Thailand Shrimp Market Size, Share, Trends and Forecast by Environment, Species, Shrimp Size, Distribution Channel, and Region, 2025-2033

Thailand Shrimp Market Size and Share:

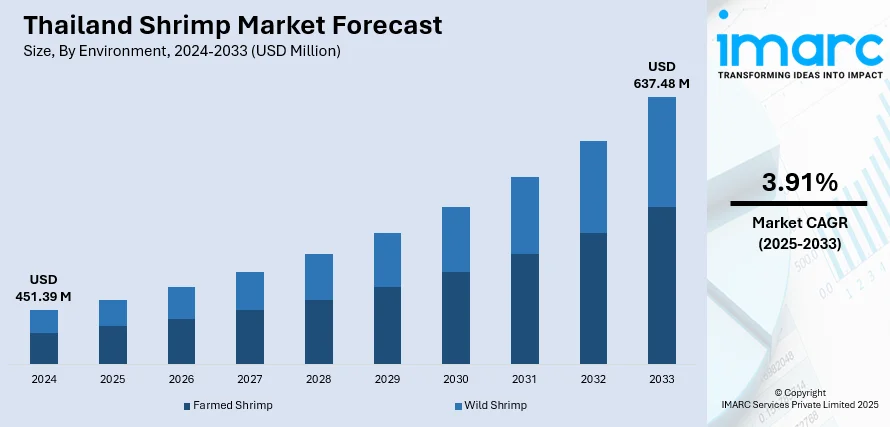

The Thailand shrimp market size reached USD 451.39 Million in 2024. The market is projected to reach USD 637.48 Million by 2033, exhibiting a growth rate (CAGR) of 3.91% during 2025-2033. The market growth is attributed to the rising demand for seafood, expanding shrimp farming activities, advancements in aquaculture technology, supportive government policies, increasing exports to major markets, and growing consumer preference for protein-rich diets.

Market Insights:

- Based on region, the market is divided into Bangkok, Eastern, Northeastern, Southern, Northern, and others.

- On the basis of environment, the market is segmented into farmed shrimp and wild shrimp.

- Based on the species, the market is categorized as Penaeus vannamei, Penaeus monodon, Macrobrachium rosenbergii, and others.

- On the basis of shrimp size, the market is segmented into <21, 21-25, 26-30, 31-40, 41-50, 51-60, 61-70, and >70.

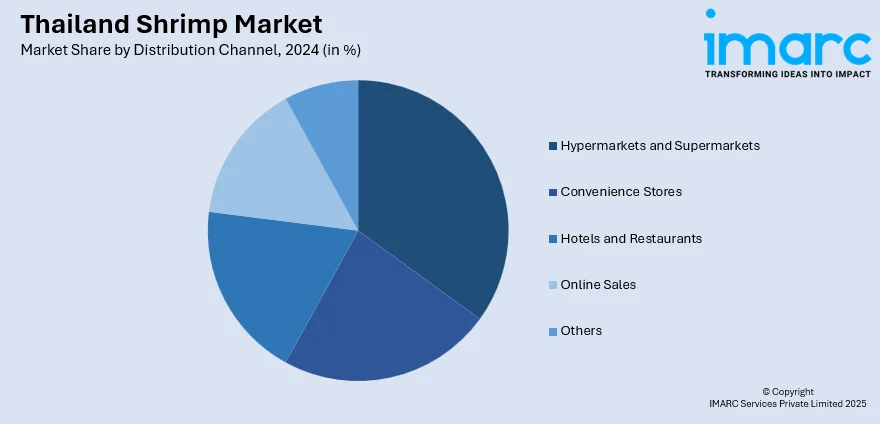

- Based on the distribution channel, the market is categorized as hypermarkets and supermarkets, convenience stores, hotels and restaurants, online sales, and others.

