Thailand Paper Packaging Market Size, Share, Trends and Forecast by Product Type, Grade, Packaging Level, End-Use Industry, and Region, 2025-2033

Thailand Paper Packaging Market Overview:

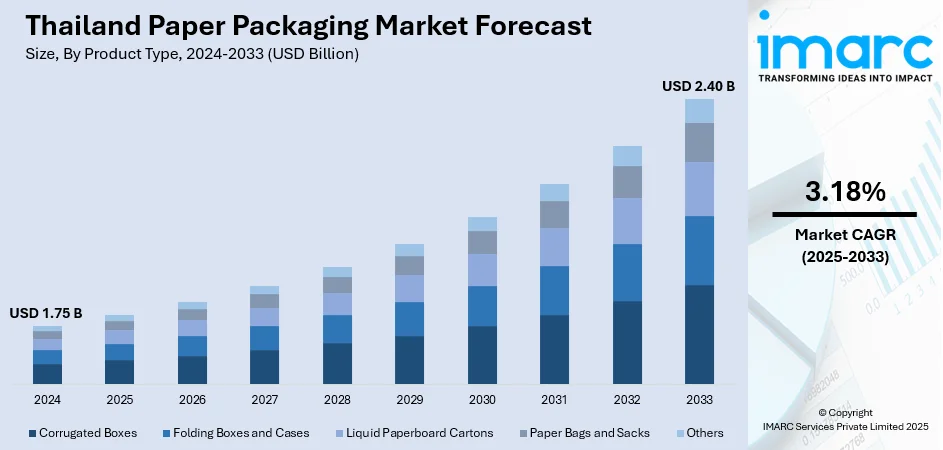

The Thailand paper packaging market size reached USD 1.75 Billion in 2024. The market is projected to reach USD 2.40 Billion by 2033, exhibiting a growth rate (CAGR) of 3.18% during 2025-2033. The market is driven by the rising sustainability demands and government regulations phasing out single-use plastics, which push businesses toward recyclable and biodegradable options. Moreover, the rapid rise of e‑commerce and industrial expansion, creating strong demand for durable and versatile packaging for shipping, storage, and exports and technological innovations like digital printing, enabling cost-effective customization and improved branding. Together, these forces are transforming paper packaging into a preferred solution across industries, supporting both functionality and environmental goals thus aiding the Thailand paper packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.75 Billion |

| Market Forecast in 2033 | USD 2.40 Billion |

| Market Growth Rate 2025-2033 | 3.18% |

Thailand Paper Packaging Market Trends:

Sustainability and regulatory pressure

Thailand’s paper packaging market is largely driven by increasing environmental awareness and strong government action against plastic waste. The country has introduced strict measures to phase out single-use plastics, creating a supportive environment for alternatives like paper. This change is in line with consumers' increasing desire for environmentally friendly products as they grow more aware of their purchases and how they affect the environment. Businesses, especially in food, retail, and consumer goods, are responding by replacing plastic with recyclable and biodegradable paper packaging. Additionally, government initiatives aimed at improving recycling systems and waste management are reinforcing the appeal of paper as a sustainable solution. These combined efforts consumer preference, regulatory backing, and corporate sustainability strategies are significantly accelerating the transition toward paper-based packaging across industries, making sustainability a key Thailand paper packaging market trend.

To get more information on this market, Request Sample

E‑commerce and industrial expansion

Thailand’s fast-growing e‑commerce sector and expanding industrial base are significantly driving demand for paper packaging. According to the Commerce Ministry, Thailand’s e‑commerce market grew by 14% in 2024, reaching 1.1 trillion baht, making it ASEAN’s second‑largest market. This surge in online retail amplifies the need for durable, lightweight, and protective packaging, such as corrugated boxes, to ensure safe product delivery. Simultaneously, Thailand’s thriving manufacturing sector—spanning food processing, electronics, and fast‑moving consumer goods—relies heavily on paper packaging for storage, transportation, and product presentation. The growth of export‑oriented manufacturing hubs further raises demand for high‑quality, standardized packaging that meets international standards. As businesses expand, they increasingly seek cost‑effective, sustainable, and versatile solutions, positioning paper packaging as an essential component of Thailand’s economic and trade infrastructure while aligning with global sustainability trends and customer expectations.

