Taiwan Insurtech Market Size, Share, Trends and Forecast by Type, Service, Technology, and Region, 2025-2033

Taiwan Insurtech Market Overview:

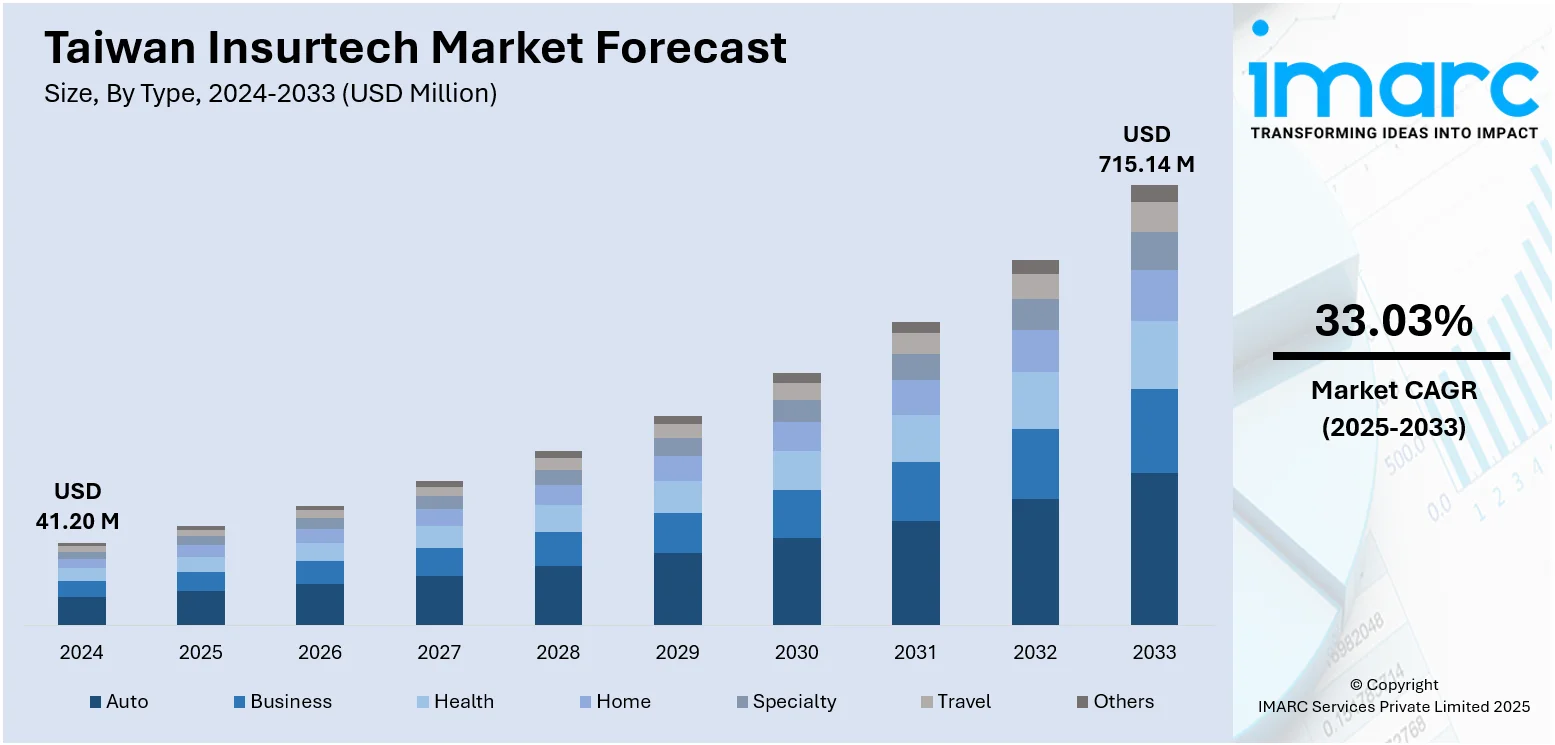

The Taiwan Insurtech market size reached USD 41.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 715.14 Million by 2033, exhibiting a growth rate (CAGR) of 33.03% during 2025-2033. The market in Taiwan is growing because of the increasing popularity of digital payment systems and the rising demand for health and life insurance. Individuals are adopting digital payment platforms, while the aging population seeks flexible, accessible insurance solutions, driving innovation and tailored offerings through digital channels, expanding the Taiwan Insurtech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 41.20 Million |

| Market Forecast in 2033 | USD 715.14 Million |

| Market Growth Rate 2025-2033 | 33.03% |

Taiwan Insurtech Market Trends:

