Thailand Seeds Market Size, Share, Trends and Forecast by Type, Seed Type, Traits, Availability, Seed Treatment, and Region, 2026-2034

Thailand Seeds Market Overview:

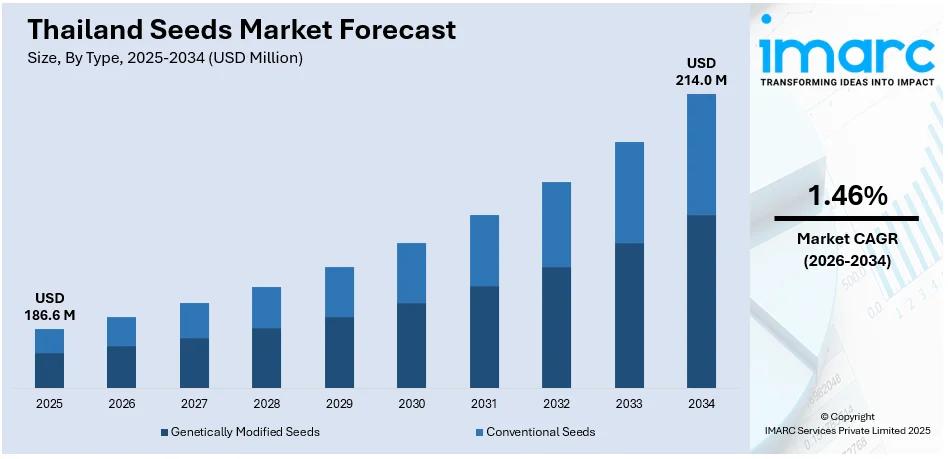

The Thailand seeds market size reached USD 186.6 Million in 2025. The market is projected to reach USD 214.0 Million by 2034, exhibiting a growth rate (CAGR) of 1.46% during 2026-2034. The market is advancing through a growing emphasis on sustainable agriculture and improved crop performance. Key trends include expanding use of hybrid and treated seeds, development of traits like pest and disease resistance, and diversification across essential crop types such as rice, maize, and vegetables. Regional concerns, from monsoon variability to soil conditions, influence seed preferences and adoption practices. Continued innovation and market development are projected to bolster the Thailand seeds market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 186.6 Million |

| Market Forecast in 2034 | USD 214.0 Million |

| Market Growth Rate 2026-2034 | 1.46% |

Thailand Seeds Market Trends:

Advancement of Seed Health Infrastructure

In January 2024, Thailand’s Department of Agriculture extended laboratory accreditation to test for seven regulated pests, setting a new benchmark in seed health management. The expanded scope reinforces the country’s phytosanitary system and helps ensure seed purity and disease-free certification. Seed health testing, now aligned with International Standards for Phytosanitary Measures, allows authorities to issue reliable certificates, and provides farmers with greater confidence when selecting seed batches. The public and private sectors continue refining protocols in seed inspection, quarantine processes, and documentation, helping to modernise the seed sector’s institutional framework. This infrastructure supports consistent seed quality across vegetable and diverse crop varieties adapted to Thailand’s tropical conditions. As accreditation becomes more widely accepted by distributors and export partners, the domestic seed industry becomes increasingly competitive. This institutional precision supports improved traceability and meets expectations for reputable seed trade. Together, these quality assurance improvements are essential to Thailand seeds market trends by embedding verified seed integrity into routine transactions and laying strong foundations for future Thailand seeds market growth.

To get more information on this market Request Sample

Scaling Community‑Level Seed Distribution

In January 2025 Thailand’s Ministry of Agriculture unveiled plans to establish 4,985 community rice seed centres during that calendar year, engaging approximately 150,000 farming households. These local hubs are designed to produce quality rice seed at community level and strengthen farmer networks. Each centre supports seed multiplication, preliminary quality checks and distribution under certified protocols. Working alongside volunteer farmers, they foster peer‑to‑peer learning and ensure supply matches local varietal needs. This decentralised model expands access to certified seeds across rural zones and helps to align production with agro-climatic variation. By engaging farmers directly in seed production and testing, the initiative encourages greater transparency and market trust. The centres’ scale enables rapid expansion of certified seed usage and fosters resilience by embedding seed governance at ground level. As these centres multiply, seed availability increases while distribution channels shorten, reducing dependency on centralised sources. This structure enhances both supply chain reach and alignment with regional demand. The networked system underscores how Thailand seeds market growth is anchored in scalable, inclusive seed delivery models.

Investing in Biotech and Regional Seed Leadership

In January 2025, Thailand’s Agriculture Ministry announced development of genome editing as a core tool to position the country as an ASEAN seed innovation hub. Programs now include research on rice, sugarcane and palm varieties enhanced for disease resistance and adaptability to stress‑prone soils. Leveraging genome editing, Thailand seeks to modernise its seed breeding systems while meeting rising regional demand for resilient crop materials. Simultaneously, crop breeding workshops and regulatory dialogues are supporting institutional readiness for new variety release frameworks. The launch of the Soniva seed initiative further broadens access for small-scale farmers across Southeast Asia, offering genetically diverse and locally adapted seed options for vegetables like chili, tomato and squash. Through these coordinated efforts, Thailand is solidifying its role beyond domestic production: it seeks to serve neighbouring markets with advanced seed biology and effective outreach. This multifaceted approach combines biotech investment, regulatory modernization and stakeholder engagement to accelerate innovation. It reflects an ambition to lead regionally in seed development.

