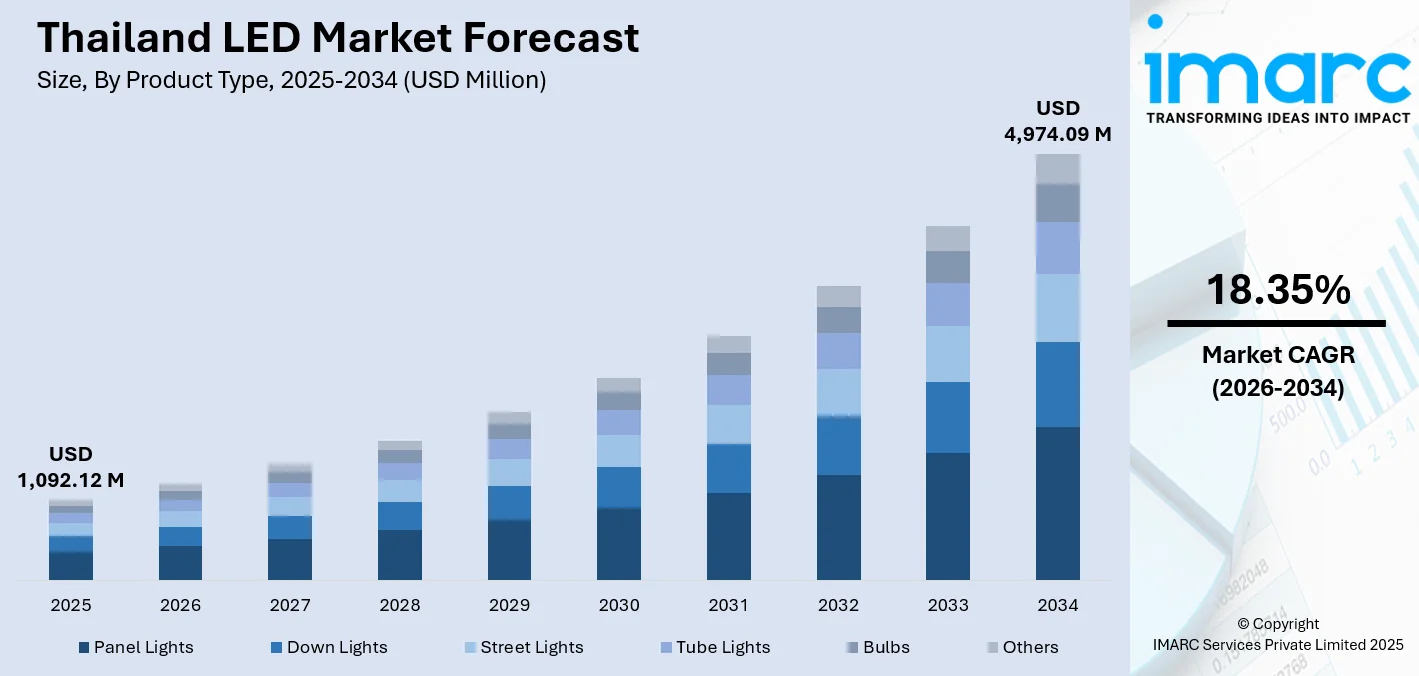

Thailand LED Market Size, Share, Trends and Forecast by Product Type, Application, Installation Type, and Region, 2026-2034

Thailand LED Market Summary:

The Thailand LED market size was valued at USD 1,092.12 Million in 2025 and is projected to reach USD 4,974.09 Million by 2034, growing at a compound annual growth rate of 18.35% from 2026-2034.

The Thailand LED market is experiencing robust growth driven by the nation's accelerating transition toward energy-efficient lighting solutions and smart city development initiatives. The growing environmental consciousness, supportive government policies, and rising electricity costs are accelerating widespread adoption across commercial, residential, and industrial sectors. The convergence of urbanization trends, infrastructure modernization programs, and increasing consumer preference for sustainable lighting technologies is fundamentally reshaping the competitive landscape. These dynamics are creating substantial opportunities for market participants to expand their presence.

Key Takeaways and Insights:

- By Product Type: Panel lights dominate the market with a share of 26% in 2025, driven by their widespread adoption in commercial and office spaces where uniform illumination, sleek design aesthetics, and superior energy efficiency are paramount considerations for facility managers.

