Semiconductor Manufacturing Plant Project Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue

Report Overview

IMARC Group’s report, titled “Semiconductor Manufacturing Plant Project Report 2025: Industry Trends, Plant Setup, Machinery, Raw Materials, Investment Opportunities, Cost and Revenue,” provides a complete roadmap for setting up a semiconductor manufacturing plant. It covers a comprehensive market overview to micro-level information such as unit operations involved, raw material requirements, utility requirements, infrastructure requirements, machinery and technology requirements, manpower requirements, packaging requirements, transportation requirements, etc. The semiconductor manufacturing plant project report provides detailed insights into project economics, including capital investments, project funding, operating expenses, income and expenditure projections, fixed costs vs. variable costs, direct and indirect costs, expected ROI and net present value (NPV), profit and loss account, financial analysis, etc.

The global semiconductor market is valued at USD 694.0 Billion (2024) and projected to reach USD 1,221.24 Billion by 2033, growing at a robust 6.48% CAGR. Demand is driven by artificial intelligence expansion, 5G infrastructure deployment, electric vehicle proliferation, and IoT device adoption across Asia-Pacific, North America, and Europe.

![]()

What is Semiconductor?

Semiconductors are materials that exhibit electrical conductivity between conductors and insulators, allowing for controlled electron movement. Composed mostly of silicon, they are designed to produce integrated circuits (chips) that carry out logic, memory, and signal processing operations. Their conductivity may be altered through doping, heat, or electric fields, thus playing a key role in today's electronics and computing technology.

Semiconductor Manufacturing Plant: Key Investment Highlights

- Process Used: Chip Fabrication

- End-use Industries: Consumer Electronics, Automotive, Telecommunications, IT and Data Centers, and Aerospace and Defence.

- Applications: Used to control and manage the flow of electrical current

Plant Capacity:

10,000-15,000 Wafer Starts Per Month (WSPM) for 200mm or 5,000-8,000 WSPM for 300mm wafers (mid-scale fab facility)

Profit Margins:

- Gross Profit: 35-45%

- Net Profit: 15-25%

Primary Cost Drivers:

- Capital Investment: 70-75% of total project cost (cleanroom infrastructure, lithography equipment, deposition systems)

- Raw Materials: 15-20% of OpEx (silicon wafers, photoresists, specialty gases)

- Utilities: 10-12% of OpEx (ultra-pure water, electricity, HVAC for cleanrooms)

- Labor & Technical Personnel: 8-10% of OpEx

Major Applications:

- Consumer Electronics (smartphones, laptops, wearables) - ~35% of demand

- Automotive & Electric Vehicles (power management, sensors, processors)

- Data Centers & Cloud Computing (~25% of global demand)

- Industrial Automation & IoT devices

- Telecommunications Infrastructure (5G equipment)

Why Semiconductor Manufacturing?

✓ Strategic Industry: Critical enabler for digital transformation, national security, and technological sovereignty

✓ High Barriers to Entry: Complex manufacturing requirements create defensible market positions and premium pricing power

✓ Megatrend Alignment: AI computing requires 3-5x more semiconductors than traditional applications; EV market growing at 25%+ annually

✓ Government Support: Multi-billion dollar incentive programs globally (U.S. CHIPS Act, EU Chips Act, India PLI schemes) offering subsidies up to 50% of CapEx

✓ Supply Chain Resilience: Growing demand for geographically diversified manufacturing reduces dependence on concentrated production regions

Transforming Vision into Reality:

This report provides the comprehensive blueprint needed to transform your semiconductor manufacturing vision into a technologically advanced and highly profitable reality.

Semiconductor Industry Outlook 2025:

The global demand for semiconductors is driven by their growing application in key industries ranging from consumer electronics and automotive to telecommunications and industrial automation. With the world going digital, semiconductors are the building blocks of today's technology—from smartphones and PCs to electric cars and 5G networks. The increase in demand is also complemented by trends such as the Internet of Things (IoT), renewable energy systems and artificial intelligence (AI), which need high-performance chips. Additionally, governments and private operators are investing significantly in local semiconductor production to mitigate supply chain risks. For example, through India's Semicon India Programme, various billions of dollars have been invested in establishing domestic fabrication and assembly facilities, enhancing the nation's place in the international semiconductor supply chain.