Technological innovation and customization

Innovations in printing and packaging design are transforming the paper packaging industry in Thailand. Digital and flexographic printing technologies allow businesses to create customized, visually appealing packaging that enhances brand identity and connects with consumers on a personal level. This is particularly beneficial for small and medium-sized enterprises, which now have access to affordable solutions for short production runs and quick design changes. The ability to customize packaging also helps brands differentiate themselves in competitive markets, especially in food, retail, and luxury goods. Additionally, advancements in production processes make paper packaging more versatile and efficient, reducing waste and improving overall quality. These innovations support growing consumer expectations for attractive, functional, and sustainable packaging. As a result, technological progress and the push for greater customization are driving Thailand paper packaging market growth.

Thailand Paper Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, grade, packaging level, and end-use industry.

Product Type Insights:

- Corrugated Boxes

- Folding Boxes and Cases

- Liquid Paperboard Cartons

- Paper Bags and Sacks

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes corrugated boxes, folding boxes and cases, liquid paperboard cartons, paper bags and sacks, and others.

Grade Insights:

- Solid Bleached

- Coated Recycled

- Uncoated Recycled

- Others

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes solid bleached, coated recycled, uncoated recycled, and others.

Packaging Level Insights:

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

A detailed breakup and analysis of the market based on the packaging level have also been provided in the report. This includes primary packaging, secondary packaging, and tertiary packaging.

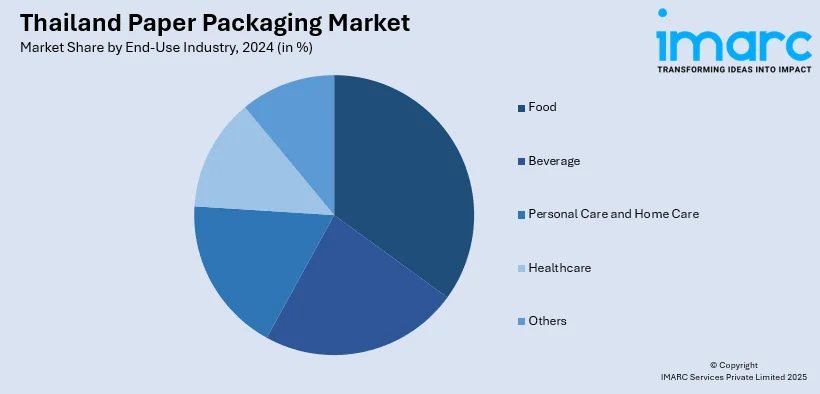

End-Use Industry Insights:

- Food

- Beverage

- Personal Care and Home Care

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes food, beverage, personal care and home care, healthcare, and others.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Paper Packaging Market News:

- In July 2024, Thailand Post launched an on-demand box and envelope manufacture service in collaboration with SCGP and LocoPack to assist farmers, SMEs, and ornamental fish producers. This initiative allows customized packaging design to enhance product value, durability, and brand identity. The first product, a cubic box (15x15x15 cm) for safely transporting goods and pets, will launch in July. Entrepreneurs can access affordable, low-minimum customized packaging through Thailand Post’s nationwide network.

Thailand Paper Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corrugated Boxes, Folding Boxes and Cases, Liquid Paperboard Cartons, Paper Bags and Sacks, Others |

| Grades Covered | Solid Bleached, Coated Recycled, Uncoated Recycled, Others |

| Packaging Levels Covered | Primary Packaging, Secondary Packaging, Tertiary Packaging |

| End-Use Industries Covered | Food, Beverage, Personal Care and Home Care, Healthcare, Others |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand paper packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand paper packaging market on the basis of product type?

- What is the breakup of the Thailand paper packaging market on the basis of grade?

- What is the breakup of the Thailand paper packaging market on the basis of packaging level?

- What is the breakup of the Thailand paper packaging market on the basis of end-use industry?

- What is the breakup of the Thailand paper packaging market on the basis of region?

- What are the various stages in the value chain of the Thailand paper packaging market?

- What are the key driving factors and challenges in the Thailand paper packaging market?

- What is the structure of the Thailand paper packaging market and who are the key players?

- What is the degree of competition in the Thailand paper packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand paper packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand paper packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand paper packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)