Rising Popularity of Digital Payment Systems

With the growing popularity of mobile wallets, quick response (QR) code transactions, and online payment platforms, people are more likely to handle financial services and make purchases online. Insurtech firms are leveraging this trend by combining their insurance services with these digital payment solutions, enabling immediate transactions for purchasing policies, renewals, and settling claims. This integrated, digital-centric strategy improves the user experience, making it easier for people to interact with insurance products and services. The ease of digital payments not only encourages more individuals to adopt digital insurance solutions but also enables Insurtech firms to scale more efficiently while reaching a larger, tech-savvy user base. An important instance of this digital shift is Taiwan’s Ministry of Digital Affairs (MODA), which, initiated a pilot for its national digital wallet (TW DIW) by December 2025. The wallet is intended to hold digital credentials, such as ID and insurance cards, providing secure, user-managed access to private information. By making the wallet's code available for public testing in a sandbox environment, MODA seeks to enhance transparency and foster trust among users. This initiative signifies the wider movement towards digital payment systems and the government's dedication to promoting secure, technology-driven solutions across various sectors, including insurance. These developments are bolstering the Taiwan Insurtech market growth by enhancing accessibility, efficiency, and user engagement in the sector.

To get more information on this market, Request Sample

Growing Demand for Health and Life Insurance Solutions

With an aging population and increasing awareness about health and financial risks, more people in Taiwan are looking for insurance options that are flexible and easily accessible to meet their changing requirements. A significant illustration of this change is emphasized in the National Development Council's 2024 population forecast report, which details Taiwan's evolution into a "super-aged society" by 2025. The report predicts that over 20% of the population will be 65 years or older, a change influenced by increased life expectancy and decreasing birth rates. By the year 2070, the percentage of individuals aged 65 and over is predicted to reach 46.5%. This demographic change is catalyzing the demand for health and life insurance offerings designed for older people, especially those that can be easily accessed via digital platforms. Insurtech firms are reacting by providing tailored health and life insurance options via digital platforms, allowing individuals to effortlessly compare policies, handle coverage, and file claims online. This transition to digital solutions enables enhanced convenience, transparency, and personalization, facilitating easier control for individuals over their health and financial security. The growing demand for customized insurance products is driving innovation in the Insurtech sector, generating new possibilities for firms to provide solutions aimed at addressing the specific requirements of Taiwan's elderly population.

Taiwan Insurtech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, service, and technology.

Type Insights:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes auto, business, health, home, specialty, travel, and others.