Semiconductor Market Trends and Growth Drivers:

Exponential growth of AI, IoT, and 5G technologies

One of the dominant trends fueling the semiconductor industry is the swift uptake of emerging technologies like the Internet of Things (IoT), 5G and artificial intelligence (AI). These emerging technologies need high-performance, power-efficient, and small chips that can process massive amounts of data in real-time. Semiconductors play a crucial role in facilitating edge computing, autonomous systems, and smart connectivity. As per the World Semiconductor Trade Statistics (WSTS), the revenue of the global semiconductor is expected to expand steadily up to 2025, with an 11.2% increase, driven by the demand of AI and wireless communication industries.

Government-supported localization and supply chain resilience efforts

Another significant trend that is transforming the semiconductor sector is the strategic initiative by different governments to create local semiconductor manufacturing ecosystems to minimize dependence on imports and strengthen supply chains. This trend was expedited by the worldwide chip shortage caused by the COVID-19 pandemic. Nations like the U.S., China, India, and the EU member states have initiated national semiconductor initiatives to attract investments, establish fabrication facilities, and facilitate R&D. For instance, India's Semicon India Programme, initiated in 2021 at a cost of ₹76,000 crore, has invited global players to establish fabs and OSAT (Outsourced Semiconductor Assembly and Testing) units with the vision to position India as a global chip production hub by 2030.

Latest Industry Developments:

- April 2025: Chip giant Intel has disposed of a controlling stake in Altera, an FPGA manufacturer, to private equity firm Silver Lake. The deal pegs the value of Altera at USD 8.75 billion, having lost nearly half its value from when it was acquired by Intel for USD 16.7 billion in 2015.

- April 2025: Nvidia announced its plans to manufacture artificial intelligence supercomputers in the United States for the first time. The company revealed that it has obtained more than one million square feet of production facilities to develop and test its advanced Blackwell chips in Arizona, along with AI supercomputers in Texas. This investment is projected to generate up to $500 billion in AI infrastructure over the next four years.

- February 2025: The initial semiconductor chips manufactured in India will be produced at Micron Technology's packaging facility in Sanand, Gujarat, during the first half of 2025.

- January 2025: Karnataka-based KASFAB Tools, a new initiative of the KAS Group, on January 27 opened its advanced semiconductor fabrication facility at Dodaballabpur, about 45 km from the state capital Bengaluru, with a view to the $125-billion global chip market.

- December 2024: Broadcom announced that its custom chip unit has developed a new technology called 3.5D XDSiP, which enhances the speed of semiconductors.

Leading Semiconductor Manufacturers:

Leading manufacturers in the global semiconductor industry include several multinational chemical companies with extensive production capacities and diverse application portfolios. Key players include

- NVIDIA

- TSMC

- Intel

- Qualcomm

- Broadcom,

all of which operate large-scale facilities and serve end-use sectors such as consumer electronics, automotive, telecommunications, IT and data centers, and aerospace and defence.

Semiconductor Plant Setup Requirements

Detailed Process Flow:

The manufacturing process is a multi-step operation that involves several unit operations, material handling, and quality checks. Below are the main stages involved in the semiconductor manufacturing process flow:

- Unit Operations Involved

- Mass Balance and Raw Material Requirements

- Quality Assurance Criteria

- Technical Tests

Key Considerations for Establishing a Semiconductor Manufacturing Plant:

Setting up a semiconductor manufacturing plant requires evaluating several key factors, including technological requirements and quality assurance. Some of the critical considerations include:

- Site Selection: The location must offer easy access to key raw materials such as silicon, gases and chemicals, photoresists, and metals. Proximity to target markets will help minimize distribution costs. The site must have robust infrastructure, including reliable transportation, utilities, and waste management systems. Compliance with local zoning laws and environmental regulations must also be ensured.

- Plant Layout Optimization: The layout should be optimized to enhance workflow efficiency, safety, and minimize material handling. Separate areas for raw material storage, production, quality control, and finished goods storage must be designated. Space for future expansion should be incorporated to accommodate business growth.

- Equipment Selection: High-quality, corrosion-resistant machinery tailored for semiconductor production must be selected. Essential equipment includes dicing machines, probing machines, polish grinders, chemical mechanical planarization (CMP) tools, and photolithography equipment. All machinery must comply with industry standards for safety, efficiency, and reliability.

- Raw Material Sourcing: Reliable suppliers must be secured for raw materials like silicon, gases and chemicals, photoresists, and metals to ensure consistent production quality. Minimizing transportation costs by selecting nearby suppliers is essential. Sustainability and supply chain risks must be assessed, and long-term contracts should be negotiated to stabilize pricing and ensure a steady supply.

