Talc Market Report by Deposit Type, Form, End Use Industry, and Region, 2025-2033

Talc Market Size and Share:

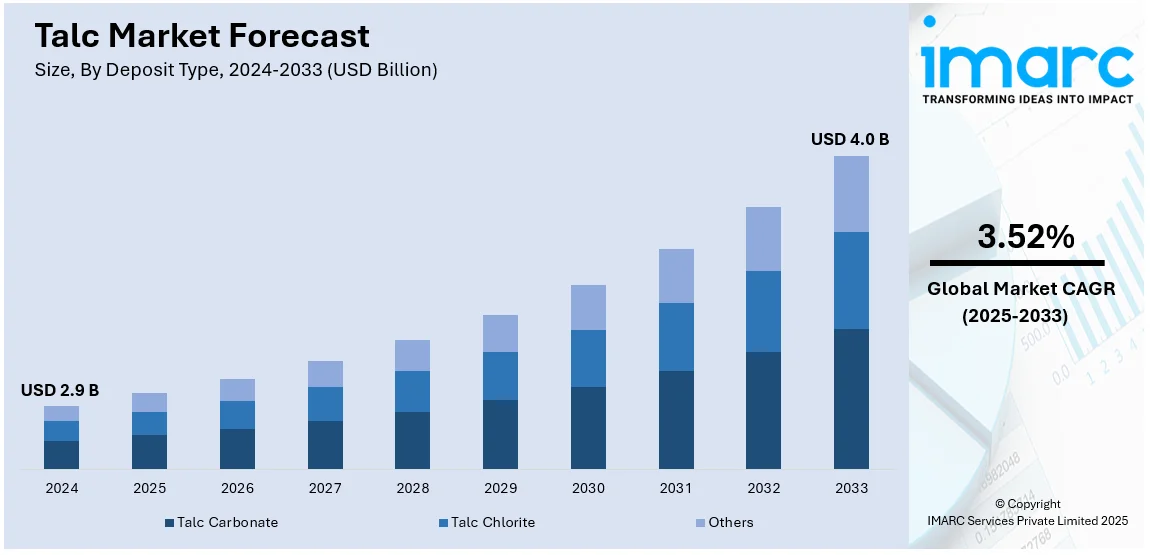

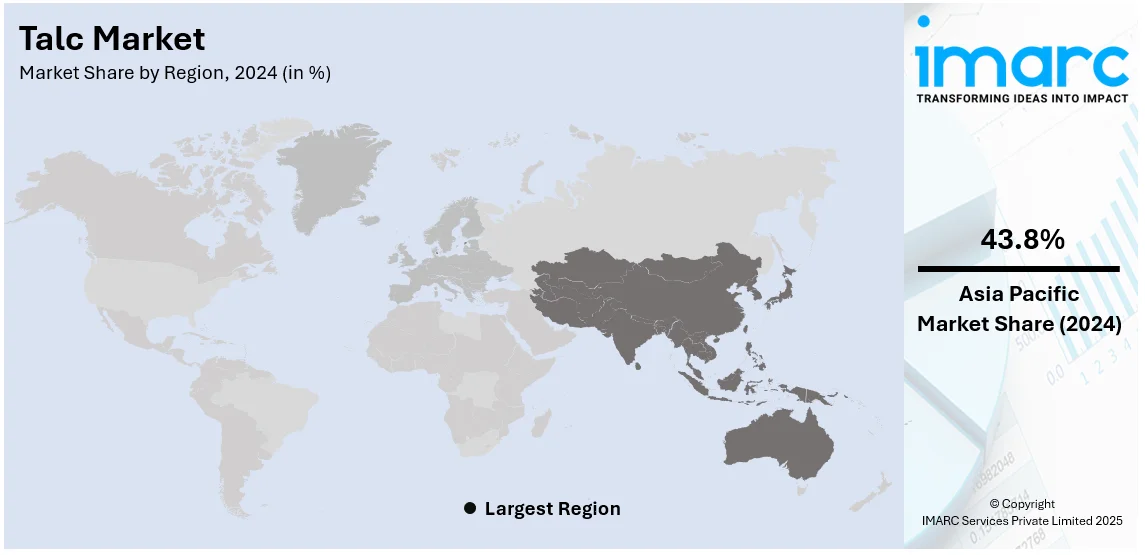

The global talc market size was valued at USD 2.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.0 Billion by 2033, exhibiting a CAGR of 3.52% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 43.8% in 2024. The global talc market share is primarily driven by continual technological advancements in processing technologies, the rising demand for consumer goods and cosmetics, extensive industrial applications in the automotive and coatings sectors, and rapid industrialization and urbanization in emerging markets.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.9 Billion |

