Taiwan Paper Packaging Market Size, Share, Trends and Forecast by Product Type, Grade, Packaging Level, End-Use Industry, and Region, 2026-2034

Taiwan Paper Packaging Market Summary:

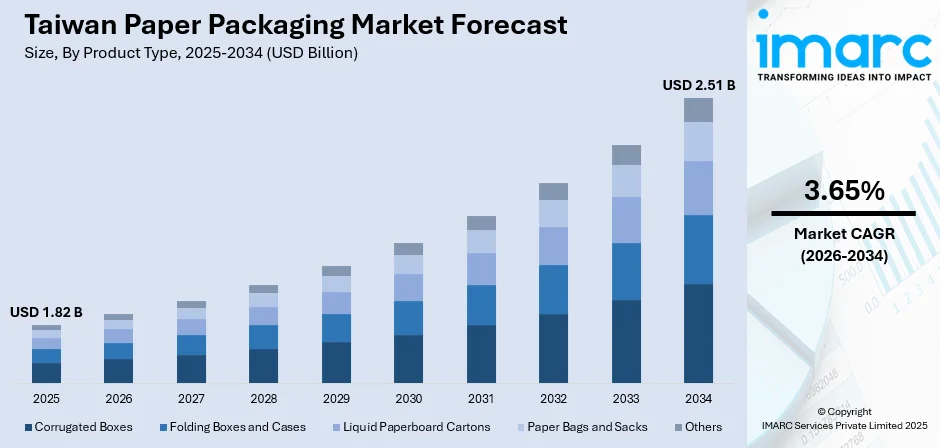

The Taiwan paper packaging market size was valued at USD 1.82 Billion in 2025 and is projected to reach USD 2.51 Billion by 2034, growing at a compound annual growth rate of 3.65% from 2026-2034.

Taiwan's paper packaging market expansion is propelled by accelerating e-commerce penetration alongside stringent environmental regulations phasing out single-use plastics. The island's Ministry of Environment implemented a nationwide ban on plastic cups, compelling beverage retailers to transition to paper-based alternatives and reusable systems. Taiwan's high per capita packaging consumption positions it among one of the leading markets, while the domestic e-commerce sector's growth generates sustained demand for protective corrugated shipping containers. Taiwan paper packaging market share benefits from the government's circular economy roadmap targeting net-zero emissions by 2050, which incentivizes manufacturers to incorporate post-consumer recycled content and establish closed-loop production systems that minimize material waste.

Key Takeaways and Insights:

-

By Product Type: Corrugated boxes dominate the market with a share of 40% in 2025, driven by e-commerce logistics expansion and demand for durable protective shipping containers that reduce product damage rates while accommodating high-volume parcel flows from online retail platforms.

-

By Grade: Solid bleached paperboard leads the market with a share of 35% in 2025, owing to superior printability enabling high-definition graphics for premium consumer goods, enhanced structural rigidity supporting pharmaceutical blister-pack applications, and consistent white surface quality meeting brand owners' shelf-appeal requirements.

-

By Packaging Level: Primary packaging represents the largest segment with a market share of 50% in 2025, propelled by food safety regulations mandating direct-contact materials that prevent contamination.