- Safety and Environmental Compliance: Safety protocols must be implemented throughout the manufacturing process of semiconductor. Advanced monitoring systems should be installed to detect leaks or deviations in the process. Effluent treatment systems are necessary to minimize environmental impact and ensure compliance with emission standards.

- Quality Assurance Systems: A comprehensive quality control system should be established throughout production. Analytical instruments must be used to monitor product concentration, purity, and stability. Documentation for traceability and regulatory compliance must be maintained.

Project Economics:

Establishing and operating a semiconductor manufacturing plant involves various cost components, including:

- Capital Investment: The total capital investment depends on plant capacity, technology, and location. This investment covers land acquisition, site preparation, and necessary infrastructure.

- Equipment Costs: Equipment costs, such as those for dicing machines, probing machines, polish grinders, chemical mechanical planarization (CMP) tools, and photolithography equipment, represent a significant portion of capital expenditure. The scale of production and automation level will determine the total cost of machinery.

- Raw Material Expenses: Raw materials, including silicon, gases and chemicals, photoresists, and metals, are a major part of operating costs. Long-term contracts with reliable suppliers will help mitigate price volatility and ensure a consistent supply of materials.

- Infrastructure and Utilities: Costs associated with land acquisition, construction, and utilities (electricity, water, steam) must be considered in the financial plan.

- Operational Costs: Ongoing expenses for labor, maintenance, quality control, and environmental compliance must be accounted for. Optimizing processes and providing staff training can help control these operational costs.

- Financial Planning: A detailed financial analysis, including income projections, expenditures, and break-even points, must be conducted. This analysis aids in securing funding and formulating a clear financial strategy.

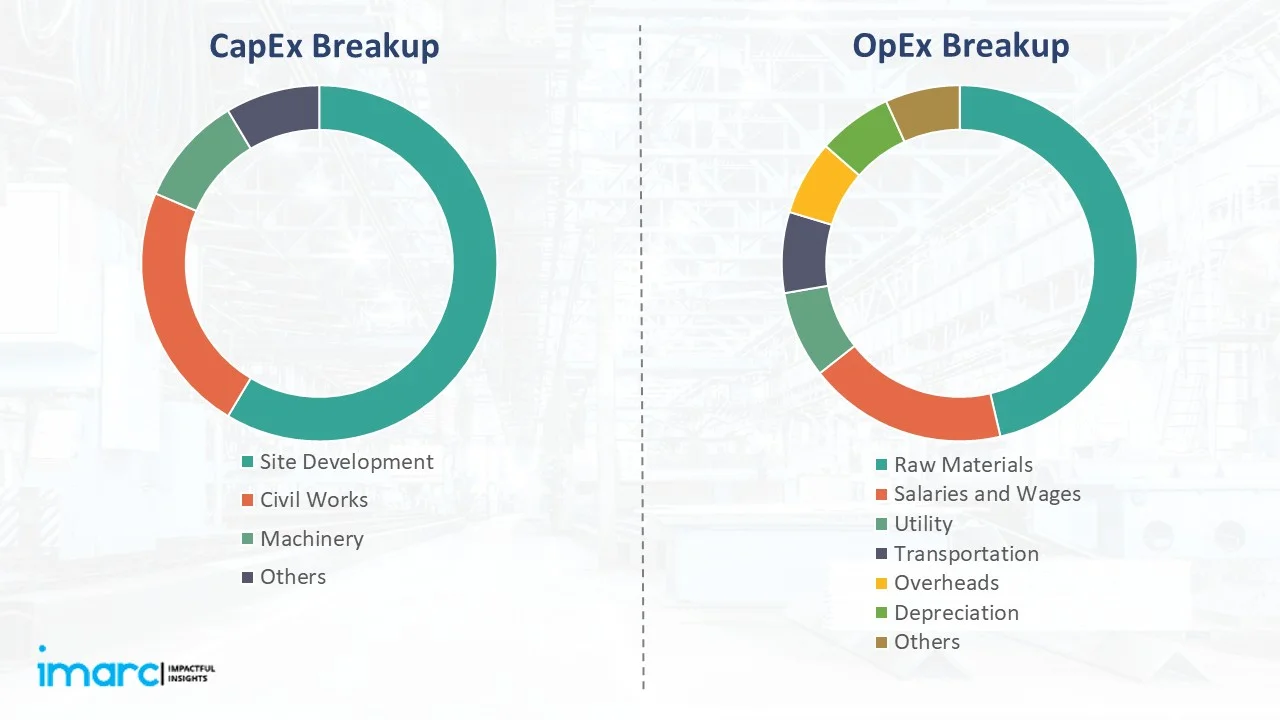

Capital Expenditure (CapEx) and Operational Expenditure (OpEx) Analysis:

