Taiwan Sportswear Market Size, Share, Trends and Forecast by Product, Distribution Channel, End User, and Region, 2026-2034

Taiwan Sportswear Market Summary:

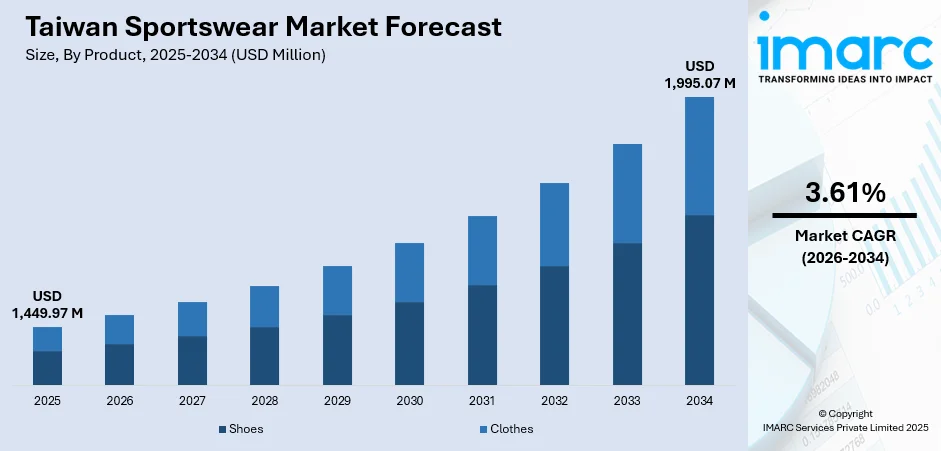

The Taiwan sportswear market size was valued at USD 1,449.97 Million in 2025 and is projected to reach USD 1,995.07 Million by 2034, growing at a compound annual growth rate of 3.61% from 2026-2034.

The Taiwan sportswear market is experiencing robust expansion driven by rising health consciousness and increased participation in fitness activities across all demographics. Growing consumer preference for athleisure wear that seamlessly transitions from athletic to casual settings is reshaping purchasing patterns. The island's strong textile manufacturing capabilities, supportive government sports initiatives, and expanding e-commerce platforms are creating favorable conditions for sustained market development, contributing to the expanding Taiwan sportswear market share.

Key Takeaways and Insights:

- By Product: Shoes dominate the market with a share of 55.73% in 2025, driven by strong consumer demand for performance footwear supporting running, hiking, and gym activities across Taiwan.

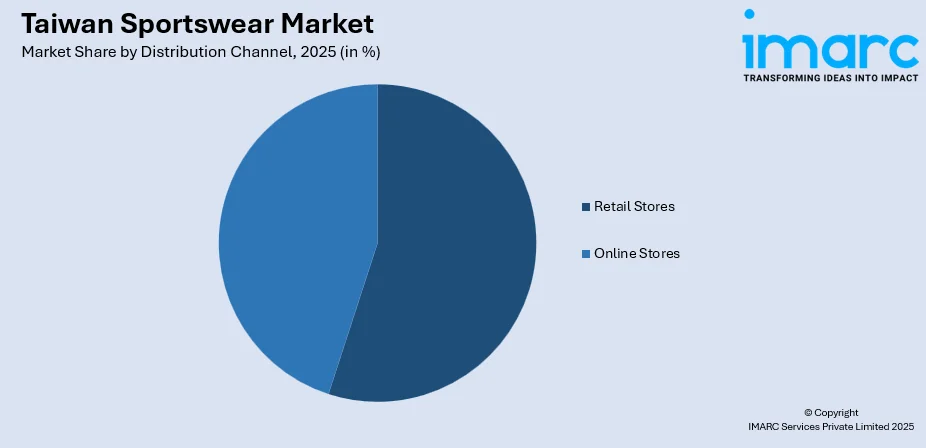

- By Distribution Channel: Retail stores lead the market with a share of 35.25% in 2025, reflecting consumer preference for in-store experiences, product trials, and immediate purchases at department stores and specialty outlets.

