Tea Processing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue

Tea Processing Plant Project Report (DPR) Summary:

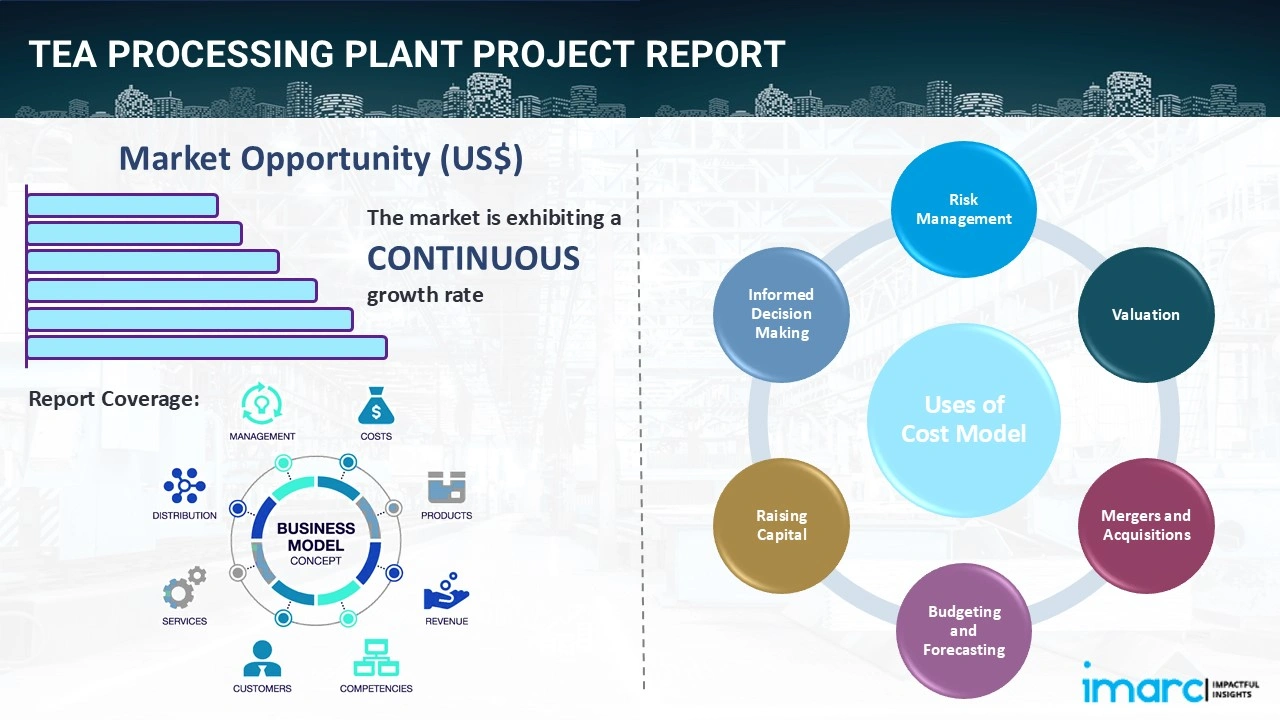

IMARC Group's comprehensive DPR report, titled "Tea Processing Plant Project Report 2026: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue," provides a complete roadmap for setting up a tea processing unit. The tea market continues to grow steadily due to rising global tea consumption, increasing preference for natural and functional beverages, expansion of organized retail, and growing demand for premium and specialty tea variants. The global tea market size was valued at USD 26.7 Billion in 2025. According to IMARC Group estimates, the market is expected to reach USD 39.40 Billion by 2034, exhibiting a CAGR of 4.4% from 2026 to 2034.

This feasibility report covers a comprehensive market overview to micro-level information such as unit operations involved, raw material requirements, utility requirements, infrastructure requirements, machinery and technology requirements, manpower requirements, packaging requirements, transportation requirements, etc.

The tea processing plant setup cost is provided in detail, covering project economics, capital investments (CapEx), project funding, operating expenses (OpEx), income and expenditure projections, fixed costs vs. variable costs, direct and indirect costs, expected ROI, and net present value (NPV), profit and loss account, financial analysis, etc.

