Taiwan Private Equity Market Size, Share, Trends and Forecast by Fund Type and Region, 2025-2033

Taiwan Private Equity Market Overview:

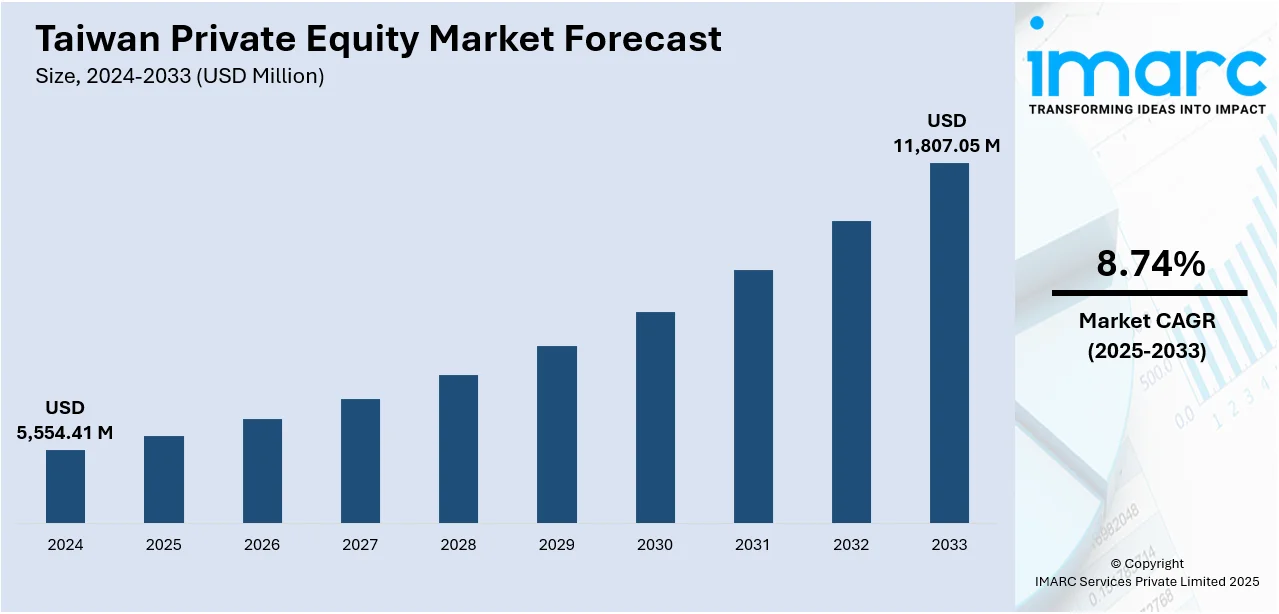

The Taiwan private equity market size reached USD 5,554.41 Million in 2024. The market is projected to reach USD 11,807.05 Million by 2033, exhibiting a growth rate (CAGR) of 8.74% during 2025-2033. Green energy regulations, robust AI and semiconductor clusters, regulatory liberalization, and expanding biotech innovation all influence the industry. Risk is highlighted by cautious geopolitics and a decline in deal volume, but capital is drawn to tech-driven and industrial projects. Taiwan private equity market share shows signs of revival.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5,554.41 Million |

| Market Forecast in 2033 | USD 11,807.05 Million |

| Market Growth Rate 2025-2033 | 8.74% |

Taiwan Private Equity Market Trends:

Increased Focus on Technology and Innovation

Taiwan private equity market growth is driven by technology-focused investments. The country is known for its vibrant tech ecosystem, with a particular emphasis on semiconductor manufacturing, AI, and green technology. For instance, a 2025 Pictet Alternative Advisors survey revealed that 68% of private equity general partners (GPs) expect AI to reduce business costs, with over 60% reporting increased revenue in their portfolio companies due to the technology. While 60% of GPs see AI's potential, barriers like data quality and cybersecurity remain. Private equity firms are concentrating on developing innovative start-ups and growing IT enterprises because Taiwan is home to significant international tech players. Emerging technology investments, such as those in 5G, AI, and electric cars, are becoming more popular and have substantial development prospects. Due to Taiwan's continued importance in the global tech supply chain, this trend is drawing in both domestic and foreign investors.

To get more information on this market, Request Sample

Cross-Border Investments and Regional Expansion

Private equity firms are being encouraged to seek beyond the local market by Taiwan's advantageous position and close economic linkages within the Asia-Pacific region. In an effort to diversify their portfolios, Taiwan-based private equity firms are increasingly making cross-border investments, particularly in Southeast Asia. These businesses are making investments in local businesses, especially those in industries that profit from Taiwan's strong manufacturing skills and market access, such as consumer products, healthcare, and logistics. Taiwanese companies are gaining traction in other high-potential sectors and solidifying their place in the global economy thanks to this trend of regional expansion. For instance, Taiwan's Financial Supervisory Commission (FSC) has announced a new rule allowing foreign institutional investors (FINIs) to appoint multiple custodians, with one primary custodian and up to three secondary custodians. This change, effective from February 24, 2025, aims to enhance investment efficiency and attract more international capital to Taiwan's stock market by improving the investment environment.

