Thailand Hot Sauce Market Size, Share, Trends and Forecast by Product Type, Application, Packaging, Distribution Channel, End Use, and Region, 2026-2034

Thailand Hot Sauce Market Summary:

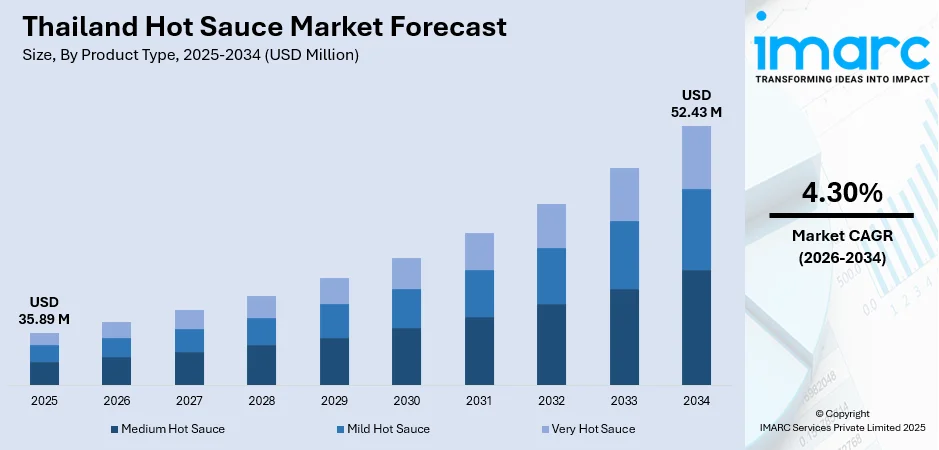

The Thailand hot sauce market size was valued at USD 35.89 Million in 2025 and is projected to reach USD 52.43 Million by 2034, growing at a compound annual growth rate of 4.30% from 2026-2034.

Thailand hot sauce market thrives on deep cultural affinity for bold, spicy flavors rooted in traditional cuisine. Driven by growing health consciousness favoring natural ingredients, expanding accessibility through modern retail formats, and rising experimentation with global flavor profiles, the market demonstrates robust momentum. Household consumption dominates alongside traditional retail channels, while bottles remain the preferred packaging format reflecting convenience and preservation requirements in tropical climates.

Key Takeaways and Insights:

- By Product Type: Medium hot sauce dominates the market with a share of 50% in 2025, driven by its versatile appeal to broad consumer demographics balancing intensity with accessibility, compatibility across diverse culinary applications from street food to home cooking.

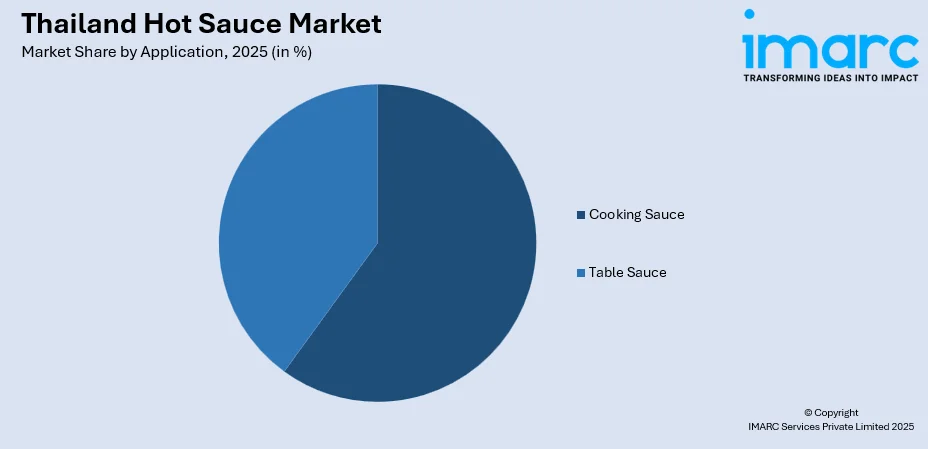

- By Application: Cooking sauce leads the market with a share of 60% in 2025, owing to Thai culinary traditions emphasizing complex flavor building during meal preparation, the cultural practice of integrating spices throughout cooking processes rather than post-service addition.

- By Packaging: Bottles represent the largest segment with a market share of 70% in 2025, driven by superior product preservation capabilities essential in Thailand's humid tropical environment.

- By Distribution Channel: Traditional grocery retailers lead the market with a share of 40% in 2025, reflecting the persistence of neighborhood shopping habits particularly outside metropolitan areas.

- By End Use: Household represents the largest segment with a market share of 85% in 2025, driven by Thailand's deeply embedded home cooking culture where families prioritize fresh meal preparation, multi-generational living arrangements.

- Key Players: The Thailand hot sauce market exhibits moderate competitive intensity, with international condiment manufacturers competing alongside established domestic producers and emerging artisanal brands across price segments, regional specialties, and heat intensity offerings.

To get more information on this market, Request Sample

Thailand's hot sauce market flourishes within culinary traditions celebrating bold, complex flavors where spiciness serves both taste and cultural functions. Capsaicin-rich products align with growing health awareness emphasizing metabolism enhancement and anti-inflammatory properties. Evolving consumer preferences favor organic formulations and clean-label products reflecting broader wellness consciousness. Digital commerce penetration expands accessibility particularly for specialty and imported varieties reaching previously underserved markets. Social media influence amplifies experimentation with extreme heat levels and novel flavor combinations among urban youth segments. In the beginning of 2024, the Internet penetration rate stood at 88%, with 68.3% of the population possessing at least one active social media profile.

Thailand Hot Sauce Market Trends:

Premiumization Through Artisanal Production Methods

The market witnesses growing consumer interest in small-batch hot sauces emphasizing traditional fermentation techniques and locally-sourced chilies. Artisanal producers highlight regional pepper varieties from Northern highlands and Southern coastal areas, creating geographical differentiation narratives appealing to authenticity-seeking consumers. Transparent production processes and direct farmer relationships resonate with educated urban demographics valuing traceability and ethical sourcing. In 2025, Exotic Food Public Company Limited marked its 25th anniversary by announcing its aim to make its Sriracha chilli sauce the top Thai sauce globally. For more than 24 years, the company has been exporting Sriracha sauce under the Flying Goose brand and has continually reached record profits.

Digital-First Brand Building and Direct Consumer Engagement

Social commerce emerges as a significant market trend with brands leveraging platforms for product launches, customer testimonials, and spice challenge content generating viral engagement. Influencer collaborations showcase recipe applications and heat tolerance demonstrations reaching younger demographics comfortable with mobile purchasing. Live-streaming sessions featuring cooking demonstrations and direct brand interaction create community connections transcending traditional retail relationships. The Tourism Authority of Thailand (TAT) revealed the launch of The MICHELIN Guide Thailand 2026, marking a pivotal year for the nation's dining landscape with new star accolades, outstanding culinary skills, and broadened sustainability acknowledgments. The 2026 edition includes 468 restaurants nationwide, confirming Thailand’s status as one of Asia’s most vibrant culinary spots.

Functional Ingredient Integration for Health-Conscious Consumers

Market innovation increasingly incorporates functional ingredients beyond traditional capsaicin benefits, including probiotics from fermentation processes supporting digestive wellness, adaptogenic herbs addressing stress management, and superfood additions like turmeric and ginger enhancing nutritional profiles. Product positioning emphasizes wellness benefits rather than solely flavor characteristics, appealing to health-conscious consumers viewing condiments as nutritional contributors. Transparent labeling communicating ingredient sourcing, processing methods, and nutritional advantages responds to educated consumer demand for substantiated health claims supporting informed purchasing decisions. In 2024, the Thai government declared the implementation of new labeling rules for pre-packaged food items that focus on enhancing information clarity for consumers while requiring the addition of manufacturer details.

Market Outlook 2026-2034:

Thailand's hot sauce market demonstrates sustained growth trajectory driven by demographic shifts favoring younger consumers embracing spicy flavors. The market generated a revenue of USD 35.89 Million in 2025 and is projected to reach a revenue of USD 52.43 Million by 2034, growing at a compound annual growth rate of 4.30% from 2026-2034. Modern retail expansion into secondary cities broadens market penetration beyond metropolitan centers. E-commerce infrastructure development overcomes geographical barriers connecting specialty producers with dispersed consumer bases. Cultural tourism exposure introduces international visitors to Thai spicy food traditions, stimulating global awareness and export demand.

Thailand Hot Sauce Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Medium Hot Sauce |

50% |

|

Application |

Cooking Sauce |

60% |

|

Packaging |

Bottles |

70% |

|

Distribution Channel |

Traditional Grocery Retailers |

40% |

|

End Use |

Household |

85% |

Product Type Insights:

- Medium Hot Sauce

- Mild Hot Sauce

- Very Hot Sauce

The Medium hot sauce dominates with a market share of 50% of the total Thailand hot sauce market in 2025.

