Thailand Insurtech Market Size, Share, Trends and Forecast by Type, Service, Technology, and Region, 2025-2033

Thailand Insurtech Market Overview:

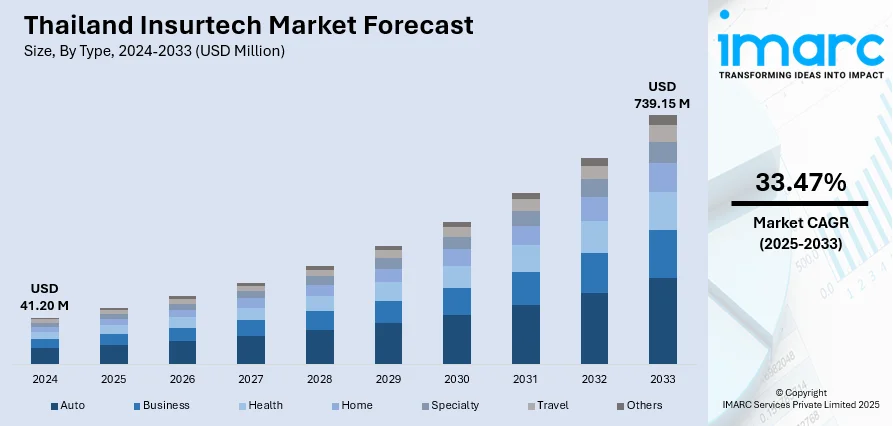

The Thailand Insurtech market size reached USD 41.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 739.15 Million by 2033, exhibiting a growth rate (CAGR) of 33.47% during 2025-2033. Partnerships with digital platforms and the adoption of embedded insurance are driving Insurtech market by expanding access, improving convenience, and reducing operational costs. These approaches simplify distribution, enable personalized offerings, and support inclusion across digital and physical channels, particularly for underserved and first-time insurance users, influencing the Thailand Insurtech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 41.20 Million |

| Market Forecast in 2033 | USD 739.15 Million |

| Market Growth Rate 2025-2033 | 33.47% |

Thailand Insurtech Market Trends:

Partnerships with E-commerce and Fintech Platforms

Insurtech firms in Thailand are progressively partnering with non-insurance digital platforms, such as payment apps, ride-hailing services, and e-commerce marketplaces, to offer micro-insurance and embedded coverage. These collaborations provide strategic entry to extensive, already engaged user groups without having to create separate distribution systems, which would require significant resources and time. Integrating insurance products directly into platforms where individuals are already engaging, such as during online checkouts or digital loan applications, enhances conversion rates through convenience and contextual significance. The e-commerce market in Thailand, as reported by IMARC Group, attained a value of USD 107.20 Billion in 2024, establishing it as a significant channel for offering affordable, high-volume insurance products. These integrated options attract individuals who are making digital purchases and might not normally look for insurance. The backend technical integration facilitates more seamless onboarding, quicker identity verification, and automated claims processing via shared data systems. This lessens friction in the user experience and lowers administrative expenses for providers. Additionally, these integrations facilitate more personalized offerings tailored to user behavior and purchase history, enhancing product significance and adoption. These collaborations across sectors enable insurers to quickly broaden their reach, enhance operational efficiency, and adapt to evolving user demands in Thailand’s rapidly expanding digital economy.

