Thailand Cement Market Size, Share, Trends and Forecast by Type, End-Use, and Region, 2025-2033

Thailand Cement Market Overview:

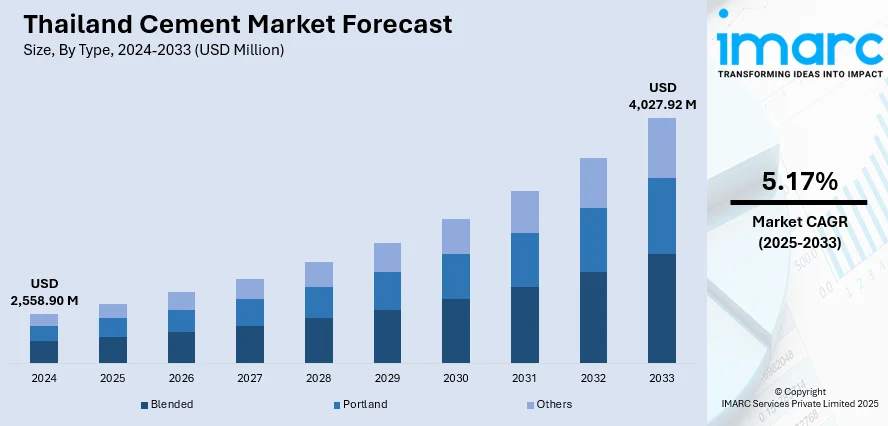

The Thailand cement market size reached USD 2,558.90 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,027.92 Million by 2033, exhibiting a growth rate (CAGR) of 5.17% during 2025-2033. At present, Thailand is focusing on the expansion of infrastructure and real estate developments, which is continuously driving the demand for construction materials. Moreover, the heightened focus on developing sustainable construction components is contributing to the market growth. Apart from this, the rising focus on improving export activities is expanding the Thailand cement market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,558.90 Million |

| Market Forecast in 2033 | USD 4,027.92 Million |

| Market Growth Rate 2025-2033 | 5.17% |

Thailand Cement Market Trends:

Growing Infrastructure and Real Estate Advances

Thailand is focusing on the expansion of infrastructure and real estate developments, which is continuously driving the demand for cement. The authorities are heavily investing in massive infrastructure projects like the Eastern Economic Corridor (EEC), high-speed rail links, airport developments, and motorway improvements. These projects are delivering steady cement consumption in the transportation and public works segments. Simultaneously, housing and commercial building work is improving, especially in cities such as Bangkok and the surrounding areas. Condominium projects, office buildings, and mixed-use buildings are increasingly depending on quality cement products for strength and durability. In addition, public-private partnerships (PPPs) are contributing to expediting project schedules and providing a steady stream of construction work. The robust demand from public infrastructure projects and private real estate developments is encouraging local manufacturers to add capacity and pursue innovative formulations like low-carbon cement. The Director-General of the Department of Business Development at the Ministry of Commerce recently revealed a significant increase in foreign investment, with 181 permits granted under the Foreign Business Act B.E. 2542 (1999) during the initial two months of 2025. This represents a notable 68% rise from the same timeframe last year, showcasing increasing investor trust in Thailand's economic outlook and its ongoing recovery.

To get more information on this market, Request Sample

Expanded Use of Green and Blended Cement

The Thai cement industry is also making a revolutionary move towards sustainability, with producers actively formulating and marketing green and blended cement. The driving forces behind this are growing environmental consciousness, pressure from regulations to limit carbon emissions, and conformity with global environmental standards. Thai producers are making more investments in research and development (R&D) to manufacture clinker-reduced and alternative material-based cement, including Portland pozzolana cement and slag-based types. These products not only lower greenhouse gas emissions when made but also improve long-term performance and durability in tropical environments. In addition, the government is introducing policies that encourage sustainable construction practices, such as the adoption of green building materials that carry certification. These regulatory systems are encouraging construction companies and developers to transition towards sustainable procurement systems, further encouraging the adoption of eco-efficient cement technologies. In 2024, Siam Cement Group (SCG) launched a new low-carbon cement, aiding Thailand's net-zero goals. The company stated that SCG is the first cement producer in Thailand to create this environment-friendly cement, lowering CO₂ emissions to as little as 0.05t in the manufacturing process. The new cement is said to be equivalent to or stronger than standard Portland cement.

Export Opportunities in ASEAN and Regional Integration

Thailand is now reinforcing its position as a prominent cement exporter in the ASEAN region by taking advantage of its strategic location and established production platform, thereby impelling the Thailand cement market growth. Cement manufacturers are taking advantage of increased demand in neighboring nations where infrastructure shortages are driving imports. The creation of the ASEAN Economic Community (AEC) and other bilateral free trade agreements are making cross-border trade easier, lowering tariffs, and simplifying logistics for Thai cement companies. This regional integration is making manufacturers upgrade production capacity and streamline supply chains to serve external demand effectively. In addition, Thai cement firms are shifting more towards competitive pricing, quality consistency, and tailoring product offerings to varying construction standards across export destinations.

Thailand Cement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end-use.

Type Insights:

- Blended

- Portland

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes blended, Portland, and others.

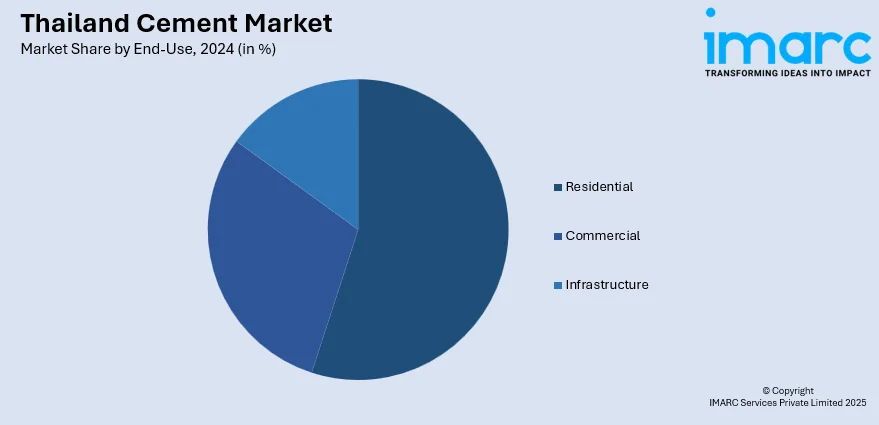

End-Use Insights:

- Residential

- Commercial

- Infrastructure

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes residential, commercial, and infrastructure.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blended, Portland, Others |

| End-Uses Covered | Residential, Commercial, Infrastructure |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand cement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand cement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cement market in Thailand was valued at USD 2,558.90 Million in 2024.

The Thailand cement market is projected to exhibit a CAGR of 5.17% during 2025-2033, reaching a value of USD 4,027.92 Million by 2033.

The market is driven by robust infrastructure development, government-backed construction projects, and increased urbanization. Growing residential and commercial real estate activities, along with rising foreign direct investments, are fueling demand. Additionally, advancements in green cement technologies and sustainability initiatives are attracting both public and private sector interest in the cement sector.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)