Thailand Real Estate Market Size, Share, Trends and Forecast by Property, Business, Mode, and Region, 2025-2033

Thailand Real Estate Market Summary:

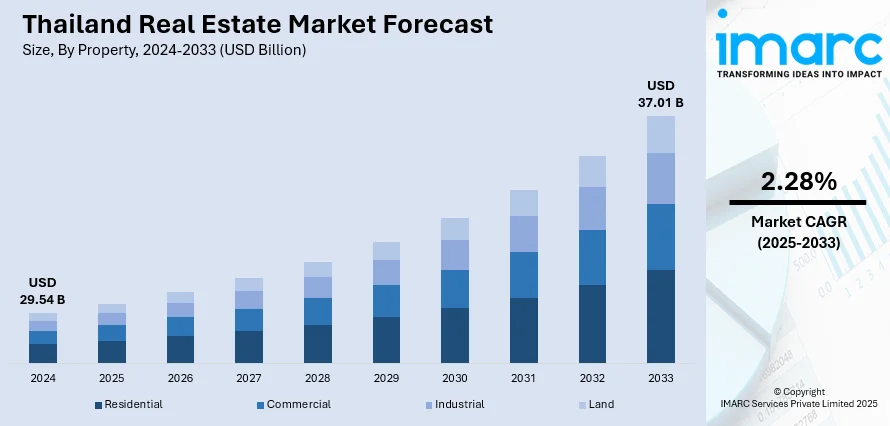

The Thailand real estate market size reached USD 29.54 Billion in 2024. Looking forward, the market is expected to reach USD 37.01 Billion by 2033, exhibiting a growth rate (CAGR) of 2.28% during 2025-2033. The market growth is attributed to government-supported infrastructure initiatives, increased foreign investment, and growth across key urban and economic corridors. Thailand’s tourism rebound is driving demand for both short-term accommodations and mixed-use developments in key tourist cities.

Market Insights:

- On the basis of property, the market is divided into residential, commercial, industrial, and land.

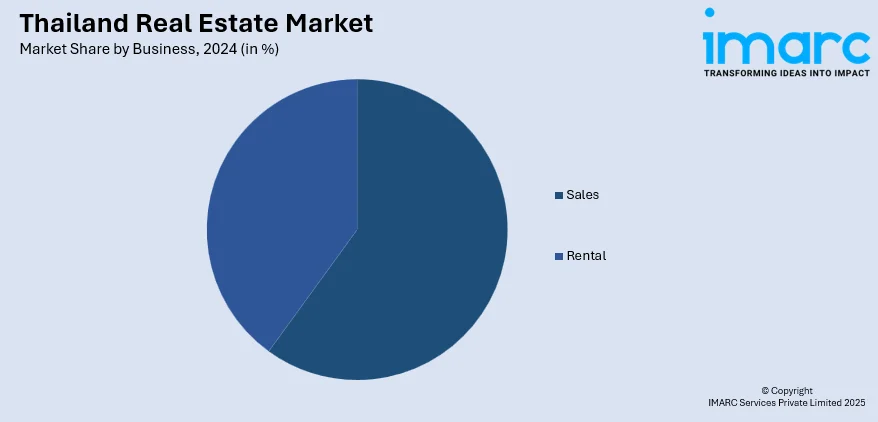

- Based on business, the market is segmented into sales and rental.

- By mode, the market includes online and offline channels.

- On the basis of the region, the market has been divided into Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Market Size and Forecast:

- 2024 Market Size: USD 29.54 Billion

- 2033 Projected Market Size: USD 37.01 Billion

- CAGR (2025-2033): 2.28%

Thailand Real Estate Market Trends:

Growing Need for Mixed-Use Developments

Within the Thailand property market, the growth in popularity of mixed-use developments is driven by shifting consumer trends and city planning paradigms. Mixed-use developments combine residential, commercial, and recreational facilities within one venue, providing an efficient, lifestyle-based setting. City dwellers, particularly those in metropolises such as Bangkok, are being drawn to properties that minimize travel times and enhance work-life balance. Developers are maximizing land use through vertical integration and advanced architectural design to gain maximum utility and beauty. The strategy enhances the country's urbanization goals and appeals to local as well as foreign investors. With land shortages in inner areas, mixed-use models are the strategic innovation, defining future directions of investments. Thailand real estate market growth is further boosted by the incorporation of live-work-play concepts, which cater to the needs of residents and businesses in the contemporary era. The trend is likely to persist as consumers behavior evolves and infrastructure construction harmonizes with integrated city living.