Access the Detailed Feasibility Analysis, Request Sample

What is Tea?

Tea is a widely consumed beverage prepared from the processed leaves of the Camellia sinensis plant. The classification of tea into black tea, green tea, white tea, oolong tea, and specialty varieties depends on the processing methods that include withering and rolling, oxidation, and drying. The refreshing taste of tea, together with its aromatic properties and its health-supporting characteristics, which include antioxidants, polyphenols, and natural caffeine make the beverage valuable. Modern tea production methods deliver reliable product quality together with specific flavor profiles while ensuring products remain safe for consumption and maintain hygienic standards. Packaged tea is available in multiple formats, such as loose leaf, tea bags, instant tea powders, and flavored blends. The combination of tea's flexibility, its acceptance in various cultures, and its health advantages has established it as a common drink in homes and restaurants and the global beverage market.

Key Investment Highlights

- Process Used: Withering, rolling or maceration, oxidation or fermentation, drying, sorting and grading, blending, quality inspection, and packaging.

- End-use Industries: Beverage industry, foodservice and horeca sector, retail and packaged food industry, and household consumption.

- Applications: Hot and iced beverages, flavored and specialty tea blends, wellness and functional drinks, and institutional beverage services.

Tea Plant Capacity:

The proposed processing facility is designed with an annual production capacity ranging between 1,000 Metric Tons, enabling economies of scale while maintaining operational flexibility.

Tea Plant Profit Margins:

The project demonstrates healthy profitability potential under normal operating conditions. Gross profit margins typically range between 25-35%, supported by stable demand and value-added applications.

- Gross Profit: 25-35%

- Net Profit: 10-18%

Tea Plant Cost Analysis:

The operating cost structure of a tea processing plant is primarily driven by raw material consumption, particularly green tea leaves, which account for approximately 65-75% of total operating expenses (OpEx).

- Raw Materials: 65-75% of OpEx

- Utilities: 10-15% of OpEx

Financial Projection:

The financial projections for the proposed project have been developed based on realistic assumptions related to capital investment, operating costs, production capacity utilization, pricing trends, and demand outlook. These projections provide a comprehensive view of the project’s financial viability, ROI, profitability, and long-term sustainability.

Major Applications:

- Beverage Industry: Processed tea serves as the primary input for packaged tea brands, ready-to-drink beverages, and specialty tea formulations with consistent flavor and aroma profiles.

- Foodservice and HoReCa Sector: Hotels, cafes, and restaurants use standardized tea blends to create standardized taste while making drink preparation and service delivery more efficient.

- Retail and Packaged Tea Segment: Branded loose tea and tea bags enable consumers to access high-quality tea products, which they can purchase from retail stores because these tea products offer simple handling and long-lasting freshness.

- Household Consumption: Tea processing enables consumers to enjoy high-quality brews with reliable taste, aroma, and infusion characteristics across daily consumption occasions.

Why Tea Processing?

✓ Consistent Global Demand: Tea is one of the most widely consumed beverages worldwide, ensuring stable demand across developed and emerging markets.

✓ Value Addition Potential: Processing activities, together with blending and packaging work, to increase product value beyond what raw leaf sales return to businesses.

✓ Product Diversification Opportunities: Manufacturers can create specialty tea products that include organic, flavored, and wellness-oriented variations to satisfy changing consumer tastes.

✓ Scalable Production Model: Tea processing plants become more efficient through moderate capital expenses, which enable them to operate with different production levels.

✓ Strong Export Opportunities: Processed tea benefits from robust international trade demand, especially for premium and origin-specific varieties.

Transforming Vision into Reality:

This report provides the comprehensive blueprint needed to transform your tea processing vision into a technologically advanced and highly profitable reality.

Tea Industry Outlook 2026:

The global tea industry maintains its steady expansion because health awareness among people, their natural beverage consumption, and their interest in high-quality tea products keep increasing. For instance, global tea consumption reached roughly 6,957 million kg in 2024, with India contributing nearly 18% of total demand. This strong consumption base highlighted tea’s deep cultural and daily relevance, directly supporting market expansion through higher domestic intake, product diversification, and sustained demand across both traditional and modern tea formats. Consumers now prefer packaged branded tea products, which provide them with reliable quality standards and easy-to-use solutions, because they live in urban areas and follow modern ways of life. The increasing popularity of cafés and foodservice establishments has created a higher demand for common tea blends.

