Thailand ATM Market Size, Share, Trends and Forecast by Solution, Screen Size, Application, ATM Type, and Region, 2025-2033

Thailand ATM Market Overview:

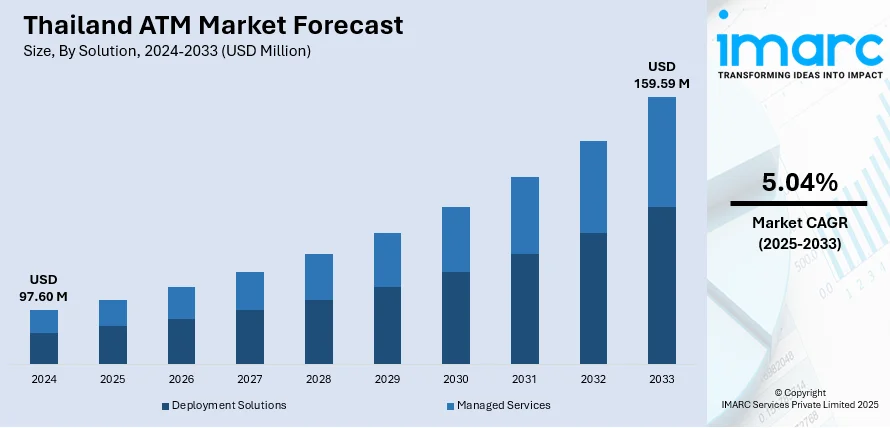

The Thailand ATM market size reached USD 97.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 159.59 Million by 2033, exhibiting a growth rate (CAGR) of 5.04% during 2025-2033. The market is expanding due to increasing demand for cashless transactions, enhanced security features, and advanced ATM technologies such as cash-recycling and biometric authentication. The growing adoption of digital banking and mobile payments is also influencing ATM usage patterns. As banks modernize their services, the market is expected to continue its growth trajectory, further boosting the Thailand ATM market share in the coming years.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 97.60 Million |

| Market Forecast in 2033 | USD 159.59 Million |

| Market Growth Rate 2025-2033 | 5.04% |

Thailand ATM Market Trends:

Adoption of Advanced ATM Technologies

The ATM market in Thailand is becoming more proficient with cutting-edge technologies in an attempt to enhance the customer experience and improve security. Cash-recycling ATMs through which users are able to deposit and withdraw cash are gaining traction thus allowing financial institutions to optimize cash handling and decrease the frequency of cash replenishment. Biometric identification such as fingerprint and facial recognition is picking up pace as a safe and easy means for authentication of user identity to block fraud and improve user experience. Contactless payments are also spreading allowing for faster and more streamlined transactions without card insertion. These developments enhance transaction speed and security and assist in curbing operational expenses for banks. As they gain increasing traction, the technologies are enhancing the overall effectiveness of ATM networks, fueling the Thailand ATM market growth while addressing changing demands by today's consumers.

To get more information on this market, Request Sample

Deployment of Smart ATMs

The use of smart ATMs in Thailand revolutionizes the banking experience through the provision of additional services beyond simple cash dispensations. The sophisticated machines are purpose-built to offer a variety of banking services, such as bill payment, money transfer, checking account balance, and even cardless dispensing. This added functionality promotes convenience for customers since they can conduct different transactions without physically going to a bank branch. Moreover, intelligent ATMs usually incorporate touchscreen interfaces, allowing a more interactive and user-friendly experience. As emerging technologies are integrated, like biometric authentication and video banking, smart ATMs become more secure and efficient. Thai banks are increasingly embracing such machines as a means of lowering the cost of operation, enhancing service provision, and addressing the need for 24/7 access to services, thus becoming one of the trends in the ATM industry.