Capital Investment (CapEx): Machinery costs account for the largest portion of the total capital expenditure. The cost of land and site development, including charges for land registration, boundary development, and other related expenses, forms a substantial part of the overall investment. This allocation ensures a solid foundation for safe and efficient plant operations.

Operating Expenditure (OpEx): In the first year of operations, the operating cost for the semiconductor manufacturing plant is projected to be significant, covering raw materials, utilities, depreciation, taxes, packing, transportation, and repairs and maintenance. By the fifth year, the total operational cost is expected to increase substantially due to factors such as inflation, market fluctuations, and potential rises in the cost of key materials. Additional factors, including supply chain disruptions, rising consumer demand, and shifts in the global economy, are expected to contribute to this increase.

Capital Expenditure Breakdown:

| Particulars | Cost (in US$) |

|---|---|

| Land and Site Development Costs | XX |

| Civil Works Costs | XX |

| Machinery Costs | XX |

| Other Capital Costs | XX |

Operational Expenditure Breakdown:

| Particulars | In % |

|---|---|

| Raw Material Cost | XX |

| Utility Cost | XX |

| Transportation Cost | XX |

| Packaging Cost | XX |

| Salaries and Wages | XX |

| Depreciation | XX |

| Other Expenses | XX |

Profitability Analysis:

| Particulars | Unit | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|---|

| Total Income | US$ | XX | XX | XX | XX | XX |

| Total Expenditure | US$ | XX | XX | XX | XX | XX |

| Gross Profit | US$ | XX | XX | XX | XX | XX |

| Gross Margin | % | XX | XX | XX | XX | XX |

| Net Profit | US$ | XX | XX | XX | XX | XX |

| Net Margin | % | XX | XX | XX | XX | XX |

Report Coverage:

| Report Features | Details |

|---|---|

| Product Name | Semiconductor |

| Report Coverage | Detailed Process Flow: Unit Operations Involved, Quality Assurance Criteria, Technical Tests, Mass Balance, and Raw Material Requirements Land, Location and Site Development: Selection Criteria and Significance, Location Analysis, Project Planning and Phasing of Development, Environmental Impact, Land Requirement and Costs Plant Layout: Importance and Essentials, Layout, Factors Influencing Layout Plant Machinery: Machinery Requirements, Machinery Costs, Machinery Suppliers (Provided on Request) Raw Materials: Raw Material Requirements, Raw Material Details and Procurement, Raw Material Costs, Raw Material Suppliers (Provided on Request) Packaging: Packaging Requirements, Packaging Material Details and Procurement, Packaging Costs, Packaging Material Suppliers (Provided on Request) Other Requirements and Costs: Transportation Requirements and Costs, Utility Requirements and Costs, Energy Requirements and Costs, Water Requirements and Costs, Human Resource Requirements and Costs Project Economics: Capital Costs, Techno-Economic Parameters, Income Projections, Expenditure Projections, Product Pricing and Margins, Taxation, Depreciation Financial Analysis: Liquidity Analysis, Profitability Analysis, Payback Period, Net Present Value, Internal Rate of Return, Profit and Loss Account, Uncertainty Analysis, Sensitivity Analysis, Economic Analysis Other Analysis Covered in The Report: Market Trends and Analysis, Market Segmentation, Market Breakup by Region, Price Trends, Competitive Landscape, Regulatory Landscape, Strategic Recommendations, Case Study of a Successful Venture |

| Currency | US$ (Data can also be provided in the local currency) |

| Customization Scope | The report can also be customized based on the requirement of the customer |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Report Customization

While we have aimed to create an all-encompassing semiconductor manufacturing plant project report, we acknowledge that individual stakeholders may have unique demands. Thus, we offer customized report options that cater to your specific requirements. Our consultants are available to discuss your business requirements, and we can tailor the report's scope accordingly. Some of the common customizations that we are frequently requested to make by our clients include:

- The report can be customized based on the location (country/region) of your plant.

- The plant’s capacity can be customized based on your requirements.

