Thailand Carbon Black Market Size, Share, Trends and Forecast by Type, Grade Wise Application, and Region, 2025-2033

Thailand Carbon Black Market Overview:

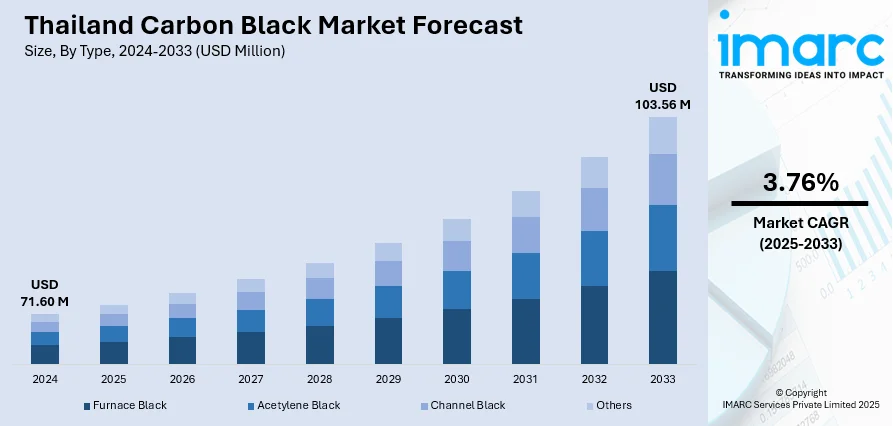

The Thailand carbon black market size reached USD 71.60 Million in 2024. Looking forward, the market is projected to reach USD 103.56 Million by 2033, exhibiting a growth rate (CAGR) of 3.76% during 2025-2033. The market is supported by strong demand from tire manufacturing, packaging, plastics, and coatings sectors. Thailand’s role as a regional automotive and rubber processing hub fuels consumption, while export-oriented industries are driving the need for certified, high-performance grades. Increasing requirements for low-PAH, high-dispersion, and performance-specific formulations are reshaping buyer preferences. These developments are expected to deepen supplier specialization and further elevate the Thailand carbon black market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 71.60 Million |

| Market Forecast in 2033 | USD 103.56 Million |

| Market Growth Rate 2025-2033 | 3.76% |

Thailand Carbon Black Market Trends:

Rubber and Tire Sector Backbone

Thailand is among the world's largest producers and exporters of natural rubber, and this advantage directly reinforces the country’s demand for carbon black in tire and rubber manufacturing. The domestic market includes operations by global tire brands and regional manufacturers that rely on carbon black to enhance elasticity, heat resistance, and wear properties of tires and industrial rubber goods. Thailand’s positioning as an automotive and two-wheeler production hub increases the consumption of reinforcing-grade carbon black in tire treads, belts, hoses, and bushings. In January 2024, Birla Carbon announced a significant expansion with a new carbon black manufacturing facility in Rayong, Thailand. This move will increase Birla’s regional capacity by more than 240 kilotons, directly supporting the fast-growing local and Southeast Asian tire, rubber, and specialty markets. The expansion underscores Thailand's position as a key producer and exporter to global customers. Localized access to natural rubber gives manufacturers flexibility in compound formulations, while carbon black quality remains a key differentiator in tire performance under tropical and high-load driving conditions. Additionally, Thailand exports large volumes of tires, particularly to Asia-Pacific and Europe, where carbon black specifications must meet stringent safety and regulatory standards. With domestic consumption growing alongside exports, carbon black continues to serve as a critical input supporting reliability and longevity in high-use applications. Increasing industrial alignment with global tire quality benchmarks is a foundational contributor to the Thailand carbon black market growth.

To get more information on this market, Request Sample

Packaging, Plastics, and Industrial Pigments

Beyond the tire sector, Thailand’s plastics and packaging industries are creating a consistent pull for pigment-grade carbon black. The material is used extensively to enhance color intensity, opacity, and UV resistance in rigid and flexible packaging, molded containers, films, and construction-grade plastics. As Thailand scales up exports of processed foods, beverages, and personal care items, packaging standards are becoming more advanced, increasing demand for food-contact-safe and high-dispersion grades of carbon black. In addition, the electronics, appliance, and automotive plastics sectors demand specialized formulations with electrical conductivity and anti-static properties. Local compounders and plastic converters increasingly require precise control over particle size and surface area to meet technical and aesthetic demands across multiple product categories. Thailand’s position as a regional manufacturing hub ensures consistent integration of carbon black into extrusion, injection molding, and blow molding applications. Industrial pigments for paints, coatings, inks, and adhesives also represent a steady demand base, particularly from the building and furniture segments. These downstream industries value the durability and colorfastness of high-purity black pigments. As technical specifications in consumer and export plastics continue to rise, carbon black’s utility in formulating stable, visually consistent products further deepens its relevance in Thailand’s diversified industrial economy.

Rising Specialty-Grade Demand and Compliance Focus

With growing attention to environmental health, worker safety, and global export compliance, Thailand is experiencing increased adoption of specialty and low-PAH carbon black grades. In September 2024, Marubeni Corporation invested in Green Rubber Energy Company Limited (GRE), which operates an end-of-life tire (ELT) pyrolysis recycling business in Thailand with a processing capacity of 10,000 tons per year. Through this partnership, Marubeni aims to establish a full tire recycling supply chain, producing recovered carbon black (rCB) and tire pyrolysis oil (TPO) for use in new tires and industrial applications, leveraging GRE’s advanced technology for stable rCB production. Regulatory pressures, particularly from Europe and North America, have made it essential for Thai manufacturers to adopt cleaner, certified inputs to ensure continued market access. This is especially relevant in segments such as tires, food packaging, toys, cosmetics containers, electronics housings, and automotive interiors. In response, the domestic carbon black supply chain is gradually shifting toward high-purity and low-contaminant variants that conform to EU REACH, RoHS, and FDA guidelines. Simultaneously, producers of conductive plastics, lithium-ion batteries, and high-voltage cables are requesting carbon black grades with tailored surface areas, structure, and porosity to meet exacting electrical and thermal performance standards. Furthermore, end-users in coatings, inks, and technical rubber are prioritizing dispersion consistency and batch traceability. International clients conducting audits and quality inspections frequently influence procurement standards among Thai converters. As Thailand continues aligning its industrial ecosystem with global quality and sustainability benchmarks, these compliance-driven shifts are shaping procurement strategies and formulation choices. Specialty-grade innovation and certification adherence are emerging as strong, long-term demand anchors within the country’s carbon black value chain.

Thailand Carbon Black Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and grade wise application.

Type Insights:

- Furnace Black

- Acetylene Black

- Channel Black

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes furnace black, acetylene black, channel black, and others.

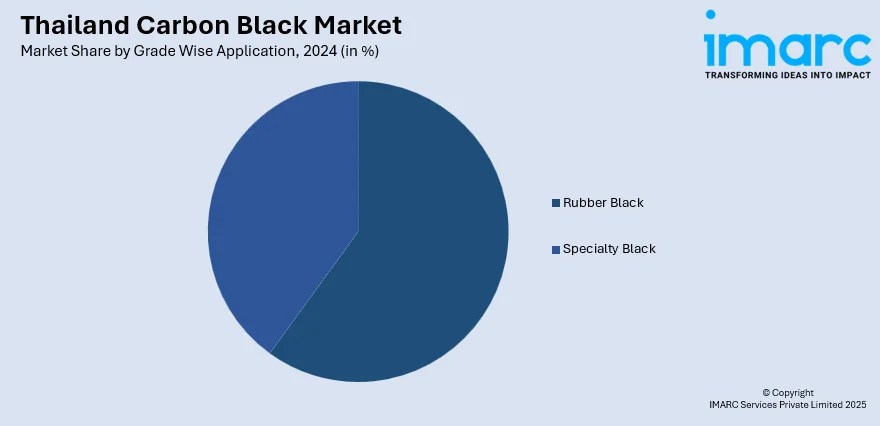

Grade Wise Application Insights:

- Rubber Black

- Tire Treads

- Inner Liner and Tubes

- Conveyor Belts

- Hoses

- Others

- Specialty Black

- Plastics

- Ink and Toners

- Paint and Coatings

- Wires and Cables

- Others

The report has provided a detailed breakup and analysis of the market based on the grade wise application. This includes rubber black (tire treads, inner liner and tubes, conveyor belts, hoses, and others) and specialty black (plastics, ink and toners, paint and coatings, wires and cables, and others).

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Carbon Black Market News:

- In July 2025, Bridgestone Corporation announced the sale of its carbon black manufacturing subsidiary, Bridgestone Carbon Black (Thailand) Co., Ltd., to Tokai Carbon Co., Ltd. and Thai Tokai Carbon Product Co., Ltd., as part of its 2024–2026 Mid-Term Plan to focus on core technical strengths and global business quality. Following the transaction, Tokai Carbon will hold a minority stake while Thai Tokai Carbon Product will hold the majority, consolidating expertise and regional supply chains in the carbon black sector.

Thailand Carbon Black Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Acetylene Black, Channel Black, Others |

| Grade Wise Applications Covered |

|

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand carbon black market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand carbon black market on the basis of type?

- What is the breakup of the Thailand carbon black market on the basis of grade wise application?

- What is the breakup of the Thailand carbon black market on the basis of region?

- What are the various stages in the value chain of the Thailand carbon black market?

- What are the key driving factors and challenges in the Thailand carbon black market?

- What is the structure of the Thailand carbon black market and who are the key players?

- What is the degree of competition in the Thailand carbon black market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand carbon black market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand carbon black market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand carbon black industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)