To get more information on this market, Request Sample

Strategic Integration of Embedded Insurance

The rising adoption of embedded insurance via strategic collaborations between traditional service providers and Insurtech firms is a critical factor impelling the Thailand Insurtech market growth. These partnerships enable the smooth integration of insurance offerings into existing user interactions on both digital and physical platforms, thus improving convenience and accessibility for users. By integrating insurance products into commonly used services, such as postal services, e-commerce sites, and ride-hailing apps, insurers can effectively broaden their audience while reducing entry obstacles. This method allows for the provision of insurance solutions to a wider audience, encompassing underserved rural communities, by integrating digital technologies with conventional distribution methods. Additionally, the integration fosters enhanced operational efficiency by utilizing data sharing and automation in underwriting, policy issuance, and claims processing, subsequently lowering costs and improving the overall user experience. The embedded insurance model significantly contributes to speeding up insurance adoption rates by tackling conventional issues like restricted access and complicated buying processes. As a result, this distribution strategy serves as a crucial growth factor, fostering innovation and broadening market reach in Thailand. In December 2024, Thailand Post partnered with Insurtech bolttech to launch an embedded online motor insurance service backed by ERGO Insurance (Thailand). The initiative enabled clients across Thailand, including in six pilot provinces, to conveniently buy and receive compulsory motor insurance via digital and postal channels.

Thailand Insurtech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, service, and technology.

Type Insights:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes auto, business, health, home, specialty, travel, and others.

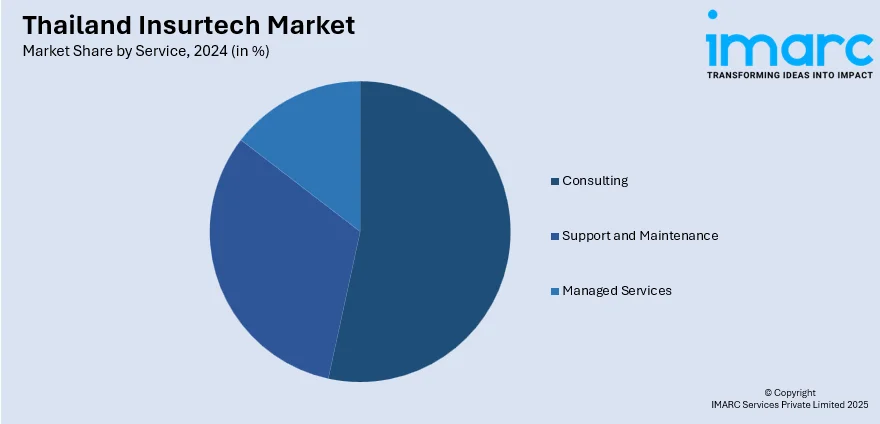

Service Insights:

- Consulting

- Support and Maintenance

- Managed Services

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes consulting, support and maintenance, and managed services.

Technology Insights:

- Block Chain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes block chain, cloud computing, IoT, machine learning, robo advisory, and others.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Insurtech Market News:

- In April 2025, Singapore-based Insurtech Igloo and Thailand’s JMT Network Services (part of Jaymart Group) formed a joint venture to launch Thailand’s first fully digital insurer. The partnership combines Jaymart’s broad user reach with Igloo’s insurance technology to deliver embedded, AI-powered insurance products. This move aims to transform Thailand’s insurance landscape and support digital financial inclusion.

- In March 2025, tigerlab partnered with Innova Insurtech to power Thai Setakij Insurance (TSI) with its i2go platform, enabling embedded insurance on THAITICKETMAJOR’s platform in Thailand. The collaboration enhances user experience, automates underwriting, and expands digital insurance distribution. This marks a major step in streamlining non-life insurance delivery via embedded tech.

Thailand Insurtech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Auto, Business, Health, Home, Specialty, Travel, Others |

| Services Covered | Consulting, Support and Maintenance, Managed Services |

| Technologies Covered | Block Chain, Cloud Computing, IoT, Machine Learning, Robo Advisory, Others |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand Insurtech market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand Insurtech market on the basis of type?

- What is the breakup of the Thailand Insurtech market on the basis of service?

- What is the breakup of the Thailand Insurtech market on the basis of technology?

- What is the breakup of the Thailand Insurtech market on the basis of region?

- What are the various stages in the value chain of the Thailand Insurtech market?

- What are the key driving factors and challenges in the Thailand Insurtech market?

- What is the structure of the Thailand Insurtech market and who are the key players?

- What is the degree of competition in the Thailand Insurtech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand Insurtech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand Insurtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand Insurtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)