Leading Tea Processors:

Leading processors in the global tea industry include several multinational companies with extensive production capacities and diverse application portfolios. Key players include:

- Associated British Foods PLC

- Barry's Tea

- Bigelow Tea

- Caraway Tea

- Dabur Ltd

all of which serve end-use sectors such as food and beverages, pharmaceuticals, cosmetics, and personal care.

How to Setup a Tea Processing Plant?

Setting up a tea processing plant requires evaluating several key factors, including technological requirements and quality assurance.

Some of the critical considerations include:

- Detailed Process Flow: The procedure process is a multi-step operation that involves several unit operations, material handling, and quality checks. Below are the main stages involved in the tea procedure process flow:

- Unit Operations Involved

- Mass Balance and Raw Material Requirements

- Quality Assurance Criteria

- Technical Tests

-

Site Selection: The location must offer easy access to key raw materials such as green tea leaves. Proximity to target markets will help minimize distribution costs. The site must have robust infrastructure, including reliable transportation, utilities, and waste management systems. Compliance with local zoning laws and environmental regulations must also be ensured.

-

Plant Layout Optimization: The layout should be optimized to enhance workflow efficiency, safety, and minimize material handling. Separate areas for raw material storage, production, quality control, and finished goods storage must be designated. Space for future expansion should be incorporated to accommodate business growth.

-

Equipment Selection: High-quality, corrosion-resistant machinery tailored for tea processing must be selected. Essential equipment includes withering troughs, rolling machines, fermenting units, dryers, graders, blending systems, and packaging equipment. All machinery must comply with industry standards for safety, efficiency, and reliability.

-

Raw Material Sourcing: Reliable suppliers must be secured for raw materials like green tea leaves to ensure consistent production quality. Minimizing transportation costs by selecting nearby suppliers is essential. Sustainability and supply chain risks must be assessed, and long-term contracts should be negotiated to stabilize pricing and ensure a steady supply.

-

Safety and Environmental Compliance: Safety protocols must be implemented throughout the tea processing process of tea. Advanced monitoring systems should be installed to detect leaks or deviations in the process. Effluent treatment systems are necessary to minimize environmental impact and ensure compliance with emission standards.

-

Quality Assurance Systems: A comprehensive quality control system should be established throughout production. Analytical instruments must be used to monitor product concentration, purity, and stability. Documentation for traceability and regulatory compliance must be maintained.

Project Economics:

Establishing and operating a tea processing plant involves various cost components, including:

-

Capital Investment: The total capital investment depends on plant capacity, technology, and location. This investment covers land acquisition, site preparation, and necessary infrastructure.

-

Equipment Costs: Equipment costs, such as those for withering troughs, rolling machines, fermenting units, dryers, graders, blending systems, and packaging equipment, represent a significant portion of capital expenditure. The scale of production and automation level will determine the total cost of machinery.

-

Raw Material Expenses: Raw materials, including green tea leaves, are a major part of operating costs. Long-term contracts with reliable suppliers will help mitigate price volatility and ensure a consistent supply of materials.

-

Infrastructure and Utilities: Costs associated with land acquisition, construction, and utilities (electricity, water, steam) must be considered in the financial plan.

-

Operational Costs: Ongoing expenses for labor, maintenance, quality control, and environmental compliance must be accounted for. Optimizing processes and providing staff training can help control these operational costs.

-

Financial Planning: A detailed financial analysis, including income projections, expenditures, and break-even points, must be conducted. This analysis aids in securing funding and formulating a clear financial strategy.

Capital Expenditure (CapEx) and Operational Expenditure (OpEx) Analysis:

Capital Investment (CapEx): Machinery costs account for the largest portion of the total capital expenditure. The cost of land and site development, including charges for land registration, boundary development, and other related expenses, forms a substantial part of the overall investment. This allocation ensures a solid foundation for safe and efficient plant operations.

