Thailand Used Cooking Oil Market Size, Share, Trends and Forecast by Source, Application, and Region, 2025-2033

Thailand Used Cooking Oil Market Overview:

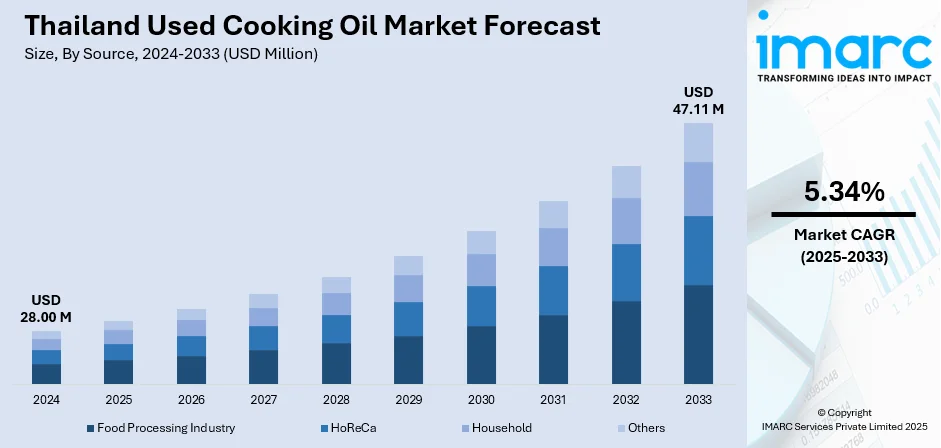

The Thailand used cooking oil market size reached USD 28.00 Million in 2024. The market is projected to reach USD 47.11 Million by 2033, exhibiting a growth rate (CAGR) of 5.34% during 2025-2033. As airlines and fuel companies are collaborating on reducing their carbon footprint, the value of used cooking oil as a critical input continues to rise, reinforcing its role in the sustainable ecosystem. Besides this, the broadening of e-commerce portals is contributing to the expansion of the Thailand used cooking oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 28.00 Million |

| Market Forecast in 2033 | USD 47.11 Million |

| Market Growth Rate 2025-2033 | 5.34% |

Thailand Used Cooking Oil Market Trends:

Growing demand for sustainable aviation fuel (SAF)

Rising demand for SAF is supporting the market growth in Thailand. SAF, derived from waste-based feedstocks like used cooking oil, offers lower lifecycle greenhouse gas emissions compared to conventional jet fuel. Thailand, with its extensive foodservice sector, generates a substantial volume of used cooking oil, making it a valuable source for SAF production. This demand is encouraging systematic collection and recycling practices, turning waste oil into a commercially viable resource. Moreover, the growing investments in sustainable fuel refining infrastructure are creating the need for feedstock security, leading to increased procurement of used cooking oil from restaurants, hotels, and food factories. In December 2024, UOB Thailand provided loans totaling 5 Billion Baht to Bangchak Corporation PCL and 1.5 Billion Baht to BSGF Co., Ltd. under its Transition Finance Framework to support the construction, development, and working capital for Thailand’s inaugural sustainable aviation fuel (SAF) project. The initiative aimed to create SAF from used cooking oil, signifying an important step in the nation’s shift towards renewable energy options. Export opportunities are also emerging, with Thailand positioned to supply used cooking oil to international sustainable aviation fuel producers. Additionally, government support for green aviation and renewable energy is strengthening the market by promoting circular economy practices. As airlines and fuel companies are collaborating on reducing their carbon footprint, the value of used cooking oil as a critical input continues to rise, reinforcing its role in a sustainable energy future.

