Thailand Animal Health Market Size, Share, Trends and Forecast by Animal Type, Product Type, and Region, 2025-2033

Thailand Animal Health Market Overview:

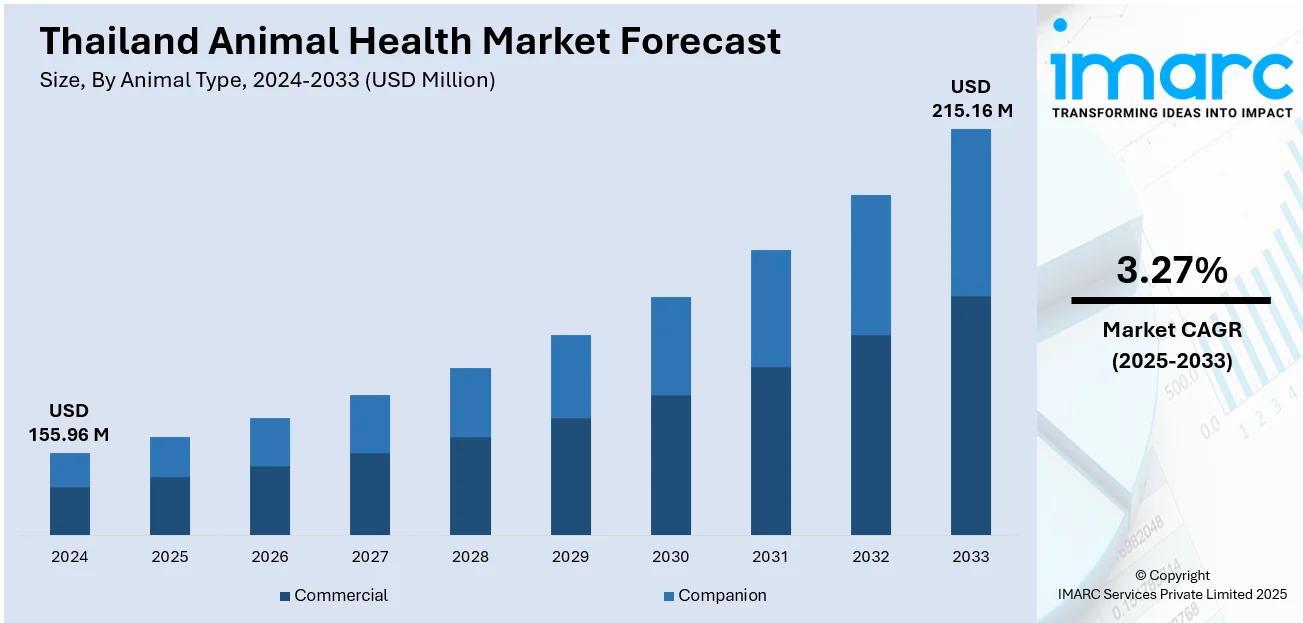

The Thailand animal health market size reached USD 155.96 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 215.16 Million by 2033, exhibiting a growth rate (CAGR) of 3.27% during 2025-2033. At present, the pet adoption trend and humanization of animals are ongoing in urban and semi-urban regions. Moreover, heightened innovations in the livestock and poultry industries, which are crucial to the country’s agricultural and export-oriented economy, are contributing to the market growth. Additionally, improvements in veterinary healthcare infrastructure are expanding the Thailand animal health market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 155.96 Million |

| Market Forecast in 2033 | USD 215.16 Million |

| Market Growth Rate 2025-2033 | 3.27% |

Thailand Animal Health Market Trends:

Increased Pet Adoption and Humanization of Animals

The animal health market in Thailand is witnessing strong growth as the pet adoption trend and humanization of animals are ongoing in urban and semi-urban regions. According to industry reports, Thailand is projected to host 5.38 million pets, with dogs and cats continuing to be the favored options, especially in the Bangkok metropolitan region. Pets are being considered like a part of the family, leading to demand for high-end veterinary services, preventive care, and sophisticated treatment options. This cultural transformation is also driving pet owners to spend greater amounts on regular check-ups, vaccination, grooming, and advanced therapies, thus increasing sales of pharmaceuticals, vaccines, and nutraceuticals. Veterinary hospitals and clinics are adding more services for catering to this growing demand, while pet insurance and wellness programs are catching on. The spread of online platforms for pet-related products is also increasing access to animal health products.

To get more information on this market, Request Sample

Growth in Livestock and Poultry Industries

The heightened innovations in the livestock and poultry industries, which are crucial to country’s agricultural and export-oriented economy, are supporting the Thailand animal health market growth. Farmers and producers are embracing conventional animal husbandry techniques, biosecurity, and disease prevention practices to improve productivity and conform to global food safety standards. The escalating demand for meat and dairy worldwide is fueling investments in intensive farming systems that demand all-encompassing health management solutions. Veterinary pharmaceutical firms are launching advanced vaccines, feed additives, and diagnostics to enable farmers to sustain herd health and avoid disease outbreaks. Government policies and programs are also facilitating this growth through the encouragement of animal health monitoring and vaccination schemes to manage zoonotic as well as endemic diseases. This consistent industrial expansion is constantly fueling a robust demand for animal health products and services, keeping the market robust and adaptable to changing disease management requirements of livestock.

