Thailand Bottled Water Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Packaging Type, and Region, 2025-2033

Thailand Bottled Water Market Overview:

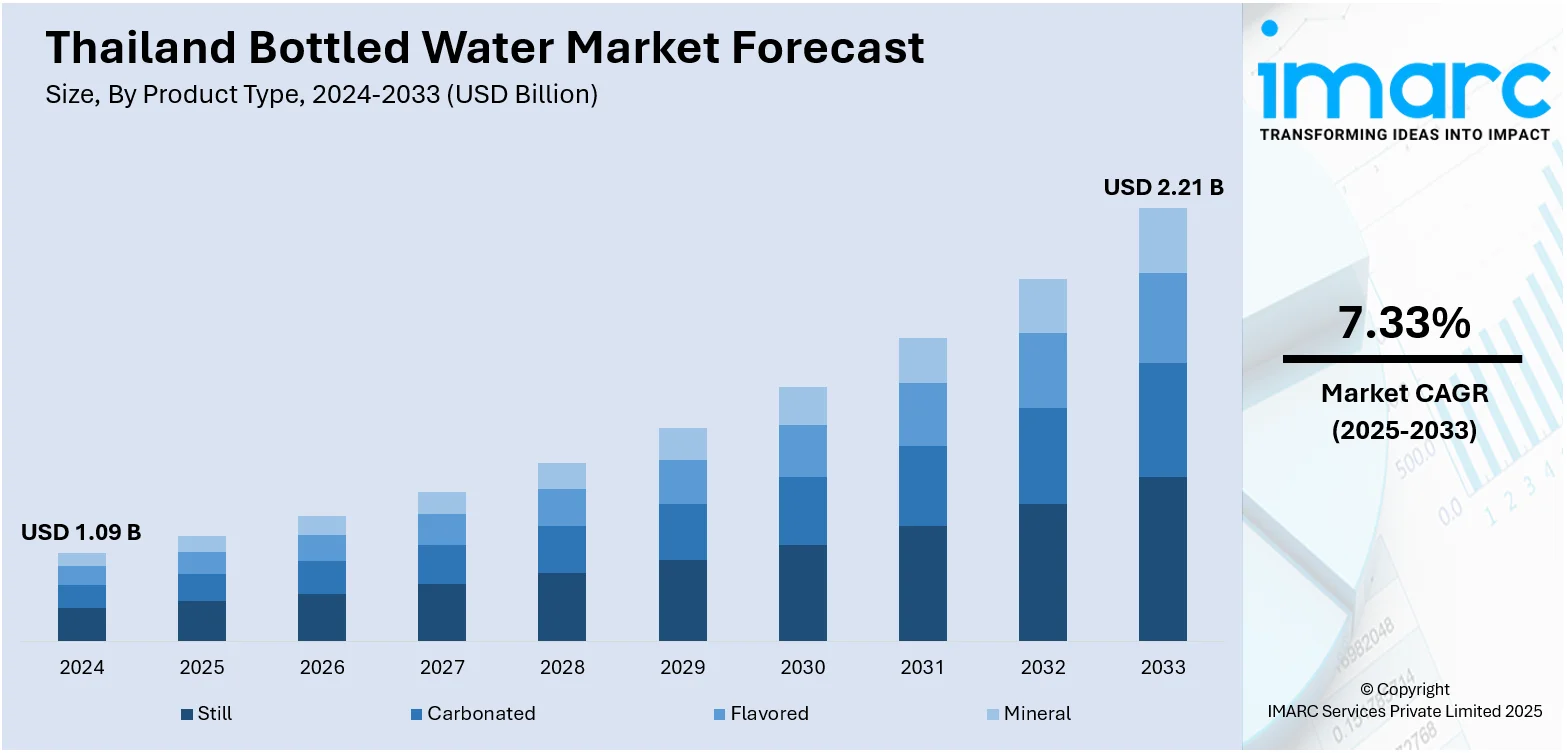

The Thailand bottled water market size reached USD 1.09 Billion in 2024. Looking forward, the market is projected to reach USD 2.21 Billion by 2033, exhibiting a growth rate (CAGR) of 7.33% during 2025-2033. The market is witnessing steady expansion driven by heightened health awareness, rising tourism, and urban consumer demand for convenient and pure hydration options. Domestic spring water brands, along with international labels, are differentiating through enhanced mineral content and sustainable packaging solutions. Growth in retail distribution and e‑commerce channels, especially in tourist hubs and busy cities, is further boosting accessibility. Combined innovation and shifting lifestyles are fueling the overall Thailand bottled water market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.09 Billion |

| Market Forecast in 2033 | USD 2.21 Billion |

| Market Growth Rate 2025-2033 | 7.33% |

Thailand Bottled Water Market Trends:

Eco‑Friendly Packaging Initiatives

Sustainability is increasingly influencing consumer choices in Thailand's bottled water sector. In response, brands are shifting towards recyclable materials, biodegradable packaging, and lighter bottle designs to minimize plastic use. Numerous companies are also focusing on bottle-to-bottle recycling initiatives and promoting refillable options to attract environmentally minded consumers. For instance, in July 2023, Mineré launched Thailand's first eco-friendly rPET bottle, made from recycled plastic, under the “BOTTLE MADE FROM BOTTLES” campaign. Certified by the FDA, this initiative aims to reduce plastic waste and carbon emissions while promoting recycling. Collaboration with 7-Eleven encourages consumers to recycle used bottles through designated drop-off points. This trend is particularly pronounced among younger individuals and urban populations who prioritize eco-friendly values in their purchasing decisions. Government initiatives aimed at reducing plastic usage, along with heightened public awareness campaigns, further bolster this trend. Marketing tactics now often emphasize environmental qualities, featuring phrases like “100% recyclable” or “made from recycled plastic” to foster trust and brand loyalty. As sustainability emerges as a key factor in purchasing decisions, eco-friendly packaging has transitioned from a niche consideration to a critical competitive element central to Thailand bottled water market growth.

To get more information on this market, Request Sample

Rising Demand for Premium and Functional Water

In Thailand’s changing bottled water landscape, the emergence of premium and functional water options is reshaping consumer expectations. Urban dwellers and health-conscious individuals are increasingly gravitating towards value-added choices like flavored, vitamin-infused, alkaline, and electrolyte-rich water. For instance, in July 2024, Space Water Co., Ltd. launched Space Flavored Water at Freshtival in Siam Square One, Thailand, featuring popular Tiktokers and actor Muk Waranit. The new brand introduces Uthai-scented flavored water, infused with collagen, zinc, and vitamin B6. Two flavors include Soft Peach and Soft Rice. These varieties are perceived not just as hydration sources but as lifestyle products promoting wellness, fitness, and everyday nutrition. As awareness of personal health rises, consumers are more inclined to pay a premium for bottled water that provides extra functional advantages. High-quality packaging, compelling brand narratives, and endorsements from health influencers are also enhancing visibility and attractiveness. This trend is particularly noticeable in urban areas, gyms, health food shops, and upscale hospitality settings. The heightened demand for unique, health-oriented beverages is driving innovation and competition among brands, contributing to the growth of Thailand's bottled water market.

Thailand Bottled Water Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and packaging type.

Product Type Insights:

- Still

- Carbonated

- Flavored

- Mineral

The report has provided a detailed breakup and analysis of the market based on the product type. This includes still, carbonated, flavored, and mineral.