Expansion in Rural Areas

In Thailand, there is an increased focus on deploying ATM networks to rural and underbanked regions. This rollout will extend access to banking facilities among individuals who had limited alternatives before. By placing ATMs in outlying areas banks can reach customers that are far from brick-and-mortar bank outlets enhancing financial inclusion. These ATMs provide essential banking facilities such as cash withdrawal, deposit, and balance checks which are highly useful in regions that lack conventional banking infrastructure. Such a step is especially crucial in a country with such a high rural population since it fills the gap in finance and expands economic opportunities in those regions. Consequently, rural ATM deployment is emerging as an imperative tactic to enhance availability and deepen banking penetration in Thailand, driving the growth of the ATM market as a whole.

Thailand ATM Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on solution, screen size, application, and ATM type.

Solution Insights:

- Deployment Solutions

- Onsite ATMs

- Offsite ATMs

- Work Site ATMs

- Mobile ATMs

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the solution. This includes deployment solutions (onsite ATMs, offsite ATMs, work site ATMs, and mobile ATMs) and managed services.

Screen Size Insights:

- 15" and Below

- Above 15"

A detailed breakup and analysis of the market based on the screen size have also been provided in the report. This includes 15" and below and above 15.

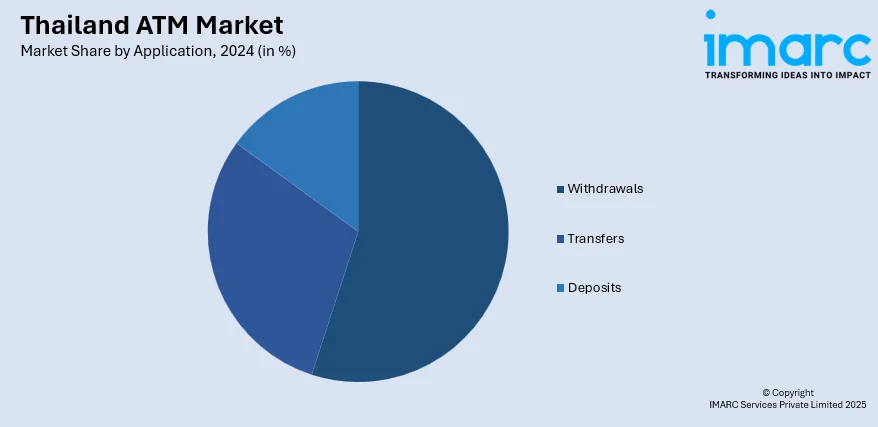

Application Insights:

- Withdrawals

- Transfers

- Deposits

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes withdrawals, transfers, and deposits.

ATM Type Insights:

- Conventional/Bank ATMs

- Brown Label ATMs

- White Label ATMs

- Smart ATMs

- Cash Dispensers

A detailed breakup and analysis of the market based on the ATM type have also been provided in the report. This includes conventional/bank ATMs, brown label ATMs, white label ATMs, smart ATMs, and cash dispensers.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand ATM Market News:

- In April 2025, Siam Commercial Bank (SCB) announced its partnership with GLN International to launch cardless ATM withdrawals for South Korean tourists in Thailand. Using the GLN app, tourists can scan a QR code at over 9,000 SCB ATMs. This service aims to enhance visitor convenience as Thailand prepares for 38.8 million tourists by 2025.

Thailand ATM Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Screen Sizes Covered | 15" and Below, Above 15" |

| Applications Covered | Withdrawals, Transfers, Deposits |

| ATM Types Covered | Conventional/Bank ATMs, Brown Label ATMs, White Label ATMs, Smart ATMs, Cash Dispensers |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand ATM market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand ATM market on the basis of solution?

- What is the breakup of the Thailand ATM market on the basis of screen size?

- What is the breakup of the Thailand ATM market on the basis of application?

- What is the breakup of the Thailand ATM market on the basis of ATM type?

- What is the breakup of the Thailand ATM market on the basis of region?

- What are the various stages in the value chain of the Thailand ATM market?

- What are the key driving factors and challenges in the Thailand ATM market?

- What is the structure of the Thailand ATM market and who are the key players?

- What is the degree of competition in the Thailand ATM market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand ATM market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand ATM market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand ATM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)