Medium hot sauce dominates the segment, reflecting broad consumer appeal balancing noticeable heat intensity with accessibility for varied tolerance levels across demographic groups. This positioning serves diverse applications from family meal preparation requiring moderated spice levels to street food vendors seeking universally acceptable heat profiles.

The segment benefits from psychological comfort consumers experience with familiar intensity levels minimizing purchase risk while delivering authentic Thai flavor enhancement. Medium formulations accommodate gradual heat tolerance building among younger consumers and international residents adapting to Thai cuisine's spice characteristics. The rise in popularity of Thai cuisine is also driving the need for medium hot sauces among the masses. In 2024, the Department of International Trade Promotion (DITP) was advocating for Thai cuisine overseas as a component of the government's 'soft power' strategy under a new theme, “Travel, Taste, Eat Thai SELECT.” The program motivates Thai eateries to obtain the Thai SELECT emblem, to strengthen the genuineness of Thai food.

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Cooking Sauce

- Table Sauce

Cooking sauce leads with a share of 60% of the total Thailand hot sauce market in 2025.

Cooking sauce leads the market driven by Thai culinary traditions emphasizing flavor integration during meal preparation rather than table-side seasoning. Home cooks incorporate hot sauce into stir-fries, curry pastes, marinades, and soup bases building complex flavor foundations throughout cooking processes. Cooking sauces are also becoming easily available through various retail and e-commerce channels, encouraging more people to purchase them.

The cultural practice of preparing fresh meals daily rather than relying on processed foods sustains demand for versatile cooking condiments enabling authentic taste recreation across diverse regional dishes from Northern khao soi to Southern Kaeng tai pla. In 2025, The Thai government has initiated the "One Village, One Thai Food Chef" program to teach culinary skills to individuals from more than 75,000 villages nationwide, allowing them to become professional chefs and earn extra income.

Packaging Insights:

- Jars

- Bottles

- Others

Bottles exhibit a clear dominance with a 70% share of the total Thailand hot sauce market in 2025.

Bottles command approximately seventy percent dominance owing to functional advantages in tropical environments requiring airtight sealing preventing oxidation and contamination. Glass and rigid plastic formats enable visual product inspection confirming quality and freshness before purchase, particularly important for premium segments emphasizing natural ingredients without artificial preservatives. Controlled dispensing through narrow openings facilitates precision in Thai cooking requiring careful heat calibration avoiding overpowering delicate flavor balances essential to authentic preparations.

Packaging in bottles protects flavor by limiting exposure to air, especially if combined with tight-seal caps. It is easier to reseal, allowing sauces to remain usable longer, even in the busiest of kitchens. Transparent bottles allow shoppers to see texture and color, thus building trust. Brands gain extra room for nutritional information and stories that do not fit well on small pouches. Apart from this, sturdier bottles save accidental spills when cooking in a hurry.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Traditional Grocery Retailers

- Online Stores

- Others

Traditional grocery retailers dominate the market with a 40% share of the total Thailand hot sauce market in 2025.

Traditional grocery retailers capture approximately forty percent market share sustained by neighborhood accessibility particularly in residential areas outside central business districts. Local grocers maintain personal relationships with regular customers providing product recommendations and accommodating specific heat preferences through direct conversation. These channels remain particularly relevant in provincial cities and rural areas where modern retail penetration remains limited despite ongoing expansion efforts.

Traditional markets offer immediate availability without requiring transportation to distant hypermarket locations. In 2025, Asset World Corp Public Company Limited (AWC), Thailand’s foremost integrated lifestyle real estate company, and Big C Supercenter Public Company Limited (Big C), unveiled the grand opening of “Big C at Phenix.” This pioneering hypermarket spans over 3,000 square meters within the Phenix, strategically situated in Pratunam, marking a significant progression in retail and gastronomic experiences in central Bangkok. Branding itself as a “Foods Destination For All,” Big C at Phenix delivers a cohesive experience that combines retail, tourism, and culinary aspects, serving both B2C and B2B clientele.

End Use Insights:

- Commercial

- Household

Household represents a clear dominance with a 85% share of the total Thailand hot sauce market in 2025.

Household consumption overwhelmingly dominates at approximately eighty-five percent share reflecting Thailand's persistent home cooking culture where families prioritize fresh meal preparation using quality ingredients. Multi-generational households maintain traditional cooking knowledge transfer with elders teaching younger members authentic preparation techniques requiring appropriate condiment selection.

The social importance of sharing home-cooked meals as expressions of care and cultural identity sustains demand for cooking ingredients enabling authentic flavor recreation. Growing health awareness encourages home preparation over restaurant dining providing greater control over ingredient quality and nutritional profiles. In 2025, KFC Thailand, took a unique initiative this Mother’s Day with the release of its new advertisement, "Mom-Approved Price." The ad pays tribute to Thai mothers who enjoy seeking out deals. They also gave out free Jumbo Chilli Sauce packets.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

Bangkok promotes hot sauce consumption through concentrated metropolitan population driving the need for flavorful condiments. Higher disposable incomes enable premium product experimentation and imported specialty varieties unavailable in provincial markets. Cosmopolitan exposure through international residents and expatriate communities stimulates diverse applications beyond traditional Thai preparations. Superior retail infrastructure spanning modern hypermarkets, specialty gourmet stores, and traditional wet markets provides comprehensive accessibility.

Eastern Thailand's hot sauce market benefits from industrial corridor development concentrating middle-class populations around manufacturing hubs in Chonburi and Rayong provinces. Coastal tourism destinations including Pattaya drive foodservice demand through restaurant and hotel channels serving international visitors seeking authentic Thai spice experiences. Proximity to Bangkok enables efficient distribution logistics reducing supply chain costs and improving product freshness.

Northeastern Thailand exhibits distinctive hot sauce consumption patterns rooted in Isaan culinary traditions emphasizing fermented flavors and intense heat levels. Regional preference for pla ra-based sauces and locally-sourced chili varieties creates opportunities for authentic specialty producers. Lower average household incomes drive price sensitivity favoring value-oriented mainstream brands over premium offerings.

Southern Thailand's hot sauce market reflects Muslim cultural influences and abundant seafood consumption requiring complementary condiment profiles. Coastal geography emphasizes hot sauces pairing with fish and shellfish preparations incorporating coconut milk, turmeric, and lemongrass flavoring traditions. Tourism concentration in Phuket, Krabi, and Samui islands generates significant foodservice demand through resort restaurants and street food vendors.

Northern Thailand's hot sauce consumption reflects Lanna culinary heritage emphasizing milder heat profiles balanced with complex flavor layering. Mountain geography and cooler climate historically limited chili cultivation reducing traditional spice intensity compared to other regions. Chiang Mai and Chiang Rai urban centers demonstrate growing modern retail penetration and cosmopolitan food culture driving premium product adoption.

Others regional markets including border provinces and rural districts demonstrate hot sauce consumption patterns characterized by price sensitivity, traditional retail dominance, and preference for familiar local brands. Distribution infrastructure limitations reduce modern product accessibility requiring manufacturers to rely on traditional wholesale networks and local grocers. Lower population densities generate smaller aggregate demand volumes discouraging premium brand market entry.

Market Dynamics:

Growth Drivers:

Why is the Thailand Hot Sauce Market Growing?

Rising Health Consciousness Driving Clean-Label and Organic Product Demand

Consumer awareness regarding functional food benefits propels interest in hot sauces featuring natural ingredients without artificial preservatives, synthetic flavors, or chemical additives commonly found in mass-market offerings. Capsaicin recognition for metabolism enhancement, cardiovascular benefits, and anti-inflammatory properties positions hot sauce as functional condiment rather than mere flavor enhancer. Organic certification and non-GMO verification are becoming important differentiators in premium segments where consumers willingly pay significant price premiums. In 2025, The Organic Trade Association (OTA) participated in Thaifex in Bangkok, Thailand. The OTA exhibit displayed a range of USDA organic items from seven U.S. firms.

Expanding Modern Retail Infrastructure Improving Product Accessibility

Hypermarket and supermarket proliferation beyond Bangkok into provincial capitals dramatically improves hot sauce accessibility for middle-class households previously reliant on limited traditional market selections. Modern retail formats offer superior product variety spanning domestic brands, imported international varieties, and premium artisanal options under controlled environmental conditions preventing quality degradation in tropical heat. This is encouraging more brands to come up with various hot sauce flavored food products. In 2025, Calbee Thailand launched its newest spicy creation, Jaxx Habanero Chili Sauce Potato Chips. With a tasty dip by your side, these chips let you adjust the spiciness, crafting a tailored spicy snacking adventure.

