Telecom Cloud Market Size, Share, Trends and Forecast by Type, Computing Services, Application, End User, and Region, 2025-2033

Telecom Cloud Market Size and Share:

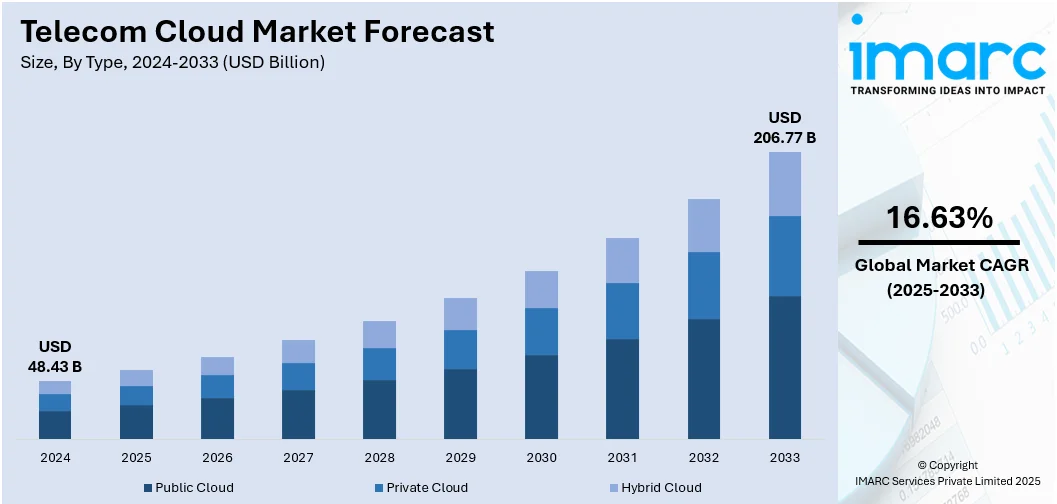

The global telecom cloud market size was valued at USD 48.43 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 206.77 Billion by 2033, exhibiting a CAGR of 16.63% from 2025-2033. North America currently dominates the market, holding a market share of 38.1% in 2024. The dominance of the region is attributed to strong investment in advanced telecom infrastructure, early adoption of 5G, and widespread presence of leading cloud and network service providers. The region also benefits from favorable regulatory support encouraging cloud-based innovations in telecommunications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 48.43 Billion |

|

Market Forecast in 2033

|

USD 206.77 Billion |

| Market Growth Rate 2025-2033 | 16.63% |

The worldwide transition towards 5G, which requires highly adaptable and scalable network infrastructures, is impelling the market growth. Telecom cloud facilitates virtualized network functions that can accommodate the high speed, low latency, and extensive device connectivity essential for 5G. This eliminates the necessity for expensive physical enhancements. In addition, telecom operators can decrease capital and operational expenditures by substituting traditional hardware with virtualized network functions (VNFs) operating on standard servers. Cloud-native architectures enable automated scaling and provisioning, minimizing the requirement for manual oversight or surplus infrastructure. Apart from this, telecom companies are employing artificial intelligence (AI) for predictive maintenance, client assistance, and network enhancement. These tools need significant computing capacity and storage, which cloud platforms can provide. It allows operators to execute AI models nearer to data sources, enhancing response times.

To get more information on this market, Request Sample

The United States plays a vital role in the market, supported by government incentives, financial support, and regulations designed to enhance broadband access and upgrade telecom infrastructure. Such policies typically support flexible, software-based networks, fostering an environment that encourages telecom cloud development. Furthermore, the rise of cloud-native platforms is facilitating quicker, more adaptable deployment of mobile services. These platforms promote scalability, improve security, and optimize network operations, enabling mobile service providers to simplify processes, decrease expenses, and speed up the launch of new products. In 2025, Neuner Mobile Technologies and UScellular revealed a collaboration to introduce a cloud-native Telecom-as-a-Service (TaaS) platform for MVNOs in the US. The platform allows for quick, safe, and scalable implementation of mobile services. It streamlines processes and speeds up innovation for future mobile service providers.

