Thailand Private Equity Market Size, Share, Trends and Forecast by Fund Type and Region, 2025-2033

Thailand Private Equity Market Overview:

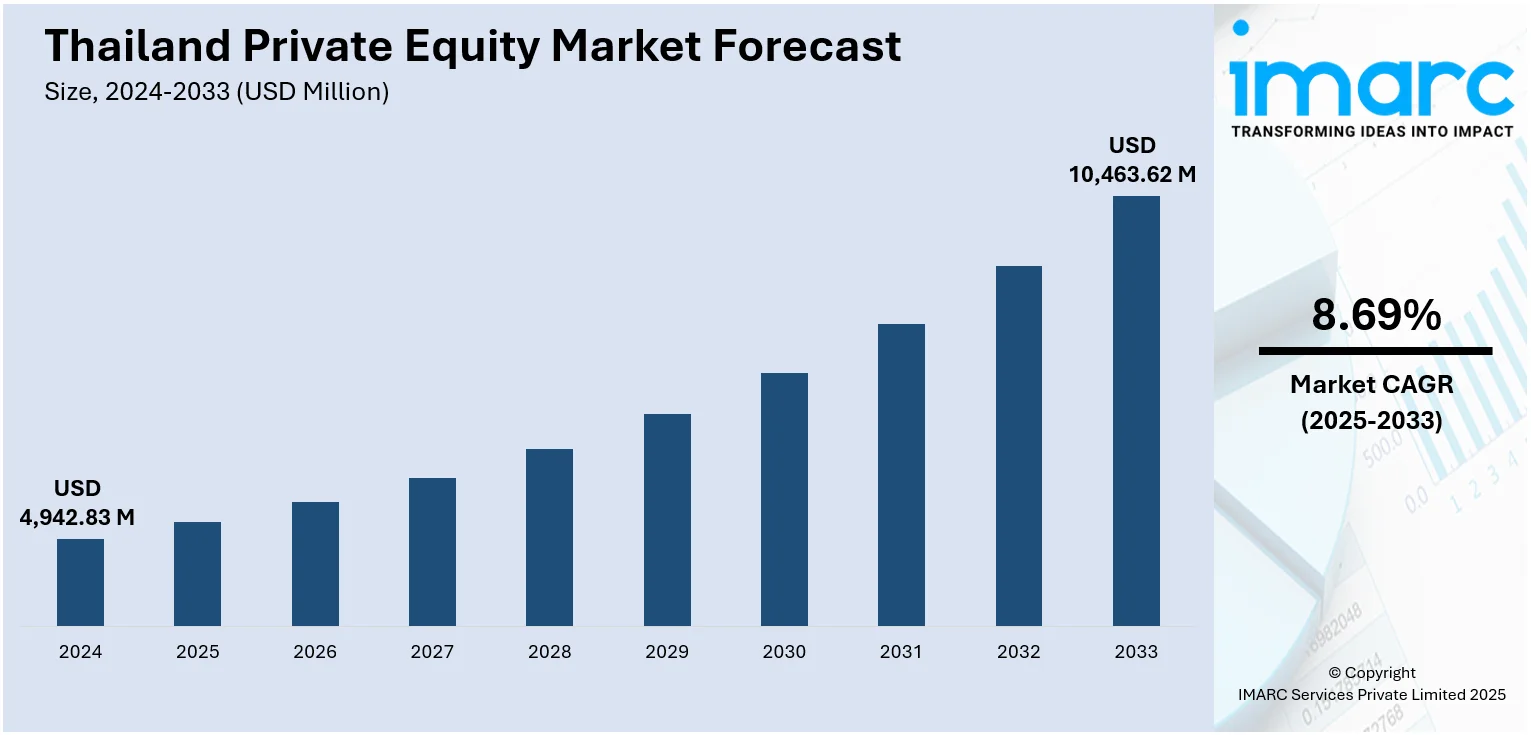

The Thailand private equity market size reached USD 4,942.83 Million in 2024. The market is projected to reach USD 10,463.62 Million by 2033, exhibiting a growth rate (CAGR) of 8.69% during 2025-2033. The market is experiencing notable growth due to increasing investor appetite, positive regulatory trends, and an active entrepreneurial environment. Active regional and global firm participation and growing demand for alternative investments are defining the competitive landscape. Sector-specific investing, digitalization, and strategic exits are among the major trends proliferating the Thailand private equity market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,942.83 Million |

| Market Forecast in 2033 | USD 10,463.62 Million |

| Market Growth Rate 2025-2033 | 8.69% |

Thailand Private Equity Market Trends:

Market Rebound Driving Deal Activity

In April 2024, Thailand's Office of the National Economic and Social Development Council reported a rise in private investment momentum, reflecting stronger capital spending across key sectors. This signaled a broader recovery trend, with deal flow in Thailand’s private equity market starting to pick up. While traditional investment activity had cooled in recent years, marked a return of confidence among fund managers, particularly in manufacturing and consumer-related verticals. The uptick in domestic capital deployment, paired with renewed interest from regional players, is helping drive increased deal volume and higher-quality transactions. Thailand’s solid economic fundamentals, improved regulatory clarity, and geographic positioning continue to support this momentum. Recent deals point to a more balanced mix of early- and growth-stage investments, with capital flowing steadily across mid-sized opportunities. Many of these developments stem from a more favorable economic backdrop and improving investor sentiment. In summary, the Thailand private equity market growth appears to be on a stable upward trajectory, supported by stronger economic indicators and a rebound in investment activity across multiple asset classes.

To get more information on this market, Request Sample

Strategic Sector Focus Redefining Investment Priorities

Thailand’s private equity landscape in 2024 reflected a notable shift in investor focus, with industrial and education sectors dominating the deal pipeline. According to a February 2024 report, industrial-related transactions alone accounted for nearly half of all private equity deal activity in the country. This concentration illustrates a broader strategic pivot toward sectors seen as resilient and aligned with Thailand’s long-term development goals. At the same time, investors are increasingly targeting infrastructure-adjacent opportunities such as energy transition assets, logistics platforms, and digital enablement to capture value amid evolving economic conditions. These shifts are not isolated. They align with regional momentum, where Southeast Asia’s private equity-backed deals hit a six-year high in both number and disclosed value. For Thailand, these signals rising integration with broader regional capital trends. As firms recalibrate their investment theses, we’re seeing more emphasis on operational value creation and less on pure financial engineering. Overall, these moves highlight a maturing ecosystem. The Thailand private equity market trends suggest growing discipline, sector specialization, and stronger alignment with macroeconomic shifts.

Investor Optimism Fuels Sector-Driven Momentum

In February 2025, the International Monetary Fund reported that Thailand’s economy expanded during the first three quarters. That momentum is building confidence among private equity investors, many of whom are sharpening their focus on mid-sized opportunities in infrastructure, energy transition, and digital assets. These sectors are now seen as long-term plays aligned with Thailand’s development agenda and growing demand for sustainable capital deployment. As global capital shifts toward Southeast Asia, Thailand is increasingly viewed as a stable anchor within the region. Investors are responding not only to macroeconomic stability but also to gradual improvements in regulatory transparency and market access. Dry powder is being reserved for assets with clearer exit potential and operational value, signaling a shift away from speculative strategies. Fund managers are aligning their theses more closely with domestic growth themes, particularly in infrastructure and technology. Looking ahead, the story is likely to deepen, supported by rising investor confidence, favorable policy signals, and increased appetite for sector-focused capital deployment.

Thailand Private Equity Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on fund type.

