Thailand Meat Market Size, Share, Trends and Forecast by Type, Product, Distribution Channel, and Region, 2025-2033

Thailand Meat Market Overview:

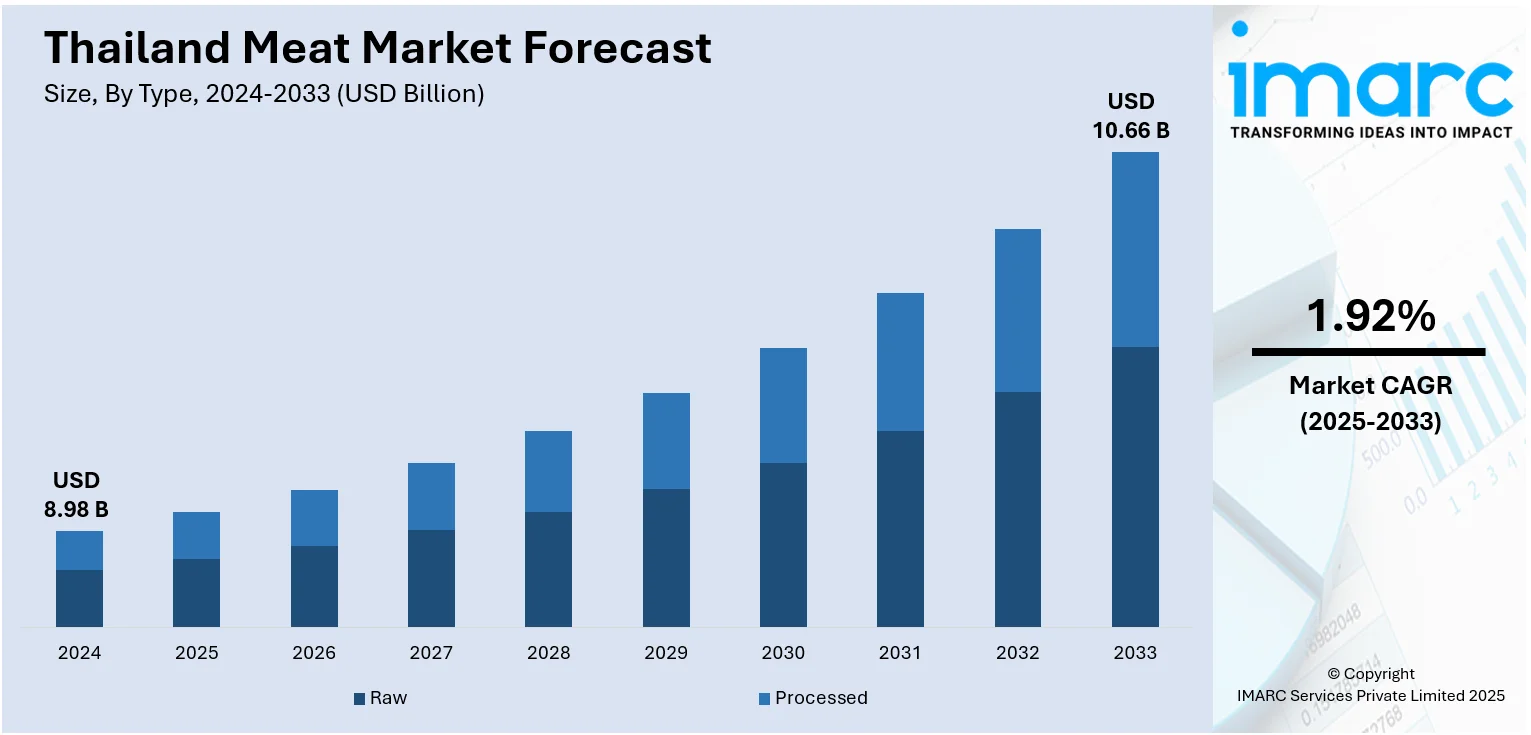

The Thailand meat market size reached USD 8.98 Billion in 2024. The market is projected to reach USD 10.66 Billion by 2033, exhibiting a growth rate (CAGR) of 1.92% during 2025-2033. The market is driven by rising domestic consumption fueled by urbanization, income growth, and changing dietary habits favoring convenient, high-protein foods. Strong export demand, especially for poultry, boosts production standards and attracts investment due to Thailand’s reputation for food safety and disease control. Technological advancements and vertical integration by major agribusinesses boost efficiency, traceability, and quality, which in turn is strengthening the Thailand's meat market share and aligning with global and regulatory demands.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.98 Billion |

| Market Forecast in 2033 | USD 10.66 Billion |

| Market Growth Rate 2025-2033 | 1.92% |

Thailand Meat Market Trends:

Rising Domestic Consumption and Urbanization

Thailand’s increasing urban population and rising middle-class income is one of the key Thailand meat market trend. As urban dwellers adopt busier lifestyles, demand for convenient, high-protein food like processed and ready-to-cook (RTC) meat has surged. Cultural preferences, particularly for pork and chicken, support consistent consumption, while Western-style diets are boosting beef and premium meat interest. Economic growth enables consumers to spend more on higher-quality, hygienic meat products, increasing demand for branded and packaged goods. Supermarkets and modern retail outlets are expanding in cities and semi-urban areas, offering easier access to meat products and encouraging repeat purchases. Food delivery platforms also contribute, making meat-based meals more accessible. Government efforts to promote domestic agricultural development and food safety standards further reinforce consumer confidence, encouraging consumption growth and market formalization.

To get more information on this market, Request Sample

Export Opportunities and Global Demand

Thailand has become a major global meat exporter, especially in poultry, owing to its strong food safety standards, efficient supply chains, and strict disease control. By 2024, livestock-related exports surpassed 320 billion baht—an 11% rise—while frozen meat exports alone soared nearly 50%, exceeding 160 billion baht. This growth reflects Thailand’s adherence to international safety systems like HACCP and GHP. The country’s vertically integrated production model ensures traceability and consistent quality, making it a trusted supplier to key markets such as Japan, Europe, China, and the Middle East. Global disruptions, like African Swine Fever, have further positioned Thai pork as a stable alternative. Government support through trade agreements, certifications, and export incentives enhances competitiveness, drawing foreign investment into processing and cold-chain infrastructure. This export momentum not only boosts Thailand meat market growth along with the rising domestic standards, reinforcing Thailand’s leadership in the global meat industry.

Technological Advancements and Agribusiness Integration

Thailand’s meat industry has embraced technology and vertical integration, significantly boosting productivity, quality, and biosecurity. Major agribusinesses—such as CP Foods and Betagro—control the entire value chain, from feed production to farming, slaughtering, and retail. This integrated model ensures consistent product standards, lower costs, and efficient disease control. Automation in meat processing, improved breeding techniques, and data-driven farm management have led to higher yields and better animal health. These innovations enable scalability and price competitiveness both locally and internationally. Technology also aids compliance with traceability regulations, essential for exports and consumer trust. Investment in cold-chain logistics and smart packaging further enhances shelf life and food safety. As smallholders struggle to compete, integration may concentrate market share among large players, but it also lifts overall industry standards. Technology thus underpins both market expansion and structural transformation.

Thailand Meat Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, and distribution channel.

Type Insights:

- Raw

- Processed

The report has provided a detailed breakup and analysis of the market based on the type. This includes raw and processed.

Product Insights:

- Chicken

- Beef

- Pork

- Mutton

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes chicken, beef, pork, mutton, and others.