Telecom Cloud Market Trends:

Increasing 5G Integration

The telecom cloud industry is poised for significant expansion, fueled by swift 5G implementation. As reported by 5G Americas and Omdia, 5G is expanding four times quicker than 4G LTE, with a global average of 1.5 wireless connections per individual anticipated by the end of 2024 and an estimated 8.3 billion 5G connections by 2029. The integration of 5G with cloud infrastructure is improving network efficiency, reducing latency, and facilitating scalable, adaptable deployment. Telecom companies utilize cloud platforms to effectively manage 5G networks and enable real-time services. In October 2024, Siemens partnered with LS telcom to provide private 5G wireless solutions for industrial applications, ensuring complete deployment and support. The cloud manages enormous 5G data volumes, enabling applications like autonomous systems and intelligent urban areas. Increasing investments in telecom cloud infrastructure and services demonstrate the growing need for quicker, more flexible connectivity.

Rising Adoption of Hybrid Cloud

Telecom companies are progressively embracing hybrid cloud strategies to utilize the benefits of both private and public cloud environments. This strategy provides adaptability by enabling sensitive information and essential applications to be managed in private clouds, while employing public clouds for scalable and economical handling of less sensitive tasks. An industry report indicates that 39% of organizations currently employ a hybrid cloud strategy, an increase from 36% the previous year, underscoring its rising attractiveness for scalability, service integration, and business continuity. Hybrid cloud solutions assist telecom companies in addressing increasing needs for data protection, adherence to regulations, and effective workload allocation. In October 2024, Bouygues Telecom Entreprises and OVHcloud joined forces to deliver hybrid cloud solutions for midsize companies, aiding in cloud migration and enhancing IT security. Through the integration of hybrid models, telecom companies can enhance operational efficiency, safeguard infrastructure, and provide tailored services that match the changing requirements of enterprises.

AI and Automation

Telecom cloud market analysis indicates that AI and automation are major factors supporting the telecom cloud industry growth. A study of the industry revealed that 59% of executives at communications service providers (CSP) utilize conventional AI for detecting security threats in networks, whereas generative AI is primarily used for spam management (33%) and fraud management (31%). AI enhances network optimization by forecasting traffic trends, dynamically reallocating resources, and improving bandwidth utilization. Predictive maintenance enables operators to identify possible failures in advance, decreasing downtime and lowering repair expenses. Additionally, AI-powered cybersecurity enhances protection against emerging threats by identifying and reducing risks instantaneously, guaranteeing safe network functions. In February 2024, Lenovo revealed edge AI partnerships with prominent telecom companies. The projects focus on providing AI tasks for clients, such as smart city solutions and sustainability initiatives. These partnerships represent an important advancement in positioning AI at the center of telecommunications and cloud technology.

Telecom Cloud Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global telecom cloud market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, computing services, application, and end user.

Analysis by Type:

- Public Cloud

- Private Cloud

- Hybrid Cloud

Public cloud dominates the market owing to its cost-effectiveness, adaptability, and capacity to offer on-demand resources without necessitating significant capital expenditure. Telecom providers are increasingly depending on public cloud service to handle varying workloads, speed up time-to-market, and simplify infrastructure management. This platform enables quick service deployment, remote access, and smooth scalability, which is crucial for addressing the changing needs of the telecom industry. Public cloud also provides integrated tools for data analysis, network automation, and AI integration, improving operational efficiency and decision-making. With robust support for interoperability and standardized frameworks, public cloud allows telecom firms to upgrade legacy systems while ensuring service reliability. Ongoing improvements in public cloud security, compliance features, and service-level agreements enhance its attractiveness. As telecom providers prioritize agility and cost control, the public cloud remains a preferred choice for deploying computing, storage, and network resources across geographically distributed operations.