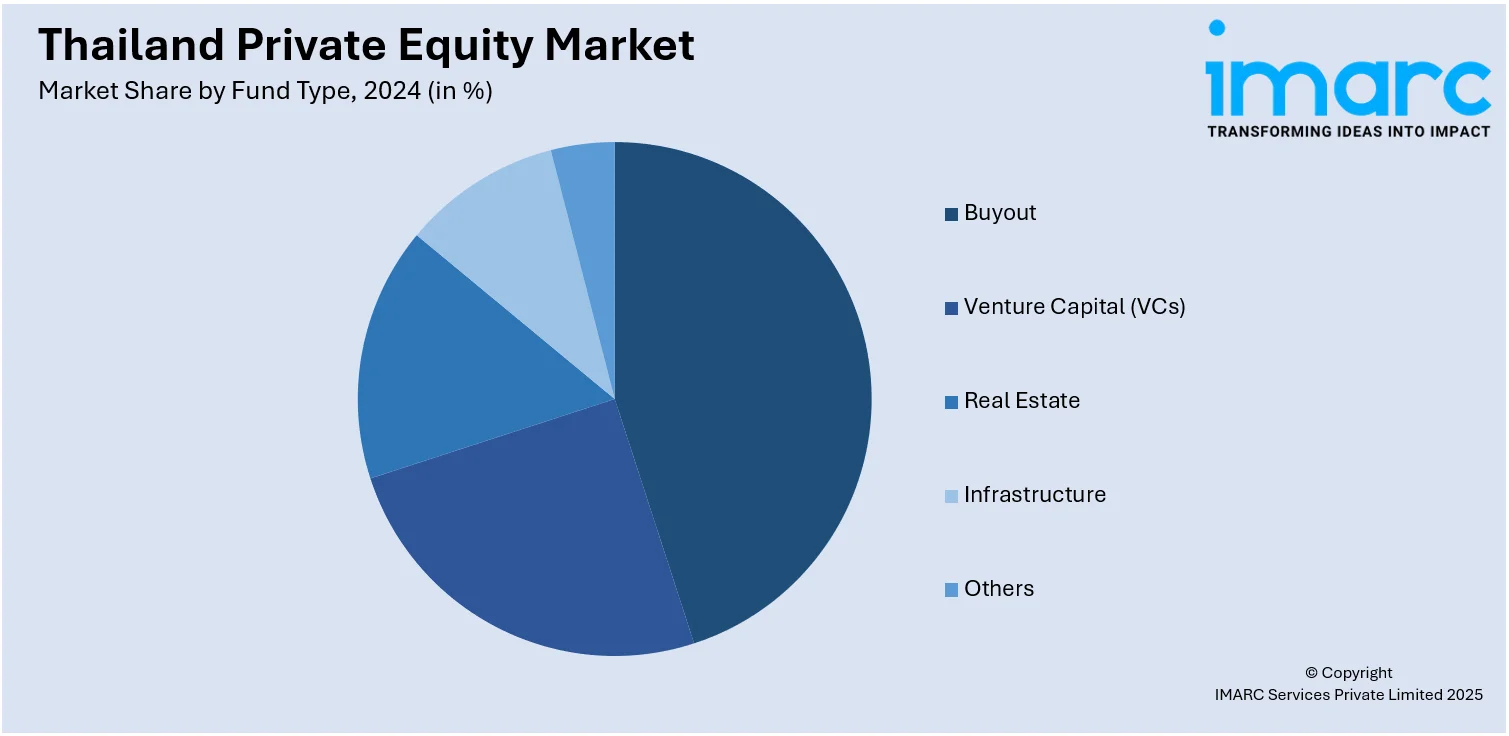

Fund Type Insights:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

The report has provided a detailed breakup and analysis of the market based on the fund type. This includes buyout, venture capital (VCs), real estate, infrastructure, and others.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Private Equity Market News:

- March 2025: SCB WEALTH, the wealth management arm of Siam Commercial Bank in Thailand, has formed a strategic alliance with global asset manager BlackRock to elevate its offerings for Thai investors. The collaboration grants access to international investment opportunities, in-depth research, and bespoke long‑term strategies tailored for Thai clients. BlackRock will also help train and enhance SCB Wealth Academy’s advisory teams to international standards. Together, the two firms aim to strengthen Thailand’s wealth management landscape and deliver world‑class solutions focused on the local market.

Thailand Private Equity Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fund Types Covered | Buyout, Venture Capital (VCs), Real Estate, Infrastructure, Others |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand private equity market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand private equity market on the basis of fund type?

- What is the breakup of the Thailand private equity market on the basis of region?

- What are the various stages in the value chain of the Thailand private equity market?

- What are the key driving factors and challenges in the Thailand private equity market?

- What is the structure of the Thailand private equity market and who are the key players?

- What is the degree of competition in the Thailand private equity market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand private equity market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand private equity market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand private equity industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)