|

Market Forecast in 2033

|

USD 4.0 Billion |

| Market Growth Rate (2025-2033) | 3.52% |

The talc market growth is driven by various factors, including its widespread use in diverse industries such as cosmetics, pharmaceuticals, ceramics, and paper. The growing demand for beauty and personal care products, particularly those containing talc as a key ingredient, is a major driver. According to the IMARC Group, the global beauty and personal care products market size reached USD 529.5 Billion in 2024 and is projected to reach USD 802.6 Billion by 2033, exhibiting a CAGR of 4.2% during 2025-2033. Additionally, the increasing awareness about the benefits of talc in improving product texture, absorbency, and slip is contributing substantially to industry expansion growth. Besides this, the construction and ceramics industries also continue to rely on talc for enhancing product durability and performance, propelling overall market growth.

The United States has emerged as a key regional market for talc, primarily driven by the increasing demand for talc in industries such as cosmetics, automotive, and plastics. The widespread use of talc in personal care products, particularly in skin care and baby powders, is significantly supporting market growth. Additionally, talc is used in rubber manufacturing, providing strength and durability to products. As per a report published by the IMARC Group, the United States rubber market size is forecasted to exhibit a CAGR of 5.00% during 2024-2032. Besides this, the demand for talc in ceramics and paint industries, driven by the need for high-quality, smooth finishes, is also contributing to overall industry expansion.

Talc Market Trends:

Technological advancements in talc processing

Numerous companies are investing in automation and digitization to improve efficiency and productivity and, thus, creating a favorable global talc market outlook. Modern techniques enable optical minerals to be reground and purified, which produces finer and more consistent products and makes them purer. As technologies advance, they improve productivity, facilitate waste management, and create an efficient production process, lowering the overall cost and supporting market growth. In 2023, PPG announced investing USD 44 Million to modernize five powder coating manufacturing plants in the United States and Latin America. This clearly demonstrates the commitment of the industry to innovation. Investments such as these reflect a focus on developing production technologies and responding to the changing needs of end-use industries, which increases demand for talc even more. Its ability to satisfy a variety of quality standards and complexity of uses is an important factor driving the increasing talc demand and the role of talc as a basic material in different applications. The talc market size is projected to expand significantly as investments in automation, technological advancements, and the growing demand for high-quality talc across various industries, such as automotive and cosmetics, drive market growth.

Expansion in the consumer goods sector

The talc market trends indicate that talc has witnessed a growth in share in the consumer goods sector due to its versatile range of characteristics that make it the most preferred artificial ingredient for many personal care products. With the growth of the middle class in emerging economies and the expansion of global markets, there are more purchases of beauty and personal care products. This trend, among others, is a significant feature in the talc market analysis, according to which more consumers in search of these items affect the talc demand in a positive way. The position of consumers toward the given items is good, which is in correlation with the market forecast, which shows persistent growth as the result of the changing factors of demography and lifestyle. For instance, industry reports indicate that the overall market for baby talcum powder in India achieves annual sales of approximately Rs 1,500 crore (USD 173.40 Million). Within this market, the segment specifically for baby talc accounts for about Rs 450 crore (USD 52.02 Million). The talc market price is expected to see growth, driven by the increasing demand for talc in the personal care sector, as well as rising consumer preferences for high-quality products in emerging markets.

Rising industrial applications

The industrial sector is a major driver of the talc market growth. The characteristics of talc, such as resistance to heat, electricity, and acids, make it an essential ingredient in this sector. As a result, it is widely used in the automotive, construction, and manufacturing industries. In vehicle production, the purpose of talc is to fabricate lightweight plastic parts that increase fuel economy and reduce emissions at the same time. Its use in rubber manufacturing enhances product durability and flexibility, making it essential for tires, seals, and hoses. In paint and coatings, talc provides durability and finish improvement of the end products. The role of talc in ceramics, where it helps create stronger and more durable materials, is also contributing to its growing demand. The industrial demand for talc from these sectors creates a positive talc market outlook. With the high development of the industrial field, the talc industry is poised to move forward steadily. The talc market forecast indicates continued growth, driven by its essential applications across industries such as automotive, construction, and manufacturing, where its unique properties enhance performance and product durability.

Talc Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on deposit type, form, and end use industry.

Analysis by Deposit Type:

- Talc Carbonate

- Talc Chlorite

- Others

Talc carbonate stands as the largest component in 2024, holding around 88.5% of the market. The industry is mainly influenced by the prevalence of talc carbonate deposits, which hold the majority of the talc market share. These deposits, classified by their purity and excellence in the manufacturing of talc, are vital to companies that need superior-grade ingredients for their product formulations. The distinctive qualities of talc carbonate, such as its superior whiteness and impressive heat resistance, make it extremely in demand in industries that prompt better end products, including cosmetic products and polymer. The presence of such deposits serves as the pivotal point in the talc market research report, as they play a valuable role in determining production strategies and market factors.

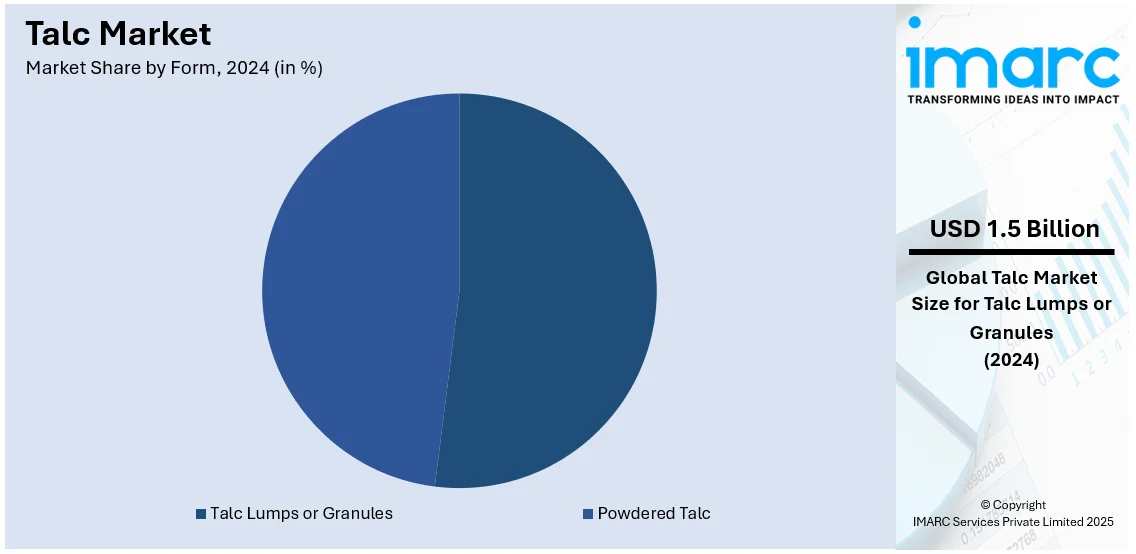

Analysis by Form:

- Powdered Talc

- Talc Lumps or Granules

Talc lumps or granules lead the market with around 52.3% of market share in 2024. Talc lumps or granules are usually used in industrial applications such as the production of ceramics, plastics, and paints. These larger forms of talc undergo further processing into finer forms depending upon the demands of the end product. The growth of the segment is supported by applications in heavy-duty industries, where the properties of heat resistance and strength enhancement obtained from talc are in great demand. Their larger size also ensures better handling, storage, and transportation efficiency, making them a preferred choice and cementing their dominance in the market. The talc market price for lumps and granules is expected to remain stable, driven by their widespread use in heavy-duty industrial applications and the increased demand for products requiring heat resistance and strength enhancement.

Analysis by End Use Industry:

- Pulp and Paper

- Plastic Industry

- Ceramics

- Paints and Coatings

- Cosmetics and Personal Care

- Pharmaceuticals

- Food

- Others

Plastic industry represents the leading market segment in 2024, with around 27.5% of market share. Plastic holds the largest share of the market as the greatest source of consumption of talc in the industry. Mainly applied as an additive to polymer compounds, talc improves the mechanical properties, thermal resistance, and surface quality of plastic products. This key factor is embodied in the talc market report where the composition of talc in plastics cuts expenses and also serves to reduce the overall weight of automotive components. As environmental regulations focus on more sustainable manufacturing practices, the role of talc in the plastic industry solidifies its position at the forefront of the industry.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 43.8%. Asia Pacific is the leading market for the industry, as per talc industry trends. This can be supported by strong industrial growth, vast mineral deposits, and a high level of production. Moreover, China and India are major players in the talc market. These countries, with their large mining operations and heavy manufacturing industries that require large amounts of talc, play a significant part in the consumption of talc. According to the talc market report, the talc requirement in the Asia Pacific region is significantly driven by the soaring automotive, construction, and cosmetic industries that are the primary consumers of this material. This dominant trend is further reinforced by the talc market forecast, which features growing numbers of investments into the region's heavy infrastructure and consumer goods.