Taiwan Private Equity Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on fund type.

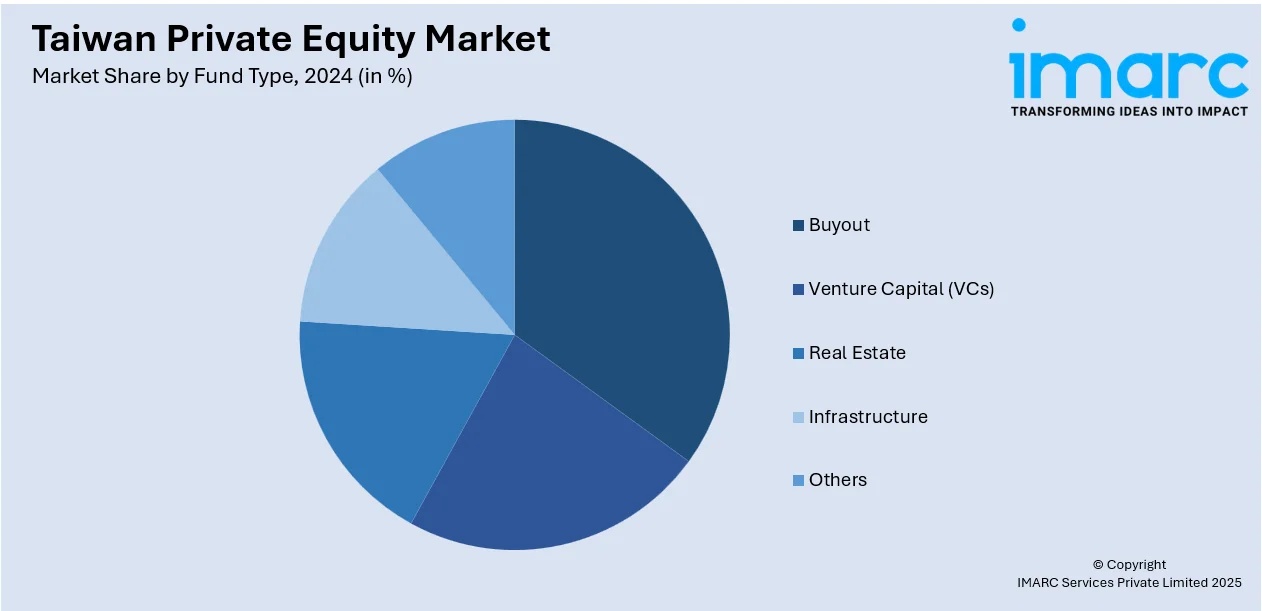

Fund Type Insights:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

The report has provided a detailed breakup and analysis of the market based on the fund type. This includes buyout, venture capital (VCs), real estate, infrastructure, and others.

Regional Insights:

- Northern Taiwan

- Central Taiwan

- Southern Taiwan

- Eastern Taiwan

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Taiwan, Central Taiwan, Southern Taiwan, and Eastern Taiwan.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Taiwan Private Equity Market News:

- In May 2025, StepStone Group emerged as the buyer for Taiwan Life Insurance’s private equity portfolio, marking a major secondary market transaction in Taiwan. The deal underlines strong demand from global secondaries firms like StepStone amid Taiwanese insurers’ strategies to rebalance their private asset holdings. StepStone’s acquisition reinforces its expanding role in Asia’s institutional secondary market landscape.

- In January 2024, Taiwan’s Fubon Life Insurance committed USD 300 Million to global buyout and infrastructure private equity funds. The insurer aims to boost its alternative‑asset allocation through partnerships with managers across multiple strategies.

Taiwan Private Equity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fund Types Covered | Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others |

| Regions Covered | Northern Taiwan, Central Taiwan, Southern Taiwan, Eastern Taiwan |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Taiwan private equity market performed so far and how will it perform in the coming years?

- What is the breakup of the Taiwan private equity market on the basis of fund type?

- What is the breakup of the Taiwan private equity market on the basis of region?

- What are the various stages in the value chain of the Taiwan private equity market?

- What are the key driving factors and challenges in the Taiwan private equity market?

- What is the structure of the Taiwan private equity market and who are the key players?

- What is the degree of competition in the Taiwan private equity market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Taiwan private equity market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Taiwan private equity market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Taiwan private equity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)