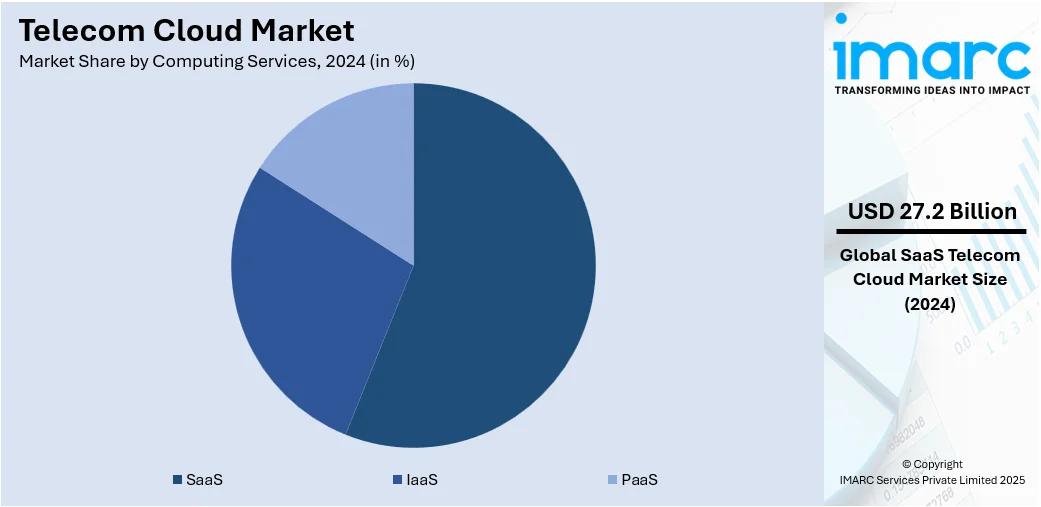

Analysis by Computing Services:

- SaaS

- IaaS

- PaaS

SaaS stand as the largest component in 2024, holding 56.2% of the market. The dominance of the segment is because of its straightforward deployment, scalability, and capability to provide applications online without complicated infrastructure needs. Telecom companies favor SaaS solutions to optimize operations, decrease IT maintenance demands, and facilitate quicker service delivery. It enables remote accessibility, live collaboration, and effective management of customer-oriented and backend applications. The rise of subscription model of SaaS, which effectively supports cost optimization objectives, is enabling telecom companies to handle expenses more consistently while expanding services according to demand. SaaS enables swift updates, seamless integration with various cloud services, and adherence to regulatory requirements via centralized management. As the need for cloud-native applications rises, SaaS solutions are evolving, enhancing automation, analytics, and user experiences. Telecom companies depend on SaaS for managing client relations, billing systems, network analysis, and workforce productivity tools, establishing it as a vital element of computing services within the telecom cloud environment.

Analysis by Application:

- Computing

- Data Storage

- Achieving

- Enterprise Application

- Others

Computing represents the largest segment attributed to the increasing demand for effective processing capabilities, scalable infrastructure, and assistance for virtualization throughout telecom networks. As telecom providers transition from classic hardware-based frameworks to software-defined settings, cloud computing becomes crucial for overseeing network functions, data flow, and service provision. It enables telecom companies to handle substantial data quantities with decreased latency, enhanced reliability, and minimized operational costs. Telecom cloud computing applications facilitate automation, orchestration, and AI integration, all of which improve service efficiency and network agility. As the need for bandwidth-heavy services and real-time analytics grows, telecom companies are embracing cloud computing solution for edge processing and centralized data management. These abilities are essential for overseeing distributed networks and facilitating next-generation services.