Digital Commerce Penetration Connecting Specialty Producers with Distributed Consumer Base

E-commerce platform growth transforms market dynamics by enabling small artisanal producers to reach national audiences without requiring extensive distribution network investments prohibitively expensive for emerging brands. Online marketplaces reduce geographical barriers connecting Northern chili farmers producing limited-batch fermented sauces with Bangkok gourmets seeking authentic regional specialties unavailable through conventional retail channels. The Thai e-Commerce Association (THECA) states that Thailand's e-commerce industry is expanding swiftly, fueled by an increasing number of Thai vendors on digital platforms and the heightened prevalence of online shopping in everyday life. Currently, over 16 million Thais are engaged as online shoppers, with more than 300 million products available across e-commerce platforms throughout the country.

Market Restraints:

What Challenges the Thailand Hot Sauce Market is Facing?

Heat Intensity Perception Creating Purchase Barriers for Mainstream Consumers

Consumer concerns regarding excessive spiciness levels deter trial among conservative demographics, families with young children, and elderly populations with reduced heat tolerance capabilities. Psychological associations between hot sauce and potential digestive discomfort create purchase hesitation particularly among consumers with sensitive stomachs or existing gastrointestinal conditions.

Limited Product Differentiation in Mass-Market Segment Intensifying Price Competition

Commodity-style positioning of mainstream hot sauce brands creates difficulty establishing meaningful differentiation beyond price considerations driving margin compression across the sector. Large-scale manufacturers leverage production efficiencies and distribution networks enabling aggressive pricing that smaller producers cannot match. Generic private-label products from major retailers undercut branded offerings further pressuring pricing structures.

Seasonal Consumption Fluctuations Impacting Demand Consistency

Weather-related consumption patterns create revenue volatility with reduced hot sauce usage during Thailand's hot season when consumers naturally gravitate toward cooling foods and beverages. Festival periods and holiday seasons generate temporary demand spikes followed by purchasing lulls affecting inventory management and production planning.

Competitive Landscape:

Thailand's hot sauce market features diverse competitive dynamics spanning multinational condiment corporations, established domestic manufacturers, regional specialty producers, and emerging artisanal brands competing across price tiers and distribution channels. International players leverage global brand recognition, extensive distribution networks, and marketing sophistication establishing premium positioning through heritage storytelling and quality consistency messaging. Domestic manufacturers dominate mainstream segments through deep understanding of local taste preferences, established relationships with traditional retail channels, and cost structures enabling competitive pricing for price-sensitive consumers. Regional producers emphasize geographical authenticity sourcing local chili varieties and employing traditional preparation methods appealing to consumers valuing cultural heritage and regional specialization.

Recent Developments:

- In March 2025, KFC Thailand has partnered with Buldak to launch the intense Buldak Dunk Wings, featuring an unmatched degree of heat. These crunchy wings are soaked in Buldak’s distinctive sauce, ensuring a powerful heat that reaches deep into the bone.

Thailand Hot Sauce Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Medium Hot Sauce, Mild Hot Sauce, Very Hot Sauce |

| Applications Covered | Cooking Sauce, Table Sauce |

| Packagings Covered | Jars, Bottles, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Traditional Grocery Retailers, Online Stores, Others |

| End Uses Covered | Commercial, Household |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Thailand hot sauce market size was valued at USD 35.89 Million in 2025.

The Thailand hot sauce market is expected to grow at a compound annual growth rate of 4.30% from 2026-2034 to reach USD 52.43 Million by 2034.

Medium hot sauce dominated the product type segment capturing approximately 50% of market share due to its balanced heat intensity appealing to broad consumer demographics, versatile application across diverse culinary preparations from home cooking to street food vendors, and psychological comfort enabling confident purchases among consumers with varying heat tolerance levels.

Key factors driving the Thailand hot sauce market include rising health consciousness among consumers favoring natural ingredients and clean-label products with functional benefits, expanding modern retail infrastructure improving product accessibility across metropolitan and provincial markets through hypermarkets and specialty food sections, and digital commerce penetration enabling subscription services and social commerce engagement transforming purchasing behaviors particularly among younger urban demographics.

Major challenges include heat intensity perception creating purchase barriers, limited product differentiation in mass-market segments, and seasonal consumption fluctuations affecting demand consistency during hot weather periods and agricultural cycles influencing chili pepper availability creating raw material cost volatility impacting profit margins.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)