Thailand Foreign Exchange Market Size, Share, Trends and Forecast by Counterparty, Type, and Region, 2025-2033

Thailand Foreign Exchange Market Overview:

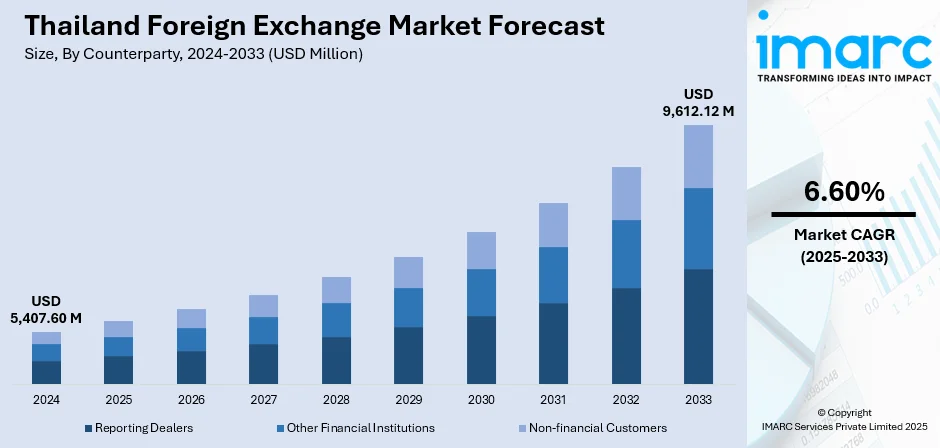

The Thailand foreign exchange market size reached USD 5,407.60 Million in 2024. The market is projected to reach USD 9,612.12 Million by 2033, exhibiting a growth rate (CAGR) of 6.60% during 2025-2033. The market is fueled by the country's expanding trade, investment flows, and increased participation from foreign institutional investors. Moreover, rising demand for tourism-related currency exchange, regional supply chain integration, and fluctuations in global commodity prices also influence trading volumes. Besides that, the Bank of Thailand's monetary policies, interest rate differentials with major economies, and active intervention strategies play a significant role in augmenting the Thailand foreign exchange market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5,407.60 Million |

| Market Forecast in 2033 | USD 9,612.12 Million |

| Market Growth Rate 2025-2033 | 6.60% |

Thailand Foreign Exchange Market Trends:

Growing Regional Trade and Investment Integration

Thailand’s increasing integration with regional economies under frameworks like the Regional Comprehensive Economic Partnership (RCEP) has strengthened its role in cross-border trade and investment. Moreover, the expansion of regional supply chains, particularly in sectors such as electronics, automotive, and agriculture, has led to higher volumes of foreign exchange transactions tied to import-export activity. In addition to this, companies frequently require currency conversion and hedging tools to manage exposures, especially with major trade partners such as China, Japan, and ASEAN countries. Also, the Thai baht plays a central role in these flows, with demand influenced by shifts in trade balances, investment positions, and the terms of payment in cross-border contracts. This has prompted domestic financial institutions to expand their foreign exchange offerings to cater to businesses involved in regional operations. The rise in cross-border infrastructure investments, such as transport corridors and energy grid, further amplifies this trend, requiring substantial capital inflows and outflows denominated in foreign currencies.

To get more information on this market, Request Sample

Digitalization and the Expansion of Electronic FX Platforms

The adoption of digital platforms and algorithmic trading systems has significantly influenced the Thailand foreign exchange market growth. Both banks and non-bank financial institutions have increasingly integrated digital solutions to offer real-time currency quotes, automated execution, and advanced analytics. This transformation has enhanced price transparency and reduced transaction costs for clients ranging from large exporters to retail investors. Apart from this, the availability of 24-hour online trading platforms further contributes to higher participation from smaller market players, particularly SMEs and individual traders. The Bank of Thailand has supported this shift through regulatory facilitation, allowing fintech providers and foreign exchange brokers to expand services under clearly defined licensing regimes. With growing confidence in digital security infrastructure, electronic trading volumes have outpaced traditional over-the-counter methods. This digitization trend is also tied to increased demand for mobile FX applications, particularly among tourists, expatriates, and overseas workers sending remittances to Thailand.

Monetary Policy Divergence and Exchange Rate Volatility

The divergence in monetary policy between Thailand and major global economies, especially the United States, the Eurozone, and Japan, has become a significant driver of exchange rate volatility in the Thai baht. The price dynamic influences the behavior of traders, investors, and corporate hedging strategies. As per industry reports, Thailand’s baht climbed to its highest level in over three years. In July 2025, the currency appreciated by 0.1% to reach 32.12 against the US dollar, its strongest performance since February 2022. Furthermore, the market responds not only to current rate settings but also to expectations shaped by central bank communications, inflation data, and geopolitical developments. As a result, Thai financial institutions and multinational corporations increasingly use forward contracts, swaps, and options to mitigate risks associated with currency fluctuations. Besides this, portfolio inflows and outflows—particularly in government bonds and equities—can also be highly sensitive to interest rate differentials, prompting rapid shifts in FX positioning. These developments underscore the baht’s sensitivity to external policy cues, making monetary divergence a persistent source of volatility and strategic importance in currency trading.

Thailand Foreign Exchange Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on counterparty and type.

Counterparty Insights:

- Reporting Dealers

- Other Financial Institutions

- Non-financial Customers

The report has provided a detailed breakup and analysis of the market based on the counterparty. This includes reporting dealers, other financial institutions, and non-financial customers.

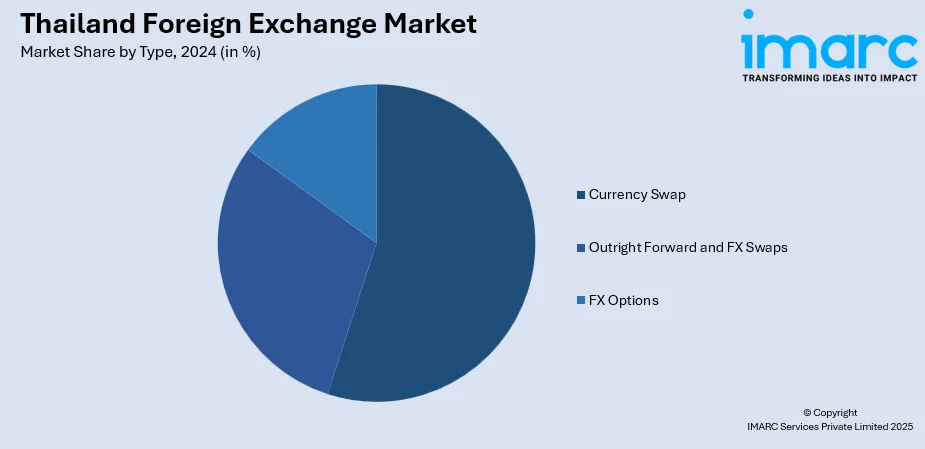

Type Insights:

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes currency swap, outright forward and FX swaps, and FX options.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Foreign Exchange Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Counterparties Covered | Reporting Dealers, Other Financial Institutions, Non-Financial Customers |

| Types Covered | Currency Swap, Outright Forward and FX Swaps, FX Options |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand foreign exchange market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand foreign exchange market on the basis of counterparty?

- What is the breakup of the Thailand foreign exchange market on the basis of type?

- What is the breakup of the Thailand foreign exchange market on the basis of region?

- What are the various stages in the value chain of the Thailand foreign exchange market?

- What are the key driving factors and challenges in the Thailand foreign exchange market?

- What is the structure of the Thailand foreign exchange market and who are the key players?

- What is the degree of competition in the Thailand foreign exchange market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand foreign exchange market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand foreign exchange market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand foreign exchange industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)