Thailand Home Decor Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Thailand Home Decor Market Overview:

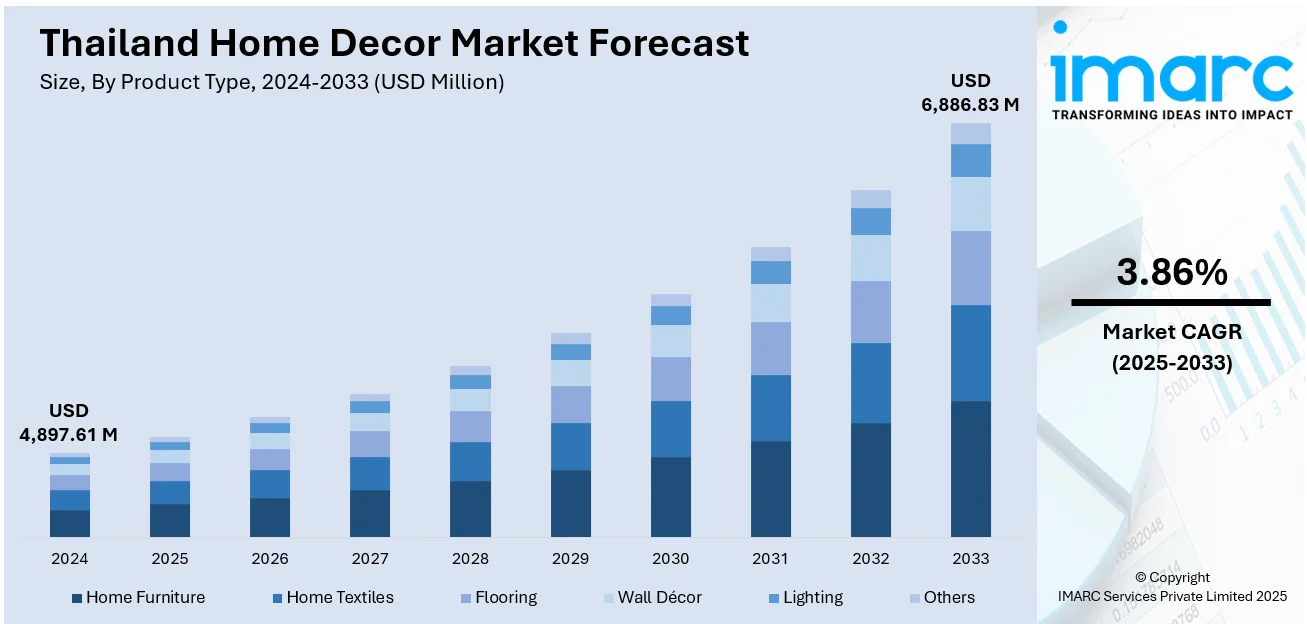

The Thailand home decor market size reached USD 4,897.61 Million in 2024. The market is projected to reach USD 6,886.83 Million by 2033, exhibiting a growth rate (CAGR) of 3.86% during 2025-2033. The market is driven be rising urbanization and higher disposable incomes, which have increased demand for stylish, functional home decor. In addition, the expansion of e‑commerce has simplified access, which, in turn, is boosting sales. Growing consumer appetite for personalised spaces and sustainable designs, along with strong import-export activities and digital marketing further accelerate the Thailand home decor market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,897.61 Million |

| Market Forecast in 2033 | USD 6,886.83 Million |

| Market Growth Rate 2025-2033 | 3.86% |

Thailand Home Decor Market Trends:

Urbanization and Functional Design

Thailand's rapid urbanisation has reshaped living environments, leading to demand for space‑efficient, multifunctional home decor. As more Thais move into apartments and condominiums, products that combine style with functionality, such as modular shelving, convertible furniture, and compact textiles, have surged in popularity. This trend aligns with the modern minimalist aesthetic described by the woodworking exhibition, reflecting a shift toward sleek, contemporary living spaces. Homeowners prioritise decor items that maximise utility without sacrificing visual appeal, encouraging manufacturers to develop tailored solutions. This evolution has propelled the Thailand home decor market growth, as demand shifts from basic furnishing to intelligent design focused on urban lifestyles driven by space constraints. For instance, LED Expo Thailand has been rebranded as the ASEAN Light + Design Expo 2025, broadening its scope beyond traditional lighting products. Scheduled for September 2025 at the IMPACT Exhibition Centre in Bangkok, the revamped event will highlight not just design, aesthetics, and smart technologies but also functional decor solutions for compact, modern urban spaces. Attendees can expect interactive installations, design-focused workshops, and cutting-edge innovations in lighting and smart home solutions.