Market Size and Forecast:

- 2024 Market Size: USD 451.39 Million

- 2033 Projected Market Size: USD 637.48 Million

- CAGR (2025-2033): 3.91%

Thailand Shrimp Market Trends:

Overseas Orders Drive Steady Sales

Thailand shrimp market growth has stayed firm due to stable demand in key export destinations and solid support at home. Shrimp from Thailand continues to see strong orders from the US, Japan, and European markets, which has helped producers bounce back from earlier disease issues and supply dips. Hatcheries have improved breeding stock and water filtration, giving farmers healthier young shrimp. Feed makers now supply feeds that cut down disease risks and support better growth, which is augmenting the Thailand shrimp market share. Many farms have put stronger checks in place to tackle problems like early mortality, which once caused heavy losses. Exporters have locked in supply deals with large supermarket chains and restaurant brands to keep shipments moving. Processing plants have added new freezing systems and packaging lines to keep shrimp fresh longer. Producers have also pushed out easy-cook products like frozen breaded shrimp and seasoned packs for international stores. These changes help Thailand remain a reliable source of premium shrimp. New training projects for farm workers have helped reduce antibiotic use and protect pond health. All these steps mean more consistent supply and better quality, which keeps Thailand well-placed to serve buyers looking for safe and dependable shrimp at stable prices.

To get more information of this market, Request Sample

Greener Practices Lift Local Farms

More Thai shrimp farms have been moving to cleaner ways of working to avoid harming local land and waterways. Farmers have started using safer pond chemicals and recycling pond water to cut pollution. Industry groups and officials now check that farms do not overuse land or discharge untreated waste. Recently, many farms added better aerators and water cleaning equipment to improve water flow and keep shrimp healthy. Some farmers switched to solar pumps and small biogas units to reduce fuel costs and energy use. Independent checks for international eco-labels have grown more common, helping exporters prove their shrimp comes from careful, responsible farms. Buyers in Europe and North America often prefer this, so exporters highlight these improvements to build trust. Small farms are joining groups to share storage and transport, which keeps shrimp fresh until delivery. Feed producers are trying new mixes using plant-based proteins to reduce how much wild fish they need. Better shipping and cold chain steps help limit spoilage during export. By updating daily work and investing together, farms across Thailand are keeping supply steady and meeting rising demand for shrimp that is grown with care for the environment and long-term local jobs.

Rising Technology Integration in Shrimp Farming

The market is increasingly making use of technology to enhance productivity, cut costs, and improve quality control. Farms are embracing automated feeding systems, water monitoring sensors, and artificial intelligence-driven disease detection tools to maximize farming efficiency. Moreover, such technologies allow pond conditions to be tracked in real-time, making farmers able to regulate optimal water parameters and prevent the risk of mass mortalities. This, in turn, is enhancing the Thailand shrimp market outlook. Precision farming methods, backed by data analysis, are also employed to predict yields and align stocking densities for improved profitability. Furthermore, blockchain-based traceability platforms are also becoming popular, providing end-to-end traceability from farm to plate and increasing confidence in product authenticity. Government programs and private investment are fueling the digitization of aquaculture through capacity-building programs and subsidies to adopt technologies. This technological integration is allowing Thai shrimp farmers to become more efficient in operation, achieve strict export requirements, and compete better in a market that is increasingly shaped by the requirements of quality, sustainability, and transparency.

Growth Drivers of the Thailand Shrimp Market:

The market is steadily growing due to its export focus, sophisticated aquaculture facilities, and product quality focus. According to the Thailand shrimp market forecast, the country’s decades of expertise in shrimp farming and processing, combined with adherence to stringent international safety and sustainability standards, continue to position it as a global leader in the industry. Moreover, increasing world demand for protein-rich seafoods, especially in high-value markets like the United States, Japan, and the European Union, continues to spur production growth. Also, developments in technology, like automated feeding, AI-based monitoring, and disease prevention systems, continue to enhance yields and lower the costs of operations. Additionally, the expanding market for value-added shrimp products, including ready-to-eat and seasoned types, is allowing Thai exporters to gain increased profit margins. Government assistance through research programs, disease management initiatives, and facilitation of trade further enhances the competitiveness of the industry, making Thailand a leader in sustainable and innovation-based shrimp production.

Opportunities in the Thailand Shrimp Market:

The shrimp market in Thailand offers opportunities in sustainable aquaculture, premium product creation, and penetration of emerging markets. As consumer concern about responsible sourcing increases, shrimp labeled under sustainability programs like ASC and BAP can also fetch premium prices in world markets. There is an increased potential for growth in value-added products, ranging from ready-to-cook, marinated, to frozen, targeting convenience-oriented consumer trends. Besides that, e-commerce websites and direct-to-consumer seafood delivery services provide Thai producers with new sales channels, lessening dependence on conventional distribution systems. Moreover, rising demand from new markets in emerging Asian and Middle Eastern economies offers the potential to expand export markets beyond the conventional markets. New technologies in agricultural practices, like precision feeding, AI-driven monitoring, and blockchain-based traceability, also add to competitiveness. Strategic positioning, in combination with branding stories about quality, source, and sustainability, has the potential to reinforce Thailand's position as a quality shrimp supplier in the changing global seafood marketplace.

