Taiwan Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2025-2033

Taiwan Meat Market Overview:

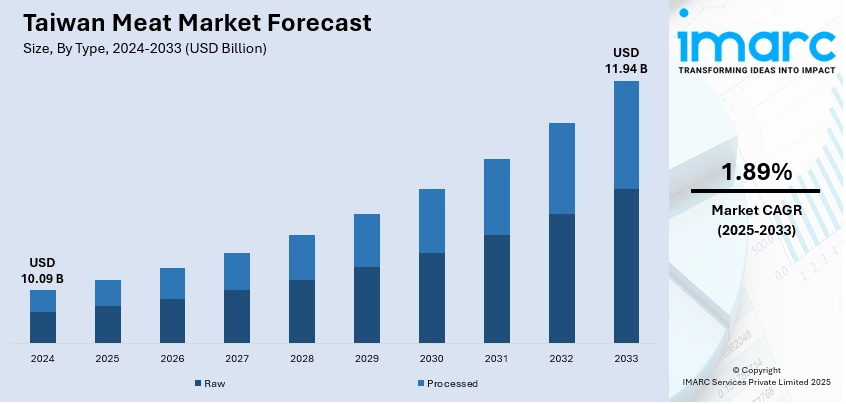

The Taiwan meat market size reached USD 10.09 Billion in 2024. The market is projected to reach USD 11.94 Billion by 2033, exhibiting a growth rate (CAGR) of 1.89% during 2025-2033. The demand is led by improving incomes and health-aware consumers looking for safer, traceable meat as incomes rise. Food safety issues, influenced by previous scandals, drive preferences towards certified, local, or organic meat. Cultural habit is also significant, with pork being at the heart of Taiwanese cuisine and celebrations. These drivers together drive market trends in meat as it promotes innovation, premiumization, and stricter regulations along the meat supply chain to cater to changing consumer expectations leading to increasing Taiwan meat market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.09 Billion |

| Market Forecast in 2033 | USD 11.94 Billion |

| Market Growth Rate 2025-2033 | 1.89% |

Taiwan Meat Market Trends:

Growing Demand for High-Quality and Imported Meat

As Taiwanese consumers become more health-conscious and affluent, demand for premium meat products such as grass-fed beef, free-range chicken, and hormone-free pork is on the rise. This shift is driven by growing disposable incomes and heightened awareness of food safety and animal welfare. Urban consumers, in particular, favor imported meat from the U.S., Australia, and Japan, associating it with higher quality and safety standards. The trend is further fueled by the popularity of Western-style dining and international cuisines. The rise of e-commerce and specialty grocers has expanded access to premium cuts, while trade agreements reducing tariffs support increased imports. In 2024, U.S. beef exports to Taiwan reached US $709 million, capturing 52% of the market, followed by Australia at 19% and Paraguay at 13%. Local producers are responding by enhancing quality and branding, yet the market continues to shift toward traceable, high-value meat options.

To get more information on this market, Request Sample

Health and Food Safety Concerns

Food safety remains a central concern in Taiwan’s meat market trends, significantly influencing consumer behavior and regulatory policies. Past scandals, such as contaminated pork or concerns over ractopamine in U.S. meat imports, have made Taiwanese consumers particularly cautious. As a result, there is a strong preference for meat with traceable origins and certifications that assure quality and safety, including organic and antibiotic-free labels. This concern has driven demand for locally sourced meat perceived as fresher and safer. The government has responded by tightening import controls, improving labeling laws, and enhancing inspection regimes. Additionally, health-conscious consumers are shifting toward leaner meats and plant-based alternatives, further shaping the meat market. Retailers and restaurants are under growing pressure to disclose sourcing and processing details. In essence, safety and health concerns are not just barriers—they have become powerful motivators for innovation and differentiation in Taiwan’s meat industry.

Influence of Cultural Preferences and Culinary Traditions

Cultural and culinary traditions strongly shape Taiwan’s meat consumption, with pork remaining the most consumed meat 36 kg per capita in 2022 due to its deep roots in local cuisine, from braised pork rice (lu rou fan) to dumplings and hotpot. Chicken follows closely at 43.12 kg, while beef stands at 7.34 kg. That year, total meat consumption hit 87.5 kg per person, surpassing grain intake for the first time. Seasonal festivals like Lunar New Year and Mid-Autumn drive spikes in pork and poultry demand, while Taiwan’s vibrant street food culture sustains year-round consumption of sausages, skewers, and barbecue. Western diets are gaining ground among younger consumers, but traditional meals still dominate. Religious practices, particularly during Buddhist or Taoist observances, cause periodic declines in meat intake. These enduring culinary customs support consistent demand, even as rising health and sustainability concerns begin to shift preferences toward more moderate and ethical consumption.

Taiwan Meat Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, and distribution channel.

Type Insights:

- Raw

- Processed

The report has provided a detailed breakup and analysis of the market based on the type. This includes raw and processed.

Product Insights:

- Chicken

- Beef

- Pork

- Mutton

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes chicken, beef, pork, mutton, and others.

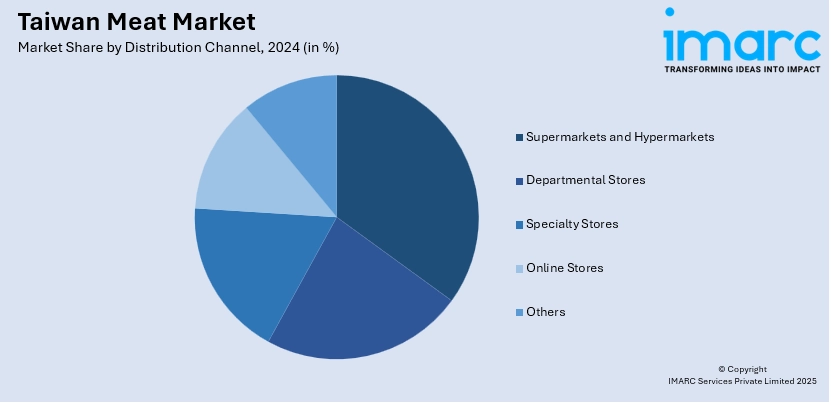

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, departmental stores, specialty stores, online stores, and others.

Regional Insights:

- Northern Taiwan

- Central Taiwan

- Southern Taiwan

- Eastern Taiwan

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Taiwan, Central Taiwan, Southern Taiwan, and Eastern Taiwan.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Taiwan Meat Market News:

- In May 2024, Steakholder Foods Ltd partnered with Taiwan’s Industrial Technology Research Institute (ITRI) to develop and commercialize 3D-printed, plant-based meat products tailored to Taiwanese cuisine. The collaboration aims to reduce Taiwan’s dependence on traditional meat by promoting sustainable alternatives. Using Steakholder’s SHMeat and SHFish premixes and 3D printing tech, the partnership will work with local food companies to boost production and adoption of plant-based meat across Taiwan.

Taiwan Meat Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Pork, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Northern Taiwan, Central Taiwan, Southern Taiwan, Eastern Taiwan |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Taiwan meat market performed so far and how will it perform in the coming years?

- What is the breakup of the Taiwan meat market on the basis of type?

- What is the breakup of the Taiwan meat market on the basis of product?

- What is the breakup of the Taiwan meat market on the basis of distribution channel?

- What is the breakup of the Taiwan meat market on the basis of region?

- What are the various stages in the value chain of the Taiwan meat market?

- What are the key driving factors and challenges in the Taiwan meat market?

- What is the structure of the Taiwan meat market and who are the key players?

- What is the degree of competition in the Taiwan meat market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Taiwan meat market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Taiwan meat market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Taiwan meat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)