-

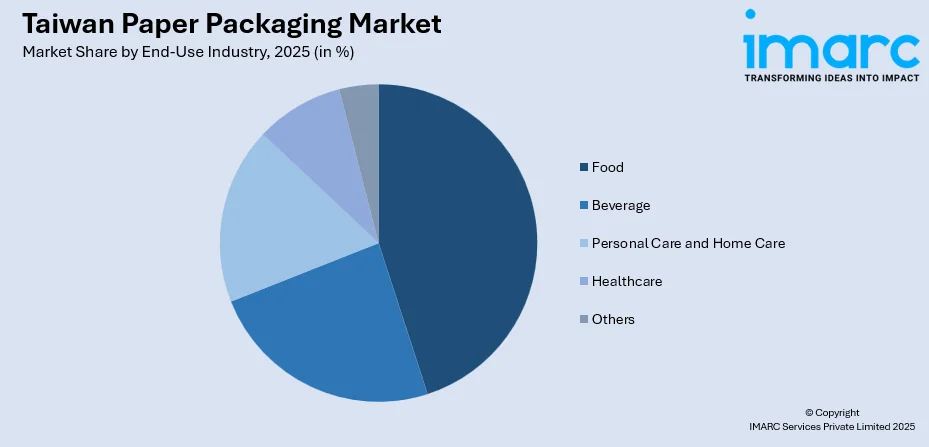

By End-Use Industry: Food dominates the market with a share of 45% in 2025, supported by Taiwan's expanding convenience food sector, growing demand for ready-to-eat meal solutions.

-

Key Players: The Taiwan paper packaging market exhibits moderate competitive intensity with multinational corporations competing alongside domestic manufacturers across price segments. International players leverage advanced coating technologies and global supply chain networks, while local producers capitalize on proximity to end-users, faster turnaround times, and specialized capabilities in small-batch customization for Taiwan's diverse food manufacturing ecosystem.

To get more information on this market Request Sample

Taiwan's paper packaging industry operates within a sophisticated manufacturing ecosystem comprising over 1,000 packaging and packaging machinery factories. The sector recorded robust post-pandemic recovery throughout 2023, with demand fully rebounding as new manufacturing facilities commissioned equipment for powder filling applications serving pharmaceutical and food sectors. The Taiwan Packaging Association reported strong growth in automated connection lines seamlessly integrating food processing with packaging machinery, providing turnkey solutions that reduce labor costs while enhancing food safety compliance. In 2024, Taipei Pack exhibition featured a large number of Taiwanese exhibitors showcasing sustainable materials, smart supply chains, and customized printing processes, with companies like BENISON introducing eco-friendly materials paired with intelligent production lines.

Taiwan Paper Packaging Market Trends:

Accelerated Transition to Sustainable Fiber-Based Materials

Taiwan's packaging manufacturers are rapidly substituting plastic components with fiber-based alternatives responding to regulatory pressures and consumer environmental consciousness. The Taiwan Ministry of Environment declared reduced recycling and disposal charges for plastic containers made with recycled material or following eco-friendly design guidelines. According to Article 16 of Taiwan's Waste Disposal Act, fees must be paid by manufacturers and importers of plastic containers based on the recyclability, weight, and type of their products. This policy of Extended Producer Responsibility (EPR) for plastic containers has been in effect since 2001 and has since been modified to promote sustainable practices.

Digital Transformation Through Intelligent Packaging Equipment

Automation and artificial intelligence (AI) are revolutionizing Taiwan's packaging machinery sector driven by acute labor shortages affecting both domestic operations and export markets. Taiwan Packaging Association chairman Benker Liao emphasized the island's competitive advantage in software-hardware integration for packaging automation, noting that while Taiwan struggles competing against Japan or China for standard machinery solutions, Taiwanese manufacturers offer superior flexibility, communication responsiveness, and competitive pricing. Intelligent packaging equipment harnesses AI for dynamic production adjustments, while digital inkjet printers enable on-demand coding and marking for traceability compliance. New Taipei-based Sinletai Group manufactures inkjet printers for product coding using technology licensed from California-based Hewlett-Packard since 2005, capitalizing on pharmaceutical industry demand for visibility and traceability from source to finish driven by serialization mandates.

Circular Economy Implementation Through Recycled Content Integration

Taiwan's commitment to circular economy principles is driving substantial investment in recycled material infrastructure aligned with the government's 2050 net-zero emissions roadmap. Packaging paper manufacturer Cheng Loong Corporation utilizes a major amount of recycled paper as raw material feedstock, exemplifying industry-wide efforts to minimize virgin fiber dependency. Taiwan Semiconductor Manufacturing Company established the Taichung Zero Waste Manufacturing Center in November 2024, projected to reduce annual waste processing outsourcing by 130,000 metric tons while cutting carbon emissions by 40,000 metric tons equivalent to offsetting more than 110 Daan Forest Parks.

