Thailand Cyber Insurance Market Size, Share, Trends and Forecast by Component, Insurance Type, Organization Size, End-Use Industry, and Region, 2025-2033

Thailand Cyber Insurance Market Overview:

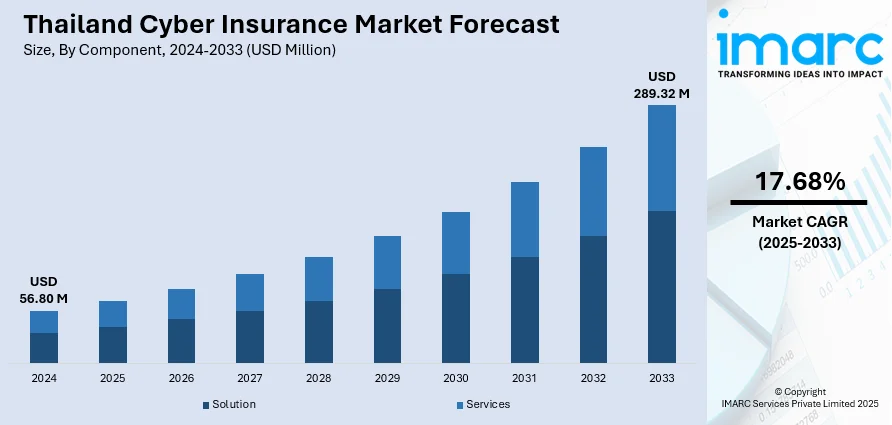

The Thailand cyber insurance market size reached USD 56.80 Million in 2024. The market is projected to reach USD 289.32 Million by 2033, exhibiting a growth rate (CAGR) of 17.68% during 2025-2033. The market is expanding due to increased digital adoption across key industries and growing awareness of cyber risks. Additionally, strict data protection laws and tailored policy offerings are helping strengthen Thailand cyber insurance market share across both large enterprises and small businesses.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 56.80 Million |

| Market Forecast in 2033 | USD 289.32 Million |

| Market Growth Rate 2025-2033 | 17.68% |

Thailand Cyber Insurance Market Trends:

Expansion Driven by Digital Adoption

The Thailand cyber insurance market growth is being propelled by the rapid digitalization of enterprises across the country. Organizations in sectors such as finance, healthcare, and retail are increasingly adopting cloud computing, IoT, and data-driven operations. This shift has led to a greater exposure to cyber threats, including ransomware, phishing, and data breaches. As a result, more companies are recognizing the need for cyber insurance as part of their risk management strategies. Government programs such as Thailand 4.0 have encouraged this digital expansion, while simultaneously highlighting the importance of cybersecurity. Small and medium-sized enterprises, which were previously less inclined to invest in such policies, are now beginning to integrate cyber insurance into their operational planning. Insurance providers are also adjusting their offerings, introducing sector-specific and scalable products to suit varying organizational needs. This level of flexibility is increasing accessibility and improving adoption rates. In parallel, rising awareness of financial and reputational consequences from cyber incidents is influencing purchase decisions. These combined factors technological growth, increased threat levels, and the availability of tailored policies are driving consistent demand across the market.

To get more information on this market, Request Sample

Compliance Requirements Accelerating Adoption

Regulatory developments are significantly influencing the uptake of cyber insurance in Thailand. The implementation of the Personal Data Protection Act (PDPA) has mandated higher standards of data security and accountability across all sectors. Businesses face legal and financial risks in the event of non-compliance, which has led to increased interest in cyber coverage as a means of risk transfer. Regulatory bodies, including the Bank of Thailand, are also reinforcing expectations for cyber resilience in critical sectors such as banking and financial services. These changes are compelling organizations to reassess their cybersecurity frameworks and implement comprehensive protection strategies, including insurance. Insurers are responding by enhancing policy features, offering coverage that includes legal support, forensics, and breach response services. This shift is making cyber insurance more relevant and valuable to potential buyers. Additionally, requirements for incident reporting and public disclosure are creating a culture of transparency and preparedness, both of which reinforce the importance of insurance coverage. The interaction between regulatory enforcement, institutional risk awareness, and improved product offerings continues to shape the growth trajectory of Thailand’s cyber insurance market.

Thailand Cyber Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on component, insurance type, organization size, and end-use industry.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Insurance Type Insights:

- Packaged

- Stand-alone

The report has provided a detailed breakup and analysis of the market based on the insurance type. This includes packaged and stand-alone.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small and medium enterprises and large enterprises.

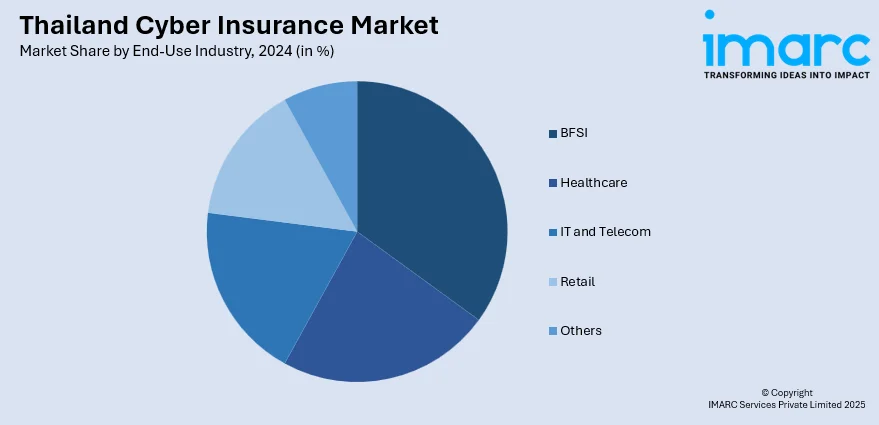

End-Use Industry Insights:

- BFSI

- Healthcare

- IT and Telecom

- Retail

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes BFSI, healthcare, IT and telecom, retail, and others.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Cyber Insurance Market News:

- August 2024: AIS launched Thailand’s first personalized cyber immunity tool and introduced Secure Net+ Protected by MSIG, offering personal cyber insurance covering identity theft and financial fraud. This development increased awareness and accessibility, positively influencing Thailand’s cyber insurance market adoption and consumer trust.

Thailand Cyber Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Insurance Types Covered | Packaged, Stand-alone |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End-Use Industries Covered | BFSI, Healthcare, IT and Telecom, Retail, Others |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand cyber insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand cyber insurance market on the basis of component?

- What is the breakup of the Thailand cyber insurance market on the basis of insurance type?

- What is the breakup of the Thailand cyber insurance market on the basis of organization size?

- What is the breakup of the Thailand cyber insurance market on the basis of end-use industry?

- What is the breakup of the Thailand cyber insurance market on the basis of region?

- What are the various stages in the value chain of the Thailand cyber insurance market?

- What are the key driving factors and challenges in the Thailand cyber insurance market?

- What is the structure of the Thailand cyber insurance market and who are the key players?

- What is the degree of competition in the Thailand cyber insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand cyber insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand cyber insurance market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand cyber insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)