Thailand Seeds Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, seed type, traits, availability, and seed treatment.

Type Insights:

- Genetically Modified Seeds

- Conventional Seeds

The report has provided a detailed breakup and analysis of the market based on the type. This includes genetically modified seeds and conventional seeds.

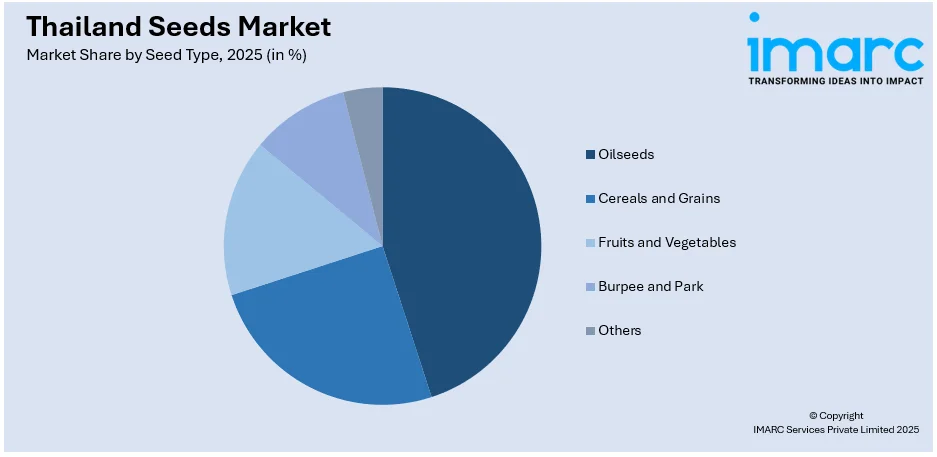

Seed Type Insights:

Access the comprehensive market breakdown Request Sample

- Oilseeds

- Soybean

- Sunflower

- Cotton

- Canola/Rapeseed

- Cereals and Grains

- Corn

- Wheat

- Rice

- Sorghum

- Fruits and Vegetables

- Tomatoes

- Lemons

- Brassica

- Pepper

- Lettuce

- Onion

- Carrot

- Burpee and Park

- Others

A detailed breakup and analysis of the market based on the seed type have also been provided in the report. This includes oilseeds (soybean, sunflower, cotton, and canola/rapeseed), cereals and grains (corn, wheat, rice, and sorghum), fruits and vegetables (tomatoes, lemons, brassica, pepper, lettuce, onion, and carrot), burpee and park, and others.

Traits Insights:

- Herbicide-Tolerant (HT)

- Insecticide-Resistant (IR)

- Others

The report has provided a detailed breakup and analysis of the market based on the traits. This includes herbicide-tolerant (HT), insecticide-resistant (IR), and others.

Availability Insights:

- Commercial Seeds

- Saved Seeds

A detailed breakup and analysis of the market based on the availability have also been provided in the report. This includes commercial seeds and saved seeds.

Seed Treatment Insights:

- Treated

- Untreated

The report has provided a detailed breakup and analysis of the market based on the seed treatment. This includes treated and untreated.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Seeds Market News:

- March 2025: Thailand-based KPAGRO and Advanta Seeds have inaugurated a state-of-the-art sweet corn seed drying facility in Lopburi, marking a significant milestone in their 19-year partnership. This facility enhances Thailand's position as a global hub for tropical sweet corn seed production, supporting exports to over 34 countries. Equipped with advanced technologies such as automated intake systems, centralized heating stack drying, and SCADA-controlled monitoring, the facility ensures high-quality seed processing to meet growing domestic and international demand.

Thailand Seeds Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Genetically Modified Seeds, Conventional Seeds |

| Seed Types Covered |

|

| Traits Covered | Herbicide-Tolerant (HT), Insecticide-Resistant (IR), Others |

| Availabilities Covered | Commercial Seeds, Saved Seeds |

| Seed Treatments Covered | Treated, Untreated |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand seeds market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand seeds market on the basis of type?

- What is the breakup of the Thailand seeds market on the basis of seed type?

- What is the breakup of the Thailand seeds market on the basis of traits?

- What is the breakup of the Thailand seeds market on the basis of availability?

- What is the breakup of the Thailand seeds market on the basis of seed treatment?

- What is the breakup of the Thailand seeds market on the basis of region?

- What are the various stages in the value chain of the Thailand seeds market?

- What are the key driving factors and challenges in the Thailand seeds market?

- What is the structure of the Thailand seeds market and who are the key players?

- What is the degree of competition in the Thailand seeds market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand seeds market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand seeds market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand seeds industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)