- By End User: Men represent the largest segment with a market share of 59.83% in 2025, attributable to higher sports participation rates and increased spending on athletic footwear and performance apparel.

- Key Players: The Taiwan sportswear market exhibits moderate competitive intensity, with multinational brands and local manufacturers competing through product innovation, retail expansion, omnichannel strategies, and sustainable fabric technologies to capture evolving consumer preferences.

To get more information on this market Request Sample

The Taiwan sportswear market continues to strengthen as consumers increasingly prioritize health, wellness, and active lifestyles. Growing fitness awareness across demographic segments reflects a cultural shift toward physical activity and personal wellbeing. This expanding engagement with sports and exercise is driving sustained demand for performance apparel and footwear designed for diverse athletic pursuits. Local textile manufacturers have established Taiwan as a global leader in functional fabric innovation, supplying major international sportswear brands with advanced materials featuring moisture management, breathability, and sustainability. Government commitment to promoting sports participation through dedicated institutional frameworks and budget allocations further supports market development. These factors, combined with the athleisure trend's seamless integration into everyday fashion and workplace settings, position the market for continued expansion throughout the forecast period.

Taiwan Sportswear Market Trends:

Growth of Athleisure and Everyday Sportswear

Athleisure has emerged as a dominant force reshaping Taiwan's sportswear landscape, blurring traditional boundaries between athletic apparel and casual fashion. Consumers increasingly seek versatile garments suitable for workouts, commuting, and social settings. This cultural shift reflects changing lifestyle priorities where comfort and functionality hold equal importance to style. Young professionals and millennials are driving demand for hybrid collections that combine technical performance features with contemporary aesthetics. Local and international brands are responding with innovative designs that transition seamlessly from fitness activities to everyday wear.

Technological Advancements in Functional Textiles

Taiwan's advanced textile manufacturing sector continues pioneering innovations in high-performance sportswear fabrics. The island serves as a critical supply chain partner for leading global sportswear brands, with Taiwanese firms supplying a significant majority of high-performance sustainable fabrics used worldwide. Local manufacturers are integrating smart fabrics featuring moisture-wicking, temperature regulation, and anti-odor properties suited to Taiwan's humid climate. Taiwanese textile producers developed uniforms featuring carbon-captured polyester and advanced sculpted fabrics for the Chinese Taipei Olympic team at the Paris 2024 Games, showcasing the nation's technical expertise driving Taiwan sportswear market growth.

E-commerce and Omnichannel Retail Expansion

Digital transformation is revolutionizing sportswear distribution channels across Taiwan. Online marketplaces, brand websites, and social commerce platforms provide consumers convenient access to diverse product selections and exclusive offerings. Live streaming commerce and influencer marketing are engaging digitally savvy shoppers, particularly younger demographics. Retailers are investing in omnichannel strategies that integrate online experiences with physical stores, creating seamless shopping journeys. This convergence of digital convenience with tactile retail experiences is reshaping consumer expectations and driving competitive differentiation among market participants.

Market Outlook 2026-2034:

The Taiwan sportswear market is poised for sustained growth as health-conscious consumers embrace active lifestyles and fitness participation continues expanding across demographics. Government initiatives supporting sports development, combined with Taiwan's textile manufacturing excellence, create favorable conditions for market advancement. The market generated a revenue of USD 1,449.97 Million in 2025 and is projected to reach a revenue of USD 1,995.07 Million by 2034, growing at a compound annual growth rate of 3.61% from 2026-2034.

Taiwan Sportswear Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Shoes | 55.73% |

| Distribution Channel | Retail Stores | 35.25% |

| End User | Men | 59.83% |

Product Insights:

- Shoes

- Clothes

Shoes dominate with 55.73% share of the total Taiwan sportswear market in 2025.

Shoes maintain market leadership driven by robust consumer demand for performance footwear supporting diverse athletic activities. Running, hiking, and fitness training have gained widespread popularity, fueling purchases of specialized footwear designed for comfort, durability, and functionality. Taiwan's humid climate necessitates footwear featuring moisture management and breathability, prompting brands to invest in advanced cushioning systems and ventilation technologies. Local textile manufacturers supply innovative materials to global footwear brands, strengthening product offerings in the domestic market.