Analysis by End User:

- BFSI

- Retail

- Manufacturing

- Transportation and Distribution

- Healthcare

- Government

- Media and Entertainment

- Others

BFSI leads the market due to its persistent need for secure, scalable, and high-performance communication systems. The industry depends significantly on continuous data access, instant communication, and smooth connectivity to facilitate everyday activities, client interaction, and adherence to regulations. As financial transactions rise, cloud solutions allow BFSI companies to handle workloads more effectively while ensuring data integrity and accessibility. The demand for secure and compliant settings encourages financial institutions to utilize telecom cloud platforms that incorporate security, encryption, and monitoring functionalities. BFSI also takes advantage of the flexibility of cloud services to introduce new digital products, adapt to evolving client demands, and enhance internal communication systems. The industry's emphasis on disaster recovery, uptime guarantees, and operational resilience promotes the use of telecom cloud services. Ongoing innovation and the pursuit of modernization guarantee that BFSI continues to be a vital force in the telecom cloud environment.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 38.1%, due to its robust digital infrastructure, swift 5G deployment, and extensive cloud integration in the telecom industry. For instance, in 2025, Rogers Communications announced the first deployment of 5G Advanced (5G-A) in Canada, using Ericsson’s RedCap software to improve IoT connectivity and network efficiency. Apart from this, the region benefits from having prominent cloud service providers and telecom companies that invest significantly in updating and automating networks. Regulatory assistance for data protection, along with a rising number of businesses embracing advanced telecom services, is impelling the market growth. North American companies are at the forefront of adopting cloud-native architectures, enhancing service delivery, and meeting real-time communication requirements, positioning the area as a central hub for telecom cloud innovations and strategic progress.

Key Regional Takeaways:

United States Telecom Cloud Market Analysis

In North America, the market portion held by the United States was 70.00%, propelled by the increasing need for affordable and scalable solutions as telecom firms aim to enhance their infrastructure. Additionally, the escalating demand for improved operational efficiency, attained via automation and resource optimization, is supporting the adoption of cloud technology. The rising uptake of 5G technology is strengthening the market growth, as it demands agile and adaptable cloud infrastructures to meet its elevated requirements. Besides this, the swift incorporation of data analytics and AI in telecom services is enhancing the market demand. The ongoing shift toward digital transformation, driving telecoms to modernize their IT infrastructures, is also a key market driver. An industry report showed that 94% of major companies in the US possess a digital transformation strategy. Moreover, 56% of executives in the US indicate that the return on investment from these initiatives has surpassed expectations, while US expenditure on digital transformation accounts for 35.8% of worldwide spending. Furthermore, strong cybersecurity measures provided by cloud providers are boosting the market confidence and growth. In addition, the increasing need for regulatory compliance in data storage and privacy is fostering greater cloud adoption in the sector and creating lucrative market opportunities.

Europe Telecom Cloud Market Analysis

The telecom cloud sector in Europe is growing due to the rising need for improved network flexibility and scalability. In accordance with this, the transition towards 5G networks is catalyzing the demand for flexible and resilient cloud infrastructures to enable high-speed services. The Mobile Economy Europe report projected that by 2030, 5G adoption in Europe will likely hit 80%, providing an economic uplift of EUR 164 Billion. By the conclusion of 2024, 5G represented 30% of mobile connections in Europe, exceeding the global average of 24%. Additionally, the growing use of cloud-based content delivery networks (CDNs) is broadening the market scope. The rising deployment of IoT devices throughout Europe is driving the need for flexible cloud systems to handle and analyze large volumes of data. Moreover, the increasing focus on elevating client experiences via tailored services is encouraging the adoption of cloud-based customer relationship management (CRM) systems, enhancing market attractiveness.