Market Outlook 2026-2034:

The Taiwan paper packaging market is positioned for steady growth driven by sustained e-commerce growth and regulatory momentum favoring sustainable materials. The market generated a revenue of USD 1.82 Billion in 2025 and is projected to reach a revenue of USD 2.51 Billion by 2034, growing at a compound annual growth rate of 3.65% from 2026-2034. Mobile commerce penetration reaching new heights by 2030 will accelerate direct-to-consumer (D2C) shipments necessitating branded packaging with high-resolution graphics, while pharmaceutical serialization requirements and food safety protocols are driving the need for high quality paper packaging solutions.

Taiwan Paper Packaging Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Corrugated Boxes |

40% |

|

Grade |

Solid Bleached |

35% |

|

Packaging Level |

Primary Packaging |

50% |

|

End-Use Industry |

Food |

45% |

Product Type Insights:

- Corrugated Boxes

- Folding Boxes and Cases

- Liquid Paperboard Cartons

- Paper Bags and Sacks

- Others

Corrugated boxes dominate with a market share of 40% of the total Taiwan paper packaging market in 2025.

Corrugated boxes offer a practical and reliable packaging choice across many industries because they balance strength, flexibility, and cost efficiency. Made with layered paperboard, they provide strong protection against impact, compression, and rough handling during storage and transport, helping reduce product damage and returns. Their lightweight nature keeps shipping costs under control while still supporting heavy or fragile items. Corrugated boxes are easy to customize in size, shape, and print, which allows brands to improve product presentation and communication without adding complexity to packing operations. They are also simple to stack, store flat, and assemble, saving warehouse space and labor time.

From an environmental angle, corrugated boxes are widely recyclable and often produced using recycled fibers, which supports waste reduction and responsible material use. Many suppliers also offer options made from sustainably sourced paper, aligning packaging choices with corporate sustainability goals. Corrugated packaging adapts well to automation and modern logistics systems, making it suitable for high volume operations as well as small businesses. Its versatility allows use across food, electronics, retail, and industrial goods, proving useful in both short distance distribution and long haul shipping while maintaining product safety and operational efficiency. VietnamPrintPack 2024 featured a diverse array of exhibits, including cutting-edge printing equipment, packaging innovations, and materials. Attendees will get to discover the newest developments in digital corrugated printing and sustainable packaging options, emphasizing the worldwide movement towards environmentally friendly and efficient manufacturing methods.

Grade Insights:

- Solid Bleached

- Coated Recycled

- Uncoated Recycled

- Others

Solid bleached leads with a share of 35% of the total Taiwan paper packaging market in 2025.

Solid bleached paperboard (SBP) is a premium packaging material known for its high strength, brightness, and superior printability, making it ideal for packaging luxury and consumer goods. One of its primary benefits is its excellent surface quality, which allows for high-quality printing, ensuring vibrant and sharp visuals on product packaging. This makes it an excellent choice for brands aiming to create an eye-catching, premium image for their products, particularly in industries such as cosmetics, food, and pharmaceuticals. SBP is also highly durable, offering great resistance to tearing and moisture, which ensures that products remain secure and undamaged during transportation and storage.

Additionally, it is non-toxic and safe for direct contact with food, adding to its versatility for food packaging applications. SBP is lightweight, yet sturdy, allowing for cost-effective transportation without sacrificing protection. It is also a sustainable option, as it is fully recyclable, often made from renewable wood fibers, and can be processed into new paperboard products, making it an eco-friendlier alternative to plastic-based packaging. The combination of strength, visual appeal, and environmental benefits makes solid bleached paperboard an excellent choice for businesses seeking to balance premium packaging with sustainability.

Packaging Level Insights:

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

Primary packaging exhibits a clear dominance with a 50% share of the total Taiwan paper packaging market in 2025.