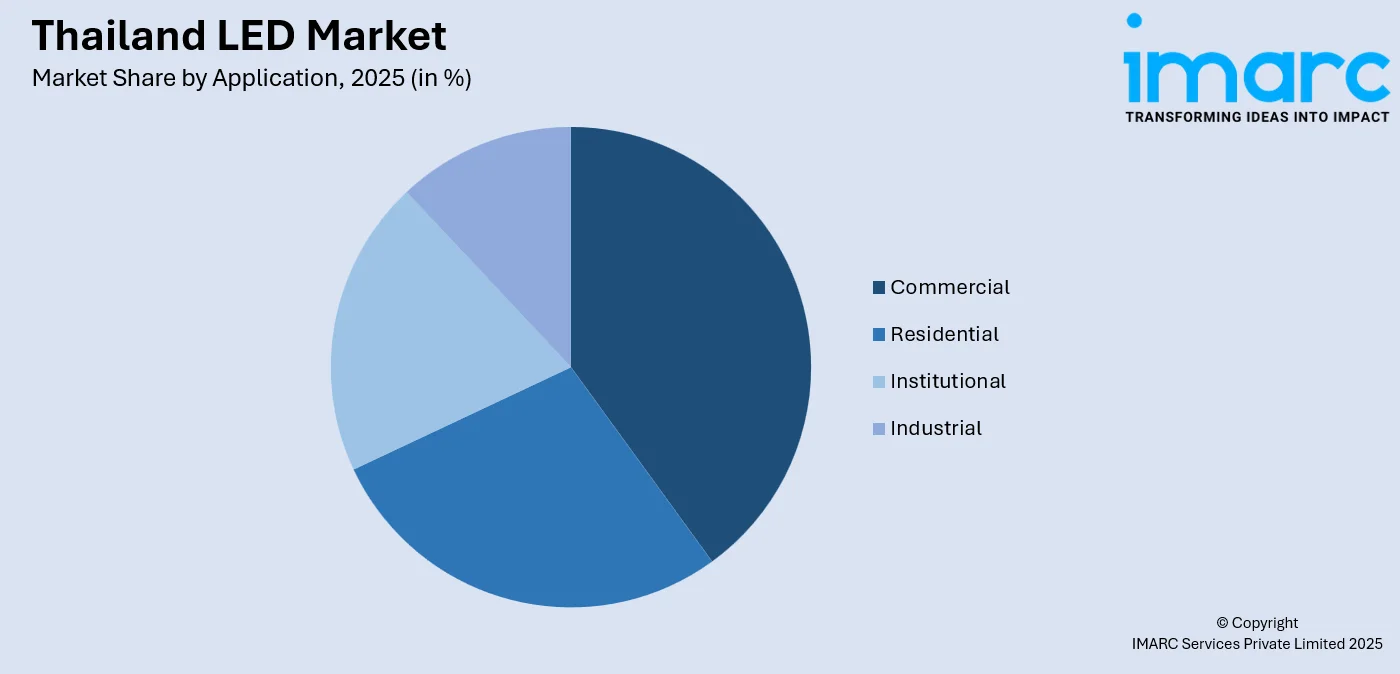

- By Application: Commercial leads the market with a share of 35% in 2025. This dominance is because of Thailand's expanding retail infrastructure, hospitality sector recovery, and corporate office developments requiring modern lighting solutions.

- By Installation Type: New installation represents the largest segment with a market share of 62% in 2025, reflecting the robust construction activity and infrastructure development projects across Thailand's commercial and residential sectors.

- By Region: Northeastern Thailand dominate the market with a share of 18% in 2025, supported by the growing urbanization, agricultural infrastructure modernization, and government initiatives to develop the Isan region.

- Key Players: The Thailand LED market exhibits moderate competitive intensity, with multinational lighting corporations competing alongside regional manufacturers across diverse price segments and distribution channels. Strategic focus areas include smart lighting integration, energy efficiency improvements, and expanding distribution networks.

To get more information on this market Request Sample

The Thailand LED lighting market is positioned for transformative growth as the nation accelerates its commitment to sustainable urban development and energy conservation. Driven by rising electricity costs, government-led energy efficiency programs, and increasing environmental awareness, LED adoption is expanding across residential, commercial, and industrial sectors. Public infrastructure initiatives, such as smart city projects, street lighting upgrades, and mass transit developments, are further catalyzing the demand for advanced lighting solutions, supported by favorable policy measures. Notably, in 2025, Thailand approved a targeted tax incentive offering an additional 50% income tax deduction on investments in energy-efficient machinery, equipment, and materials through December 31, 2028, strengthening the financial case for LED adoption. Alongside these measures, rapid urbanization, robust construction activity, and the modernization of retail and hospitality spaces continue to support the market growth. Technological advancements, including smart lighting systems, Internet of Things (IoT) integration, and extended product lifespans, are enhancing value propositions for end users, positioning LEDs as a cornerstone of Thailand’s low-carbon and energy-efficient future.

