Taiwan Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2025-2033

Taiwan Steel Tubes Market Overview:

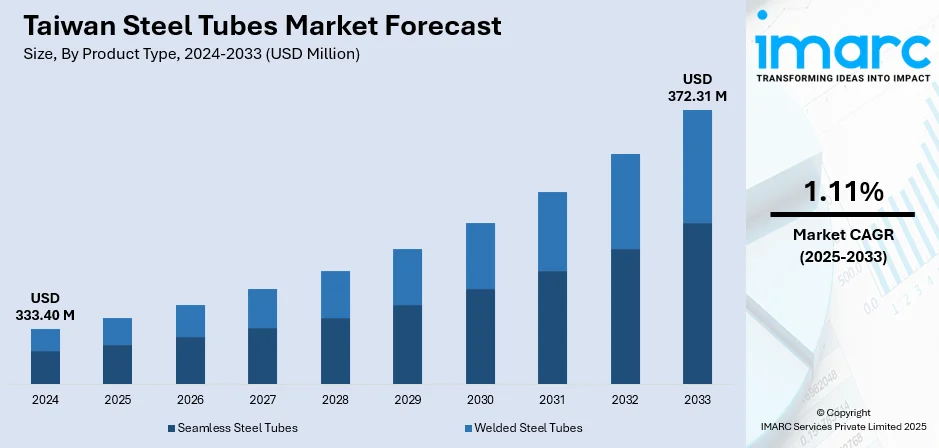

The Taiwan steel tubes market size reached USD 333.40 Million in 2024. The market is projected to reach USD 372.31 Million by 2033, exhibiting a growth rate (CAGR) of 1.11% during 2025-2033. The market is transforming with increasing demand in multiple industries, such as automotive, construction, and energy. Companies are improving product quality and leveraging sophisticated production methods to satisfy various usage demands. The sector enjoys robust domestic capabilities and expanding opportunities for exports, making Taiwan a competitive force in the international steel tubes market. Ongoing innovation and strategic investment are likely to fuel long-term growth and consolidate Taiwan steel tubes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 333.40 Million |

| Market Forecast in 2033 | USD 372.31 Million |

| Market Growth Rate 2025-2033 | 1.11% |

Taiwan Steel Tubes Market Trends:

Increase in Export Demand

In January 2025, Taiwan Customs Office announced significant growth in welded steel pipe exports. The growth is evidence of the increased participation of Taiwan in the international market of steel tubes, driven by Taiwan's robust industry and observance of quality standards. The growth of exports finds backing in Taiwan's trade diplomacy and effective logistics system, through which producers can meet foreign demand timely and credibly. With the growth in export volumes, steel tube manufacturers are making investments in high-end technologies and expansions to remain competitive and cater to varied market demands. The trend indicates the significance of Taiwan's export industry as a prime driver of the Taiwan steel tubes market growth. Global buyers' continuous demand not only consolidates Taiwan as a leading supplier but also stimulates innovation and sustainability in manufacturing processes. Taiwan's capacity to evolve with changing trade conditions and sustain product quality remains the underlying factor for the robust outlook in the steel tubes market.

To get more information on this market, Request Sample

Rising Energy Costs Shift Industry Dynamics

Taiwan's Ministry of Economic Affairs in March 2024 approved a rise in industrial electricity prices to reduce the financial pressure on state utilities and promote more efficient energy consumption among heavy industries. The new policy is encouraging major manufacturing sectors, particularly steelmaking to rethink energy plans. For steel tube producers, electricity is an important input, and this price change is driving the momentum towards plant modernization and equipment upgrades to decrease power usage. Quite a few producers are presently investigating heat recovery systems, intelligent scheduling of off-peak manufacturing, and energy-saving equipment. These developments not only assist in lowering costs but also enable more consistent production cycles and punctual shipment, both vital considerations for addressing customer demand. This shift is likely to influence investments in the future of automation and sustainability in the tubing segment. Since energy is still a central element in manufacturing competitiveness, how the industry adapts to such cost structures will be instrumental in determining Taiwan steel tubes market trends in the next few years.