To get more information on this market, Request Sample

Sustainability and Local Craft Revival

Environmental awareness and cultural appreciation have driven a resurgence of sustainable and traditional designs in Thailand's home decor sector. Consumers now favour eco‑friendly materials—such as reclaimed wood, bamboo, natural fibres—and support products with low environmental impact. The government-backed Thailand Creative & Design Center (TCDC) and Creative Economy initiatives have further elevated local craftsmanship, encouraging designers to blend heritage techniques with contemporary aesthetics. This fusion appeals to both environmentally conscious buyers and those seeking culturally rich home accents. Supporting local artisans through craft‑based decor such as hand‑woven textiles and woodwork enhances market diversity. This trend both preserves tradition and stimulates eco‑centric innovation, reinforcing Thailand home decor market growth. For instance, in February 2025, Index Living Mall launched the ASAHIKAWA series in Thailand, blending Mid-Century design with sustainable materials like retired rubber trees and recycled wood. Inspired by Japanese craftsmanship, the collection includes bedroom, dining, living, and workspace furniture. It combines retro aesthetics with modern functionality, appealing to design-conscious, eco-aware consumers seeking nostalgic yet practical home decor.

Thailand Home Decor Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Home Furniture

- Home Textiles

- Flooring

- Wall Decor

- Lighting

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes home furniture, home textiles, flooring, wall decor, lighting, and others.

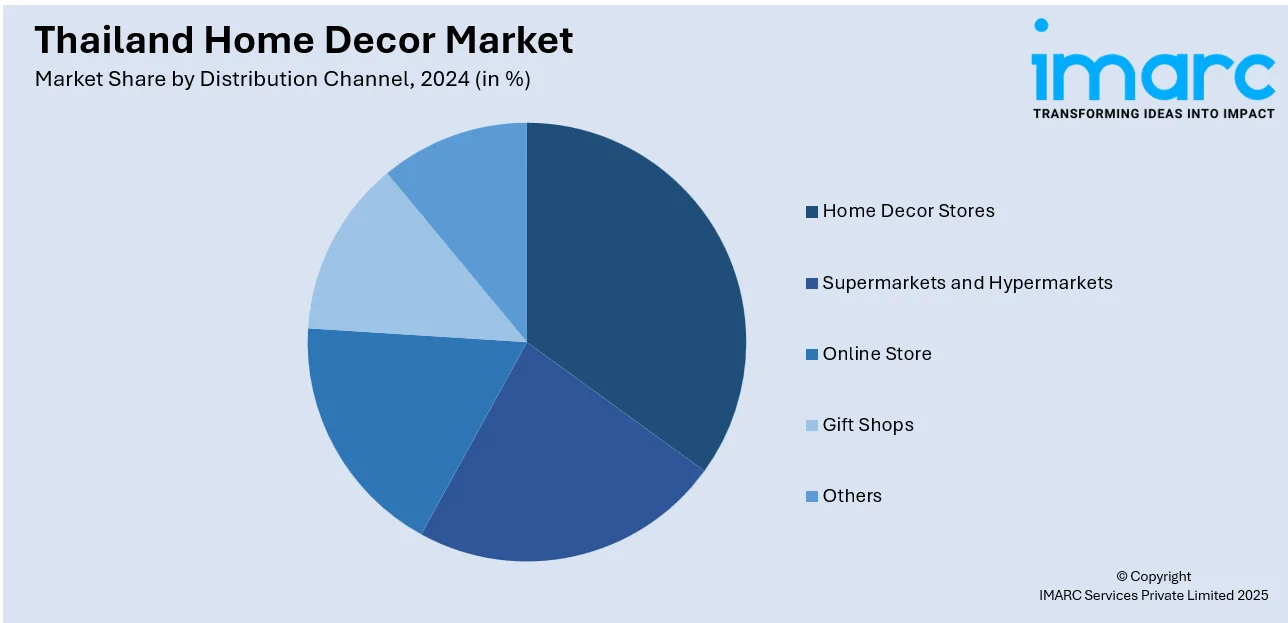

Distribution Channel Insights:

- Home Decor Stores

- Supermarkets and Hypermarkets

- Online Store

- Gift Shops

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes home decor stores, supermarkets and hypermarkets, online store, gift shops, and others.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Home Decor Market News:

- In June 2025, MR. D.I.Y. secured two major wins at the 2025 Retail Asia Awards—Specialty Store of the Year (Thailand) for the second year and Store Design of the Year for its Seacon Square flagship. With over 1,000 stores, MR. D.I.Y. emphasized affordability, innovation, and community outreach, reinforcing its leadership in Thailand’s home retail and décor market.

- In November 2024, Index Living Mall, Thailand’s top furniture and home decor retailer, officially entered the Indian market through an exclusive partnership with Creaticity in Pune. With a 32% modern retail market share in Thailand, ILM launched a 32,000 sq. ft. showroom offering furniture, décor, and home solutions.

Thailand Home Decor Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Home Furniture, Home Textiles, Flooring, Wall Decor, Lighting, Others |

| Distribution Channels Covered | Home Decor Stores, Supermarkets and Hypermarkets, Online Store, Gift Shops, Others |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand home decor market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand home decor market on the basis of product type?

- What is the breakup of the Thailand home decor market on the basis of distribution channel?

- What is the breakup of the Thailand home decor market on the basis of region?

- What are the various stages in the value chain of the Thailand home decor market?

- What are the key driving factors and challenges in the Thailand home decor market?

- What is the structure of the Thailand home decor market and who are the key players?

- What is the degree of competition in the Thailand home decor market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand home decor market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand home decor market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand home decor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)