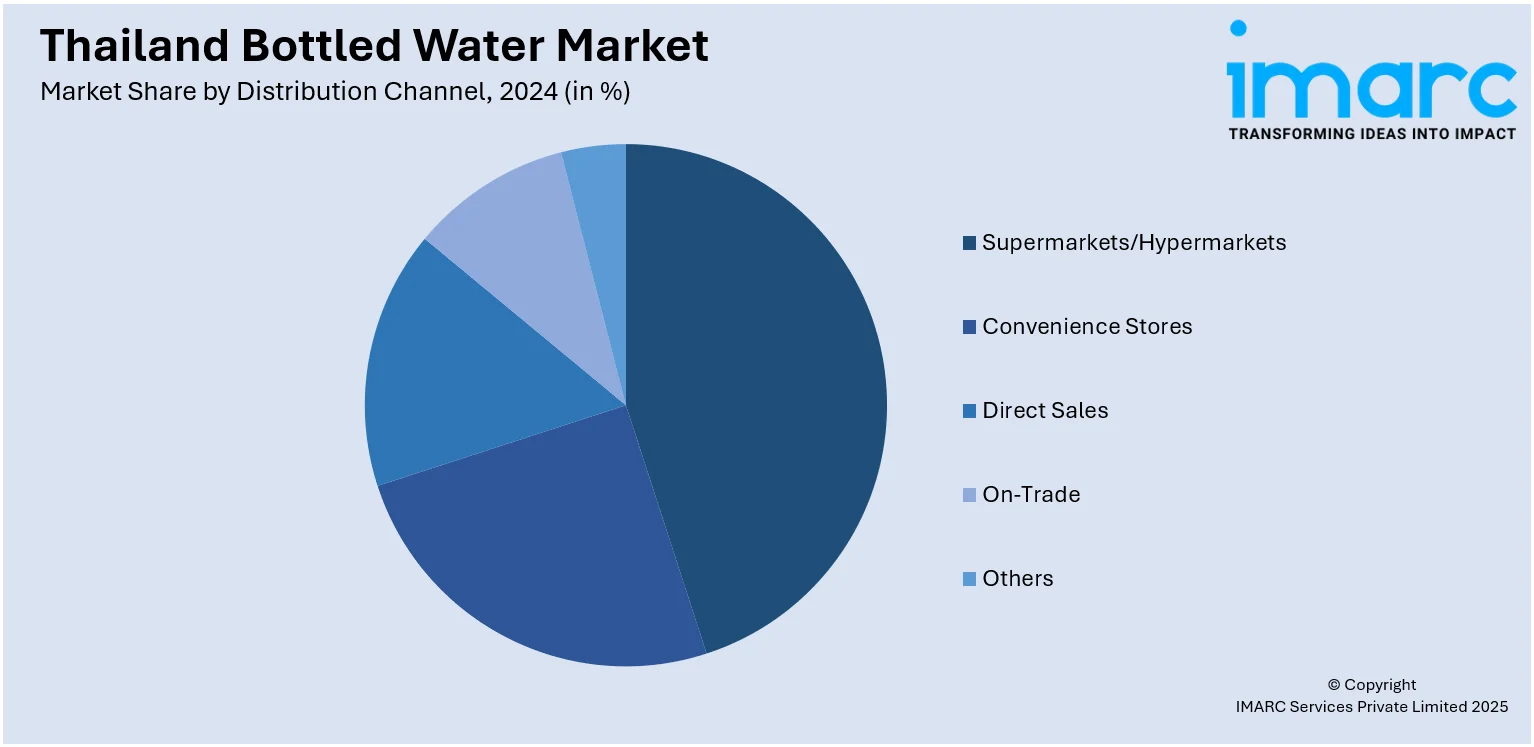

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Convenience Stores

- Direct Sales

- On-Trade

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, direct sales, on-trade, and others.

Packaging Type Insights:

- PET Bottles

- Metal Cans

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging type. This includes PET bottles, metal cans, and others.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Bottled Water Market News:

- In May 2025, 6ty Degrees mineral water, launched by Rare Beverage Company, aims for global expansion, debuting at THAIFEX - ANUGA ASIA 2025. Sourced from a geothermal hot spring in Chiang Dao, it features natural minerals and an eco-friendly cap. The brand targets health-conscious consumers, promoting awareness through its "6ty Manifesto" campaign.

- In March 2024, Nestlé Pure Life, part of Nestlé (Thai) Ltd.’s Water Business Unit, launched its “Fresh No Limit” campaign to engage Generation Z, backed by a budget of 200 million baht. The campaign, which includes a complete brand overhaul, features new augmented reality (AR) packaging, a music single, and interactive activities, in partnership with Sonray Music and the T-pop band BUS.

Thailand Bottled Water Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Still, Carbonated, Flavored, Mineral |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Direct Sales, On-Trade, Others |

| Packaging Types Covered | PET Bottles, Metal Cans, Others |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand bottled water market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand bottled water market on the basis of product type?

- What is the breakup of the Thailand bottled water market on the basis of distribution channel?

- What is the breakup of the Thailand bottled water market on the basis of packaging type?

- What is the breakup of the Thailand bottled water market on the basis of region?

- What are the various stages in the value chain of the Thailand bottled water market?

- What are the key driving factors and challenges in the Thailand bottled water market?

- What is the structure of the Thailand bottled water market and who are the key players?

- What is the degree of competition in the Thailand bottled water market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand bottled water market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand bottled water market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand bottled water industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)