Primary packaging dominates the packaging level segment driven by food safety regulations mandating direct-contact materials preventing contamination and preserving product integrity throughout shelf life. The retail sector in Taiwan comprising convenience stores, supermarkets, and hypermarkets, valued at $30 billion in 2024 generates substantial demand for individually wrapped portions, with consumers prioritizing hygiene and single-serve convenience aligned with urban lifestyles and smaller household sizes. Taiwan's older population shows a growing preference for products that offer additional health advantages, whereas smaller household sizes are increasing the need for smaller portion sizes.

Pharmaceutical serialization requirements under healthcare regulations necessitate unit-dose packaging with tamper-evident features enabling track-and-trace compliance from manufacturer through retail dispensing. Digital printing technologies enable variable data printing for batch codes, expiration dates, and regulatory disclosures directly on primary packaging, eliminating secondary labeling operations while ensuring information accuracy. Taiwan's cultural preference for individually portioned food items drives higher primary packaging intensity compared to Western markets, with snack manufacturers, bakery producers, and traditional medicine suppliers emphasizing single-serve formats appealing to on-the-go consumption patterns.

End-Use Industry Insights:

Access the comprehensive market breakdown Request Sample

- Food

- Beverage

- Personal Care and Home Care

- Healthcare

- Others

Food dominates with a market share of 45% of the total Taiwan paper packaging market in 2025.

Food packaging dominates end-use industry applications reflecting Taiwan's substantial food manufacturing base and evolving consumer dietary patterns emphasizing convenience, portion control, and food safety assurance. The food sector is experiencing rapid growth driven by rising disposable incomes, urbanization increasing demand for packaged ready-to-eat meals, and health-conscious consumers seeking products with clean labeling and minimal processing. Taiwan's strict food safety regulations and quality control emphasis ensure packaging materials meet rigorous standards for migration testing, barrier properties, and shelf-life extension.

E-commerce food delivery services including online grocery platforms and meal kit subscriptions generate incremental packaging demand for temperature-controlled shipping, moisture-resistant barriers, and portion-specific containers maintaining product freshness during last-mile distribution. Traditional snack manufacturers, bakery operations, and food service providers increasingly adopt sustainable paper packaging alternatives responding to consumer environmental awareness and regulatory restrictions on single-use plastics. IMARC Group predicts that the Taiwan e-commerce market is projected to attain USD 1,269.55 Billion by 2033, exhibiting a growth rate (CAGR) of 28.04% during 2025-2033.

Regional Insights:

- Northern Taiwan

- Central Taiwan

- Southern Taiwan

- Eastern Taiwan

Northern Taiwan, home to the capital Taipei, is a key hub for the paper packaging market, driven by its industrial base and proximity to major ports. The region has a high concentration of manufacturing facilities, including electronics and consumer goods, which generates demand for durable and innovative packaging solutions. Additionally, its well-developed logistics and infrastructure support the swift distribution of paper packaging products, making it a central player in the overall market growth.

Central Taiwan, with its strong industrial focus, is a significant contributor to the paper packaging market, especially in the manufacturing and automotive sectors. The region's factories are known for producing large quantities of paper products, including boxes and cartons. As a central location between the north and south, it serves as a logistics hub for distribution, which helps meet the demands of both local and international markets. The region is also seeing increased interest in sustainable and recyclable packaging options.

Southern Taiwan is a growing area for the paper packaging industry, particularly in the packaging of food products, electronics, and textiles. The region benefits from its strong presence in sectors such as semiconductor manufacturing, which requires specialized packaging solutions. The industrial output and export activities in cities like Kaohsiung also support robust demand for paper packaging. Additionally, the increasing trend toward sustainability in packaging is gaining traction here, driving innovation in eco-friendly paper packaging solutions.

