Thailand Drones Market Size, Share, Trends and Forecast by Type, Component, Payload, Point of Sale, End-Use Industry, and Region, 2025-2033

Thailand Drones Market Overview:

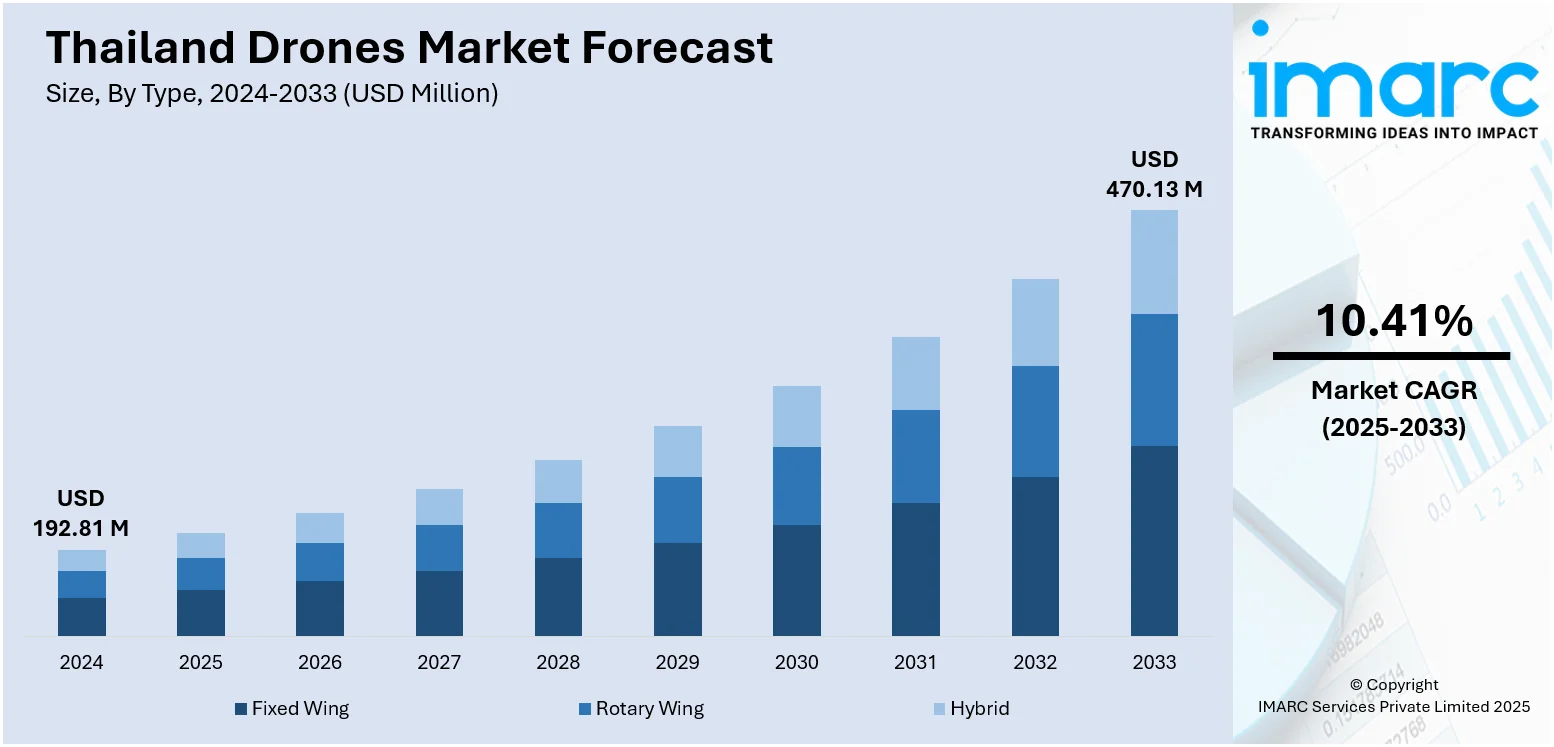

The Thailand drones market size reached USD 192.81 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 470.13 Million by 2033, exhibiting a growth rate (CAGR) of 10.41% during 2025-2033. The market is fueled by government policies, widening industry applications, and the entry of domestic service providers. Government policies promoting drone testing and regulatory streamlining have opened applications in agriculture, infrastructure inspection, and environmental monitoring. Construction and energy industries embrace drone-based surveying, asset inspection, and aerial imaging, which boost project efficiency and security. Increasing number of drone firms and startups are also providing regional services specifically suited to local topography and industry requirements, which fosters adoption and assists in bolstering Thailand drones market share across Southeast Asia.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 192.81 Million |

| Market Forecast in 2033 | USD 470.13 Million |

| Market Growth Rate 2025-2033 | 10.41% |

Thailand Drones Market Trends:

Government Support and Regulatory Progress

The drone market in Thailand is picking up pace as the government increases support to simplify regulations on unmanned aerial systems. CAAT has been working to ensure a structured framework would be developed in terms of registering and getting a "flight approval" for drones, which makes it easier for commercial and industrial operators to employ drone technology legally and efficiently. The government also appreciates the role of drones in propelling its "Thailand 4.0" vision, which focuses on digital transformation and innovation-driven development. Policies and incentives are henceforth being launched to attract startups and incumbent companies to invest in drone solutions. Special economic zones and innovation clusters near Bangkok and Eastern Economic Corridor (EEC) areas offer a supportive environment for testing and implementing drones across industries. These regions serve as test beds for aerial technology applications in logistics, infrastructure, and public safety, making Thailand an emerging regional hub for drone-driven innovation and deployment.

To get more information on this market, Request Sample

Agriculture and Environmental Monitoring

Agriculture is also one of the most significant sectors fueling the adoption of drones in Thailand. Thailand relies heavily on crops such as rice, rubber, sugarcane, and palm oil, many of which grow in massive rural and remote areas. The drones are proving vital for precision agriculture, helping with the monitoring of crop health, soil mapping, and precise pesticide spraying. Thai cooperatives and farmers are finding drone services more and more attractive as ways to reduce labor costs and enhance yield efficiency. In areas like the Central Plains and the Northern provinces, drones assist in tracking irrigation systems and in detecting at an early stage any disease or infestation caused by pests. Drones are also being utilized in reforestation activities and in tracking the well-being of natural ecosystems, especially in national parks and protected areas. These applications are consonant with Thailand's emphasis on sustainable development and ecological preservation, providing scalable solutions for agricultural productivity and ecosystem observation through real-time data and aerial monitoring, and further contribute to the Thailand drones market growth.

Industrial Use and Commercial Growth

Thailand's infrastructure development, smart city initiatives, and growing base of industries are further increasing the demand for drones. Building companies, especially in metropolitan areas such as Bangkok and Chiang Mai, are employing drones for site surveying, tracking progress, and safety inspection. Drones are also utilized in power stations, oil refineries, and warehouse logistics for monitoring equipment and thermal scanning. In the energy industry, drone technology assists utility companies to maintain power lines and monitor solar farms throughout rural areas. Furthermore, media, tourism, and event industries are increasingly using drones for aerial photography, live streaming, and promotional content. Thailand's thriving e-commerce and logistics industry, fueled by expansion in internet penetration and urbanization, is looking into drone deliveries as a futuristic solution. With these various applications picking up, more Thai startups and service providers are tailoring drone solutions to meet local requirements. This diversity of sectors continues to fuel growth and innovation in Thailand's fast-developing drone economy.

Thailand Drones Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, payload, point of sale, and end-use industry.

Type Insights:

- Fixed Wing

- Rotary Wing

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the type. This includes fixed wing, rotary wing, and hybrid.

Component Insights:

- Hardware

- Software

- Accessories

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and accessories.

Payload Insights:

- <25 Kilograms

- 25-170 Kilograms

- >170 Kilograms

A detailed breakup and analysis of the market based on the payload have also been provided in the report. This includes <25 Kilograms, 25-170 Kilograms, and >170 Kilograms.

Point of Sale Insights:

- Original Equipment Manufacturers (OEM)

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the point of sale. This includes original equipment manufacturers (OEM) and aftermarket.

