Thailand Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2025-2033

Thailand Steel Tubes Market Overview:

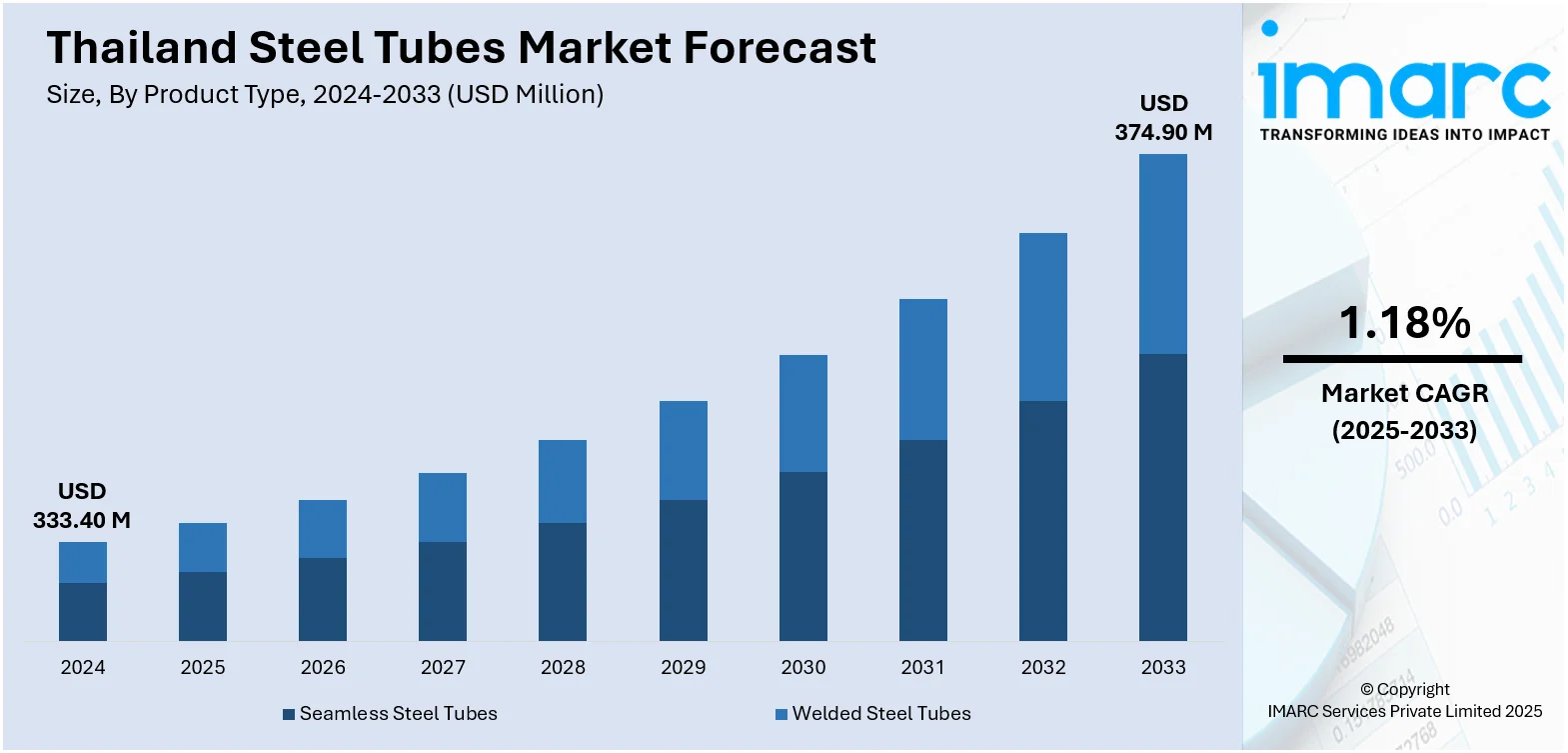

The Thailand steel tubes market size reached USD 333.40 Million in 2024. The market is projected to reach USD 374.90 Million by 2033, exhibiting a growth rate (CAGR) of 1.18% during 2025-2033. The market is experiencing consistent growth with rising demand in construction, automotive, and manufacturing industries. Technological advances in production processes and a trend towards lightweight, high-strength materials are further propelling the market growth. Leaders are emphasizing product innovation and strategic partnerships to consolidate their presence. The market is divided among types, applications, end-use industry, and geography, providing varied growth opportunities and investment options. These factors combine to form the changing environment of the Thailand steel tubes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 333.40 Million |

| Market Forecast in 2033 | USD 374.90 Million |

| Market Growth Rate 2025-2033 | 1.18% |

Thailand Steel Tubes Market Trends:

Infrastructure‑Driven Demand Revival

In January 2025, Thailand’s steel pipe exports reached a notable high in recent months, driven by rising regional demand and renewed project orders from ASEAN partners. The upswing in exports reflects not just recovery but growing confidence in the industry’s output capacity. Locally, the government’s infrastructure roadmap covering roads, rail, logistics hubs, and utilities is translating directly into steel tube demand. These tubes are essential for structural support, underground piping, and frame applications. Their versatility makes them a go to solution in both high-rise and civil projects. Meanwhile, domestic manufacturers are adjusting to meet higher demand from transport and energy developments across multiple provinces. Rather than spiking suddenly, demand has been climbing steadily, which indicates sustainable growth instead of a short-term spike. Thailand’s investment in logistics and public works is acting as a demand stabilizer. As project cycles stretch into the next two years, the Thailand steel tubes market growth is expected to align closely with these long-term infrastructure plans, building a more resilient pipeline of opportunities for suppliers and fabricators alike.

To get more information on this market, Request Sample

Eco‑Friendly Manufacturing Gains Ground

In May 2025, the Federation of Thai Industries announced a projected rise in national steel consumption, reinforcing a broader sentiment of cautious optimism across the manufacturing sector. As the market recovers, conversations have shifted toward sustainability and carbon-conscious sourcing. Steel tube producers are no longer only competing on cost or quality environmental footprints that are now part of the equation. There’s rising pressure from downstream buyers, especially in construction and infrastructure, to verify cleaner steel origins. That’s pushing domestic mills and tube fabricators to invest in low-emission production processes and greener logistics. This transition isn’t dramatic but is quietly gaining traction through internal policy changes and updated production standards. Increased uptake of recycled steel and energy-efficient welding processes is becoming more visible in procurement specs. In short, market players are responding with practical adjustments rather than wholesale reinvention. This realignment is shaping new buyer behavior and driving investment decisions. As these shifts continue, Thailand steel tubes market trends are reflecting a growing preference for sustainability not as a niche concern, but as a new baseline expectation in the procurement cycle.

Export Markets Show Consistent Recovery

In March 2024, customs data showed a significant spike in Thailand’s exports of steel pipes, tubes, and hollow profiles. This wasn’t just a seasonal shift it marked a rebound in Thailand’s trade performance after several slower quarters. Neighboring countries such as Vietnam, Malaysia, and Indonesia have increased their import volumes, turning to Thai suppliers due to cost stability, better lead times, and consistent product quality. Exporters are taking advantage of regional trade pacts and easing logistics bottlenecks. That’s creating a more favorable environment for scaling output, especially for mid-sized producers with the agility to serve international orders without major delays. With global buyers increasingly interested in diversifying sourcing away from traditional heavyweights, Thailand is emerging as a trusted partner. This is less about market expansion and more about strategic positioning within the regional supply chain. As such, the Thailand steel tubes market is being meaningfully reinforced by this steady recovery in exports setting a foundation not just for volume increases, but for stronger, long-term buyer relationships abroad.

Thailand Steel Tubes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

The report has provided a detailed breakup and analysis of the market based on the product type. This includes seamless steel tubes and welded steel tubes.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes carbon steel, stainless steel, alloy steel, and other.

