Thailand Sportswear Market Size, Share, Trends and Forecast by Product, Distribution Channel, End User, and Region, 2025-2033

Thailand Sportswear Market Overview:

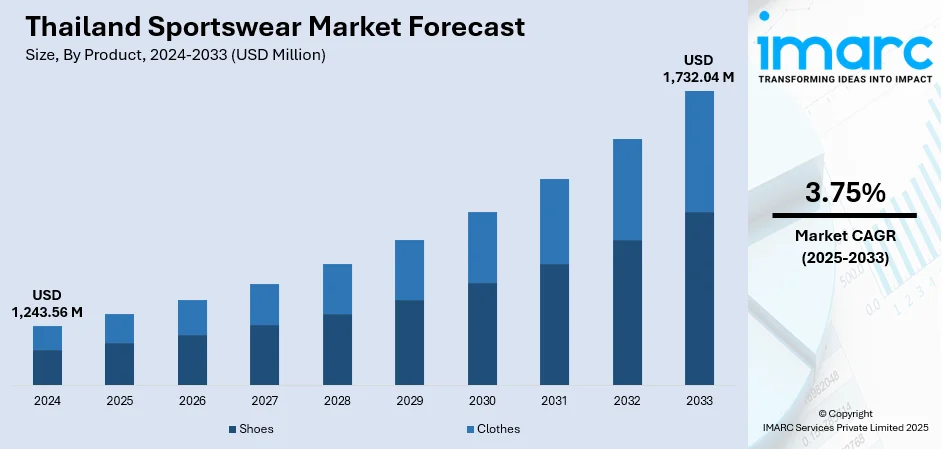

The Thailand sportswear market size reached USD 1,243.56 Million in 2024. Looking forward, the market is expected to reach USD 1,732.04 Million by 2033, exhibiting a growth rate (CAGR) of 3.75% during 2025-2033. The market is expanding rapidly, driven by growing health and wellness awareness, rising popularity of athleisure fashion, and increasing participation in sports and outdoor activities. Digital retail and seamless omnichannel strategies are also widening consumer access that is escalating the demand for sportswear across the country. Local and global brands are actively competing, further increasing the Thailand sportswear market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,243.56 Million |

| Market Forecast in 2033 | USD 1,732.04 Million |

| Market Growth Rate 2025-2033 | 3.75% |

Thailand Sportswear Market Trends:

Government-Backed Fitness and Wellness Initiatives

Thailand’s government has increasingly promoted health and wellness campaigns to combat lifestyle diseases and boost overall public health. Programs such as “Healthy Thailand” and national fitness drives encourage citizens to adopt active lifestyles, which, in turn, fuel demand for athletic apparel and gear. Communal gyms, sporting activities, and state marathons have incorporated exercise and recreation easily and economically. Through these programs, the consumption of sportswear is not only boosted, but consumer orientations are also affected to purchase more functional, breathable, and performance-oriented garments. As part of the initiatives of the states in manifesting towards the necessity of preventive healthcare, the sportswear market finds motion, specifically, it booms among modern urban folk as well as the middle-income population who become avid participants in the trend of preventive healthcare and actively contribute to it by spending more money on active wear and accessories.

To get more information on this market, Request Sample

Rising Influence of Athleisure and Urban Fashion Trends

In Thailand, the convergence of streetwear and sportswear has led to the rapid expansion of the athleisure trend. Consumers, particularly millennials and Gen Z, increasingly prefer versatile apparel that blends comfort, functionality, and style for both fitness and casual settings, which is a major factor driving the Thailand sportswear market growth. Influencers, local celebrities, and K-pop culture have contributed to popularizing sleek, brand-driven sportswear as a form of everyday expression. The shift toward hybrid lifestyles, combining work, fitness, and social engagement, further reinforces the demand for fashionable sportswear. Domestic and international brands are responding with capsule collections and limited-edition drops, accelerating market growth. This evolution of activewear into lifestyle attire is reshaping purchasing behavior and expanding the customer base beyond athletes and gym-goers.

Expanding E-commerce Ecosystem and Omni-channel Strategies

Thailand’s robust digital infrastructure and growing consumer comfort with online shopping are playing a vital role in driving sportswear sales. E-commerce platforms, social commerce, and brand-owned online stores offer convenient access to a wide variety of products, often paired with discounts, customization, and home delivery. Digital marketing campaigns, live-stream shopping events, and mobile-first experiences are attracting younger, tech-savvy consumers. Additionally, leading sportswear brands are adopting omnichannel strategies, seamlessly integrating online and offline touchpoints to enhance customer engagement. Virtual try-ons, click-and-collect options, and loyalty apps are improving user experience, encouraging repeat purchases. This digital transformation is not only boosting sales volumes but also enabling deeper brand penetration across Thailand’s urban and semi-urban markets.

Thailand Sportswear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, distribution channel, and end user.

Product Insights:

- Shoes

- Clothes

The report has provided a detailed breakup and analysis of the market based on the product. This includes shoes and clothes.

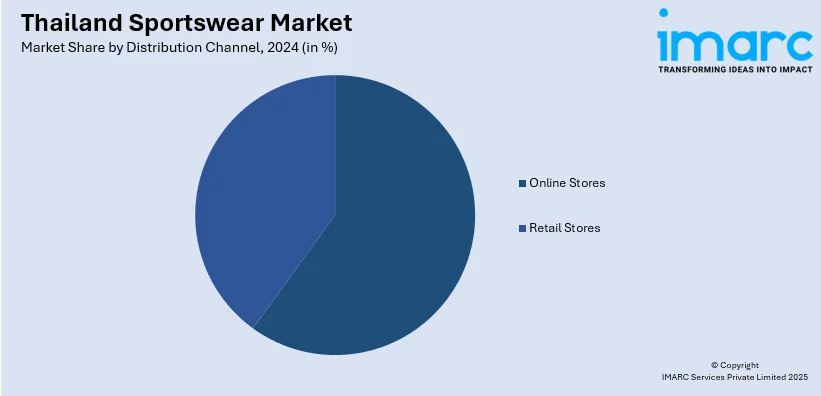

Distribution Channel Insights:

- Online Stores

- Retail Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online stores and retail stores.

End User Insights:

- Men

- Women

- Kids

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes men, women, and kids.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Sportswear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Shoes, Clothes |

| Distribution Channels Covered | Online Stores, Retail Stores |

| End Users Covered | Men, Women, Kids |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand sportswear market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand sportswear market on the basis of product?

- What is the breakup of the Thailand sportswear market on the basis of distribution channel?

- What is the breakup of the Thailand sportswear market on the basis of end user?

- What is the breakup of the Thailand sportswear market on the basis of region?

- What are the various stages in the value chain of the Thailand sportswear market?

- What are the key driving factors and challenges in the Thailand sportswear market?

- What is the structure of the Thailand sportswear market and who are the key players?

- What is the degree of competition in the Thailand sportswear market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand sportswear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand sportswear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand sportswear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)