Asia Pacific Telecom Cloud Market Analysis

The Asia Pacific market is primarily driven by the swift digitalization in the area, as telecom companies implement sophisticated cloud solutions to improve service provision. Moreover, the increasing need for high-quality video streaming and over-the-top (OTT) services is driving the market demand. The growth of 5G networks in the area is encouraging the adoption of telecom cloud solutions to facilitate rapid data processing and low-latency services. Additionally, the continuous implementation of smart city initiatives in nations, such as China and India, is encouraging the adoption of cloud-based solutions for city management. For instance, the Government of India sanctioned 12 new industrial smart city initiatives totaling INR 28,602 Crore for infrastructure enhancement under the National Industrial Corridor Programme, concentrating on areas like manufacturing, electronics, and pharmaceuticals. The increase in enterprise cloud utilization for business continuity and disaster recovery is impelling the telecom cloud market growth. In addition, favorable government initiatives promoting digital transformation and cloud adoption in various sectors are significantly contributing to market expansion.

Latin America Telecom Cloud Market Analysis

In Latin America, the telecom cloud sector is expanding owing to the increasing requirement for improved network flexibility to facilitate digital transformation in various industries. Likewise, the region's rising mobile internet usage and data usage are driving the demand for scalable cloud infrastructures. According to the IBGE, between 2022 and 2023, the percentage of Brazilian households using mobile broadband increased from 81.2% to 83.3%, while the use of fixed broadband rose from 86.4% to 86.9%. Moreover, the ongoing shift toward the Internet of Things (IoT) and connected devices, which drive increased cloud usage for data management and processing, is improving the market accessibility. Apart from this, telecom providers are utilizing cloud solutions to lower expenses and enhance operational effectiveness, thus broadening the market potential.

Middle East and Africa Telecom Cloud Market Analysis

The Middle East and Africa market is influenced by the rising reliance on 5G technology, which needs adaptable cloud infrastructures to facilitate rapid data processing. Moreover, the increasing demand for digital services in multiple sectors, such as healthcare, education, and finance, is bolstering the market growth. Furthermore, the area's ongoing drive for smart city projects is accelerating the adoption of telecom cloud solutions for effective urban governance. Accordingly, Abu Dhabi secured the 10th position in the Smart City Index 2024, progressing through a USD 2.5 billion partnership for AI-driven city management. The city aspires to become the first completely AI-native by 2027, improving sustainability and efficiency. Besides this, the growing demand for affordable solutions and enhanced operational efficiencies is encouraging telecom companies to transition to cloud environments, creating a positive telecom cloud market outlook.

Competitive Landscape:

Major participants in the industry are promoting cloud-native platforms, facilitating effective implementation of virtualized and containerized network functions. They are concentrating on AI implementation, network automation, and edge computing to enhance low-latency services and improve telecom operations. Working with telecom providers continues to be crucial for enhancing service capabilities and speeding up the 5G deployment. Leading companies are also focusing on providing secure, scalable multi-cloud solutions that meet evolving regulatory and performance standards. Furthermore, many key players are actively pursuing strategic acquisitions of specialized technology firms to strengthen their offerings and gain a competitive edge. In November 2024, Skyvera completed the acquisition of CloudSense, a provider of Salesforce-native CPQ and order management solutions for telecom and media industries. This acquisition strengthens Skyvera's telecom software portfolio, with plans to enhance CloudSense's platform using AI-driven innovations, boosting operational efficiency and customer experience for telecom operators.

The report provides a comprehensive analysis of the competitive landscape in the telecom cloud market with detailed profiles of all major companies, including:

- Amazon Web Services Inc. (Amazon.com Inc.)

- BT Group plc

- China Telecom Corporation Limited

- Dell Technologies Inc.

- Deutsche Telekom AG

- Google LLC

- International Business Machines Corporation

- Microsoft Corporation

- Nippon Telegraph and Telephone Corporation

- Oracle Corporation

- Singapore Telecommunications Limited

- Telefonaktiebolaget LM Ericsson

- Telstra Corporation Limited

- Telus Corporation

- Verizon Communications Inc.