- Plant machinery and costs can be customized based on your requirements.

- Any additions to the current scope can also be provided based on your requirements.

Why Buy IMARC Reports?

- The insights provided in our reports enable stakeholders to make informed business decisions by assessing the feasibility of a business venture.

- Our extensive network of consultants, raw material suppliers, machinery suppliers and subject matter experts spans over 100+ countries across North America, Europe, Asia Pacific, South America, Africa, and the Middle East.

- Our cost modeling team can assist you in understanding the most complex materials. With domain experts across numerous categories, we can assist you in determining how sensitive each component of the cost model is and how it can affect the final cost and prices.

- We keep a constant track of land costs, construction costs, utility costs, and labor costs across 100+ countries and update them regularly.

- Our client base consists of over 3000 organizations, including prominent corporations, governments, and institutions, who rely on us as their trusted business partners. Our clientele varies from small and start-up businesses to Fortune 500 companies.

- Our strong in-house team of engineers, statisticians, modeling experts, chartered accountants, architects, etc. has played a crucial role in constructing, expanding, and optimizing sustainable manufacturing plants worldwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Frequently Asked Questions

Our feasibility studies assess several key factors to provide a detailed evaluation of your project's potential. The study includes a pricing analysis of feedstocks, helping to understand industry profit margins and cost variations. Detailed insights into mass balance, unit operations, raw material requirements, and the manufacturing process flow are also provided to ensure a clear understanding of the production setup.

The study also covers critical elements such as location analysis, environmental impact, plant layout, and costs associated with land, machinery, raw materials, packaging, transportation, utilities, and human resources. The project economics section provides an in-depth analysis of capital expenditure (CapEx), operating expenditure (OpEx), income projections, taxation, depreciation, liquidity, profitability, payback period, net present value (NPV), uncertainty, and sensitivity analysis.

Additionally, IMARC Group's feasibility studies address regulatory procedures, financial assistance, and necessary certifications, ensuring all legal and compliance requirements are met. By covering these aspects, IMARC Group's feasibility studies support informed decision-making, risk reduction, and the overall viability of your business.

Yes, our site identification services include a thorough assessment of potential sites based on proximity to raw materials, ensuring cost-effective and timely supply chain operations. We also consider access to infrastructure, such as transportation networks, utilities, and technology, which are essential for smooth plant operations. Labor availability is another key factor we analyze to ensure that the site has access to a skilled workforce. Additionally, we evaluate the environmental impact to ensure compliance with regulations and sustainable practices. By integrating these factors, we provide a comprehensive site evaluation to identify the optimal location for your new plant, supporting your strategic goals and operational efficiency.

Yes, our regulatory approvals and licensing services are made specifically to support companies in effectively and efficiently navigating the ever-changing regulatory environment. We start by carefully evaluating your company's requirements as well as the unique regulatory framework that applies to your sector. After that, you are assisted by our team of professionals throughout the whole process of securing the necessary industrial permits, business licenses, and environmental clearances.

Additionally, we help with industry-specific regulatory licensing so that your company complies with all sector-specific regulations. To further safeguard your brand and innovations from the outset, we also offer support for intellectual property rights (IPR) registrations and licensing. We manage the required documentation and communicate with pertinent authorities on your behalf by utilizing our deep industry experience and painstaking attention to detail. This allows you to focus on building and growing your business while we take care of the regulatory complexities. Partnering with us ensures that your business is fully compliant and ready to thrive from the start.

Our skilled engineering staff specializes in designing efficient and effective plant layouts that meet your unique needs. We begin with a comprehensive process design to ensure the best possible workflow and use of resources.

Our services include careful equipment selection, ensuring that your plant design incorporates the most suitable and advanced machinery. We also focus on meticulous layout planning, strategically arranging workstations and equipment to optimize output and reduce operational bottlenecks. Furthermore, our facility design takes into account every important factor, such as regulatory compliance, scalability, and safety.

By leveraging our expertise, we ensure that your plant layout not only meets your current operational needs but is also adaptable to future growth and technological advancements. Our goal is to create a well-organized, efficient, and compliant facility that enhances your overall operational efficiency and supports your business objectives.

Yes, our raw material and machinery sourcing services are designed to identify and connect you with reliable and affordable providers. We leverage our extensive network and industry expertise to source high-quality raw materials and advanced machinery that meet your specific requirements.

