Thailand Electric Two-Wheeler Market Size, Share, Trends and Forecast by Vehicle Type, Battery Type, Voltage Type, Peak Power, Battery Technology, Motor Placement, and Region, 2025-2033

Thailand Electric Two-Wheeler Market Overview:

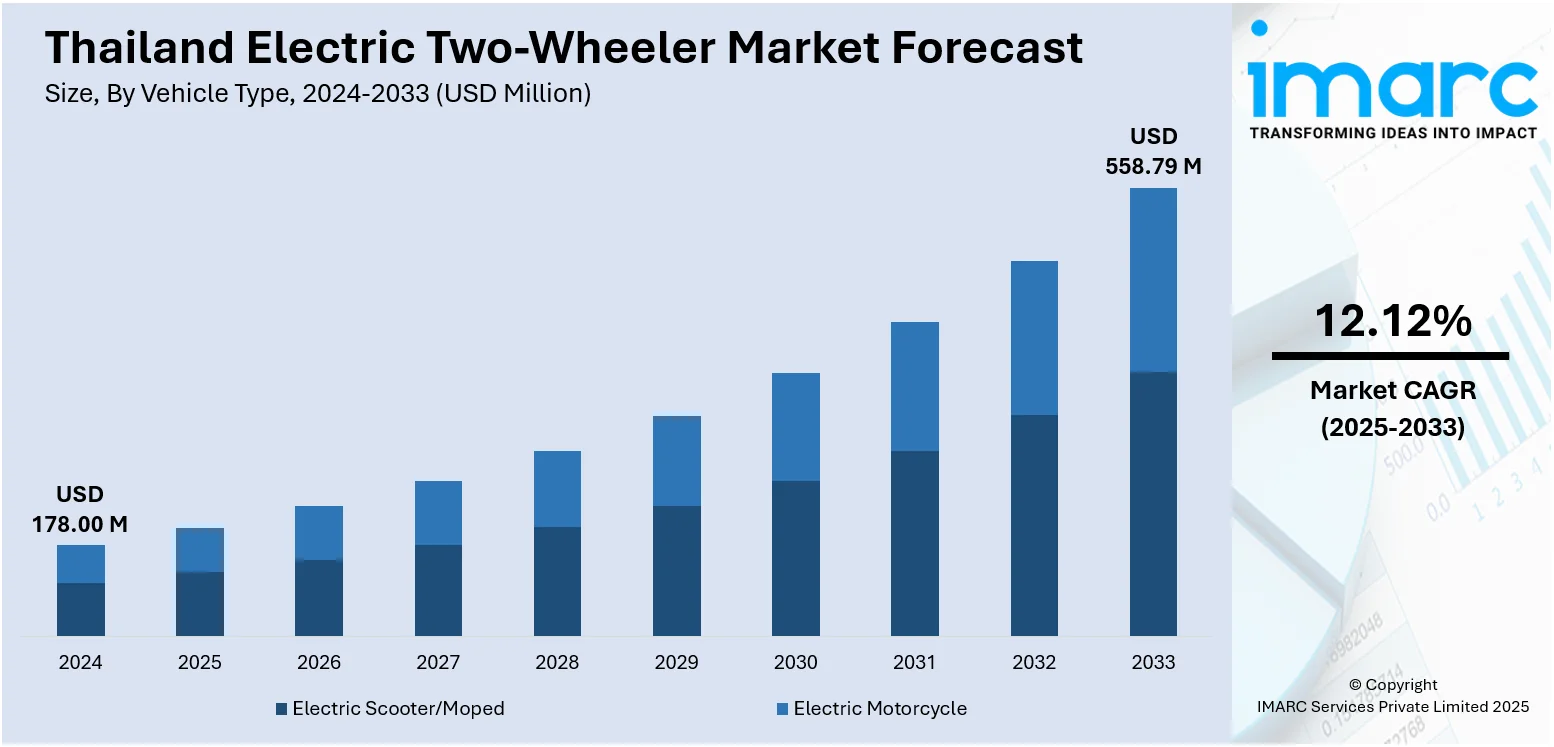

The Thailand electric two-wheeler market size reached USD 178.00 Million in 2024. The market is projected to reach USD 558.79 Million by 2033, exhibiting a growth rate (CAGR) of 12.12% during 2025-2033. The market is propelled by growing urban congestion, increasing fuel prices, and rising demand for cleaner transportation. Government subsidies and friendly policies promote manufacturers as well as consumers to adopt electric mobility. Growth in e-commerce and delivery services drives demand for low-maintenance, efficient two-wheelers. There is also growing environmental awareness among young consumers influencing preferences. In addition, developments in charging networks and battery-swapping programs make electric two-wheelers more practical and convenient for daily use, which propels their Thailand electric two-wheeler market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 178.00 Million |

| Market Forecast in 2033 | USD 558.79 Million |

| Market Growth Rate 2025-2033 | 12.12% |

Thailand Electric Two-Wheeler Market Trends:

Government Policies & Incentives

Thailand’s government plays a vital role in accelerating electric two-wheeler adoption through a range of supportive policies. These include tax breaks, reduced import duties, and incentives for local manufacturing, all designed to strengthen the domestic EV industry and reduce reliance on fossil fuels. A key example is the national “30@30” policy, which aims to produce 675,000 electric two-wheelers annually by 2030—demonstrating a strong commitment to scale and sustainability. Authorities also encourage research and investment in battery and charging technologies to boost long-term infrastructure readiness. These efforts have fostered a more attractive and stable market for manufacturers and investors, while also shaping consumer trust in electric mobility. By lowering production costs and expanding industry capacity, government backing is not only facilitating more affordable options but is also positioning Thailand as a regional leader in clean transport. This comprehensive approach is a powerful driver of Thailand electric two-wheeler market growth.