International sportswear brands have expanded their presence across Taiwan's retail landscape, offering extensive footwear collections tailored to local preferences. Department stores, specialty sports outlets, and branded flagship locations provide consumers access to diverse product ranges spanning performance running shoes, casual athletic sneakers, and outdoor footwear. E-commerce platforms have further accelerated market penetration, enabling convenient access to both mainstream and niche footwear categories while supporting customer reviews and sizing guidance.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online Stores

- Retail Stores

Retail stores lead with 35.25% share of the total Taiwan sportswear market in 2025.

Retail stores continue commanding market leadership as consumers value in-person shopping experiences for sportswear purchases. Physical retail locations enable product trials, fitting assessments, and immediate access to merchandise, which are factors particularly important for footwear where proper sizing ensures comfort and performance. Department stores remain popular destinations, offering curated selections from multiple brands within convenient shopping environments. Large-format specialty retailers provide extensive product assortments combined with knowledgeable staff assistance.

Outdoor goods stores across Taiwan have expanded significantly, offering shoppers diverse brand offerings and comfortable shopping environments. International retailers entering the market have introduced large-scale store formats providing comprehensive sporting goods selections. These retail developments reflect consumer appreciation for experiential shopping where they can evaluate product quality, compare options, and receive personalized recommendations before purchasing decisions.

End User Insights:

- Men

- Women

- Kids

Men hold 59.83% share of the total Taiwan sportswear market in 2025.

Men maintain clear market dominance attributable to higher sports participation rates and substantial spending on athletic apparel and footwear. Popular activities among Taiwanese men including running, cycling, hiking, and gym training drive consistent demand for performance-oriented products. The athleisure trend has expanded men's sportswear wardrobes beyond traditional athletic contexts, with casual sports-inspired apparel becoming acceptable for workplace and social settings.

Marketing efforts from major sportswear brands increasingly target male consumers through athlete endorsements, fitness influencer partnerships, and digital engagement campaigns. Product development emphasizes technical performance features, durability, and versatile styling that appeals to active male consumers seeking functionality alongside contemporary aesthetics. The growing middle class in Taiwan, with increased disposable income and leisure time, has strengthened purchasing power among male consumers driving sustained segment growth.

Regional Insights:

- Northern Taiwan

- Central Taiwan

- Southern Taiwan

- Eastern Taiwan

Northern Taiwan dominates the sportswear market due to high population density, elevated income levels, and concentrated retail infrastructure in the Taipei metropolitan area. Major department stores, flagship brand outlets, and premium fitness facilities provide consumers extensive access to diverse sportswear products.

Central Taiwan benefits from growing fitness culture and expanding retail development in urban centers. Rising health consciousness among residents drives demand for performance apparel and footwear. The region's moderate climate supports year-round outdoor activities, encouraging consistent sportswear purchases across seasonal categories.

Southern Taiwan presents significant growth opportunities as urbanization accelerates and sports participation increases. Expanding retail networks and e-commerce penetration are improving product accessibility. The region's warm climate influences consumer preferences toward lightweight, breathable sportswear suitable for outdoor fitness activities.

Eastern Taiwan's abundant natural landscapes and outdoor recreation opportunities drive demand for hiking, cycling, and adventure sportswear categories. Though population density remains lower, the region attracts fitness enthusiasts and tourists seeking performance apparel suited for mountainous terrain and coastal activities.

Market Dynamics:

Growth Drivers:

Why is the Taiwan Sportswear Market Growing?

Rising Health Consciousness and Fitness Participation

Health awareness among Taiwan's population has strengthened significantly, driving increased participation in sports and fitness activities. Government surveys indicate that the proportion of residents exercising regularly has reached record levels, with wearable device technology and home fitness emerging as major trends. Running, cycling, hiking, and gym training have gained widespread popularity across demographic segments, generating sustained demand for performance sportswear. The cultural shift toward prioritizing wellness and active lifestyles encourages consumers to invest in quality athletic apparel and footwear. As of 2023, Taiwan established 16 sports technology hubs and 128 fitness clubs, demonstrating institutional commitment to expanding sports participation.

