Taiwan Lithium-ion Battery Market Size, Share, Trends and Forecast by Product Type, Power Capacity, Application, and Region, 2025-2033

Taiwan Lithium-ion Battery Market Overview:

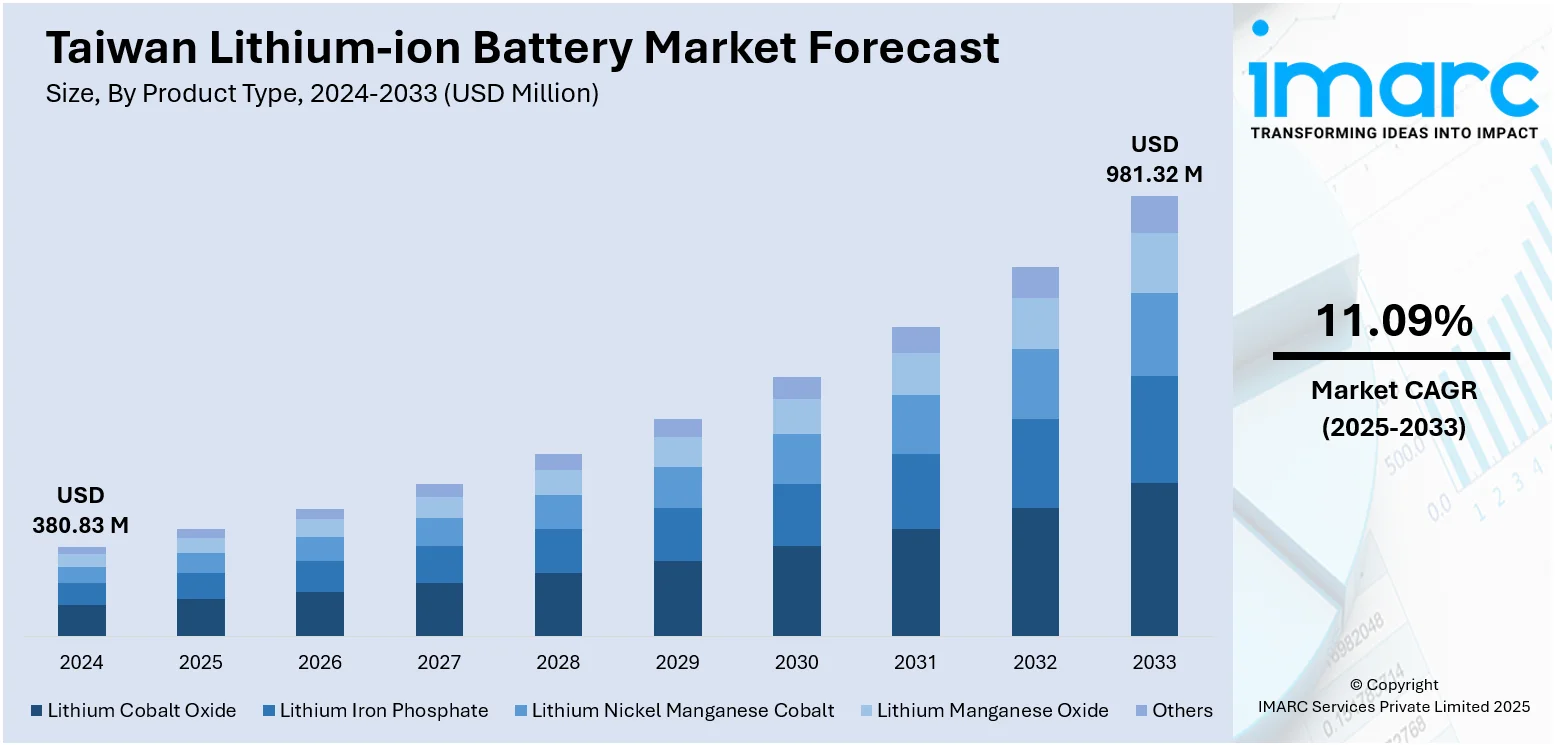

The Taiwan lithium-ion battery market size reached USD 380.83 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 981.32 Million by 2033, exhibiting a growth rate (CAGR) of 11.09% during 2025-2033. Increasing demand for electric vehicles, renewable energy storage, and consumer electronics is one of the factors contributing to the Taiwan lithium-ion battery market share. Government support for clean energy initiatives, advancements in battery technology, and growing investments in EV infrastructure further fuel market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 380.83 Million |

| Market Forecast in 2033 | USD 981.32 Million |

| Market Growth Rate 2025-2033 | 11.09% |

Taiwan Lithium-ion Battery Market Trends:

Improving Battery Efficiency with Silicon Oxide Anodes

The lithium-ion battery market is seeing a shift toward advanced anode materials that significantly boost performance. Silicon Oxide (SiOx) is emerging as a promising alternative to traditional graphite anodes, offering up to five times the capacity, which leads to enhanced energy density and improved battery range. This innovation is particularly beneficial for electric vehicles and energy storage applications, where maximizing battery efficiency is key. As manufacturers explore scalable production of SiOx materials, their potential to replace graphite in commercial batteries grows. The growing interest in SiOx reflects a broader push for more sustainable, high-performance energy solutions, catering to the increasing demand for longer-lasting, faster-charging batteries. These factors are intensifying the Taiwan lithium-ion battery market growth. For example, in November 2024, Solidion Technology signed an MOU with Taiwan's Giga Solar Materials to boost the production of Silicon Oxide (SiOx) anode materials in the US. The partnership aims to enhance lithium-ion battery performance, with SiOx offering five times the capacity of graphite anodes, improving EV energy density and range. Both companies, with 100 MTPA capacity in Taiwan, would explore US manufacturing and commercialization of advanced SiOx solutions for EVs and energy storage.

To get more information on this market, Request Sample

Growth of Lithium-Ion Batteries in Electric Vehicles

The rising demand for batteries in electric vehicles (EVs) is a prominent trend in Taiwan's lithium-ion battery industry. With worldwide efforts turning toward greener energy solutions and Taiwan's superior technical environment, EV adoption has increased, resulting in a greater need for high-performance lithium-ion batteries. To meet the increased demand for electric vehicles, Taiwanese manufacturers are increasingly focused on enhancing battery efficiency, energy density, and longevity. Additionally, there is a strong drive to localize battery production, reduce reliance on foreign suppliers, and strengthen the domestic supply chain. This trend is also supported by government policies that encourage the development of sustainable transportation, further accelerating the growth of the EV sector. As automakers look for solutions to extend the driving range of electric vehicles, the demand for high-quality, long-lasting lithium-ion batteries continues to increase. The convergence of technological innovation, policy support, and consumer interest in eco-friendly transportation options is set to drive significant growth in Taiwan's lithium-ion battery market.

Taiwan Lithium-ion Battery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, power capacity, and application.

Product Type Insights:

- Lithium Cobalt Oxide

- Lithium Iron Phosphate

- Lithium Nickel Manganese Cobalt

- Lithium Manganese Oxide

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes lithium cobalt oxide, lithium iron phosphate, lithium nickel manganese cobalt, lithium manganese oxide, and others.

Power Capacity Insights:

- 0 to 3000mAh

- 3000mAh to 10000mAh

- 10000mAh to 60000mAh

- More than 60000mAh

The report has provided a detailed breakup and analysis of the market based on the power capacity. This includes 0 to 3000mAh, 3000mAh to 10000mAh, 10000mAh to 60000mAh, and more than 60000mAh.