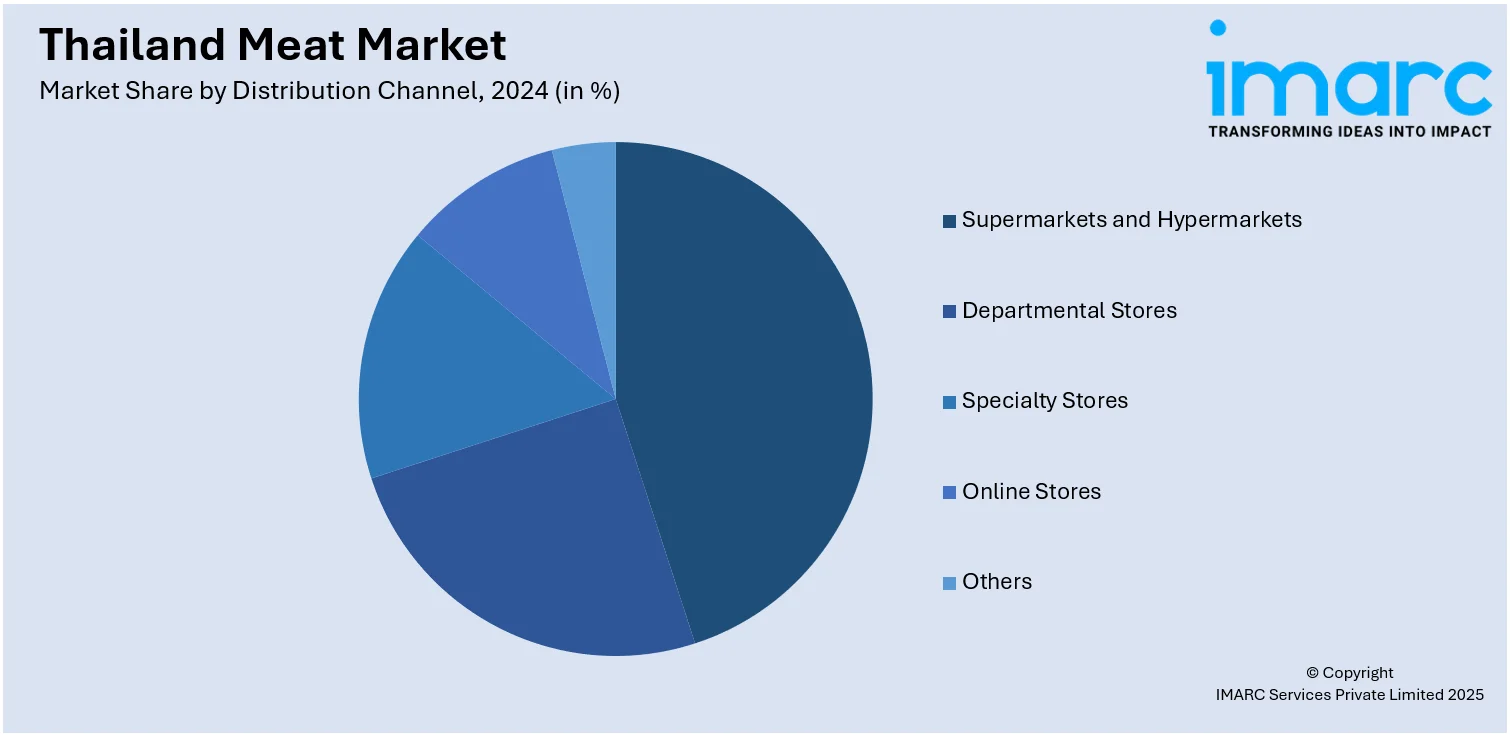

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, departmental stores, specialty stores, online stores, and others.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Meat Market News:

- In May 2025, Thailand launched a new chicken breed, ‘Luang Dong Yaw’, to enhance rural incomes and food security. Developed by the Sakon Nakhon Livestock Research and Breeding Center, it’s a cross between the local Tamhuang and Rhode Thai breeds. This hybrid is hardy, fast-growing, and easy to raise, making it ideal for small-scale farmers. Officials highlight its potential to boost productivity and economic returns in Thailand’s poultry sector.

- In December 2024, Aleph Farms submitted Thailand’s first cultivated meat application to BIOTEC under Thai FDA novel food guidelines, aiming for market entry by mid-2026. The Israeli company plans to launch its cultivated Petit Steak under the Aleph Cuts brand, in partnership with Thai Union. CEO Didier Toubia highlights Thailand’s reliance on beef imports and sees this milestone as key to expanding Aleph’s presence across Southeast Asia and shaping the region’s novel food regulations.

Thailand Meat Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Pork, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand meat market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand meat market on the basis of type?

- What is the breakup of the Thailand meat market on the basis of product?

- What is the breakup of the Thailand meat market on the basis of distribution channel?

- What is the breakup of the Thailand meat market on the basis of region?

- What are the various stages in the value chain of the Thailand meat market?

- What are the key driving factors and challenges in the Thailand meat market?

- What is the structure of the Thailand meat market and who are the key players?

- What is the degree of competition in the Thailand meat market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand meat market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand meat market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand meat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)