Improvements in Veterinary Healthcare Infrastructure

The Thailand animal health industry is witnessing a tremendous pace because of the continuous improvements in veterinary healthcare infrastructure. The nation is installing advanced veterinary clinics, animal hospitals, diagnostic laboratories, and mobile veterinary units to meet the increasing demand for affordable and quality animal healthcare. Veterinary experts are also receiving ongoing training to embrace new diagnostic and treatment methods, with technology incorporation advancing service provision through telemedicine, electronic health records, and distant consultations. Research and development (R&D) efforts are also stepping up with public-private partnerships, resulting in new product offerings and enhanced disease control solutions. Educational campaigns are also increasing awareness of preventive care and responsible pet ownership, driving frequent veterinary visits. Such improvements are cumulatively building Thailand's ability to deal with animal health effectively, thus reaffirming confidence and stimulating ongoing investment in the industry. In 2025, the global veterinary charity, Worldwide Veterinary Service (WVS), inaugurated a state-of-the-art veterinary training facility in Chiang Mai, Thailand, aimed at delivering specialized training for veterinarians and veterinary students both locally and globally, ensuring that more animals receive top-tier veterinary care.

Thailand Animal Health Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on animal type and product type.

Animal Type Insights:

- Commercial

- Companion

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes commercial and companion.

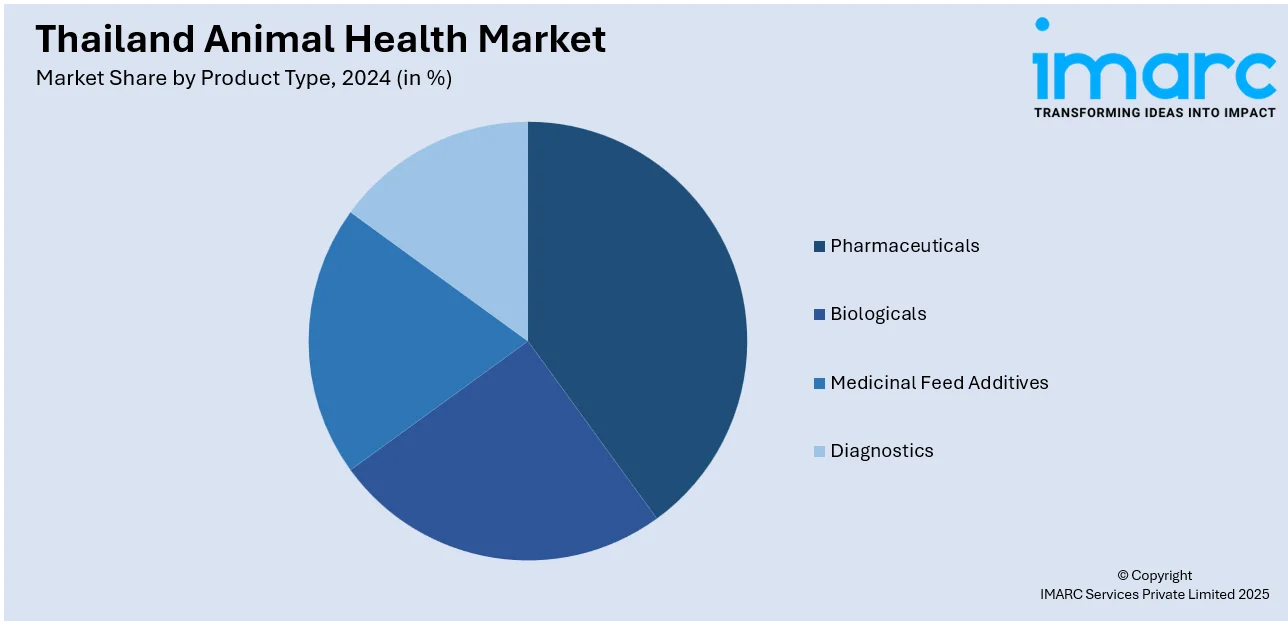

Product Type Insights:

- Pharmaceuticals

- Biologicals

- Medicinal Feed Additives

- Diagnostics

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes pharmaceuticals, biologicals, medicinal feed additives, and diagnostics.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Animal Health Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Animal Types Covered | Commercial, Companion |

| Product Types Covered | Pharmaceuticals, Biologicals, Medicinal Feed Additives, Diagnostics |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand animal health market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand animal health market on the basis of animal type?

- What is the breakup of the Thailand animal health market on the basis of product type?

- What is the breakup of the Thailand animal health market on the basis of region?

- What are the various stages in the value chain of the Thailand animal health market?

- What are the key driving factors and challenges in the Thailand animal health market?

- What is the structure of the Thailand animal health market and who are the key players?

- What is the degree of competition in the Thailand animal health market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand animal health market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand animal health market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand animal health industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)