battery life further boost appeal across demographics. Taiwan’s robust manufacturing capabilities and highly digital consumer base accelerate the adoption of these technologies. This dynamic tech evolution positions Taiwan not just as a domestic innovator but as a global leader in electric mobility, pushing the boundaries of two-wheeler technological capabilities.

Taiwan Electric Two-Wheeler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on vehicle type, battery type, voltage type, peak power, battery technology, and motor placement.

Vehicle Type Insights:

- Electric Scooter/Moped

- Electric Motorcycle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes electric scooter/moped, and electric motorcycle.

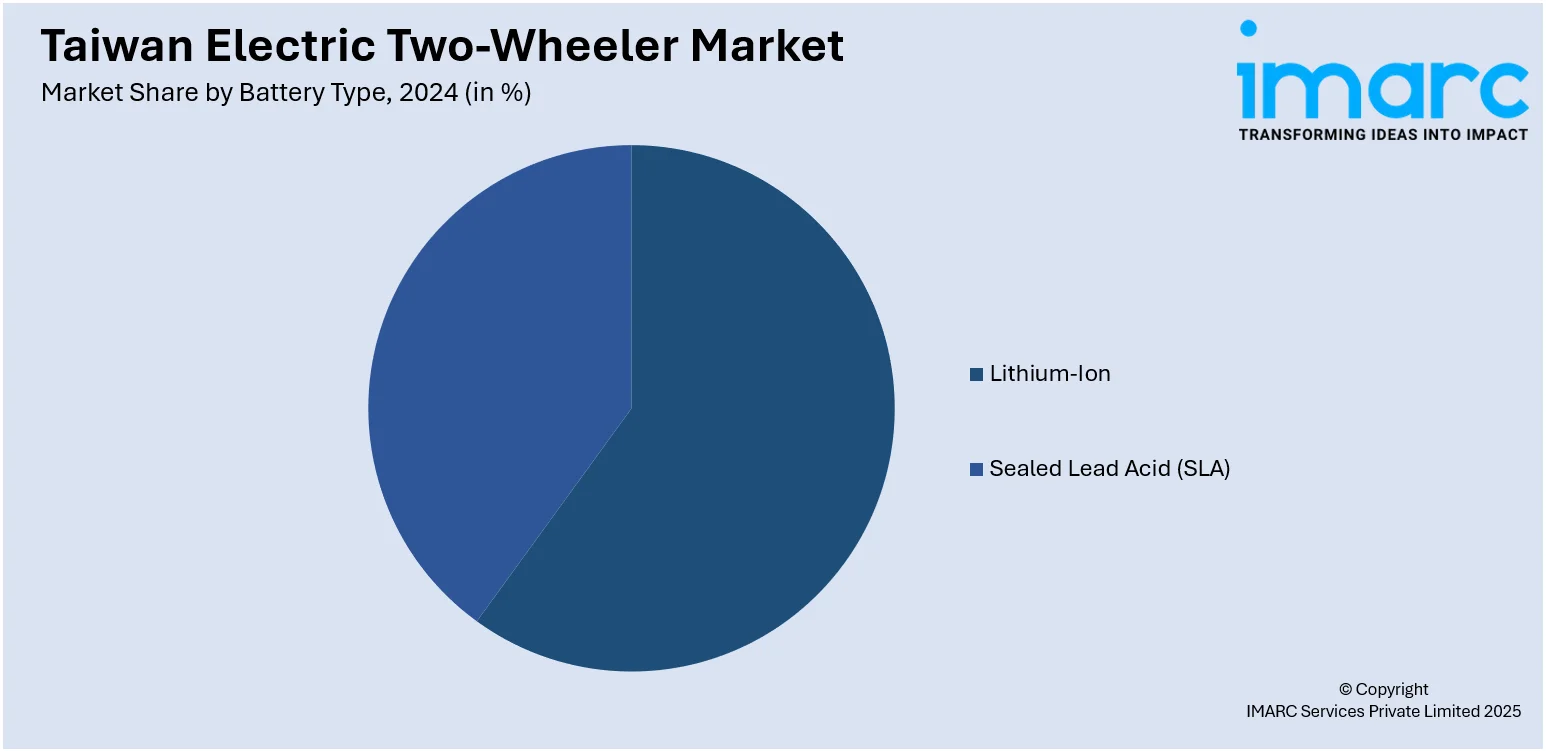

Battery Type Insights:

- Lithium-Ion

- Sealed Lead Acid (SLA)

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-ion, and sealed lead acid (SLA).

