Terephthalic Acid Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition

Terephthalic Acid (TPA) Price Trend, Index and Forecast

Track real-time and historical terephthalic acid (TPA) prices across global regions. Updated monthly with market insights, drivers, and forecasts.

Terephthalic Acid (TPA) Prices January 2026

| Region | Price (USD/Kg) | Latest Movement |

|---|---|---|

| Northeast Asia | 0.73 | 5.8% ↑ Up |

| Europe | 0.84 | 2.4% ↑ Up |

| Southeast Asia | 0.81 | 9.5% ↑ Up |

| North America | 1.12 | 5.7% ↑ Up |

Terephthalic Acid (TPA) Price Index (USD/KG):

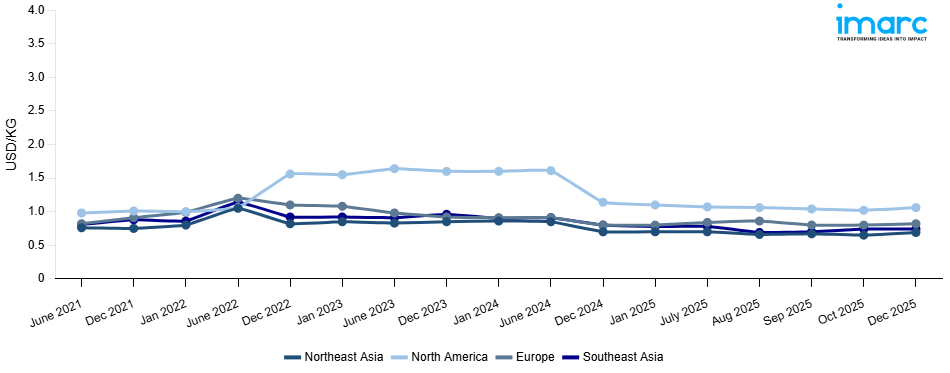

The chart below highlights monthly terephthalic acid (TPA) prices across different regions.

Get Access to Monthly/Quarterly/Yearly Prices, Request Sample

Market Overview Q3 Ending September 2025

Northeast Asia: China saw increased domestic operating rates, but fluctuations in crude oil prices impacted paraxylene procurement, tightening margins. Seasonal demand from the polyester fiber and PET resin industries supported pricing, particularly with heightened textile exports from China and South Korea. Currency movements of the yen and yuan against the US dollar further altered import parity prices for buyers, thereby influencing regional benchmarks. Meanwhile, domestic logistical costs in China rose due to stricter compliance measures on freight handling and carbon emission standards, adding to delivered costs.

Europe: Weakness in the polyester and PET packaging sector, particularly due to subdued consumer spending in Germany, France, and Italy, weighed on demand. The energy-intensive production environment in Europe was further challenged by natural gas price volatility, which raised overall manufacturing costs for integrated petrochemical facilities. Several localized maintenance shutdowns at European plants reduced output temporarily, but these supply constraints were insufficient to offset declining consumption trends. Moreover, imports from Asia at competitive pricing exerted downward pressure on European spot values, particularly as shipping costs on Asia–Europe lanes normalized following earlier container shortages.

Southeast Asia: Key producers in Thailand, Indonesia, and Vietnam operated at steady rates, with localized fluctuations due to scheduled maintenance. Demand from the textile and packaging industries remained resilient, supported by continued growth in apparel exports and increased consumption of PET-based beverage packaging in ASEAN markets. However, feedstock costs rose as paraxylene imports from the Middle East and Northeast Asia became more expensive due to freight surcharges and exchange rate fluctuations against the US dollar. Seasonal weather disruptions, including monsoon-related port delays in Vietnam and Malaysia, elevated domestic logistics costs, and created temporary supply bottlenecks. Import dependency on higher-priced crude-derived feedstocks further influenced regional cost structures.

North America: In North America, prices faced downward pressure due to sluggish polyester demand and stable domestic supply availability. US and Canadian producers operated at normal run rates, with no major supply disruptions reported. Weakness in downstream PET resin demand from the beverage and packaging industries, particularly with muted consumer spending during the summer season, limited price recovery. At the same time, import flows from Asia remained competitive, placing further stress on local producers’ pricing strategies. Rail transport constraints, and higher inland trucking costs contributed to distribution challenges.

Terephthalic Acid (TPA) Price Trend, Market Analysis, and News

IMARC's latest publication, “Terephthalic Acid (TPA) Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data Report 2026 Edition,” presents a detailed examination of the terephthalic acid (TPA) market, providing insights into both global and regional trends that are shaping prices. This report delves into the spot price of terephthalic acid (TPA) at major ports and analyzes the composition of prices, including FOB and CIF terms. It also presents detailed terephthalic acid (TPA) prices trend analysis by region, covering North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. The factors affecting terephthalic acid (TPA) pricing, such as the dynamics of supply and demand, geopolitical influences, and sector-specific developments, are thoroughly explored. This comprehensive report helps stakeholders stay informed with the latest market news, regulatory updates, and technological progress, facilitating informed strategic decision-making and forecasting.

Terephthalic Acid (TPA) Industry Analysis

The global terephthalic acid (TPA) industry size reached USD 81.42 Billion in 2025. By 2034, IMARC Group expects the market to reach USD 124.2 Billion, at a projected CAGR of 4.56% during 2026-2034. The market is driven by the rising consumption of polyester fibers in the textile industry, expanding demand for PET bottles and packaging materials, ongoing industrialization in Asia, and advancements in recycling technologies that enhance the sustainability of TPA-based applications.