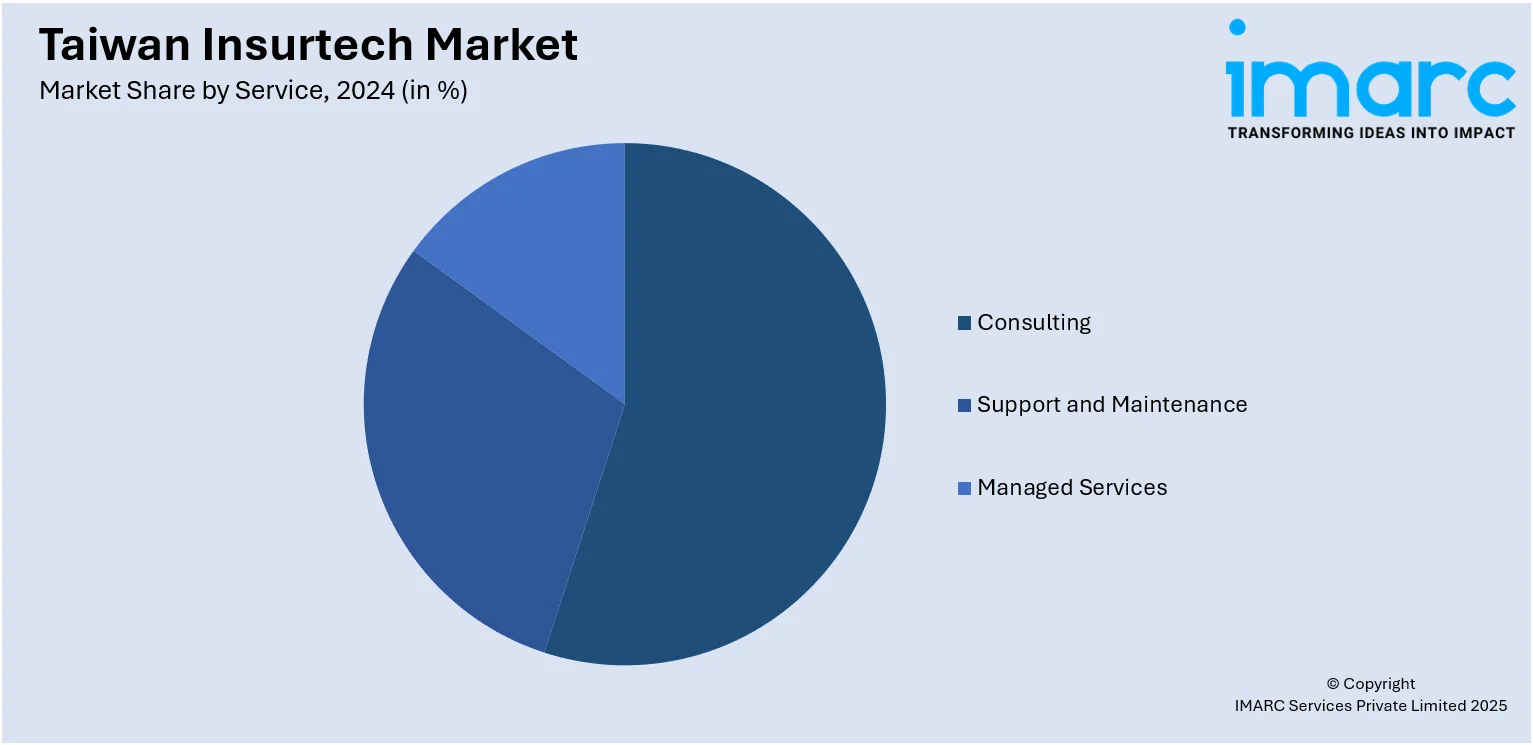

Service Insights:

- Consulting

- Support and Maintenance

- Managed Services

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes consulting, support and maintenance, and managed services.

Technology Insights:

- Block Chain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes block chain, cloud computing, IoT, machine learning, robo advisory, and others.

Regional Insights:

- Northern Taiwan

- Central Taiwan

- Southern Taiwan

- Eastern Taiwan

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Taiwan, Central Taiwan, Southern Taiwan, and Eastern Taiwan.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Taiwan Insurtech Market News:

- In August 2025, IXT (a subsidiary of AIFT) and Richmond Insurance Brokers launched Taiwan’s first digital commercial insurance platform. The platform simplifies access to insurance for SMEs, integrating products from major insurers and cybersecurity risk assessments via Cymetrics. It aims to modernize and streamline traditionally manual insurance processes.

- In May 2025, Taiwan's Financial Supervisory Commission (FSC) revised digital insurance regulations to boost innovation and attract investment. Key changes include allowing non-financial entities to launch digital insurers, lowering capital requirements, and permitting physical service points. The term "internet-only insurers" was rebranded to "digital insurers" to reflect global trends.

Taiwan Insurtech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Auto, Business, Health, Home, Specialty, Travel, Others |

| Services Covered | Consulting, Support and Maintenance, Managed Services |

| Technologies Covered | Block Chain, Cloud Computing, IoT, Machine Learning, Robo Advisory, Others |

| Regions Covered | Northern Taiwan, Central Taiwan, Southern Taiwan, Eastern Taiwan |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Taiwan Insurtech market performed so far and how will it perform in the coming years?

- What is the breakup of the Taiwan Insurtech market on the basis of type?

- What is the breakup of the Taiwan Insurtech market on the basis of service?

- What is the breakup of the Taiwan Insurtech market on the basis of technology?

- What is the breakup of the Taiwan Insurtech market on the basis of region?

- What are the various stages in the value chain of the Taiwan Insurtech market?

- What are the key driving factors and challenges in the Taiwan Insurtech market?

- What is the structure of the Taiwan Insurtech market and who are the key players?

- What is the degree of competition in the Taiwan Insurtech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Taiwan Insurtech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Taiwan Insurtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Taiwan Insurtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)