Voltage Type Insights:

- <48V

- 48-60V

- 61-72V

- 73-96V

- >96V

A detailed breakup and analysis of the market based on the voltage type have also been provided in the report. This includes <48V, 48-60V, 61-72V, 73-96V, and >96V.

Peak Power Insights:

- <3 kW

- 3-6 kW

- 7-10 kW

- >10 kW

A detailed breakup and analysis of the market based on the peak power have also been provided in the report. This includes <3 kW, 3-6 kW, 7-10 kW, and >10 kW.

Battery Technology Insights:

- Removable

- Non-Removable

A detailed breakup and analysis of the market based on the battery technology have also been provided in the report. This includes removable, and non-removable.

Motor Placement Insights:

- Hub Type

- Chassis Mounted

A detailed breakup and analysis of the market based on the motor placement have also been provided in the report. This includes hub type, and chassis mounted.

Regional Insights:

- Northern Taiwan

- Central Taiwan

- Southern Taiwan

- Eastern Taiwan

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Taiwan, Central Taiwan, Southern Taiwan, and Eastern Taiwan.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Taiwan Electric Two-Wheeler Market News:

- In March 2024, Gogoro launched its new JEGO Smartscooter in Taiwan, seeing strong sales momentum in its first week nearly eight times its 2024 weekly L1 sales and triple those of February 2023. Priced from just $760 after subsidies, JEGO targets a broader commuter market. Its success is backed by Gogoro’s 12,000+ battery-swap stations and a new low-cost subscription plan starting at $7/month for 1,000 km.

- In January 2024, Taiwan-based electric scooter maker Gogoro launched its premium Pulse series, developed in collaboration with U.S. chipmaker Qualcomm Technologies. The flagship e-scooters feature advanced smart capabilities and mark Gogoro’s push into high-end EV mobility. This partnership leverages Qualcomm’s cutting-edge processing technology to enhance performance, connectivity, and user experience, positioning the Pulse series as a top-tier option in the electric two-wheeler market.

Taiwan Electric Two-Wheeler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Electric Scooter/Moped, Electric Motorcycle |

| Battery Types Covered | Lithium-Ion, Sealed Lead Acid (SLA) |

| Voltage Types Covered | <48V, 48-60V, 61-72V, 73-96V, >96V |

| Peak Powers Covered | <3 kW, 3-6 kW, 7-10 kW, >10 kW |

| Battery Technologies Covered | Removable, Non-Removable |

| Motor Placements Covered | Hub Type, Chassis Mounted |

| Regions Covered | Northern Taiwan, Central Taiwan, Southern Taiwan, Eastern Taiwan |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Taiwan electric two-wheeler market performed so far and how will it perform in the coming years?

- What is the breakup of the Taiwan electric two-wheeler market on the basis of vehicle type?

- What is the breakup of the Taiwan electric two-wheeler market on the basis of battery type?

- What is the breakup of the Taiwan electric two-wheeler market on the basis of voltage type?

- What is the breakup of the Taiwan electric two-wheeler market on the basis of peak power?

- What is the breakup of the Taiwan electric two-wheeler market on the basis of battery technology?

- What is the breakup of the Taiwan electric two-wheeler market on the basis of motor placement?

- What is the breakup of the Taiwan electric two-wheeler market on the basis of region?

- What are the various stages in the value chain of the Taiwan electric two-wheeler market?

- What are the key driving factors and challenges in the Taiwan electric two-wheeler market?

- What is the structure of the Taiwan electric two-wheeler market and who are the key players?

- What is the degree of competition in the Taiwan electric two-wheeler market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Taiwan electric two-wheeler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Taiwan electric two-wheeler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Taiwan electric two-wheeler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)