Latest News and Developments:

- June 2025: Ericsson launched Ericsson On-Demand, a SaaS platform for core network services, built with Google Cloud and AI infrastructure. It enables communication service providers to deploy, scale, and innovate rapidly with transparent, consumption-based pricing. The fully managed platform offers cost efficiency, agility, and global deployment options.

- June 2025: Nokia launched its AI-driven Autonomous Networks Fabric, in partnership with Google Cloud, offering full network automation with telco-trained AI models and tools. The service integrates security and observability features, enhancing network efficiency. Nokia also collaborated with Telstra to provide developers with access to live APIs for enterprise app creation.

- March 2025: Tata Communications launched Vayu, a next-gen cloud fabric designed to reduce costs and simplify multi-cloud management. It integrates IaaS, PaaS, AI platforms, and security, offering up to 30% cost savings. Vayu features high-performance NVIDIA GPUs, AI Studio, and zero-trust security, optimizing cloud and AI solutions.

- March 2025: Wipro launched TelcoAI360, an AI-driven managed services platform designed to help telecom operators reduce costs. Developed with ServiceNow's telecom solutions, it integrates AI-powered tools to streamline operations, enhance network performance, and improve security, enabling telecom providers to cut operational expenses and boost efficiency.

- February 2025: Ethio telecom launched seven cloud-based solutions to empower enterprises, including digital livestock tracking, core banking, and education management systems. These services aim to enhance productivity, streamline operations, and foster financial inclusion, contributing to Ethiopia's digital transformation and economic growth through scalable, secure, and cost-effective technologies.

- November 2024: China Mobile and ZTE launched an AI-Driven Green Telco Cloud solution to optimize energy efficiency in telecom networks. The solution uses AI to adjust computing resources, reducing energy consumption by up to 25%. It enhances sustainability, lowers costs, and supports the global move toward carbon neutrality.

Telecom Cloud Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Public Cloud, Private Cloud, Hybrid Cloud |

| Computing Services Covered | SaaS, IaaS, PaaS |

| Applications Covered | Computing, Data Storage, Achieving, Enterprise Application, Others |

| End Users Covered | BFSI, Retail, Manufacturing, Transportation and Distribution, Healthcare, Government, Media and Entertainment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amazon Web Services Inc. (Amazon.com Inc.), BT Group plc, China Telecom Corporation Limited, Dell Technologies Inc., Deutsche Telekom AG, Google LLC, International Business Machines Corporation, Microsoft Corporation, Nippon Telegraph and Telephone Corporation, Oracle Corporation, Singapore Telecommunications Limited, Telefonaktiebolaget LM Ericsson, Telstra Corporation Limited, Telus Corporation, Verizon Communications Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the telecom cloud market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global telecom cloud market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the telecom cloud industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The telecom cloud market was valued at USD 48.43 Billion in 2024.

The telecom cloud market is projected to exhibit a CAGR of 16.63% during 2025-2033, reaching a value of USD 206.77 Billion by 2033.

The telecom cloud market is being driven by the growing demand for scalable network infrastructure, increasing use of virtualization and containerization, and the need for real-time data processing. Operators are investing in cloud-native solutions to improve agility, reduce operational costs, and support emerging technologies like 5G, edge computing, and IoT across global telecommunications networks.

North America currently dominates the telecom cloud market, accounting for a share of 38.1%. The dominance of the region is attributed to strong investment in advanced telecom infrastructure, early adoption of 5G, and widespread presence of leading cloud and network service providers.

Some of the major players in the telecom cloud market include Amazon Web Services Inc. (Amazon.com Inc.), BT Group plc, China Telecom Corporation Limited, Dell Technologies Inc., Deutsche Telekom AG, Google LLC, International Business Machines Corporation, Microsoft Corporation, Nippon Telegraph and Telephone Corporation, Oracle Corporation, Singapore Telecommunications Limited, Telefonaktiebolaget LM Ericsson, Telstra Corporation Limited, Telus Corporation, Verizon Communications Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)