Taiwan Foreign Exchange Market Size, Share, Trends and Forecast by Counterparty, Type, and Region, 2025-2033

Taiwan Foreign Exchange Market Overview:

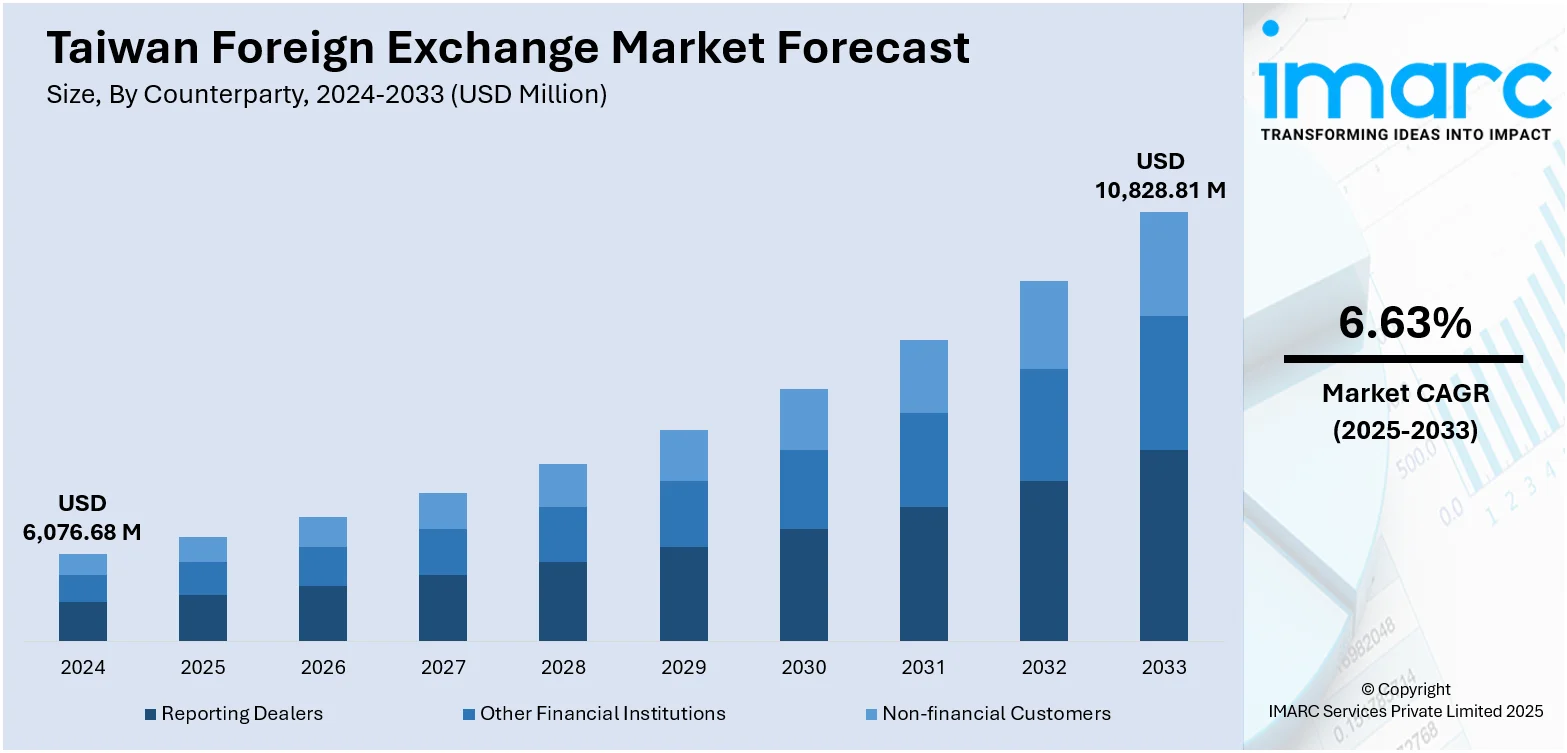

The Taiwan foreign exchange market size reached USD 6,076.68 Million in 2024. The market is projected to reach USD 10,828.81 Million by 2033, exhibiting a growth rate (CAGR) of 6.63% during 2025-2033. The market is fueled by the robust export performance generates substantial foreign currency inflows and supports the country's trade surplus. Further, the central bank plays a pivotal role through its active intervention and monetary policies aimed at maintaining currency stability amid global economic fluctuations. In addition to this, capital movements related to foreign institutional investments in equities and government bonds also significantly augment the Taiwan foreign exchange market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6,076.68 Million |

| Market Forecast in 2033 | USD 10,828.81 Million |

| Market Growth Rate 2025-2033 | 6.63% |

Taiwan Foreign Exchange Market Trends:

Export-Driven Currency Inflows

The market is fundamentally shaped by its strong export base, especially in high-value manufactured goods. According to industry reports, Taiwan recorded its second-best foreign trade performance in 2024. Exports rose 9.9% to USD 475 Billion, led by electronic components (37.3%), ICT and audiovisual products (27.9%), and basic metals (6%). The country's economic model is heavily reliant on external trade, and consistent trade surpluses contribute to a steady inflow of foreign currencies. Exporters, particularly in the manufacturing and electronics sectors, regularly convert their overseas earnings into New Taiwan Dollars (TWD), creating a sustained demand-supply dynamic that influences exchange rate movements. This inflow reinforces the strength of the TWD during periods of high export activity. Apart from that, seasonal fluctuations in global demand can amplify these effects, resulting in short-term volatility in foreign exchange transactions. The predictability of these inflows allows financial institutions and corporate treasuries to engage in strategic currency hedging and risk management, contributing to market maturity. Over time, the scale and consistency of Taiwan's exports have established this trend as a key pillar in determining the foreign exchange market's direction, with direct consequences on currency valuation and liquidity conditions.

To get more information on this market, Request Sample

Sensitivity to Global Capital Movements

The market exhibits a high degree of sensitivity to cross-border capital flows. Portfolio investment, particularly short-term capital, can significantly impact the TWD's value, depending on investor sentiment and global financial conditions. When international investors channel funds into Taiwanese equities or debt instruments, they increase the demand for local currency, leading to appreciation pressures. Conversely, capital flight triggered by risk aversion or changes in global interest rate environments can cause sharp currency depreciation. These movements are often driven by external macroeconomic developments, such as monetary policy shifts in major economies, rather than domestic fundamentals. Moreover, the rapid nature of such flows adds a layer of volatility to the market, affecting both spot and forward exchange rates. This volatility is further amplified by speculative activity in foreign exchange derivatives, which are used to anticipate or respond to anticipated capital shifts. As a result, capital flow responsiveness remains a critical trend that defines the dynamic behavior of Taiwan's currency market under varying global economic cycles.

Central Bank Oversight and Policy Interventions

The role of Taiwan's central bank is significantly impacting the Taiwan foreign exchange market growth. The authority does not permit the currency to float freely; instead, it employs a managed exchange rate regime, intervening in the market to mitigate excessive volatility. The central bank's interventions are typically aimed at maintaining economic stability and protecting export competitiveness by preventing sharp appreciation or depreciation of the TWD. Such actions include direct buying or selling of foreign currency, as well as regulatory adjustments affecting foreign exchange trading conditions. Also, policy measures are often calibrated to align with broader monetary objectives, such as inflation control or financial system stability. In line with this, the bank uses macroprudential tools to supervise capital movement and manage foreign reserve levels effectively. Its presence as a stabilizing force ensures that market participants operate within a relatively predictable framework. This deliberate and calculated involvement by the central bank is an entrenched trend that continuously shapes the contours of Taiwan's foreign exchange ecosystem.

Taiwan Foreign Exchange Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on counterparty and type.

Counterparty Insights:

- Reporting Dealers

- Other Financial Institutions

- Non-financial Customers

The report has provided a detailed breakup and analysis of the market based on the counterparty. This includes reporting dealers, other financial institutions, and non-financial customers.