Latest developments in the Terephthalic Acid (TPA) Industry:

- August 2025: A research team successfully engineered Saccharomyces cerevisiae to produce terephthalic acid (TPA). By knocking out six alcohol dehydrogenases, they blocked competing pathways and enhanced p-toluic acid output. Strategic integration, enzyme fusion, and expression of the heterologous TsaMB enzyme enabled effective TPA biosynthesis, achieved through a carefully designed two-stage biphasic fermentation process.

- November 2024: GAIL (India) announced that its subsidiary, GAIL Mangalore Petrochemicals (GMPL), re-engaged with process licensor INEOS to revitalize its 1.25 MMTPA purified terephthalic acid (PTA) manufacturing plant in Mangalore. The renewed collaboration aimed to enhance the plant’s efficiency and align production with market demand. This move was aligned with India’s Atmanirbhar Bharat initiative to reduce import dependency and strengthen domestic petrochemical manufacturing.

- April 2024: The Eurasian Economic Commission's decided to extend for two years the zero rate of import customs duty in respect of terephthalic acid and its salts (code 2917 36 000 0 of the CN FEA of the EAEU). The goods in question were terephthalic acid, its salts and esters and are used primarily for the manufacture of polyethylene terephthalate polymers used as raw materials in manufacturing plastic bottles, films, and packaging containers for the food industry.

Product Description

Terephthalic acid (TPA) is a white crystalline aromatic dicarboxylic acid primarily derived from the oxidation of paraxylene. Classified as a key intermediate in polyester production, it holds a central role in global petrochemical consumption. Its defining property lies in forming strong, durable polymers when combined with ethylene glycol to produce polyethylene terephthalate (PET). Industrially, TPA is widely used in manufacturing polyester fibers for textiles, PET resins for bottles and packaging, and engineering plastics. Its ability to enhance tensile strength, durability, and chemical resistance makes it indispensable across packaging, textiles, and industrial applications, underpinning its strategic importance in modern supply chains.

Report Coverage

| Key Attributes | Details |

|---|---|

| Product Name | Terephthalic Acid |

| Report Features | Exploration of Historical Trends and Market Outlook, Industry Demand, Industry Supply, Gap Analysis, Challenges, Terephthalic Acid Price Analysis, and Segment-Wise Assessment. |

| Currency/Units | US$ (Data can also be provided in local currency) or Metric Tons |

| Region/Countries Covered | The current coverage includes analysis at the global and regional levels only. Based on your requirements, we can also customize the report and provide specific information for the following countries: Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand* Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece* North America: United States and Canada Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru* Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco* *The list of countries presented is not exhaustive. Information on additional countries can be provided if required by the client. |

| Information Covered for Key Suppliers |

|

| Customization Scope | The report can be customized as per the requirements of the customer |

| Report Price and Purchase Option |

Plan A: Monthly Updates - Annual Subscription

Plan B: Quarterly Updates - Annual Subscription

Plan C: Biannually Updates - Annual Subscription

|

| Post-Sale Analyst Support | 360-degree analyst support after report delivery |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report presents a detailed analysis of terephthalic acid pricing, covering global and regional trends, spot prices at key ports, and a breakdown of Ex Works, FOB, and CIF prices.

- The study examines factors affecting terephthalic acid price trend, including raw material costs, supply-demand shifts, geopolitical impacts, and industry developments, offering insights for informed decision-making.

- The competitive landscape review equips stakeholders with crucial insights into the latest market news, regulatory changes, and technological advancements, ensuring a well-rounded, strategic overview for forecasting and planning.

- IMARC offers various subscription options, including monthly, quarterly, and biannual updates, allowing clients to stay informed with the latest market trends, ongoing developments, and comprehensive market insights. The terephthalic acid price charts ensure our clients remain at the forefront of the industry.

Key Questions Answered in This Report

The terephthalic acid (TPA) prices in January 2026 were 0.73 USD/Kg in Northeast Asia, 0.84 USD/Kg in Europe, 0.81 USD/Kg in Southeast Asia, and 1.12 USD/Kg in North America.

The terephthalic acid (TPA) pricing data is updated on a monthly basis.

We provide the pricing data primarily in the form of an Excel sheet and a PDF.

Yes, our report includes a forecast for terephthalic acid (TPA) prices.

The regions covered include North America, Europe, Asia Pacific, Middle East, and Latin America. Countries can be customized based on the request (additional charges may be applicable).

Yes, we provide both FOB and CIF prices in our report.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Why Choose Us

IMARC offers trustworthy, data-centric insights into commodity pricing and evolving market trends, enabling businesses to make well-informed decisions in areas such as procurement, strategic planning, and investments. With in-depth knowledge spanning more than 1000 commodities and a vast global presence in over 150 countries, we provide tailored, actionable intelligence designed to meet the specific needs of diverse industries and markets.

1000

+Commodities

150

+Countries Covered

3000

+Clients

20

+Industry

Robust Methodologies & Extensive Resources

IMARC delivers precise commodity pricing insights using proven methodologies and a wealth of data to support strategic decision-making.

Subscription-Based Databases

Our extensive databases provide detailed commodity pricing, import-export trade statistics, and shipment-level tracking for comprehensive market analysis.

Primary Research-Driven Insights

Through direct supplier surveys and expert interviews, we gather real-time market data to enhance pricing accuracy and trend forecasting.

Extensive Secondary Research

We analyze industry reports, trade publications, and market studies to offer tailored intelligence and actionable commodity market insights.

Trusted by 3000+ industry leaders worldwide to drive data-backed decisions. From global manufacturers to government agencies, our clients rely on us for accurate pricing, deep market intelligence, and forward-looking insights.

Request Customization

Request Customization

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst Request Brochure

Request Brochure

.webp)

.webp)