Thailand Luxury Fashion Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033

Thailand Luxury Fashion Market Overview:

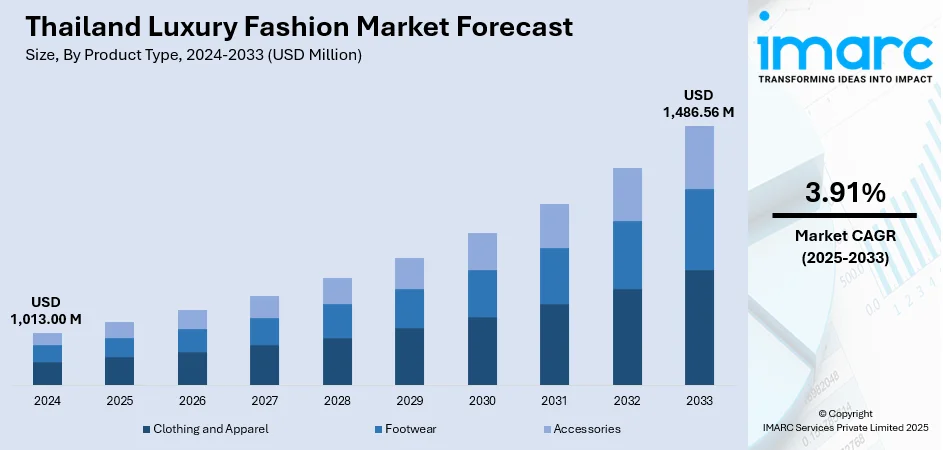

The Thailand luxury fashion market size reached USD 1,013.00 Million in 2024. The market is projected to reach USD 1,486.56 Million by 2033, exhibiting a growth rate (CAGR) of 3.91% during 2025-2033. The market is fueled by increasing disposable incomes among the country's urban population, rising demand for premium apparel and accessories, and the influence of global fashion trends through digital media. Further, younger consumers are actively shaping the sector through interest in brand exclusivity, limited editions, and online luxury purchases. Besides that, the growth of international tourism, particularly from high-spending visitors, further augments the Thailand luxury fashion market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,013.00 Million |

| Market Forecast in 2033 | USD 1,486.56 Million |

| Market Growth Rate 2025-2033 | 3.91% |

Thailand Luxury Fashion Market Trends:

Influence of Chinese Tourism and Regional Affluence

The market significantly benefits from inbound tourism, and Chinese tourists remain a particularly influential consumer base. According to industry reports, approximately 6.73 Million Chinese travelers visited Thailand in 2024, reflecting a substantial 91.7% surge compared to the previous year. With the return of outbound travel from China post-COVID-19 restrictions, Thai retailers and luxury malls have observed renewed activity from Chinese shoppers, especially in Bangkok, Phuket, and Pattaya. Chinese tourists are typically brand-conscious and well-informed, often arriving with specific purchase intentions for luxury items that are more affordable or accessible in Thailand than in mainland China. Retailers have responded by hiring Mandarin-speaking staff, integrating Alipay and WeChat Pay systems, and tailoring marketing materials to cater to this segment. Beyond Chinese travelers, affluent visitors from neighboring ASEAN countries such as Vietnam, Malaysia, and Indonesia are contributing to cross-border luxury consumption, drawn by Thailand’s comparative pricing and product availability. Apart from this, the presence of regional high-net-worth individuals (HNWI) at flagship stores, outlet malls, and multi-brand retailers is driving demand for tailored customer service, exclusive merchandise, and in-store experiences. This influx is influencing store formats, language services, and merchandising strategies across the market.

To get more information on this market, Request Sample

Rise of Digital-First Luxury Consumption

The shift toward digital channels is providing a boost to the Thailand luxury fashion market growth. With rising internet accessibility and mobile-first behavior, digital platforms are becoming primary touchpoints for luxury discovery and purchase. As of 2025, Thailand’s population stands at 71.6 Million, with 91.2% of residents having internet access, equivalent to 65.4 Million users. Additionally, 71.1% of the population maintains at least one active social media profile, amounting to 51 Million accounts. This connected consumer base, particularly affluent individuals in urban centers like Bangkok and Chiang Mai, is increasingly using digital platforms to browse, evaluate, and buy luxury products. Furthermore, social media channels such as Instagram, TikTok, and Line have become integral to how luxury brands position themselves, run campaigns, and interact with potential buyers. Also, influencer marketing and live-streamed product launches are now commonplace, enabling international and domestic labels to cultivate exclusivity while maintaining accessibility. In addition to this, e-commerce platforms such as JD Central and Lazada Luxe have enhanced logistics and customer service, aligning with luxury expectations. Moreover, official brand websites and online boutiques are optimizing mobile experiences and offering virtual consultations or styling sessions, which appeal to tech-savvy Thai consumers. Besides this, luxury buyers are also using digital channels to authenticate items, research product histories, and participate in pre-order events or limited-release drops. The convenience of digital browsing, coupled with secure payment systems and faster delivery options, has made online luxury shopping a normalized experience, particularly post-pandemic. This transition has necessitated digital fluency across all touchpoints in the luxury purchase cycle.