Renewable Energy Growth Fuels Tubing Innovation

In March 2025, Taiwan’s offshore wind industry reached a new milestone with the financial close of the Fengmiao I wind farm, the first project under Round 3 of the country’s wind energy development program. As Taiwan moves steadily toward its clean energy goals, the infrastructure supporting this transition is creating new momentum across related manufacturing sectors, particularly in steel tubes. These components are essential in the foundation, cabling, and support systems of wind turbines. In response, local tube producers are focusing on marine-grade materials and engineering enhancements that meet the long-term demands of offshore environments. This shift is not only stimulating domestic innovation but also encouraging closer collaboration between energy developers and material suppliers. As these energy projects scale, the ripple effect is increasing operational efficiency and helping Taiwan as a key contributor to global clean energy infrastructure. This growth is strengthening the foundation for long-term stability and advancement in the steel tube industry, creating strong alignment between industrial capability and national sustainability goals.

Taiwan Steel Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seamless steel tubes and welded steel tubes.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, stainless steel, alloy steel, and other.

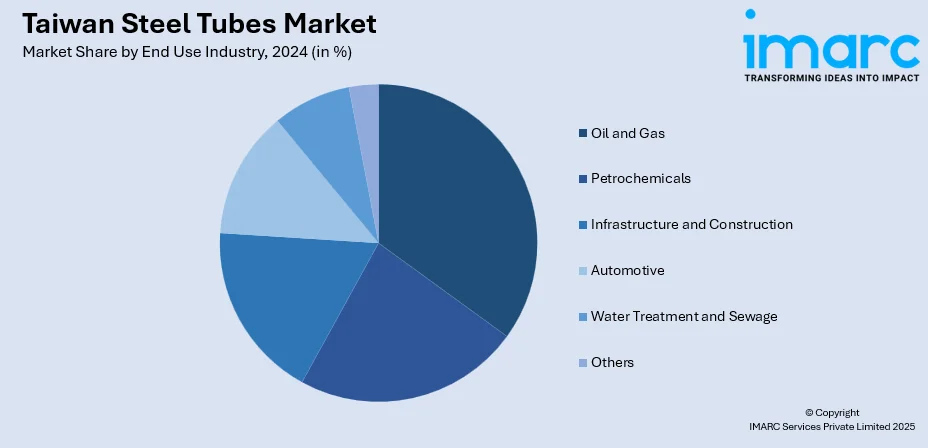

End Use Industry Insights:

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, petrochemicals, infrastructure and construction, automotive, water treatment and sewage, and others.

Regional Insights:

- Northern Taiwan

- Central Taiwan

- Southern Taiwan

- Eastern Taiwan

The report has also provided a comprehensive analysis of all the major regional markets, which include the Northern Taiwan, Central Taiwan, Southern Taiwan, and Eastern Taiwan.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Taiwan Steel Tubes Market News:

- January 2025: Taiwan's YC Inox has opened a new steel pipe and plate factory in Turkey's Kocaeli Province, representing a strategic push for the country's steel sector. The firm views Turkey as a key logistics center from which it can reach markets in Asia, Europe, and Africa. The plant complements YC Inox's existing business in the region and indicates Taiwan's increasing industrial presence outside of its own boundaries. The project underscores Taiwan's international competitiveness in steel production.

Taiwan Steel Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Types Covered | Carbon Steel, Stainless Steel, Alloy Steel, Other |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| Regions Covered | Northern Taiwan, Central Taiwan, Southern Taiwan, Eastern Taiwan |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Taiwan steel tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the Taiwan steel tubes market on the basis of product type?

- What is the breakup of the Taiwan steel tubes market on the basis of material type?

- What is the breakup of the Taiwan steel tubes market on the basis of end use industry?

- What is the breakup of the Taiwan steel tubes market on the basis of region?

- What are the various stages in the value chain of the Taiwan steel tubes market?

- What are the key driving factors and challenges in the Taiwan steel tubes market?

- What is the structure of the Taiwan steel tubes market and who are the key players?

- What is the degree of competition in the Taiwan steel tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Taiwan steel tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Taiwan steel tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Taiwan steel tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)