Thailand CCTV Camera Market Size, Share, Trends and Forecast by Type, End User Vertical, and Region, 2025-2033

Thailand CCTV Camera Market Overview:

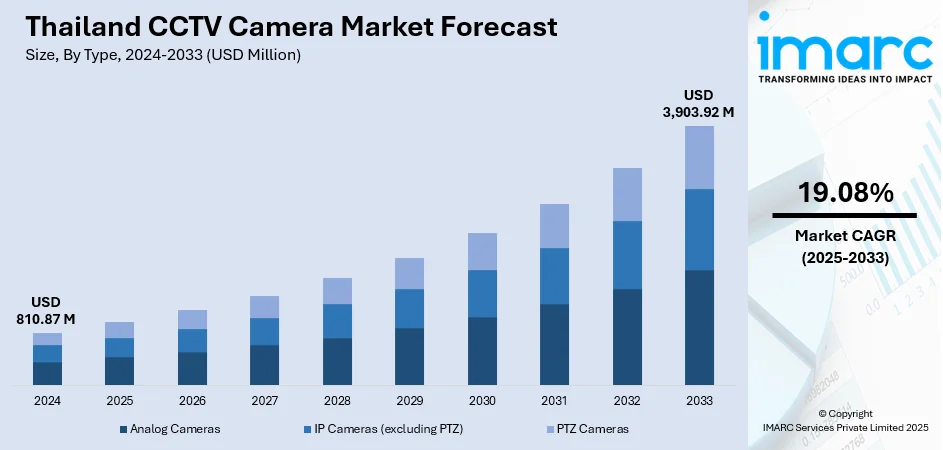

The Thailand CCTV camera market size reached USD 810.87 Million in 2024. Looking forward, the market is projected to reach USD 3,903.92 Million by 2033, exhibiting a growth rate (CAGR) of 19.08% during 2025-2033. The market is witnessing steady growth, driven by rising concerns over public safety, infrastructure development, and adoption of smart surveillance. Government initiatives and commercial sector expansion are boosting demand. A key trend shaping the landscape is the transition from analog to IP-based systems, along with AI and IoT integration. These advancements are expected to drive an increase in Thailand CCTV camera market share over the coming years.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 810.87 Million |

| Market Forecast in 2033 | USD 3,903.92 Million |

| Market Growth Rate 2025-2033 | 19.08% |

Thailand CCTV Camera Market Trends:

Smart City Integration

The drive toward developing smart cities is significantly fueling the growth of the CCTV camera market in Thailand. Urban regions are progressively implementing intelligent surveillance systems to improve public safety, manage traffic, and enhance emergency response capabilities. CCTV cameras are now part of extensive city-wide networks that link transportation systems, utilities, and law enforcement activities. These sophisticated systems offer real-time monitoring, data analytics, and centralized management, facilitating rapid decision-making in critical situations. Initiatives such as smart lighting, interconnected intersections, and automated public transportation are integrating high-resolution IP cameras equipped with AI and IoT features. This comprehensive strategy boosts security and aids in more effective city administration. As Thailand focuses on upgrading infrastructure in cities like Bangkok, Chiang Mai, and Phuket, the demand for advanced CCTV systems is projected to grow, underscoring their importance in the country’s journey toward digital transformation. For instance, in August 2024, the Bangkok Metropolitan Administration launched AI-enhanced CCTV cameras to improve road safety and enforce traffic laws. The system monitors cyclists on pavements, streamlining the identification and penalization process. Fines for violations remain at 2,000 baht, with the initiative piloted in 15 areas across the city.

To get more information on this market, Request Sample

Adoption of AI-Powered Cameras

The incorporation of artificial intelligence into CCTV systems is playing a significant role in the Thailand CCTV camera market growth. AI-enabled cameras have evolved beyond simple video recording; they now provide sophisticated features such as facial recognition, motion tracking, and behavioral analytics. For instance, in May 2025, AIS has launched AiCAM, Southeast Asia’s first 5G-powered AI CCTV camera, enhancing home and community security. Developed with JFTECH, it features real-time object detection and alerts for various applications, including elderly and child monitoring. These innovations enable early threat identification, empowering security teams to react quickly to unusual or suspicious behavior. In busy locations like airports, shopping centers, and urban areas, AI assists in crowd management and detects unusual behavior patterns in real-time. Moreover, businesses utilize AI to assess customer foot traffic and enhance operations. As Thailand progresses in its smart city initiatives and digital infrastructure, AI-enhanced surveillance systems are becoming essential components of urban safety measures. This increasing dependence on intelligent monitoring solutions is projected to drive ongoing demand in the Thailand CCTV camera market in the foreseeable future.

Thailand CCTV Camera Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end user vertical.

Type Insights:

- Analog Cameras

- IP Cameras (excluding PTZ)

- PTZ Cameras

The report has provided a detailed breakup and analysis of the market based on the type. This includes analog cameras, IP cameras (excluding PTZ), and PTZ cameras.

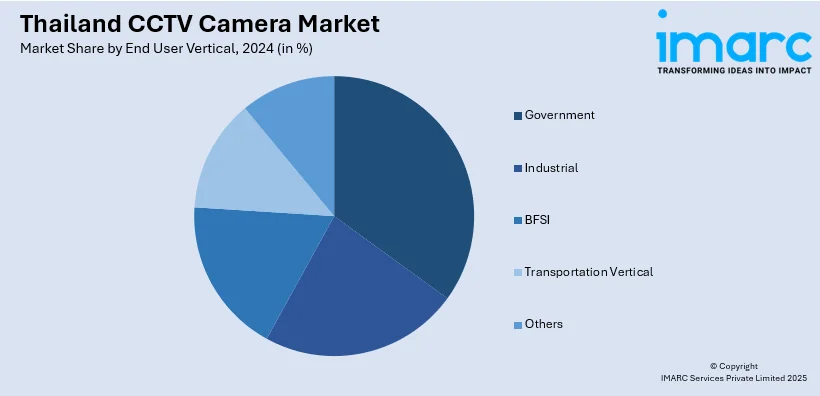

End User Vertical Insights:

- Government

- Industrial

- BFSI

- Transportation Vertical

- Others

A detailed breakup and analysis of the market based on the end user vertical have also been provided in the report. This includes government, industrial, BFSI, transportation vertical, and others.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand CCTV Camera Market News:

- In July 2025, Thailand announced its plans to expand the Phuket Eye surveillance system to enhance tourist safety and crime control on the island. By doubling CCTV cameras and integrating them into a police database, officials aim to improve real-time monitoring, traffic management, and bolster Phuket’s reputation as a secure travel destination.

- In May 2025, Pattaya enhanced public safety by expanding its real-time CCTV network, with over 400 cameras now live through the LINE OA: Pattaya Connect system. Mayor Poramet Ngampichet is set to sign a memorandum of understanding with the national police to enhance surveillance capabilities and monitor suspects, with the goal of increasing safety for both residents and visitors.

Thailand CCTV Camera Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Analog Cameras, IP Cameras (excluding PTZ), PTZ Cameras |

| End User Verticals Covered | Government, Industrial, BFSI, Transportation Vertical, Others |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand CCTV camera market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand CCTV camera market on the basis of type?

- What is the breakup of the Thailand CCTV camera market on the basis of end user vertical?

- What is the breakup of the Thailand CCTV camera market on the basis of region?

- What are the various stages in the value chain of the Thailand CCTV camera market?

- What are the key driving factors and challenges in the Thailand CCTV camera market?

- What is the structure of the Thailand CCTV camera market and who are the key players?

- What is the degree of competition in the Thailand CCTV camera market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand CCTV camera market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand CCTV camera market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand CCTV camera industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)