Thailand Luxury Fashion Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end user.

Product Type Insights:

- Clothing and Apparel

- Jackets and Coats

- Skirts

- Shirts and T-Shirts

- Dresses

- Trousers and Shorts

- Denim

- Underwear and Lingerie

- Others

- Footwear

- Accessories

- Gems and Jewellery

- Belts

- Bags

- Watches

The report has provided a detailed breakup and analysis of the market based on the product type. This includes clothing and apparel (jackets and coats, skirts, shirts and T-shirts, dresses, trousers and shorts, denim, underwear and lingerie, and others), footwear, and accessories (gems and jewellery, belts, bags, and watches).

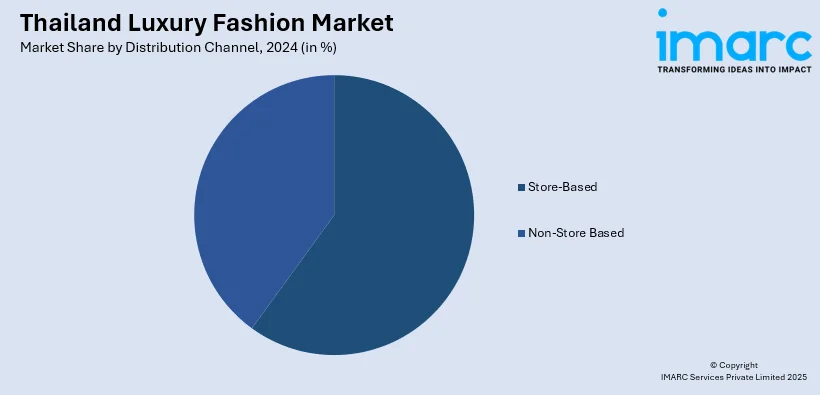

Distribution Channel Insights:

- Store-Based

- Non-Store Based

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes store-based and non-store based.

End User Insights:

- Men

- Women

- Unisex

The report has provided a detailed breakup and analysis of the market based on the end user. This includes men, women, and unisex.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Luxury Fashion Market News:

- April 2025: Italian luxury fashion brand Etro announced the launch of its first branded residential estate in Thailand, located in Phuket. This exclusive development marks the brand’s second global real estate venture after Istanbul and will feature only eight ultra-luxury units tailored for high-end international clientele and Etro loyalists. According to CEO Fabrizio Cardinali, Phuket was chosen for its dynamic luxury tourism market and strong local partnerships, aligning with the brand’s vision for premium, limited-edition living experiences.

- February 2025: Danish fashion label GANNI, under the TANACHIRA Group, inaugurated its second flagship store in Thailand at Siam Discovery, marking a strategic expansion designed to engage the country’s rising demographic of luxury streetwear consumers. The store, situated within a premium lifestyle hub, highlights GANNI’s Spring/Summer 2025 collection and integrates sustainable design elements using recycled materials. This development reinforces TANACHIRA’s fashion portfolio by strengthening its presence in Thailand’s high-growth contemporary fashion segment.

Thailand Luxury Fashion Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Store-Based, Non-Store Based |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand luxury fashion market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand luxury fashion market on the basis of product type?

- What is the breakup of the Thailand luxury fashion market on the basis of distribution channel?

- What is the breakup of the Thailand luxury fashion market on the basis of end user?

- What is the breakup of the Thailand luxury fashion market on the basis of region?

- What are the various stages in the value chain of the Thailand luxury fashion market?

- What are the key driving factors and challenges in the Thailand luxury fashion market?

- What is the structure of the Thailand luxury fashion market and who are the key players?

- What is the degree of competition in the Thailand luxury fashion market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand luxury fashion market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand luxury fashion market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand luxury fashion industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)