We also conduct supplier audits and evaluations so that you get the best value for your investment. We evaluate potential suppliers on the basis of cost, quality, reliability, and delivery timelines. We also make sure that all the legal requirements are met, including customs, tax regulations, labor laws, and import/export laws, to ensure you are fully compliant.

When you choose to work with us, you gain access to a list of suppliers pre-screened for affordability and reliability, helping you optimize your procurement process and reduce overall operational costs. It is our goal to assist you in establishing a new plant effectively and economically, ensuring long-term success and sustainability.

IMARC Group can effectively manage the construction of your new facility through our comprehensive construction management services. Our dedicated construction management team oversees the entire construction phase, ensuring that all activities are executed according to plan and within the specified timeline. We manage contractors, coordinating their efforts to ensure smooth and efficient workflow on-site.

Furthermore, our team pays great attention to the progress of the construction work, and we conduct site reviews and quality control to ensure that the construction work is done to the highest standards. We resolve any problems as they arise, thus avoiding any form of delay and keeping the project on schedule. When you work with us, you can be assured that your new facility will be constructed to the highest standards that will enable you to concentrate on your core business activities.

Yes, our distributor identification services are designed to connect companies with trusted distributors who meet high standards of reliability, performance, and ethical practices. We leverage our vast network of vetted distributors across various industries and regions to find the best match for your business needs.

Our process begins with a careful analysis of your particular needs and business goals. We then carry out rigorous research and due diligence to identify the distributors that have market reach and the capability to manage your product lines effectively. Our thorough vetting process involves the distributors' background checks and performance history reviews to ensure that they meet industry standards and have a proven track record.

Also, we ensure compliance with the relevant legislation and regulations to avoid legal issues that may affect the functioning of the company. Once potential distributors are identified, we organize business meetings, as well as handle all logistics to facilitate productive discussions. We provide continuous support throughout the partnership, including performance monitoring and logistics coordination, to ensure the success and optimization of your distribution networks in the long run.

Yes, our factory audit services provide a systematic and thorough evaluation of your plant's performance across various critical parameters. Our experienced auditors utilize industry best practices to conduct detailed inspections, focusing on safety, quality, efficiency, compliance, and sustainability.

Our audits assess safety protocols to ensure a secure working environment, evaluate quality standards to enhance product satisfaction and optimize processes to increase productivity and reduce costs. Compliance checks ensure adherence to relevant regulations, mitigating legal risks, and our sustainability assessments recommend eco-friendly practices to minimize environmental impact.

Our holistic approach delivers actionable insights through detailed audit reports, offering clear recommendations for continuous improvement. By partnering with us, you gain valuable insights into your plant's operations, enabling you to drive enhancements, achieve operational excellence, and maintain a competitive edge.

Yes, our contract manufacturer identification services are designed to assist businesses in navigating the complex landscape of contract manufacturing. We start by defining the ideal contract manufacturer through in-depth discussions with our clients, followed by extensive research to identify potential candidates.

Once potential manufacturers are identified, we conduct a rigorous evaluation and vetting process to ensure they meet high standards of quality, reliability, and compliance with relevant regulations. Our team handles the pre-screening process, arranging meetings between our clients and interested candidates, and managing all logistics to facilitate productive discussions.

We have strict performance monitoring and quality control checks to ensure the manufacturers remain at par with your expectations and contribute positively to your business throughout the partnership lifecycle. Through our expertise and extensive network, we ensure that you partner with capable and credible contract manufacturers, who help you drive efficiency, quality, and growth in your production processes.

IMARC Group offers a comprehensive suite of marketing and sales services dedicated to helping businesses increase revenues and effectively sell products. Our performance marketing services focus on data-driven campaigns that maximize return on investment, utilizing programmatic advertising and retargeting techniques to reach the right audience at the right time. We enhance your online presence through SEO and SMO, driving organic traffic and improving your digital footprint.

The lead generation strategies we use target high-quality quality leads that convert into loyal clients, while our brand promotion strategies including influencer marketing and creative designing enhance the visibility and credibility of your brand. Our social media management services assist you in engaging with your audience, establishing relationships with them, and driving conversions through targeted campaigns.

By partnering with IMARC Group, you benefit from our approach that is tailored to your business needs and unique objectives. Our strategies cover all aspects of digital marketing so that you can reach your target audience consistently, along with our ongoing support and optimization to keep your campaigns effective and relevant. Our cutting edge and performance driven marketing services help you gain the competitive advantage and ensure long-term success.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization