Thailand Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel, Industry Vertical, and Region, 2025-2033

Thailand Commercial Insurance Market Overview:

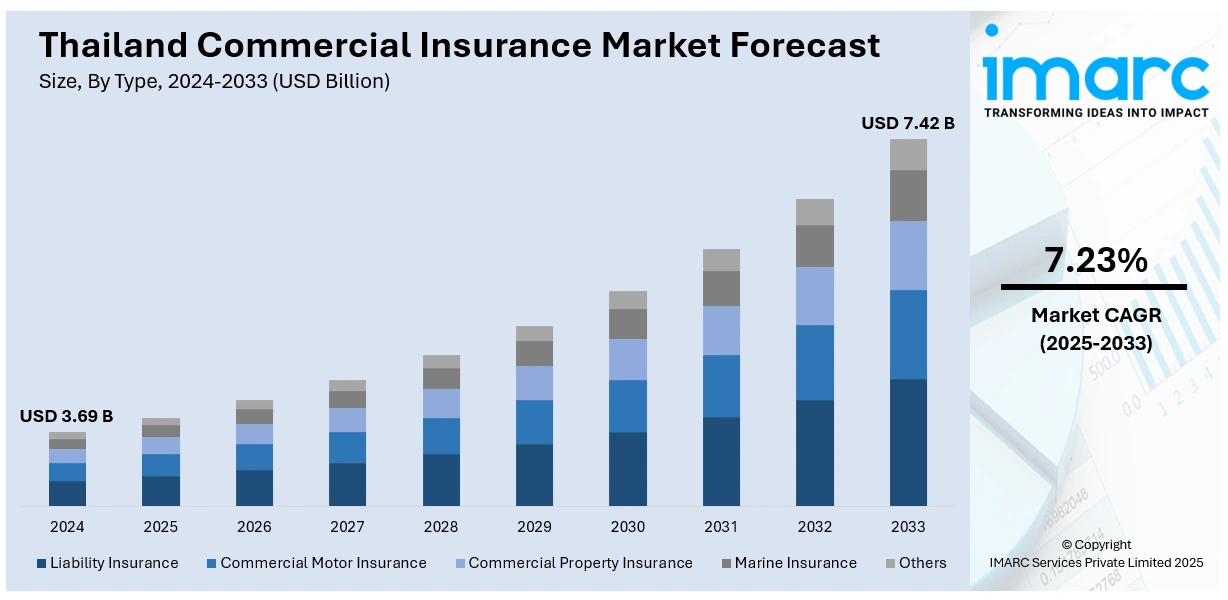

The Thailand commercial insurance market size reached USD 3.69 Billion in 2024. The market is projected to reach USD 7.42 Billion by 2033, exhibiting a growth rate (CAGR) of 7.23% during 2025-2033. The market is expanding, driven by increasing demand for comprehensive coverage solutions across various sectors. Growing awareness around risk management and a stronger regulatory environment are key factors supporting the market's growth. These trends are contributing to the rise of Thailand commercial insurance market share, particularly in health, property, and casualty insurance.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.69 Billion |

| Market Forecast in 2033 | USD 7.42 Billion |

| Market Growth Rate 2025-2033 | 7.23% |

Thailand Commercial Insurance Market Trends:

Strong Financial Stability Driving Industry Growth

Thailand commercial insurance market has been supported by strong financial performances of major industry players that contribute to growing market confidence. A good illustration of this trend is Muang Thai Life Assurance (MTL), which has announced USD 4 Billion of new business premiums for the first half of 2024. While there was a modest dip in premiums year-over-year, MTL's healthy financial foundation, as indicated by a 381% RBC ratio, has translated into its resilience in an uncertain market. MTL's sound performance in the face of softening premiums highlights the financial strength at the heart of commercial insurance sector stability. Such robust capital position is essential for insurers to withstand challenges such as market volatility and new risks. By holding good reserves, MTL not only provides for its own solvency but also enhances investor confidence in the industry. Such financial stability enables insurance companies to offer diverse products and services, thus contributing to the overall growth of the Thailand commercial insurance market growth. The presence of companies with strong capital foundations fosters a sense of security, encouraging both consumers and businesses to engage with the sector, ensuring its continued expansion in the long term.

To get more information on this market, Request Sample

Legal Expertise Strengthening Market Infrastructure

A key trend driving the development of the Thailand commercial insurance market is the increasing importance of legal and regulatory expertise, which is enhancing market infrastructure and driving competitiveness. The opening of Wotton Kearney’s Bangkok office in May 2025 marked a significant step in this direction, reflecting a growing demand for legal support tailored to the unique needs of the insurance industry in Thailand. The firm’s expansion into Thailand highlights the rising necessity for specialized legal services in Southeast Asia’s evolving insurance landscape. By providing in-depth legal guidance on regulatory compliance, risk management, and dispute resolution, Wotton Kearney helps insurance companies navigate complex legal frameworks, ensuring they remain competitive in a rapidly changing market. As insurance firms face increasing regulatory pressures and new challenges from technological advancements and changing consumer behavior, the role of legal firms becomes critical in ensuring companies operate smoothly and efficiently. Wotton Kearney’s presence strengthens the overall legal infrastructure in Thailand, which in turn enhances the commercial insurance market’s competitiveness. This growing legal support structure enables insurers to offer more comprehensive services while maintaining compliance, ensuring the long-term growth and stability of the sector.

Thailand Commercial Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on type, enterprise size, distribution channel, and industry vertical.

Type Insights:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes liability insurance, commercial motor insurance, commercial property insurance, marine insurance, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

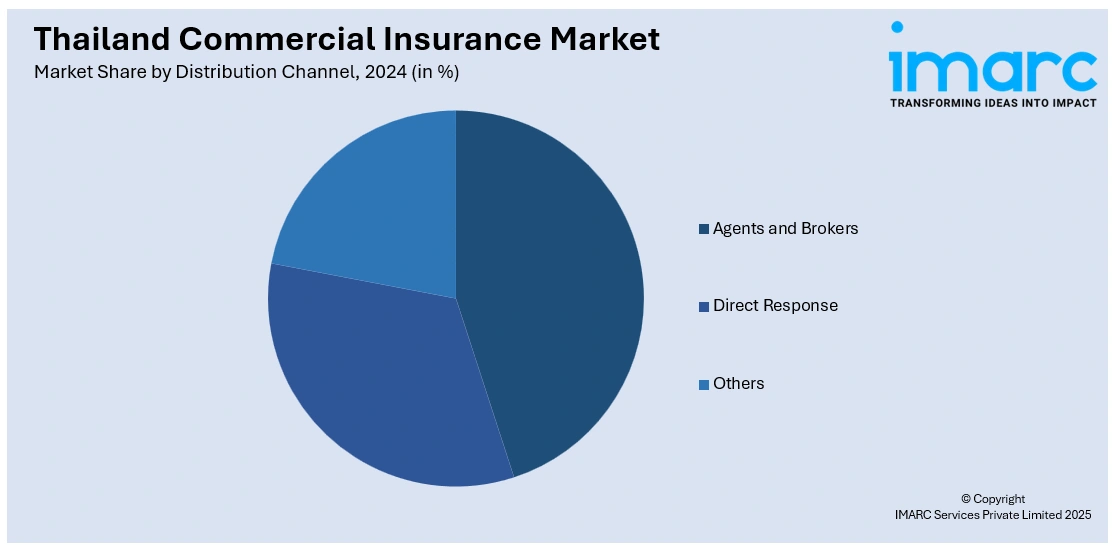

Distribution Channel Insights:

- Agents and Brokers

- Direct Response

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes agents and brokers, direct response, and others.

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes transportation and logistics, manufacturing, construction, it and telecom, healthcare, energy and utilities, and others.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Commercial Insurance Market News:

- August 2025: Thailand's Office of the Insurance Commission launched its 5th Insurance Development Plan (2026-2030), focusing on enhancing stability, adapting to modern risks like cyber threats and disasters, and promoting industry growth. The plan aimed to strengthen Thailand's commercial insurance sector by encouraging innovation, improving regulatory systems, and addressing consumer needs, boosting market competitiveness globally.

- January 2025: Lazada and Peak3 launched a digital insurance joint venture across Southeast Asia. The collaboration integrated embedded insurance offerings, including property, casualty, accident, and health coverage, into Lazada's eCommerce platform. This innovation expanded commercial insurance access, increasing policy issuance and market penetration.

Thailand Commercial Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand commercial insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand commercial insurance market on the basis of type?

- What is the breakup of the Thailand commercial insurance market on the basis of enterprise size?

- What is the breakup of the Thailand commercial insurance market on the basis of distribution channel?

- What is the breakup of the Thailand commercial insurance market on the basis of industry vertical?

- What is the breakup of the Thailand commercial insurance market on the basis of region?

- What are the various stages in the value chain of the Thailand commercial insurance market?

- What are the key driving factors and challenges in the Thailand commercial insurance market?

- What is the structure of the Thailand commercial insurance market and who are the key players?

- What is the degree of competition in the Thailand commercial insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand commercial insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand commercial insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand commercial insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)