Key Regional Takeaways:

United States Talc Market Analysis

In 2024, the United States accounts for over 82.80% of the talc market share in North America. The demand for talc in the United States, where it is an important ingredient in the cosmetic industry for improving texture and application of products such as powders, foundations, and blushes, has been quite high. In 2022, the United States was among the top exporting countries globally, with USD 6.02 Billion in exported beauty products, based on data from the Observatory of Economic Complexity (OEC). The growth of the U.S. beauty market has been driven by rising consumer demand for high-performance products and by the strict insistence on quality and safety standards, particularly in regard to asbestos-free talc. Since talc is a vital ingredient in obtaining superior product formulations, it is also important in terms of meeting changing market preferences at home and abroad. The U.S. is also the innovation leader in the beauty sector, so a refined and consistent supply of talc to this market continues to drive the demand. Increasingly, it points to the role that talc plays in enabling the rapidly growing U.S. beauty market.

Europe Talc Market Analysis

In Europe, talc is widely used as a functional additive in paper and board manufacturing, where it enhances the smoothness, printability, and strength of these materials while improving production efficiency. As the Confederation of European Paper Industries reported, the production of packaging paper and board among CEPI members was at 49,831 thousand metric tons in 2020 and had grown to 53,545 thousand metric tons in 2021. This demonstrates the need for high-quality packaging materials all over Europe because the e-commerce sector is booming, and there is increased attention toward green packaging solutions. As the packaging industry strives to meet more stringent environmental requirements, the role of talc in producing lightweight, durable, and recyclable materials becomes increasingly vital. The continued growth in the production of packaging paper and board directly supports the demand for talc in the European market. Given that Europe is leading global efforts in sustainable practices, the reliance on talc to improve the performance and sustainability of paper products is expected to further boost the region's talc market.

Asia Pacific Talc Market Analysis

Talc is used extensively in plastics manufacturing in the Asia Pacific region to improve product quality, enhance surface smoothness, and provide better heat resistance. In 2021, the Asia-Pacific (APAC) region accounted for just over half of the world's plastics production at 52% or 390.7 million metric tons, as per the Environmental Resources Management (ERM). This high production share is directly proportional to the growth of the talc market in the region. With the steady rise in the demand for good quality plastics in industries such as automobiles, packaging, and electronics, there is a growing need for the addition of talc to further improve the properties of the materials. Talc usage is also experiencing a significant boost due to the rapid industrialization and growing consumer markets of the Asia Pacific region, driving innovations in plastics production. The integration of talc in varied plastic applications, along with the growing concerns over sustainability, places the Asia Pacific region at the forefront of growth factors for the talc market. Continued investments in technology and production efficiencies also support the expansion of talc applications to enhance the functionality of plastics in Asia Pacific.

Latin America Talc Market Analysis

In the Latin America region, talc is widely used in the paper industry as a filler and coating material, where it improves opacity, smoothness, and printability, and also reduces friction in the production process. According to the Brazilian Tree Industry (Ibá), Brazil's pulp production increased by 2.6% while export volume rose by 12.9% in the first quarter of 2023 compared to the same period in 2022. This growth highlights the expanding demand for high-quality pulp and paper products in Latin America. As the region's paper industry continues to be focused on sustainable practices and improved efficiency, the need for talc products that enhance paper properties is also on the rise. Thus, growth in Latin American demand for superior-performance papers is supporting the demand for products obtained from improved ecological production and extraction processes involving the use of talc. The focus on more eco-friendly efforts related to the usage and production processes for paper-based items is further fueling the demand for talc.