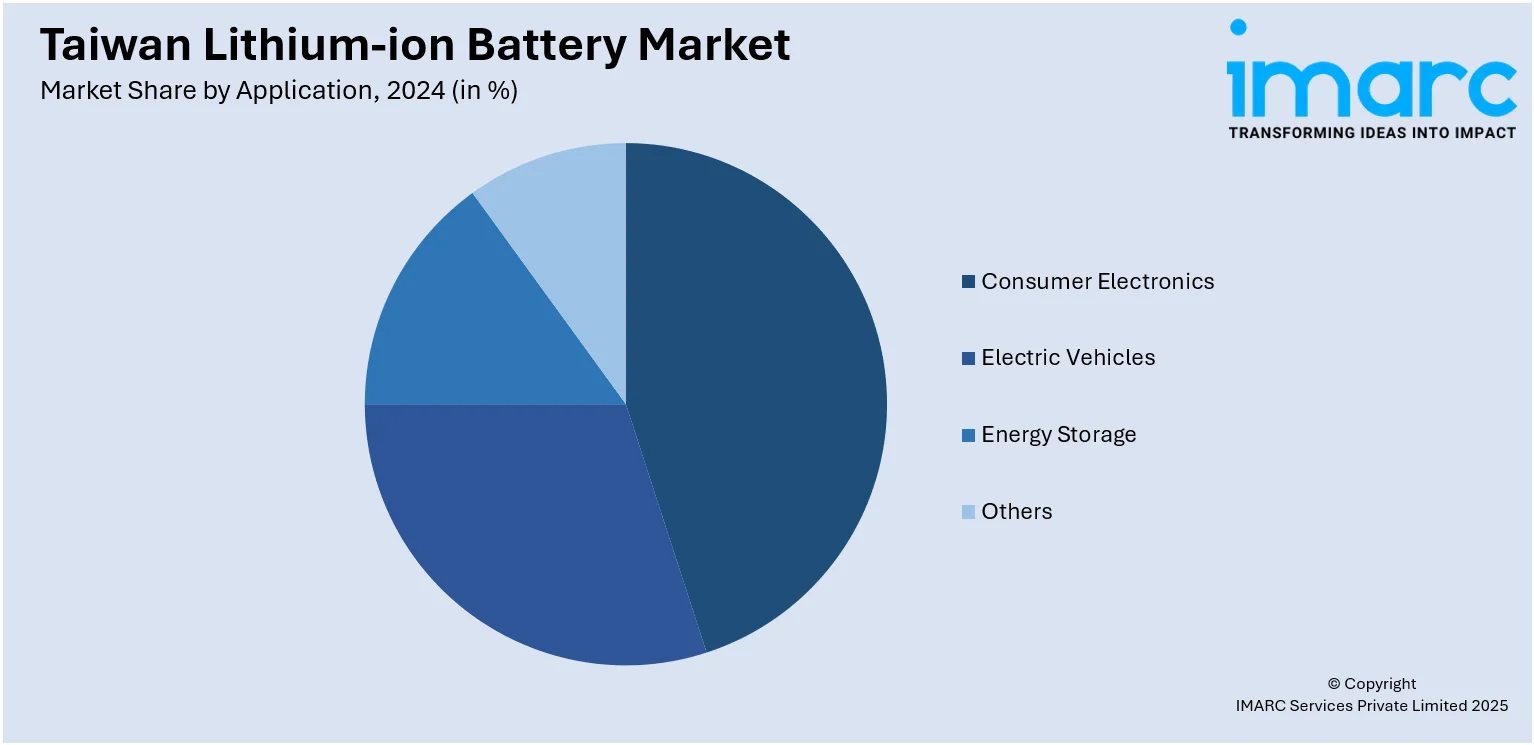

Application Insights:

- Consumer Electronics

- Electric Vehicles

- Energy Storage

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes consumer electronics, electric vehicles, energy storage, and others.

Regional Insights:

- Northern Taiwan

- Central Taiwan

- Southern Taiwan

- Eastern Taiwan

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Taiwan, Central Taiwan, Southern Taiwan, and Eastern Taiwan.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Taiwan Lithium-ion Battery Market News:

- In June 2025, GUS Technology, a Taiwan-based battery manufacturer, partnered with California's TYFAST to develop next-gen vanadium-based lithium-ion batteries. Utilizing lithium vanadium oxide (LVO) anode tech, these batteries offer 10x faster charging, reaching a full charge in under 10 minutes. With over 10,000 charge cycles and energy densities of up to 200 Wh/kg, the batteries are designed for heavy-duty industries like construction, mining, and trucking.

Taiwan Lithium-ion Battery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt, Lithium Manganese Oxide, Others |

| Power Capacities Covered | 0 to 3000mAh, 3000mAh to 10000mAh, 10000mAh to 60000mAh, More than 60000mAh |

| Applications Covered | Consumer Electronics, Electric Vehicles, Energy Storage, Others |

| Regions Covered | Northern Taiwan, Central Taiwan, Southern Taiwan, Eastern Taiwan |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Taiwan lithium-ion battery market performed so far and how will it perform in the coming years?

- What is the breakup of the Taiwan lithium-ion battery market on the basis of product type?

- What is the breakup of the Taiwan lithium-ion battery market on the basis of power capacity?

- What is the breakup of the Taiwan lithium-ion battery market on the basis of application?

- What is the breakup of the Taiwan lithium-ion battery market on the basis of region?

- What are the various stages in the value chain of the Taiwan lithium-ion battery market?

- What are the key driving factors and challenges in the Taiwan lithium-ion battery market?

- What is the structure of the Taiwan lithium-ion battery market and who are the key players?

- What is the degree of competition in the Taiwan lithium-ion battery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Taiwan lithium-ion battery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Taiwan lithium-ion battery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Taiwan lithium-ion battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)