Operating Expenditure (OpEx): In the first year of operations, the operating cost for the tea processing plant is projected to be significant, covering raw materials, utilities, depreciation, taxes, packing, transportation, and repairs and maintenance. By the fifth year, the total operational cost is expected to increase substantially due to factors such as inflation, market fluctuations, and potential rises in the cost of key materials. Additional factors, including supply chain disruptions, rising consumer demand, and shifts in the global economy, are expected to contribute to this increase.

.webp)

Capital Expenditure Breakdown:

| Particulars | Cost (in US$) |

|---|---|

| Land and Site Development Costs | XX |

| Civil Works Costs | XX |

| Machinery Costs | XX |

| Other Capital Costs | XX |

To access CapEx Details, Request Sample

Operational Expenditure Breakdown:

| Particulars | In % |

|---|---|

| Raw Material Cost | 65-75% |

| Utility Cost | 10-15% |

| Transportation Cost | XX |

| Packaging Cost | XX |

| Salaries and Wages | XX |

| Depreciation | XX |

| Taxes | XX |

| Other Expenses | XX |

To access OpEx Details, Request Sample

Profitability Analysis:

| Particulars | Unit | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Average |

|---|---|---|---|---|---|---|---|

| Total Income | US$ | XX | XX | XX | XX | XX | XX |

| Total Expenditure | US$ | XX | XX | XX | XX | XX | XX |

| Gross Profit | US$ | XX | XX | XX | XX | XX | XX |

| Gross Margin | % | XX | XX | XX | XX | XX | 25-35% |

| Net Profit | US$ | XX | XX | XX | XX | XX | XX |

| Net Margin | % | XX | XX | XX | XX | XX | 10-18% |

To access Financial Analysis, Request Sample

Latest Industry Developments:

- September 2025: The Tea Research Association (Tocklai) launched a decaffeinated green tea powder at its 61st annual general meeting in Kolkata. The tea product, developed from Assam clones TV 9, 11, and 12, delivers 75% lower caffeine, high antioxidants, and is aimed to rival Japanese matcha.

- May 2025: Lipton marked its most significant brand transformation in over a decade, featuring a refreshed logo, updated packaging, and expanded tea offerings. The revamp introduced new English Breakfast and Earl Grey tea variants, secured nationwide availability, and reinforced the company’s strategy to modernize the brand while strengthening its presence in the competitive tea category.

Report Coverage:

| Report Features | Details |

|---|---|

| Product Name | Tea |

| Report Coverage | Detailed Process Flow: Unit Operations Involved, Quality Assurance Criteria, Technical Tests, Mass Balance, and Raw Material Requirements Land, Location and Site Development: Selection Criteria and Significance, Location Analysis, Project Planning and Phasing of Development, Environmental Impact, Land Requirement and Costs Plant Layout: Importance and Essentials, Layout, Factors Influencing Layout Plant Machinery: Machinery Requirements, Machinery Costs, Machinery Suppliers (Provided on Request) Raw Materials: Raw Material Requirements, Raw Material Details and Procurement, Raw Material Costs, Raw Material Suppliers (Provided on Request) Packaging: Packaging Requirements, Packaging Material Details and Procurement, Packaging Costs, Packaging Material Suppliers (Provided on Request) Other Requirements and Costs: Transportation Requirements and Costs, Utility Requirements and Costs, Energy Requirements and Costs, Water Requirements and Costs, Human Resource Requirements and Costs Project Economics: Capital Costs, Techno-Economic Parameters, Income Projections, Expenditure Projections, Product Pricing and Margins, Taxation, Depreciation Financial Analysis: Liquidity Analysis, Profitability Analysis, Payback Period, Net Present Value, Internal Rate of Return, Profit and Loss Account, Uncertainty Analysis, Sensitivity Analysis, Economic Analysis Other Analysis Covered in The Report: Market Trends and Analysis, Market Segmentation, Market Breakup by Region, Price Trends, Competitive Landscape, Regulatory Landscape, Strategic Recommendations, Case Study of a Successful Venture |

| Currency | US$ (Data can also be provided in the local currency) |

| Customization Scope | The report can also be customized based on the requirement of the customer |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Report Customization

While we have aimed to create an all-encompassing tea processing plant project report, we acknowledge that individual stakeholders may have unique demands. Thus, we offer customized report options that cater to your specific requirements. Our consultants are available to discuss your business requirements, and we can tailor the report's scope accordingly. Some of the common customizations that we are frequently requested to make by our clients include:

- The report can be customized based on the location (country/region) of your plant.