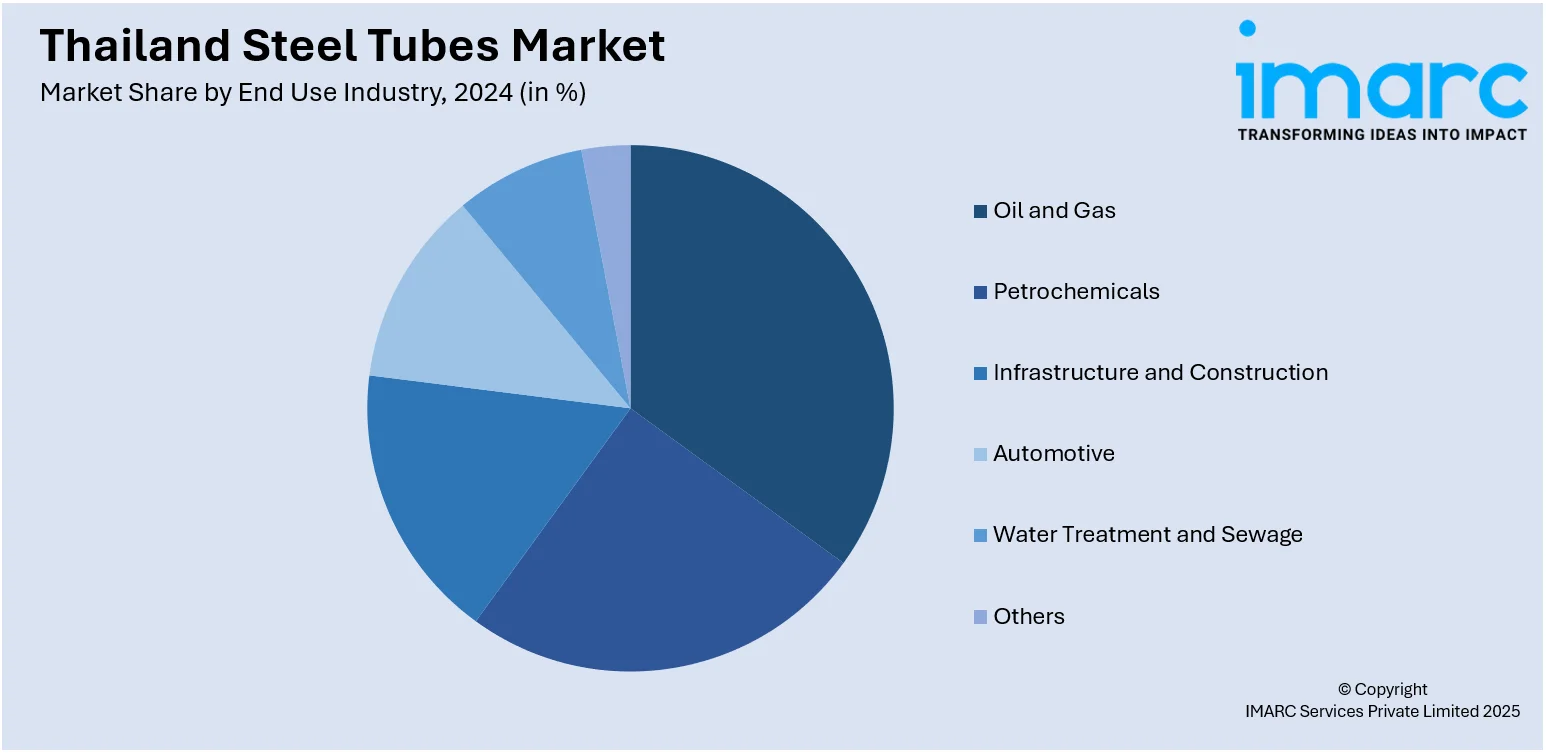

End Use Industry Insights:

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes oil and gas, petrochemicals, infrastructure and construction, automotive, water treatment and sewage, and others.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include the Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Steel Tubes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Types Covered | Carbon Steel, Stainless Steel, Alloy Steel, Other |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand steel tubes market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand steel tubes market on the basis of product type?

- What is the breakup of the Thailand steel tubes market on the basis of material type?

- What is the breakup of the Thailand steel tubes market on the basis of end use industry?

- What is the breakup of the Thailand steel tubes market on the basis of region?

- What are the various stages in the value chain of the Thailand steel tubes market?

- What are the key driving factors and challenges in the Thailand steel tubes market?

- What is the structure of the Thailand steel tubes market and who are the key players?

- What is the degree of competition in the Thailand steel tubes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand steel tubes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand steel tubes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand steel tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)