To get more information on this market, Request Sample

Environmental Awareness & Urban Mobility Needs

Increasing urbanization and worsening traffic congestion have led many Thai consumers to seek smarter, cleaner alternatives for short-distance travel. Electric two-wheelers offer a quiet, low-maintenance, and eco-friendly solution, well-suited for navigating crowded city streets. Public concern over air pollution and environmental degradation is pushing both individuals and businesses to consider greener mobility options. Younger generations, in particular, are showing a preference for sustainable transportation that aligns with their values. Delivery and ride-hailing services are also turning to electric scooters to cut operating costs and appeal to eco-conscious customers. This growing awareness of environmental responsibility, paired with practical benefits like reduced noise and fuel savings, strengthens demand. As people and companies alike prioritize sustainability and efficiency in their daily operations, the electric two-wheeler becomes an increasingly attractive option, solidifying this Thailand electric two-wheeler market trend as a key force behind market expansion.

Infrastructure Support & Battery Innovations

One of the biggest concerns among potential electric two-wheeler users is the availability of reliable charging options. To address this, Thailand is actively expanding its EV infrastructure and supporting battery innovation. The government is targeting an ambitious rollout of 12,000 fast chargers by 2030, with further expansion planned by 2035, aiming to meet growing demand and reduce range anxiety. Local authorities and private companies are also investing in battery-swapping stations and fast-charging networks to increase accessibility. These developments give users greater confidence in using electric two-wheelers for daily travel, knowing they won’t be left stranded without power. At the same time, advancements in battery technology such as longer ranges and faster charge times are improving the practicality and user experience. With more flexible and convenient charging options emerging, Thailand is steadily removing one of the key adoption barriers, boosting consumer confidence and supporting long-term growth in the electric two-wheeler market.

Thailand Electric Two-Wheeler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on vehicle type, battery type, voltage type, peak power, battery technology, and motor placement.

Vehicle Type Insights:

- Electric Scooter/Moped

- Electric Motorcycle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes electric scooter/moped and electric motorcycle.

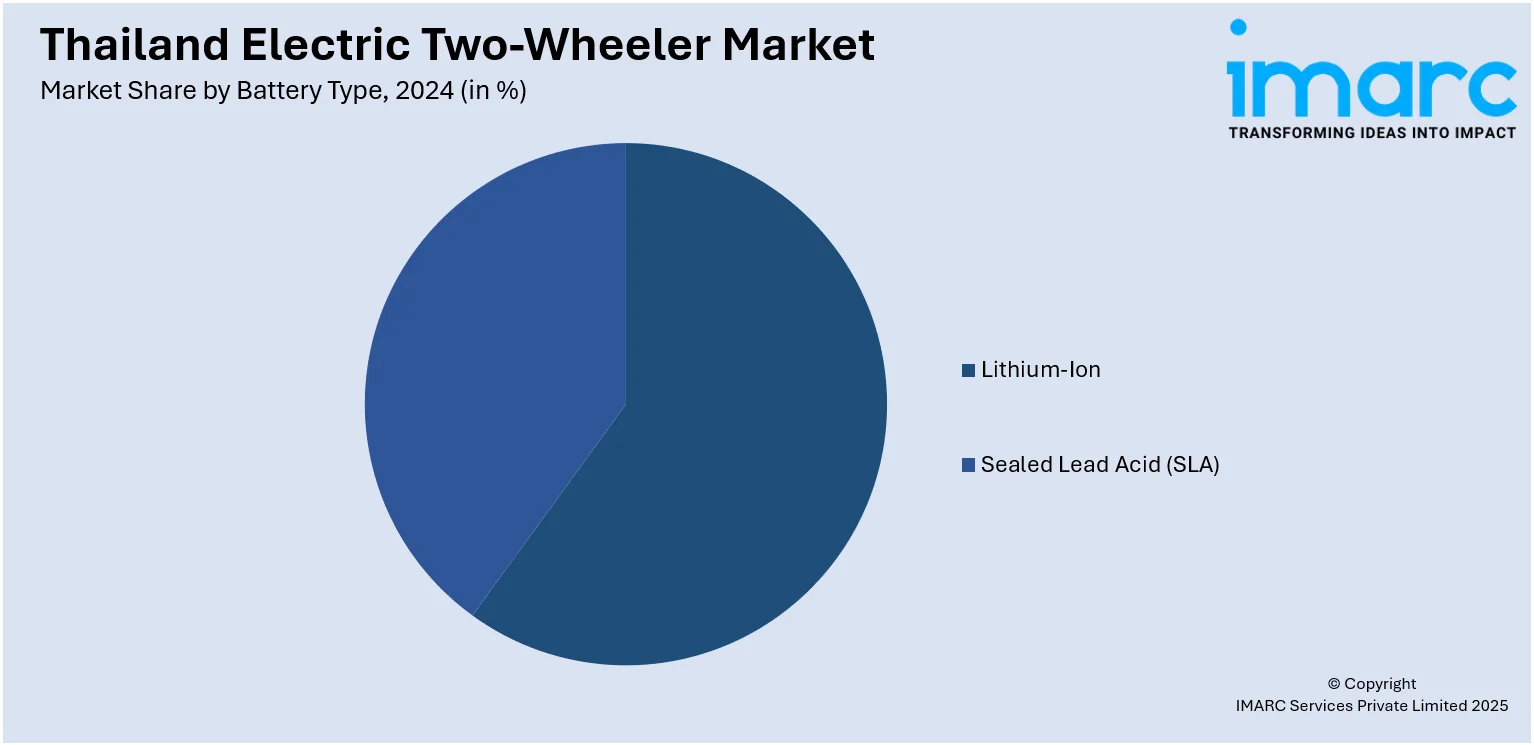

Battery Type Insights:

- Lithium-Ion

- Sealed Lead Acid (SLA)

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-ion and sealed lead acid (SLA).

Voltage Type Insights:

- <48V

- 48-60V

- 61-72V

- 73-96V

- >96V

A detailed breakup and analysis of the market based on the voltage type have also been provided in the report. This includes <48V, 48-60V, 61-72V, 73-96V, and >96V.

Peak Power Insights:

- <3 kW

- 3-6 kW

- 7-10 kW

- >10 kW

A detailed breakup and analysis of the market based on the peak power have also been provided in the report. This includes <3 kW, 3-6 kW, 7-10 kW, and >10 kW.

Battery Technology Insights:

- Removable

- Non-Removable

A detailed breakup and analysis of the market based on the battery technology have also been provided in the report. This includes removable and non-removable.

Motor Placement Insights:

- Hub Type

- Chassis Mounted

A detailed breakup and analysis of the market based on the motor placement have also been provided in the report. This includes hub type and chassis mounted.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Electric Two-Wheeler Market News:

- In June 2025, Thai electric motorcycle maker EM Motor Co., Ltd. unveiled the Legend Pro, its latest e-motorbike, combining sleek design, smart tech, and strong performance. The model features a 2,500-watt motor, 72V 24Ah lithium-ion battery, with a top speed of 75 km/h and up to 80 km range per charge. Launched in June 2025, EM Motor aims to accelerate growth and expand its presence in the electric mobility market.

- In September 2024, Yadea, a global leader in electric two-wheelers, entered the Thai market by opening three flagship stores in Pathum Thani and Chonburi. The launch introduced models like Orla, Ocean, and iCute, featuring graphene batteries and eco-friendly designs. With test rides, discounts, and gifts, the event drew high local interest. Yadea aims to support Thailand’s green mobility goals and expand its presence through further store openings nationwide.

- In March 2024, STROM (Thailand) unveiled three new electric motorcycle models at the 2024 Bangkok International Motor Show, offering up to 350 km range and starting at 38,900 baht. Models like the APE AP-400L and Panther V2 target sporty and urban riders alike. Exclusive event warranties and promotions were announced. STROM also partners with SCG to launch Thailand’s first Swap&Charge station, enhancing charging convenience and supporting Thailand’s push for greener mobility.

Thailand Electric Two-Wheeler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Electric Scooter/Moped, Electric Motorcycle |

| Battery Types Covered | Lithium-Ion, Sealed Lead Acid (SLA) |

| Voltage Types Covered | <48V, 48-60V, 61-72V, 73-96V, >96V |

| Peak Powers Covered | <3 kW, 3-6 kW, 7-10 kW, >10 kW |

| Battery Technologies Covered | Removable, Non-Removable |

| Motor Placements Covered | Hub Type, Chassis Mounted |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand electric two-wheeler market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand electric two-wheeler market on the basis of vehicle type?

- What is the breakup of the Thailand electric two-wheeler market on the basis of battery type?

- What is the breakup of the Thailand electric two-wheeler market on the basis of voltage type?

- What is the breakup of the Thailand electric two-wheeler market on the basis of peak power?

- What is the breakup of the Thailand electric two-wheeler market on the basis of battery technology?

- What is the breakup of the Thailand electric two-wheeler market on the basis of motor placement?

- What is the breakup of the Thailand electric two-wheeler market on the basis of region?

- What are the various stages in the value chain of the Thailand electric two-wheeler market?

- What are the key driving factors and challenges in the Thailand electric two-wheeler market?

- What is the structure of the Thailand electric two-wheeler market and who are the key players?

- What is the degree of competition in the Thailand electric two-wheeler market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand electric two-wheeler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand electric two-wheeler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand electric two-wheeler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)