To get more information this market, Request Sample

Resort and Wellness Property Growth

The growth of wellness-oriented tourism and lifestyle preferences are driving a visible increase in resort-style and health-oriented real estate assets in coastal and picturesque regions. In Thailand real estate market trends, this phenomenon is most evident in provinces like Phuket, Chiang Mai, and Hua Hin, where wellness retreats and resort homes are in greater demand. Health-conscious consumers, remote workers, and pensioners are looking for properties that provide peace, nature, and proximity to wellness facilities like spas, gyms, and holistic health services. This aligns with Thailand’s national strategy to be a world-class health and wellness destination. With rebounding tourism and enhanced international mobility, the demand for resort and wellness properties will continue to increase moderately. Also, government development projects improve connectivity to these locations, further boosting the segment. The properties are not just being used as homes but also as a long-term investment in well-being and lifestyle.

Growing Use of Smart and Sustainable Housing

Technological innovation and ecologism are rewriting residential preferences in Thailand's urban and suburban areas. According to the sources, in June 2024, SC Asset debuted five new luxury residential series worth more than 10 billion baht, reinforcing itself as a high-end developer in the Thailand property market. Moreover, the Thailand real estate market growth is fueled by demands for energy-efficient, smart-enabled houses featuring environmentally integrated solutions like solar power systems, water recycling, and intelligent security systems. This is inspired by a rapidly expanding middle class that embraces digital connectivity and environmental responsibility. Builders are adding green certifications and sustainable building methodologies to meet worldwide standards and attract environmentally conscious consumers. The smart home appeal is more about convenience and remote control of utilities than cost savings. As younger, technology-oriented buyers become major players in the market, there is a strong preference for properties with built-in Internet of Things (IoT) systems. This emphasis on innovation is making Thailand a competitive location for forward-looking residential growth, contributing to the Thailand real estate market share. The integration of intelligent technology and green design is becoming the hallmark of new home projects across the country.

Rise of Co-living and Flexible Leasing Models

Thailand’s real estate market is witnessing growing traction in co-living spaces and flexible lease arrangements, particularly in urban centers like Bangkok and Chiang Mai. Driven by shifting work patterns, rising housing costs, and demand from younger professionals and digital nomads, these developments offer affordability, convenience, and built-in communities. This in turn creates a favorable Thailand real estate market outlook. Co-living operators are targeting both locals and foreigners with furnished units, shared amenities, and short-to-medium lease durations. Additionally, property owners and developers are embracing hybrid business models that combine residential, hospitality, and workspace elements to improve asset utilization and occupancy. This flexibility aligns with evolving lifestyle preferences, especially among mobile professionals and expatriates seeking cost-effective yet community-driven housing options in Thailand’s urban real estate landscape.

Thailand Real Estate Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on property, business, and mode.

Property Insights:

- Residential

- Commercial

- Industrial

- Land

The report has provided a detailed breakup and analysis of the market based on the property. This includes residential, commercial, industrial, and land.

Business Insights:

- Sales

- Rental

A detailed breakup and analysis of the market based on the business have also been provided in the report. This includes sales and rental.

Mode Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the mode. This includes online and offline.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Real Estate Market News:

- In June 2025, Onyx Hospitality Group has given notice of intentions to introduce the Onyx Leasehold Real Estate Investment Trust (ONYXRT) in 2025 by combining four significant hotel properties worth THB 6.5 billion. The REIT will provide regional hotel growth and debt servicing funding, strengthening Onyx's position in the Thailand real estate sector.

- In January 2024, EDEN ESTATE debuted Thailand's first "Ultra-Luxury Low-Density" low-rise development, EDEN EKKAMAI, in downtown Bangkok. Comprising only 17 rare units, the project brings a new home segment that focuses on seclusion, room, and environmentally friendly design, setting a new standard in the real estate market in Thailand.

Thailand Real Estate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Properties Covered | Residential, Commercial, Industrial, Land |

| Businesses Covered | Sales, Rental |

| Modes Covered | Online, Offline |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand real estate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand real estate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The real estate market in Thailand was valued at USD 29.54 Billion in 2024.

The Thailand real estate market is projected to exhibit a CAGR of 2.28% during 2025-2033, reaching a value of USD 37.01 Billion by 2033.

The market is driven by urban migration, expanding infrastructure projects, and rising demand for residential and commercial spaces. Lifestyle changes, a preference for modern amenities, and interest from both domestic and foreign investors are shaping development. Middle-income housing, tourism-linked properties, and mixed-use projects are gaining traction in cities with strong economic and transport connectivity.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)