Thailand LED Market Trends:

Expansion of Street Lighting and Public Safety Projects

Government and municipal investment in street lighting upgrades is driving the LED adoption across Thailand. LEDs provide stronger illumination, improved color rendering, and higher visibility, supporting road safety and public security while reducing maintenance requirements. This shift is evident in Pattaya City’s 2025 initiative, which replaced 4,000 high-pressure sodium lamps with 110-watt LED streetlights to improve nighttime safety and lower energy consumption. Executed in four phases over six months, the project reflects broader efforts by cities to modernize outdoor lighting networks. Alongside the growing use of solar-powered LED systems in semi-urban and remote areas, sustained focus on infrastructure reliability and public safety is catalyzing the demand for outdoor LED lighting nationwide.

Rapid Infrastructure Development

Smart city expansion and large infrastructure developments are significantly driving the demand for modern lighting solutions across Thailand. LEDs are widely adopted due to lower energy use, long operating life, and minimal maintenance needs, making them suitable for high-density urban environments. This trend is reinforced by national initiatives, with the Ministry of Digital Economy and Society reporting in 2025 that 37 smart cities had already been certified, as part of a plan to develop 105 smart cities by 2027. Airports, mass transit systems, commercial complexes, and mixed-use developments increasingly specify LED lighting as standard. As urban density and infrastructure complexity rise, efficient lighting remains essential for cost control, reliability, and sustainable urban development across new construction and renovation projects nationwide.

Local Manufacturing and Regional Export Opportunities

Thailand’s position as a regional manufacturing and distribution hub continues to support the growth of the LED market. Local assembly facilities and component suppliers improve supply chain efficiency, shorten delivery timelines, and strengthen cost competitiveness while reducing reliance on imports. This manufacturing advantage was reinforced in 2024, when Rishang LED (Thailand) Co., Ltd. launched its production base in Rayong, equipped with advanced automated lines for LED modules and strips. The facility supported supply to Southeast Asia, Europe, and the Americas. Backed by established electronics manufacturing capabilities and regional trade linkages, Thailand’s LED ecosystem enables both rising domestic adoption and export-oriented expansion as demand for energy-efficient lighting increases across neighboring markets.

Market Outlook 2026-2034:

The Thailand LED market demonstrates exceptional growth potential over the forecast period, supported by continued infrastructure expansion, urban development, and strengthening energy efficiency regulations. Rising adoption of LED lighting across residential, commercial, and industrial applications is driven by lower energy usage, longer product life, and declining costs. Government support for sustainable lighting solutions is expected to further contribute to the market growth. The market generated a revenue of USD 1,092.12 Million in 2025 and is projected to reach a revenue of USD 4,974.09 Million by 2034, growing at a compound annual growth rate of 18.35% from 2026-2034.

Thailand LED Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Panel Lights |

26% |

|

Application |

Commercial |

35% |

|

Installation Type |

New Installation |

62% |

|

Region |

Northeastern Thailand |

18% |

Product Type Insights:

- Panel Lights

- Down Lights

- Street Lights

- Tube Lights

- Bulbs

- Others

Panel lights dominate with a market share of 26% of the total Thailand LED market in 2025.

Panel lights represent the largest segment owing to their notable suitability for commercial and institutional environments requiring uniform, glare-free illumination. Offices, retail stores, hospitals, and educational facilities prefer panel lights for their slim profile, high luminous efficiency, and consistent light distribution. These products enhance visual comfort, improve workplace productivity, and support modern interior designs, making them a preferred lighting solution across high-traffic indoor spaces.

The growing adoption of energy-efficient building designs and interior modernization projects further supports the dominance of panel lights in the market. Their easy installation, compatibility with suspended ceilings, and long operational lifespan reduce maintenance requirements and operating costs. Panel lights also integrate well with smart lighting controls and dimming systems. The rising number of commercial construction and renovation activities across Thailand reinforces strong demand for LED panel lights.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Commercial

- Residential

- Institutional

- Industrial

Commercial leads with a market share of 35% of the total Thailand LED market in 2025.

Commercial dominates the market due to strong demand from offices, retail complexes, hotels, hospitals, and public facilities. These environments require high-performance lighting systems that operate for long hours, making energy efficiency and durability critical. LED lighting provides consistent illumination, lower electricity consumption, and reduced maintenance needs, helping businesses manage operating costs effectively while maintaining modern lighting quality and visual appeal across commercial spaces.

Continued growth in tourism, retail expansion, and commercial real estate development further strengthens this dominance. New hotels, shopping centers, airports, and mixed-use developments increasingly specify LED lighting to meet sustainability goals and building efficiency standards. LEDs also support advanced lighting controls and smart building integration, which improves operational efficiency. Furthermore, government-backed energy efficiency programs and green building initiatives are encouraging the widespread adoption of LED across Thailand’s commercial sector.

Installation Type Insights:

- New Installation

- Retrofit Installation

New installation exhibits a clear dominance with a 62% share of the total Thailand LED market in 2025.

New installation holds the biggest market share, driven by continuous expansion of commercial buildings, public infrastructure projects, and residential developments. Modern construction projects increasingly incorporate LED lighting at the planning and design stage to comply with energy efficiency standards, enhance illumination quality, and lower long-term operating and maintenance costs. This early-stage integration is catalyzing the demand for new LED installations across offices, retail spaces, healthcare facilities, and residential complexes.

Urban development programs, smart city initiatives, and continued expansion of tourism-related infrastructure are reinforcing the demand for modern LED lighting systems across Thailand. Large-scale projects involving airports, hotels, transport hubs, and public spaces increasingly specify LEDs to meet efficiency targets and long service-life requirements. Developers value LEDs for consistent performance, reduced maintenance needs, and compliance with national energy standards. These factors support strong adoption across new commercial and mixed-use developments in rapidly urbanizing areas.

Regional Insights:

- Northern Thailand

- Northeastern Thailand

- Western Thailand

- Central Thailand

- Eastern Thailand

- Southern Thailand

Northeastern Thailand dominates with a market share of 18% of the total Thailand LED market in 2025.

Northeastern Thailand leads the market attributed to expanding public infrastructure, urban growth, and rising electrification across semi-urban and rural areas. Large-scale government spending on roads, hospitals, schools, and transport is driving adoption of energy-efficient lighting. This momentum is reinforced by the Ministry of Transport’s $80 billion infrastructure program launched in 2024, targeting rail expansion, airport upgrades, and green logistics. Projects in cities like Khon Kaen in Northeastern Thailand, including planned light rail systems, are further boosting the need for LED across public and community infrastructure applications.

The region also benefits from the growing residential construction, agricultural modernization, and ongoing replacement of conventional lighting technologies. Households and small enterprises favor LED solutions due to lower electricity utilization, longer lifespan, and reduced maintenance requirements. Cost-conscious individuals increasingly view LEDs as a practical long-term investment. Utility-led efficiency programs, rural electrification efforts, and regional development initiatives continue to accelerate adoption, reinforcing Northeastern Thailand’s strong position within the national LED market.

Market Dynamics:

Growth Drivers:

Why is the Thailand LED Market Growing?

Hospitality and Tourism Sector Demand

Thailand’s hospitality and tourism sector continues to play a major role in influencing the LED market, as hotels, resorts, airports, and entertainment venues seek lighting solutions that balance energy efficiency with visual appeal. This demand is reinforced by strong tourism activity, with more than 5.5 million international visitors recorded between January 1 and February 16, 2025, generating over 270 billion baht in revenue. High footfall levels encourage frequent renovations and lighting upgrades to enhance guest experience. LEDs support flexible design, mood lighting, and outdoor applications while lowering operating costs. As tourism infrastructure expands and modernizes, LED lighting remains central to efficiency goals and brand positioning across hospitality and leisure facilities nationwide.

Growing Demand for Experiential and High-End Architectural Lighting

The rising demand for immersive and experience-led environments is driving advanced LED adoption in Thailand, particularly within hospitality, MICE, and premium commercial spaces. Developers and venue operators are increasingly using large-format, high-resolution LED displays to differentiate offerings and attract global audiences. This trend was evident in 2025, when Chiang Mai Marriott Hotel launched Plaii, Thailand’s first 360° LED ballroom, featuring an 84-metre wraparound display with a 6.24-metre screen height. The three-storey hybrid complex integrates meeting, leisure, and entertainment spaces, highlighting how architectural LED solutions are redefining event experiences. Such projects are catalyzing the demand for customized, high-performance LED systems across luxury venues, convention centers, and destination-focused developments nationwide.

Industry Platforms Driving Technology Adoption and Market Awareness

Industry exhibitions and trade platforms are playing an important role in bolstering the LED market growth in Thailand by promoting technology adoption and stakeholder engagement. These events enable manufacturers, solution providers, and buyers to exchange technical knowledge and explore new applications in energy-efficient lighting. This role was evident at LED Expo Thailand 2024, held at the IMPACT Exhibition & Convention Centre in Bangkok, where smart, connected, and energy-efficient LED solutions were showcased. The event facilitated networking, lead generation, and discussion around IoT-enabled lighting and sustainability. By improving market visibility and encouraging collaboration, such platforms help speed up innovation diffusion, support digital transformation, and strengthen demand for advanced LED solutions across Thailand’s lighting ecosystem.

Market Restraints:

What Challenges the Thailand LED Market is Facing?

Intense Price Competition from Imported Products

The Thailand LED market faces significant pressure from competitively priced imports, particularly from manufacturing powerhouses that benefit from economies of scale. This price competition erodes profit margins for domestic manufacturers and established brands, forcing market participants to compete primarily on pricing rather than technological differentiation. The dynamic challenges investment in research and development (R&D) while potentially compromising product quality standards.

Supply Chain Disruptions and Raw Material Volatility

Global supply chain complexities and fluctuations in raw material prices create operational challenges for LED manufacturers operating in Thailand. The semiconductor shortage has impacted production of LED drivers and controllers, causing delivery delays and increased costs. Volatility in rare earth elements essential for LED manufacturing compounds these difficulties, creating uncertainty that affects pricing strategies and inventory management across the supply chain.

Consumer Awareness Gaps in Remote Regions

Limited understanding about LED technology benefits persists in rural and remote areas of Thailand, constraining market penetration beyond urban centers. Many people in these regions prioritize upfront purchase costs over lifecycle savings, creating reluctance to adopt LED solutions despite their long-term economic advantages. Distribution infrastructure limitations further restrict product accessibility in underserved areas.

Competitive Landscape:

The Thailand LED market exhibits moderate competitive intensity characterized by the presence of multinational lighting corporations alongside regional manufacturers competing across diverse product categories and distribution channels. Market dynamics reflect strategic positioning, ranging from premium innovation-driven offerings emphasizing advanced smart lighting capabilities to value-oriented products targeting price-conscious individuals. Competition is increasingly shaped by technological innovation in connected lighting solutions, sustainability credentials, and e-commerce capabilities that expand market reach. Leading players are investing in localized manufacturing, distribution network expansion, and strategic partnerships to strengthen their competitive positions while capturing growth opportunities across emerging market segments.

Recent Developments:

- September 2025: LED Expo Thailand, celebrating its 10th anniversary, was rebranded as ASEAN Light + Design Expo 2025 and co-located with Smart Living Expo, held at IMPACT Exhibition & Convention Center, Bangkok from 17–19 September. The event showcased cutting-edge lighting innovations and smart living solutions, connecting over 300 exhibitors with 4,000 trade attendees across ASEAN. It served as a platform for networking, knowledge sharing, and exploring emerging trends in sustainable, smart, and design-focused lighting technologies.

- May 2025: A new experiential space in Bangkok, Thailand, features a small LED tunnel that creates large, immersive visual effects, showcasing how motion and design can amplify perception beyond the physical size of the display. Developed by Space & Time Cube+ (China) Co., the installation demonstrates the creative potential of LED technology in compact spaces.

Thailand LED Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | New Installation, Retrofit Installation |

| Applications Covered | Commercial, Residential, Institutional, Industrial |

| Installation Types Covered | Panel Lights, Down Lights, Street Lights, Tube Lights, Bulbs, Others |

| Region Covered | Northern Thailand, Northeastern Thailand, Western Thailand, Central Thailand, Eastern Thailand, Southern Thailand |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Thailand LED market size was valued at USD 1,092.12 Million in 2025.

The Thailand LED market is expected to grow at a compound annual growth rate of 18.35% from 2026-2034 to reach USD 4,974.09 Million by 2034.

Panel lights dominated the market with 26% revenue share in 2025, driven by widespread adoption in commercial spaces, office buildings, and institutional facilities requiring uniform illumination and energy-efficient lighting solutions.

Key factors driving the Thailand LED market include government and municipal investments, which are accelerating LED streetlight adoption, improving safety and efficiency. For example, Pattaya City’s 2025 project replaced 4,000 sodium lamps with 110-watt LEDs, enhancing nighttime visibility, lowering energy use, and reflecting nationwide efforts to modernize outdoor lighting infrastructure.

Major challenges include intense price competition from imported products, supply chain disruptions affecting component availability, raw material price volatility, user awareness gaps in remote regions, and competition from established lighting technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)