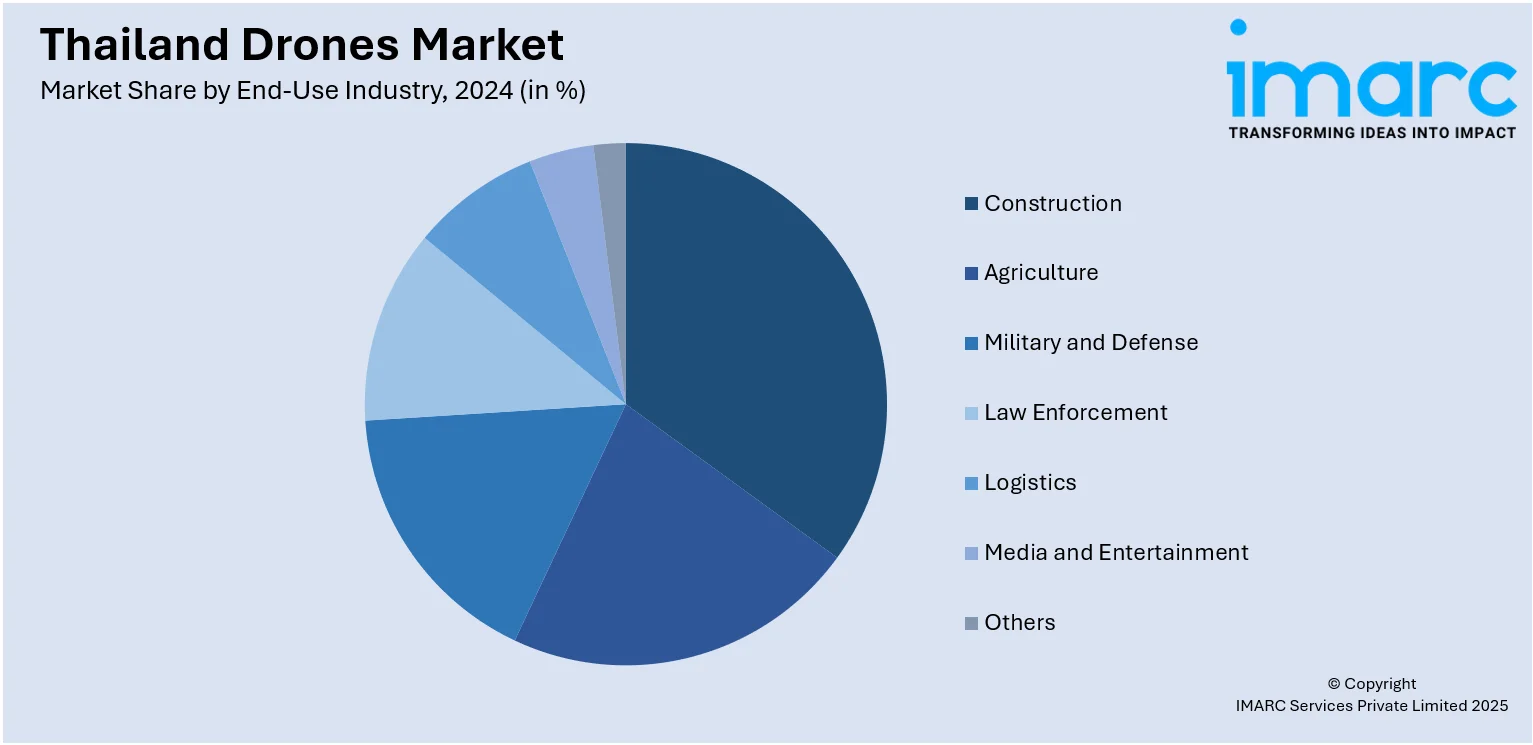

End-Use Industry Insights:

- Construction

- Agriculture

- Military and Defense

- Law Enforcement

- Logistics

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes construction, agriculture, military and defense, law enforcement, logistics, media and entertainment, and others.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which includes Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Drones Market News:

- In July 2025, AgEagle Aerial Systems Inc., a top supplier of innovative drone and aerial imaging technology, revealed the inaugural sale of its state-of-the-art eBee VISION fixed-wing drone in Thailand. This transaction was supported by local ally Sky Visual Imaging Venture (SkyVIV) and represents an important move in broadening AgEagle’s footprint throughout Southeast Asia, enhancing its status in this fast-growing market.

- 2025 signifies the seventh year of DJI Agriculture's extensive growth in Thailand. Since launching in the Thai market in 2019, more than 10,000 certified drone operators have received training, and sales of DJI Agriculture drones have surged fifty times by the end of 2024. Moving from early pilot drone projects to comprehensive intelligent agricultural solutions, DJI has enhanced Thai agriculture through technological advancements, driving agricultural modernization into a new phase. In March 2025, DJI Agriculture collaborated with Siam Kubota Corporation to introduce the Thailand Agricultural Drone Pilot Competition in the Northeast area, where innovative farming techniques are on the rise. DJI sought to speed up the use of precision agriculture tools and enhance the technical skills of operators.

Thailand Drones Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing, Rotary Wing, Hybrid |

| Components Covered | Hardware, Software, Accessories |

| Payloads Covered | <25 Kilograms, 25-170 Kilograms, >170 Kilograms |

| Points of Sales Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| End-Use Industries Covered | Construction, Agriculture, Military and Defense, Law Enforcement, Logistics, Media and Entertainment, Others |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand drones market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand drones market on the basis of type?

- What is the breakup of the Thailand drones market on the basis of component?

- What is the breakup of the Thailand drones market on the basis of payload?

- What is the breakup of the Thailand drones market on the basis of point of sale?

- What is the breakup of the Thailand drones market on the basis of end-use industry?

- What is the breakup of the Thailand drones market on the basis of region?

- What are the various stages in the value chain of the Thailand drones market?

- What are the key driving factors and challenges in the Thailand drones market?

- What is the structure of the Thailand drones market and who are the key players?

- What is the degree of competition in the Thailand drones market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand drones market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand drones market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand drones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)