Middle East and Africa Talc Market Analysis

Several key drivers are behind the growth of the Middle East and Africa talc market. Primarily, growing demand from the construction and automotive segments is majorly driving this market, as talc is used in paints, coatings, and plastic composites for additional strength and durability. The booming construction sector, particularly in countries such as the UAE and Saudi Arabia, is driving this demand. According to industry reports, the UAE government has strongly committed to development and resource distribution in infrastructure undertakings, which has resulted in several megaprojects that offer promising opportunities for building and engineering companies. Among the visible projects are redeveloping Mina Rashid in Dubai, as well as the Dubai International Financial Centre Expansion 2.0, each of which shall stimulate demand for a variety of construction materials that include talc. With the growing focus on industrial applications, such as ceramics and paper production, the requirement for talc is increasing further. The rise in the regional manufacturing base of countries is also boosting the consumption of talc-based products.

Competitive Landscape:

Key players in the market are expanding their production capacity and pursuing mergers and acquisitions to increase their share of the market. They have also allocated resources to research and development (R&D) so that they can introduce high-performance products that are tailor-made for sectors, including pharmaceuticals, cosmetics, and food, as these industries have extremely strict requirements. Besides, the companies are concerned with sustainable mining methods and enhanced processing technologies that enable them to meet environmental concerns and attain regulatory standards. By getting innovative and abiding by global quality rules, these market leaders reinforce their position and propel the industry, particularly amidst the increasing demand of both consumers and industries.

The report provides a comprehensive analysis of the competitive landscape in the talc market with detailed profiles of all major companies, including:

- AKJ Minchem Private Limited

- Anand Talc

- Elementis plc

- Golcha Group

- Guangxi Longsheng Huamei Talc Development Co. Ltd.

- Imerys S.A.

- IMI FABI S.p.A.

- Minerals Technologies Inc.

- Mughne Group of Companies

- Nippon Talc Co. Ltd.

- Sibelco

- Sun Minerals

- Xilolite S.A.

Latest News and Developments:

- August 2024: Cuticura launched a new talc offering 8-hour freshness with a branding campaign on Kochi Metro trains. The campaign targets Onam festival-goers, leveraging Kochi Metro's wide reach to showcase the product's benefits and increase visibility.

- June 2024: Dabur India launched Cool King Icy Perfume Talc, featuring a unique double-burst cooling formula and 12 hours of icy freshness. The product, designed to combat hot and humid weather, was endorsed by Bollywood actor Ranbir Kapoor. This launch aims to provide users with a refreshing, fragrant talc experience.

- April 2024: A joint venture agreement has been signed between Golchha Group and Indian Oil Mauritius Limited to erect a state-of-the-art lube blending plant for the local production of SERVO lubricants in Nepal.

- April 2024: Imerys has formed a new business area, “Solutions for Energy Transition,” to reflect accelerating momentum in critical minerals.

- April 2023: Minerals Technologies Inc. announced that it has entered three long-term precipitated calcium carbonate (PCC) supply agreements that will further expand the company’s specialty additives product line in China and India.

Talc Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deposit Types Covered | Talc Carbonate, Talc Chlorite, Others |

| Forms Covered | Powdered Talc, Talc Lumps or Granules |

| End Use Industries Covered | Pulp and Paper, Plastic Industry, Ceramics, Paints and Coatings, Cosmetics and Personal Care, Pharmaceuticals, Food, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AKJ Minchem Private Limited, Anand Talc, Elementis plc, Golcha Group, Guangxi Longsheng Huamei Talc Development Co. Ltd., Imerys S.A., IMI FABI S.p.A., Minerals Technologies Inc., Mughne Group of Companies, Nippon Talc Co. Ltd., Sibelco, Sun Minerals, Xilolite S.A., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the talc market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global talc market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the talc industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The talc market was valued at USD 2.9 Billion in 2024.

IMARC estimates the talc market to exhibit a CAGR of 3.52% during 2025-2033.

The increased demand in the cosmetics and personal care industry, growth in the construction and automotive sectors, expanding applications in the paper and plastics industries, rising industrial demand for talc in ceramics and paint production, and technological advancements in talc processing and product quality improvement are the primary factors driving the global talc market.

Asia Pacific currently dominates the market due to due to the large reserves of high-quality talc in the region, particularly in countries such as China and India.

Some of the major players in the talc market include AKJ Minchem Private Limited, Anand Talc, Elementis plc, Golcha Group, Guangxi Longsheng Huamei Talc Development Co. Ltd., Imerys S.A., IMI FABI S.p.A., Minerals Technologies Inc., Mughne Group of Companies, Nippon Talc Co. Ltd., Sibelco, Sun Minerals, Xilolite S.A., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)