Challenges in the Thailand Shrimp Market:

Despite its strengths, according to the Thailand shrimp market research report, market faces challenges related to disease outbreaks, fluctuating production costs, and intense international competition. Diseases such as Early Mortality Syndrome (EMS) and White Spot Syndrome Virus (WSSV) can cause significant yield losses, requiring continuous investment in biosecurity and farm management. Furthermore, rising feed prices, energy costs, and labor shortages also place pressure on profit margins, especially for small-scale farmers. Compliance with increasingly strict sustainability and traceability requirements in key export markets adds operational complexity and costs. Moreover, competition from other shrimp-producing nations such as India, Vietnam, and Ecuador is intensifying, often driven by lower production costs and aggressive market expansion strategies. Climate change impacts, including irregular rainfall and rising sea temperatures, further threaten farming stability. Navigating these challenges demands coordinated efforts between government bodies, industry associations, and producers to strengthen disease resilience, enhance cost efficiency, and maintain Thailand’s competitive edge in the global shrimp industry.

Thailand Shrimp Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on environment, species, shrimp size, and distribution channel.

Environment Insights:

- Farmed Shrimp

- Wild Shrimp

The report has provided a detailed breakup and analysis of the market based on the environment. This includes farmed shrimp and wild shrimp.

Species Insights:

- Penaeus Vannamei

- Penaeus Monodon

- Macrobrachium Rosenbergii

- Others

The report has provided a detailed breakup and analysis of the market based on the species. This includes penaeus vannamei, penaeus monodon, macrobrachium rosenbergii, and others.

Shrimp Size Insights:

- <21

- 21-25

- 26-30

- 31-40

- 41-50

- 51-60

- 61-70

- >70

The report has provided a detailed breakup and analysis of the market based on the shrimp size. This includes <21, 21-25, 26-30, 31-40, 41-50, 51-60, 61-70, and >70.

Distribution Channel Insights:

- Hypermarkets and Supermarkets

- Convenience Stores

- Hotels and Restaurants

- Online Sales

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hypermarkets and supermarkets, convenience stores, hotels and restaurants, online sales, and others.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Shrimp Market News:

- May 2025: The Asian Development Bank (ADB) and Thai Union Group Public Company Limited finalized a USD 150 Million “blue loan”, designed to bolster sustainable shrimp production practices. The loan comprises an A-Loan from ADB and a B-Loan syndicated with several commercial banks, and will support Thai Union’s expansion of sustainably sourced, certified shrimp in alignment with its SeaChange 2030 sustainability strategy. ADB highlighted that this initiative not only advances environmental and social responsibility across the shrimp supply chain but also serves as a pioneering model for sustainable seafood finance in Thailand.

- May 2025: Thai Union Feedmill launched the Shrimp Decarbonization Project to cut shrimp farming emissions by up to thirty-five percent. This supported Thailand’s shrimp market by promoting cleaner feed, solar power use, and better farming methods, boosting access to premium export markets.

- December 2024: Sea Farms in Thailand installed Ace Aquatec’s portable in-water stunning system through a partnership with the Shrimp Welfare Project. This step supported Thailand’s shrimp market by improving humane harvesting practices, raising welfare standards, and helping producers enhance supply chain quality and efficiency.

Thailand Shrimp Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Environments Covered | Farmed Shrimp, Wild Shrimp |

| Species Covered | Penaeus Vannamei, Penaeus Monodon, Macrobrachium Rosenbergii, Others |

| Shrimp Sizes Covered | <21, 21-25, 26-30, 31-40, 41-50, 51-60, 61-70, >70 |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Stores, Hotels and Restaurants, Online Sales, Others |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand shrimp market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand shrimp market on the basis of environment?

- What is the breakup of the Thailand shrimp market on the basis of species?

- What is the breakup of the Thailand shrimp market on the basis of shrimp size?

- What is the breakup of the Thailand shrimp market on the basis of distribution channel?

- What is the breakup of the Thailand shrimp market on the basis of region?

- What are the various stages in the value chain of the Thailand shrimp market?

- What are the key driving factors and challenges in the Thailand shrimp market?

- What is the structure of the Thailand shrimp market and who are the key players?

- What is the degree of competition in the Thailand shrimp market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand shrimp market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand shrimp market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand shrimp industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)