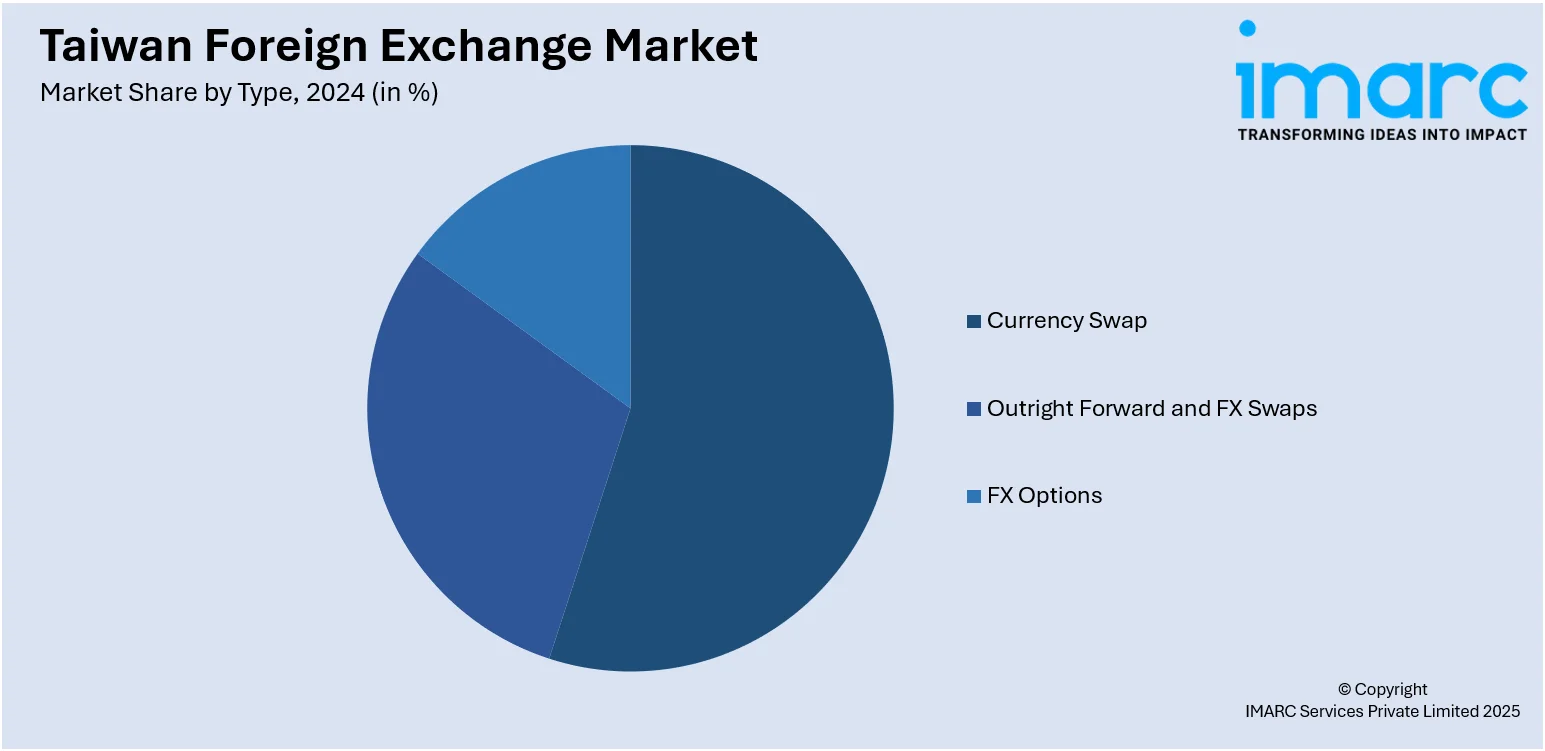

Type Insights:

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes currency swap, outright forward and FX swaps, and FX options.

Regional Insights:

- Northern Taiwan

- Central Taiwan

- Southern Taiwan

- Eastern Taiwan

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Taiwan, Central Taiwan, Southern Taiwan, and Eastern Taiwan.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Taiwan Foreign Exchange Market News:

- July 2025: The Tokyo Financial Exchange (TFX) launched its Equity Index Daily Futures contracts for Taiwanese investors, building on the earlier success of its FX Daily Futures contracts. The initiative is supported by Nissan Securities, a long-standing trading participant with deep ties to Taiwan, which has facilitated access to FX Daily Futures since 2021 and now extends this support to equity index futures. Both offerings have received official approval from Taiwan's Financial Supervisory Commission, underscoring TFX's continued efforts to expand its footprint in international markets.

Taiwan Foreign Exchange Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Counterparties Covered | Reporting Dealers, Other Financial Institutions, Non-Financial Customers |

| Types Covered | Currency Swap, Outright Forward and FX Swaps, FX Options |

| Regions Covered | Northern Taiwan, Central Taiwan, Southern Taiwan, Eastern Taiwan |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Taiwan foreign exchange market performed so far and how will it perform in the coming years?

- What is the breakup of the Taiwan foreign exchange market on the basis of counterparty?

- What is the breakup of the Taiwan foreign exchange market on the basis of type?

- What is the breakup of the Taiwan foreign exchange market on the basis of region?

- What are the various stages in the value chain of the Taiwan foreign exchange market?

- What are the key driving factors and challenges in the Taiwan foreign exchange market?

- What is the structure of the Taiwan foreign exchange market and who are the key players?

- What is the degree of competition in the Taiwan foreign exchange market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Taiwan foreign exchange market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Taiwan foreign exchange market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Taiwan foreign exchange industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)