- The plant’s capacity can be customized based on your requirements.

- Plant machinery and costs can be customized based on your requirements.

- Any additions to the current scope can also be provided based on your requirements.

Why Buy IMARC Reports?

- The insights provided in our reports enable stakeholders to make informed business decisions by assessing the feasibility of a business venture.

- Our extensive network of consultants, raw material suppliers, machinery suppliers and subject matter experts spans over 100+ countries across North America, Europe, Asia Pacific, South America, Africa, and the Middle East.

- Our cost modeling team can assist you in understanding the most complex materials. With domain experts across numerous categories, we can assist you in determining how sensitive each component of the cost model is and how it can affect the final cost and prices.

- We keep a constant track of land costs, construction costs, utility costs, and labor costs across 100+ countries and update them regularly.

- Our client base consists of over 3000 organizations, including prominent corporations, governments, and institutions, who rely on us as their trusted business partners. Our clientele varies from small and start-up businesses to Fortune 500 companies.

- Our strong in-house team of engineers, statisticians, modeling experts, chartered accountants, architects, etc. has played a crucial role in constructing, expanding, and optimizing sustainable Processing plants worldwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Frequently Asked Questions

Capital requirements generally include land acquisition, construction, equipment procurement, installation, pre-operative expenses, and initial working capital. The total amount varies with capacity, technology, and location.

To start a tea processing business, one needs to conduct a market feasibility study, secure required licenses, arrange funding, select suitable land, procure equipment, recruit skilled labor, and establish a supply chain and distribution network.

Tea production requires fresh tea leaves as the primary raw material, usually sourced from tea gardens. Additional materials may include withering trough nets, water for processing, packaging materials like paper or foil, and sometimes natural flavors or additives, depending on the product type.

The tea processing factory typically requires machinery such as withering troughs, rolling machines, fermentation units, drying machines (fluid bed or dryers), sorting/grading machines, and packaging equipment. Depending on the scale, utilities like boilers, conveyors, and quality testing tools are also essential.

The main steps generally include:

-

Plucking

-

Withering

-

Rolling

-

Fermentation (oxidation)

-

Drying

-

Sorting and Grading

-

Packaging

Usually, the timeline can range from 12 to 18 months to start a tea manufacturing plant, depending on factors like land acquisition, construction, licensing, sourcing machinery, and staff training. Fast-tracking through prefabricated setups and ready logistics can shorten the process.

Challenges may include high capital requirements, securing regulatory approvals, ensuring raw material supply, competition, skilled manpower availability, and managing operational risks.

Typical requirements include business registration, environmental clearances, factory licenses, fire safety certifications, and industry-specific permits. Local/state/national regulations may apply depending on the location.

The top tea processing manufactures are:

-

Associated British Foods PLC

-

Barry's Tea

-

Bigelow Tea

-

Caraway Tea

-

Dabur Ltd

-

LIPTON Teas and Infusions B.V.

-

TAETEA Group Co., Ltd

-

Dilmah Ceylon Tea Company PLC

-

Tata Consumer Products Limited (Tata Group)

Profitability depends on several factors including market demand, production efficiency, pricing strategy, raw material cost management, and operational scale. Profit margins usually improve with capacity expansion and increased capacity utilization rates.

Cost components typically include:

-

Land and Infrastructure

-

Machinery and Equipment

-

Building and Civil Construction

-

Utilities and Installation

-

Working Capital

Break even in a tea processing business typically range from 2 to 5 years, depending on production scale, market access, operating efficiency, and demand growth. Niche or premium tea lines may take longer but offer higher margins.

Governments may offer incentives such as capital subsidies, tax exemptions, reduced utility tariffs, export benefits, or interest subsidies to promote manufacturing under various national or regional industrial policies.

Financing can be arranged through term loans, government-backed schemes, private equity, venture capital, equipment leasing, or strategic partnerships. Financial viability assessments help identify optimal funding routes.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization