Thailand Gaming Market Size, Share, Trends and Forecast by Device Type, Platform, Revenue Type, Type, Age Group, and Region, 2025-2033

Thailand Gaming Market Overview:

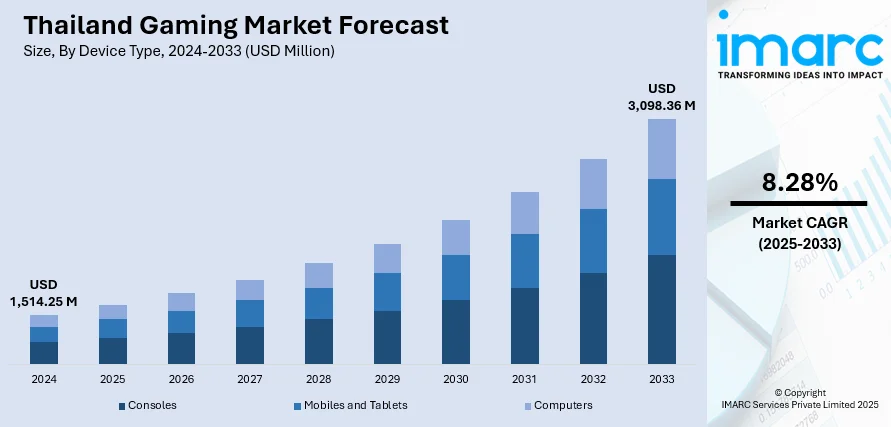

The Thailand gaming market size reached USD 1,514.25 Million in 2024. Looking forward, the market is projected to reach USD 3,098.36 Million by 2033, exhibiting a growth rate (CAGR) of 8.28% during 2025-2033. The market is driven by strong government backing, tax credits, and a flourishing creative ecosystem that supports both indie and AAA game development. Esports professionalization, official recognition, and global tournament hosting have embedded competitive gaming in national culture. Additionally, the expanding mobile gaming sector, supported by localization, strong developer presence, and cloud gaming innovation, is further augmenting the Thailand gaming market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,514.25 Million |

| Market Forecast in 2033 | USD 3,098.36 Million |

| Market Growth Rate 2025-2033 | 8.28% |

Thailand Gaming Market Trends:

Government Support and National Digital Economy Policies

Thailand’s gaming sector benefits from clear government recognition of digital entertainment as a priority industry within its national economic strategy. As per recent industry reports, Thailand has emerged as the second-largest game development hub in Southeast Asia, with 158 games on the Steam platform, accounting for 20% of the region’s total output. This growth reflects a sixfold increase since 2019, driven by strong collaboration between developers, government backing, and specialized educational programs. The Ministry of Digital Economy and Society (MDES) actively promotes game development through funding, incubation programs, and partnerships with international technology firms. The Thailand Digital Economy and Society Development Plan identifies gaming as a high-potential segment, supporting local content creation, esports expansion, and digital skills development. Initiatives such as the Thailand Game Show and the establishment of the Digital Economy Promotion Agency (DEPA) showcase institutional backing for the industry. Thailand’s gaming ecosystem further benefits from tax incentives and regulatory frameworks designed to attract foreign studios and investors. Educational partnerships between universities and gaming companies foster talent pipelines, particularly in programming, design, and animation. The government’s emphasis on exporting Thai-developed games to regional markets, especially other ASEAN countries, strengthens the commercial potential of local developers. These coordinated efforts between public, private, and academic sectors form a stable foundation for Thailand gaming market growth, ensuring that gaming remains integral to the country’s broader digital economy ambitions.

To get more information of this market, Request Sample

Growth of Mobile Gaming Across Demographic Groups

Mobile gaming dominates Thailand’s gaming landscape, supported by widespread smartphone use, affordable data plans, and growing middle-class consumer spending. As per recent industry reports, Thailand’s gaming market is projected to generate USD 2.37 Billion in revenue in 2025, with expectations of reaching USD 3.30 Billion by 2030, reflecting a CAGR of 6.81%. The sector is anticipated to serve 6.2 million users by 2030, with user penetration rising from 7.9% in 2025 to 8.7% by the end of the forecast period. Popular titles range from casual puzzle games to complex multiplayer battle arenas as well as role-playing games, thereby reflecting diverse gamer interests. Telecom providers actively collaborate with mobile game publishers to deliver tailored data packages, often bundled with promotional in-game items, driving sustained engagement. Additionally, the increasing integration of e-wallets and online payment systems has streamlined in-game purchases, strengthening monetization for free-to-play titles. Influencer-driven marketing plays a significant role, with gaming content creators on platforms such as Facebook Gaming, YouTube, and TikTok shaping game adoption trends. Mobile esports, particularly for games such as PUBG Mobile and Arena of Valor, have gained national prominence, bridging casual play and competitive scenes. Local developers, such as Thai indie studios, are increasingly creating games tailored to domestic tastes, combining Thai cultural elements with modern game mechanics. Mobile gaming’s accessibility across rural and urban populations makes it a central force in Thailand’s gaming sector, expanding its commercial footprint and reinforcing its long-term influence in the entertainment industry.

Thailand Gaming Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on device type, platform, revenue type, type, and age group.

Device Type Insights:

- Consoles

- Mobiles and Tablets

- Computers

The report has provided a detailed breakup and analysis of the market based on the device type. This includes consoles, mobiles and tablets, and computers.

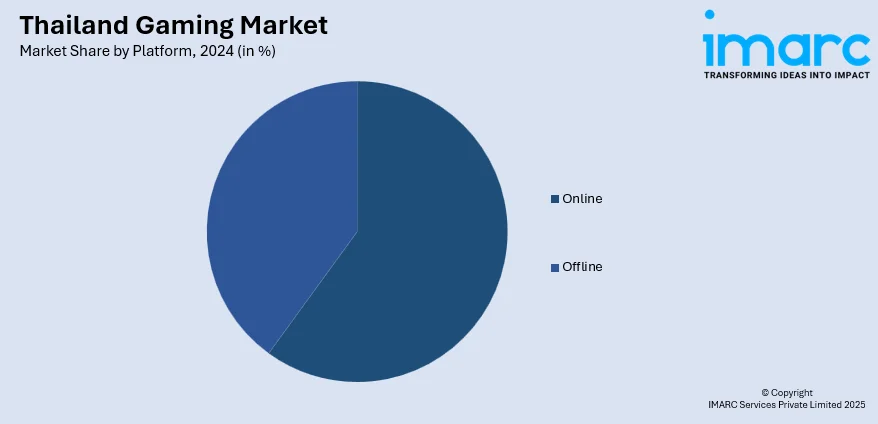

Platform Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the platform. This includes online and offline.

Revenue Type Insights:

- In-Game Purchase

- Game Purchase

- Advertising

The report has provided a detailed breakup and analysis of the market based on the revenue type. This includes in-game purchase, game purchase, and advertising.

Type Insights:

- Adventure/Role Playing Games

- Puzzles

- Social Games

- Strategy

- Stimulation

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes adventure/role playing games, puzzles, social games, strategy, stimulation, and others.

Age Group Insights:

- Adults

- Children

The report has provided a detailed breakup and analysis of the market based on the age group. This includes adults and children.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Gaming Market News:

- On June 5, 2025, FUN88 Thailand, a leading online gaming platform, launched a month-long promotional campaign celebrating its 17th anniversary with exclusive rewards and activities for its users. Running from June 2 to June 30, the event features prizes including a luxury Royal Oak watch, a 7-day trip to an English Premier League Newcastle United match, and daily rewards of up to 12,888 THB (USD 352). This promotional drive highlights the increasing consumer engagement in Thailand’s booming online gaming sector.

- On June 13, 2025, Ultimate Game Co., Ltd. announced a strategic investment exceeding 100 Million Baht (USD 2.7 Million) to expand its MMORPG mobile gaming presence across Southeast Asia. The company aims to attract over 1.25 million players during its upcoming game launches. This investment highlights Thailand’s strengthening role in Southeast Asia’s gaming industry.

Thailand Gaming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Consoles, Mobiles and Tablets, Computers |

| Platforms Covered | Online, Offline |

| Revenue Types Covered | In-Game Purchase, Game Purchase, Advertising |

| Types Covered | Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Stimulation, Others |

| Age Groups Covered | Adults, Children |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand gaming market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand gaming market on the basis of device type?

- What is the breakup of the Thailand gaming market on the basis of platform?

- What is the breakup of the Thailand gaming market on the basis of revenue type?

- What is the breakup of the Thailand gaming market on the basis of type?

- What is the breakup of the Thailand gaming market on the basis of age group?

- What is the breakup of the Thailand gaming market on the basis of region?

- What are the various stages in the value chain of the Thailand gaming market?

- What are the key driving factors and challenges in the Thailand gaming market?

- What is the structure of the Thailand gaming market and who are the key players?

- What is the degree of competition in the Thailand gaming market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand gaming market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand gaming market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand gaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)