To get more information on this market, Request Sample

Broadening of e-commerce portals

The expansion of e-commerce portals is bolstering the Thailand used cooking oil market growth. With the rising number of digital platforms and food delivery services, more restaurants, food vendors, and home-based kitchens are joining online networks, leading to increased oil usage and, consequently, greater generation of used cooking oil. E-commerce platforms also facilitate the collection and resale of used cooking oil by connecting small-scale sellers with large-scale recyclers, biodiesel producers, and waste management firms. This digital connectivity is enhancing transparency in pricing and encouraging responsible disposal practices. Furthermore, online awareness campaigns and easy-to-use mobile applications are promoting the environmental and economic benefits of recycling used cooking oil, leading to greater participation across households and commercial kitchens. The logistical capabilities of e-commerce platforms enable timely pickups and better tracking of used cooking oil flow, improving efficiency across the supply chain. As the e-commerce channels continue to expand in Thailand, it is providing a streamlined, scalable ecosystem that supports the growth of the used cooking oil market while promoting sustainability and circular economy practices. As per IMACR Group, the Thailand e-commerce market is set to attain USD 1,156.38 Billion by 2033, exhibiting a growth rate (CAGR) of 26.85% during 2025-2033.

Thailand Used Cooking Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source and application.

Source Insights:

- Food Processing Industry

- HoReCa

- Household

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes food processing industry, HoReCa, household, and others.

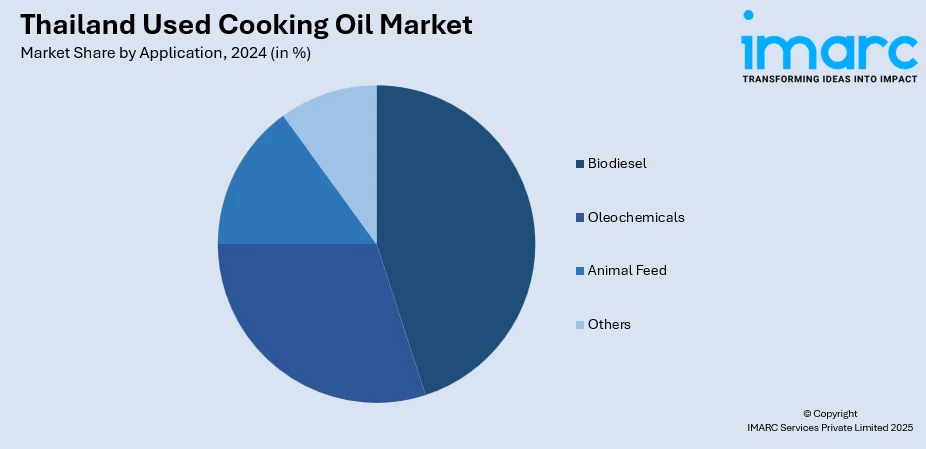

Application Insights:

- Biodiesel

- Oleochemicals

- Animal Feed

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes biodiesel, oleochemicals, animal feed, and others.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Used Cooking Oil Market News:

- In April 2025, Bangchak Group inaugurated Thailand’s first SAF production unit at the Phra Khanong Refinery. The facility was able to produce 100% neat SAF at scale, representing a significant milestone in the nation's clean energy development. Utilizing ‘Hydroprocessed Esters and Fatty Acids (HEFA)’ technology, it converted waste cooking oil and various fatty acid feedstocks into aviation fuel that could meet ASTM standards.

- In March 2025, Mr. Akanat Promphan, the Minister of Industry, led Thailand’s initiative to establish new economic drivers by directing the Department of Industrial Promotion (DIPROM) to partner with Bangchak Corporation and five major business organizations to boost SAF production. This program concentrated on utilizing used cooking oil for SAF manufacturing, in accordance with the bio-circular-green (BCG) economy policy.

Thailand Used Cooking Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Food Processing Industry, HoReCa, Household, Others |

| Applications Covered | Biodiesel, Oleochemicals, Animal Feed, Others |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand used cooking oil market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand used cooking oil market on the basis of source?

- What is the breakup of the Thailand used cooking oil market on the basis of application?

- What is the breakup of the Thailand used cooking oil market on the basis of region?

- What are the various stages in the value chain of the Thailand used cooking oil market?

- What are the key driving factors and challenges in the Thailand used cooking oil market?

- What is the structure of the Thailand used cooking oil market and who are the key players?

- What is the degree of competition in the Thailand used cooking oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand used cooking oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand used cooking oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand used cooking oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)