Eastern Taiwan, characterized by its more rural landscape, is seeing gradual growth in the paper packaging market, with an emphasis on agricultural products and local goods. The region is increasingly adopting environmentally friendly packaging solutions, particularly for organic and locally sourced products. The demand for paper packaging in Eastern Taiwan is linked to the agricultural industry, which relies on efficient, cost-effective packaging for transportation and distribution. Furthermore, the region's focus on sustainable development promotes the use of recyclable and biodegradable materials.

Market Dynamics:

Growth Drivers:

Why is the Taiwan Paper Packaging Market Growing?

Stringent Environmental Regulations Phasing Out Single-Use Plastics

Taiwan's comprehensive regulatory framework mandating plastic reduction drives structural market share gains for paper packaging alternatives across food service, retail, and e-commerce sectors. The nationwide ban on plastic cups implemented September 1, 2024, compels bubble tea retailers, operating in the beverage category, to adopt paper or fiber-based cups, establish reusable cup rental programs, or encourage customer-supplied containers, with the Ministry of Environment estimating 790 million paper cups consumed annually post-implementation. Taiwan's commitment to plastic-free status by 2030 aligns with global sustainability trends, positioning domestic manufacturers advantageously as multinational brands seek compliant supply chain partners meeting corporate environmental objectives and consumer expectations for reduced plastic packaging.

Rapid E-Commerce Expansion Driving Protective Packaging Demand

Taiwan's e-commerce sector exponential growth generates sustained demand for corrugated shipping containers, protective cushioning materials, and branded unboxing experiences differentiating online retailers in competitive digital marketplace environments. In October 2024, Japanese secondhand marketplace Mercari partnered with 7-ELEVEN Taiwan enabling pickup of cross-border purchases at over 7,000 convenience stores, exemplifying integration between e-commerce platforms and physical retail infrastructure generating incremental packaging requirements for last-mile distribution. Taiwan's social commerce segment is growing, thereby creating opportunities for packaging suppliers offering customization capabilities, short-run printing, and branded packaging solutions enhancing social media unboxing experiences that drive viral marketing and repeat purchase behavior across digitally-native consumer demographics.

Food Industry Transformation Toward Convenience and Health-Conscious Products

Taiwan's food sector evolution emphasizing ready-to-eat convenience, health-oriented formulations, and premium positioning necessitates sophisticated packaging solutions preserving product quality while communicating brand differentiation through visual merchandising. Taiwan’s food and beverage retail sales reached $8.9 billion in 2024, reflecting shifting consumer preferences toward packaged convenience foods driven by dual-income households and time-constrained lifestyles prioritizing meal preparation efficiency. Taiwan's aging population and health awareness trends stimulate demand for functional foods, dietary supplements, and personalized nutrition products requiring specialized packaging with child-resistant closures, light-barrier properties protecting photosensitive ingredients, and moisture-proof seals maintaining product efficacy throughout extended shelf life periods.

Market Restraints:

What Challenges the Taiwan Paper Packaging Market is Facing?

Raw Material Price Volatility and Supply Chain Vulnerabilities

Paper packaging manufacturers contend with fluctuating pulp prices influenced by global forestry commodity markets, energy costs affecting production operations, and supply chain disruptions impacting material availability and production continuity. Recycled fiber procurement challenges emerge during economic downturns when collection volumes decline alongside reduced consumer purchasing, while virgin pulp prices fluctuate with global capacity additions, forestry certification requirements, and competing demand from tissue and hygiene product sectors experiencing sustained growth.

Performance Limitations Compared to Plastic Packaging Alternatives

Paper packaging confronts technical constraints for applications requiring superior moisture barriers, extended shelf life exceeding capabilities of coated paperboard, and structural strength supporting heavy product loads throughout distribution chains. Paper-based solutions struggle matching plastic packaging performance for liquid containment, grease resistance without specialized coatings, and hermetic sealing preventing contamination in pharmaceutical applications, limiting addressable market scope and necessitating continued coexistence with complementary plastic packaging materials serving specialized functional requirements.