Government Sports Promotion Initiatives

Taiwan's government has demonstrated strong commitment to advancing sports development through significant policy initiatives and budget allocations. The Cabinet approved plans to establish a dedicated Ministry of Sports, representing substantial investment in promoting sports participation and industry development. The ministry's mandate encompasses formulating sports policy, popularizing athletics, and fostering international sports collaboration. Additionally, governing agency’s Sports and Technology Action Plan aims to transform Taiwan's sports ecosystem through technological integration. These initiatives create favorable conditions for sportswear market growth by encouraging fitness participation and strengthening the sports industry ecosystem.

Advanced Textile Manufacturing Capabilities

Taiwan's globally recognized textile manufacturing sector provides competitive advantages supporting sportswear market development. The island serves as a critical supplier for major international sportswear brands, with Taiwanese firms pioneering innovations in functional fabrics featuring moisture management, temperature regulation, and sustainable materials. In November 2025, Taiwan's Ministry of Economic Affairs launched the Textile Export Promotion Project to strengthen global visibility for the nation's high-performance textile capabilities. Local manufacturers have transformed marine waste into high-value fibers and developed advanced weaving techniques for athletic jerseys adopted by international sports teams. This technical expertise enables domestic brands to offer innovative products while supporting global supply chain requirements.

Market Restraints:

What Challenges the Taiwan Sportswear Market is Facing?

Intense Market Competition

The Taiwan sportswear market faces significant competitive pressures from numerous domestic and international players vying for market share. Major global brands compete alongside domestic manufacturers, creating pricing pressures and requiring substantial investment in differentiation strategies. This competitive intensity challenges profitability and necessitates continuous innovation.

Economic Fluctuations and Inflation

Economic uncertainties and inflationary pressures affect consumer purchasing behavior and sportswear demand. Budget-conscious consumers may prioritize essential purchases over discretionary sportswear spending, particularly for premium products. Rising costs of materials and operations further challenge market participants seeking to maintain competitive pricing.

Evolving Consumer Preferences

Rapidly changing consumer preferences require brands to continuously adapt product offerings and marketing strategies. Fashion cycles accelerate as digital platforms expose consumers to global trends, demanding constant innovation in design and functionality. Companies must invest significantly in research and trend forecasting to remain relevant.

Competitive Landscape:

The Taiwan sportswear market features a diverse competitive landscape comprising established multinational brands and local manufacturers. Major international players leverage global brand recognition, extensive marketing resources, and comprehensive product portfolios to maintain market positions. Competition centers on product innovation, retail presence expansion, digital engagement strategies, and sustainability initiatives. Companies are investing in omnichannel approaches that integrate physical stores with e-commerce platforms to enhance customer experiences. Strategic partnerships and collaborations enable market participants to strengthen supply chain capabilities and accelerate product development. Local textile manufacturers provide competitive advantages through innovative fabric technologies, supporting both domestic brands and international supply chains.

Taiwan Sportswear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Shoes, Clothes |

| Distribution Channels Covered | Online Stores, Retail Stores |

| End Users Covered | Men, Women, Kids |

| Regions Covered | Northern Taiwan, Central Taiwan, Southern Taiwan, Eastern Taiwan |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Taiwan sportswear market size was valued at USD 1,449.97 Million in 2025.

The Taiwan sportswear market is expected to grow at a compound annual growth rate of 3.61% from 2026-2034 to reach USD 1,995.07 Million by 2034.

Shoes held the largest revenue share of 55.73% in 2025, driven by strong consumer demand for performance footwear supporting running, hiking, and fitness activities across Taiwan's health-conscious population.

Key factors driving the Taiwan sportswear market include rising health consciousness and fitness participation, government sports promotion initiatives, advanced textile manufacturing capabilities, growing athleisure trends, and expanding e-commerce channels.

Major challenges include intense market competition from domestic and international players, economic fluctuations affecting consumer spending, evolving preferences requiring continuous innovation, and pricing pressures impacting profitability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)