Thailand Fintech Market Size, Share, Trends and Forecast by Deployment Mode, Technology, Application, End User, and Region, 2025-2033

Thailand Fintech Market Overview:

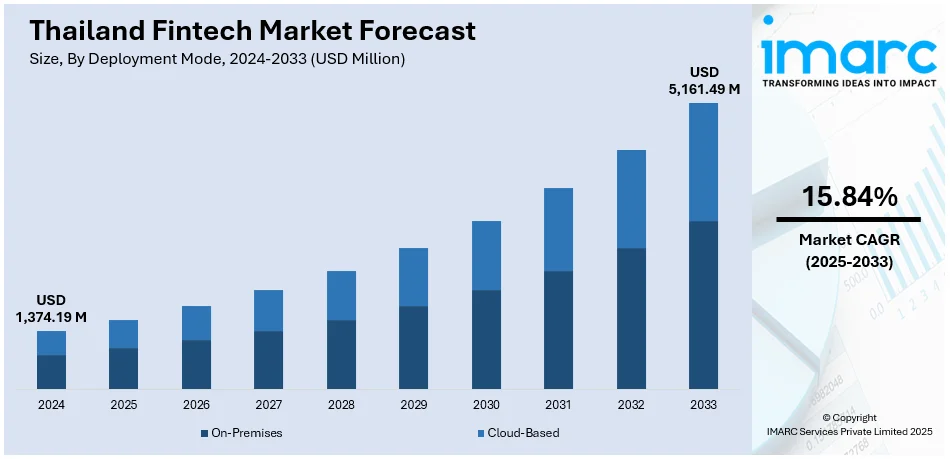

The Thailand fintech market size reached USD 1,374.19 Million in 2024. The market is projected to reach USD 5,161.49 Million by 2033, exhibiting a growth rate (CAGR) of 15.84% during 2025-2033. Thailand’s fintech sector is evolving rapidly, driven by digital payments, mobile banking, robo-advisors, blockchain, and insurtech solutions. Increasing internet and smartphone use, along with advancing digital infrastructure, is broadening financial access and enhancing user experience across the country. The rise of neobanking and digital asset services reflects shifting consumer preferences toward convenient, tech-enabled tools. Together with regulatory encouragement and technological innovation, these developments strengthen the trajectory and influence of the Thailand fintech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,374.19 Million |

| Market Forecast in 2033 | USD 5,161.49 Million |

| Market Growth Rate 2025-2033 | 15.84% |

Thailand Fintech Market Trends:

Seamless Payments & Digital Inclusion

In September 2024, Thailand officially rolled out the national digital wallet program as an initiative to drive digital payment penetration nationwide. This was a major initiative by the government to deepen financial inclusion by opening mobile and contactless payments to mainstream users. The initiative is part of a larger shift from cash to integrated digital infrastructure that provides secure, fast, and convenient financial experiences. For fintech companies, this change is an opportunity of high value to create intuitive, localised products that integrate perfectly into the way people live and make transactions. Digital identities, mobile wallets, and instant payment instruments are becoming ubiquitous, particularly in rural communities where conventional banking infrastructure was sparse. Platforms and policies supported by governments continue to push volumes while ensuring that innovation does not exclude vulnerable populations. The strategy is balanced extending access while preserving regulatory discipline and system stability. The balance is crafting a fintech sector that's inclusive, responsive, and increasingly critical to Thailand fintech market growth.

To get more information on this market, Request Sample

Innovation through Infrastructure & APIs

Thailand's fintech sector is increasingly shaped by open data platforms and regulatory systems that are intended to spur innovation in a secure manner. The Bank of Thailand has placed special emphasis on cooperation between old-school financial institutions and fintech companies, generating an environment where innovative new technology can be experimented with and tweaked. For instance, the regulatory sandbox permits fintechs to test solutions like programmable payments and biometric authentication under strict oversight. In February 2025, the central bank opened a public consultation for the "Your Data" initiative, which would provide consumers with more control over their financial information by facilitating regulated third-party access. The initiative promotes trust with user consent and data protection, while it supports fintech firms to create more customized and effective financial products. The synergy between good infrastructure, regulation, and customer-oriented approach puts Thailand in a position to provide innovative services catering to contemporary needs. Such initiatives best illustrate Thailand fintech market trends are moving towards technology, security, and consumer power.

Regulatory Foundations & Regional Expansion

Thailand's fintech industry is further sustained by regulatory developments and regional cooperation. Thailand joined Project Nexus, a multilateral project to link ASEAN member countries' fast payment systems. The project aims to make cross-border financial transfers cheaper and easier, enhancing the region's economic interlinkages. This kind of collaboration is a big step towards making Thailand a fintech center in Southeast Asia. At the same time, the Thai government is drafting a new finance business law to be submitted to the Cabinet in January 2025. According to the law, it will be easier to obtain licenses by creating a "one-stop authority" that supports fintech innovation and promotes foreign investment. These enhanced regulations create a clearer, enabling framework that lowers barriers and promotes further use of digital financial services. By putting regulatory transparency and regional integration in first place, Thailand is constructing a fintech ecosystem that is innovative, resilient, and able to expand both domestically and internationally. This foundation makes it possible to have Thailand at the center of ASEAN's digital economy in the future.

Thailand Fintech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on deployment mode, technology, application, and end user.

Deployment Mode Insights:

- On-Premises

- Cloud-Based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes application programming interface, artificial intelligence, blockchain, robotic process automation, data analytics, and others.

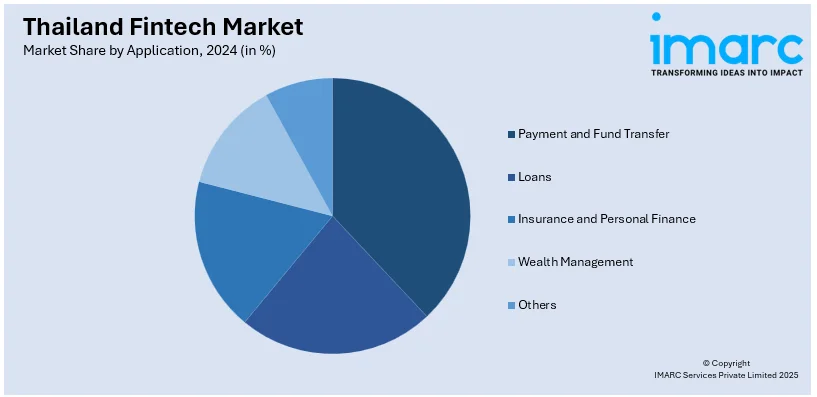

Application Insights:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes payment and fund transfer, loans, insurance and personal finance, wealth management, and others.

End User Insights:

- Banking

- Insurance

- Securities

- Others

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes banking, insurance, securities, and others.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Fintech Market News:

- May 2025: Thailand’s fintech landscape advances as KASIKORNBANK Financial Group unveils Orbix Group at Money20/20 Asia. This comprehensive digital asset ecosystem encompasses five entities: Kubix (ICO portal), Orbix Trade (exchange), Orbix Invest (fund manager), Orbix Technology (blockchain infrastructure), and Orbix Custodian (custodial wallet). Designed to serve both retail and institutional investors, Orbix Group emphasizes regulatory compliance, security, and innovation. The initiative aims to position Thailand as a regional hub for digital finance, aligning with the nation's digital transformation goals.

- July 2025: Worldpay has expanded into Thailand, offering domestic acquiring services to improve payment processing for local and international merchants. The company supports transactions in Thai baht and popular local payment methods like LINE Pay, TrueMoney, and PromptPay. Along with advanced fraud protection and dispute management, Worldpay aims to help businesses navigate Thailand’s growing digital payments landscape. This move strengthens Worldpay’s presence in the Asia Pacific region and enhances payment experiences for merchants and consumers across Thailand.

Thailand Fintech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Technologies Covered | Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, Others |

| Applications Covered | Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, Others |

| End Users Covered | Banking, Insurance, Securities, Others |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand fintech market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand fintech market on the basis of deployment mode?

- What is the breakup of the Thailand fintech market on the basis of technology?

- What is the breakup of the Thailand fintech market on the basis of application?

- What is the breakup of the Thailand fintech market on the basis of end user?

- What is the breakup of the Thailand fintech market on the basis of region?

- What are the various stages in the value chain of the Thailand fintech market?

- What are the key driving factors and challenges in the Thailand fintech market?

- What is the structure of the Thailand fintech market and who are the key players?

- What is the degree of competition in the Thailand fintech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand fintech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand fintech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand fintech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)