Capital Investment Requirements for Sustainable Technology Adoption

Transitioning toward circular economy production models demands substantial capital investments in coating equipment, recycling infrastructure, and quality control systems ensuring recycled-content materials meet food-contact safety standards and brand owner performance specifications. Small and medium enterprises comprising Taiwan's packaging manufacturing base face financing constraints limiting capacity to retrofit existing assets with advanced technologies, while government incentive programs remain insufficient addressing full transition costs toward sustainable production methods. Equipment upgrades for digital printing capabilities, automated material handling systems, and energy-efficient processing technologies require multi-year capital planning cycles, with return-on-investment timelines extending beyond financial planning horizons for privately-held family businesses characterizing Taiwan's packaging sector ownership structure.

Competitive Landscape:

The Taiwan paper packaging market demonstrates moderate competitive intensity with multinational corporations and domestic manufacturers competing across differentiated price-performance segments. International players leverage global scale advantages in procurement, advanced coating technologies, and established relationships with multinational brand owners seeking consistent quality across multi-country operations. Domestic manufacturers capitalize on proximity advantages enabling rapid turnaround times for small-batch orders, deep relationships with Taiwan's food manufacturing ecosystem, and specialized capabilities in custom packaging development for local market preferences. Market structure reflects vertical integration strategies where larger producers control pulp sourcing and converting operations, while specialized converters focus on value-added services including digital printing, structural design innovation, and logistics integration supporting just-in-time inventory management. Competitive differentiation increasingly centers on sustainability credentials, with manufacturers promoting recycled content percentages, carbon footprint transparency, and circular economy participation distinguishing offerings in procurement evaluations emphasizing environmental performance alongside traditional cost-quality-service metrics.

Recent Developments:

-

In July 2025, McDonald’s Taiwan replaced plastic-laminated packaging and paper boxes with eco-friendly paper wraps and bags for items like Big Macs, Chicken McNuggets, Filet-O-Fish, and Apple Pies, aiming to save about 10,000 trees annually and cut plastic use by 86 metric tons. The change follows three years of research and was piloted in 2024 before expanding nationwide. Over 200 outlets now also provide reusable cups to further reduce single-use waste.

Taiwan Paper Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corrugated Boxes, Folding Boxes and Cases, Liquid Paperboard Cartons, Paper Bags and Sacks, Others |

| Grades Covered | Solid Bleached, Coated Recycled, Uncoated Recycled, Others |

| Packaging Levels Covered | Primary Packaging, Secondary Packaging, Tertiary Packaging |

| End-Use Industries Covered | Food, Beverage, Personal Care and Home Care, Healthcare, Others |

| Regions Covered | Northern Taiwan, Central Taiwan, Southern Taiwan, Eastern Taiwan |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Taiwan paper packaging market size was valued at USD 1.82 Billion in 2025.

The Taiwan paper packaging market is expected to grow at a compound annual growth rate of 3.65% from 2026-2034 to reach USD 2.51 Billion by 2034.

Corrugated boxes dominated the product type segment with approximately 40% market share, driven by e-commerce expansion and protective packaging requirements for omnichannel retail distribution.

Key factors driving the Taiwan paper packaging market include stringent environmental regulations phasing out single-use plastics with the September 2024 plastic cup ban, rapid e-commerce expansion generating protective packaging demand, and food industry transformation toward convenience and health-conscious products requiring sophisticated packaging solutions. Taiwan's commitment to net-zero emissions by 2050 and circular economy initiatives further accelerate sustainable paper packaging adoption across food service, retail, and manufacturing sectors.

Major challenges include raw material price volatility stemming from global pulp commodity markets and Taiwan's dependence on imported energy resources, performance limitations compared to plastic packaging alternatives particularly for moisture barriers and extended shelf-life applications, capital investment requirements for sustainable technology adoption constraining small and medium enterprises, and technical constraints in achieving hermetic sealing and grease resistance for specialized food and pharmaceutical applications requiring continued coexistence with complementary plastic packaging materials.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)