Thailand Vegan Cosmetics Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Thailand Vegan Cosmetics Market Overview:

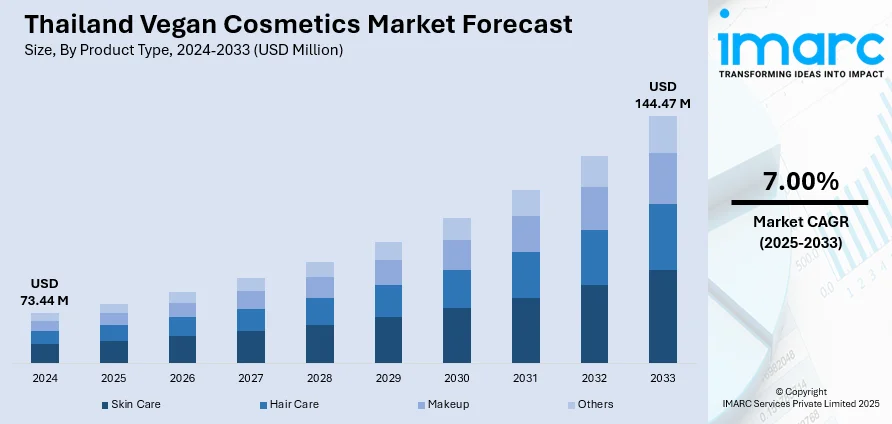

The Thailand vegan cosmetics market size reached USD 73.44 Million in 2024. Looking forward, the market is expected to reach USD 144.47 Million by 2033, exhibiting a growth rate (CAGR) of 7.00% during 2025-2033. The market is fueled by the synergy of cultural wellness practices, a healthy tourism industry, and an increasing need for environment-friendly products. Traditional ingredients found locally, including coconut oil, turmeric, lemongrass, and jasmine, are popularly incorporated in vegan products, embodying both heritage and sustainability. Social media influencers and digital platforms also drive demand, particularly among young, urban consumers looking for locally produced and ethical beauty products, which continue to have a positive effect on Thailand vegan cosmetics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 73.44 Million |

| Market Forecast in 2033 | USD 144.47 Million |

| Market Growth Rate 2025-2033 | 7.00% |

Thailand Vegan Cosmetics Market Trends:

Indigenous Botanicals and Holistic Thai Wellness Traditions

The vegan cosmetics market in Thailand is becoming more influenced by the country's vast tradition of traditional herbal wellness, derived from sources such as turmeric, lemongrass, coconut oil, tamarind, pandan, and Thai jasmine, and reimagined through vegan and cruelty‑free products. Local brands adopt centuries‑old Thai beauty knowledge, blending moisturizers, balms, and masks with botanical extracts utilized in ancient spa traditions with no animal‑derived additives. This combination of authenticity and contemporary vegan positioning strongly resonates with domestic consumers and overseas tourists looking for Thailand's singular botanical experience in responsible skincare. Numerous Thai vegan brands also leverage ingredients harvested from local farms or cooperatives, connecting product narratives to rural heritage and sustainable sourcing methods. By marrying the wellness of Thai spa culture with vegan purity and natural transparent practices, these brands establish a niche market identity. The result is a trend that is both culturally relevant and ethically ahead of its time, which is alluring to consumers who appreciate tradition, health, and plant‑based integrity.

To get more information on this market, Request Sample

Exposure and Destination Branding through Tourism in Vegan Cosmetics

Tourism in Thailand is a major driver of speeding up awareness and embracement of vegan cosmetics. Destinations such as Bangkok, Phuket, Chiang Mai, and Koh Samui are key beauty tourism destinations where tourists discover spa care, wellness retreats, and green resorts focusing on cruelty‑free, plant‑based products. This experience prompts both local consumers and repeat visitors to look for vegan cosmetic ranges with local exotic plant extracts such as tamarind extract, coconut milk, jasmine rice bran oil and Andaman seaweed. Luxury spa brands and boutique hotels now introduce signature vegan skincare packages, drawing visitors to look for similar products on the internet or in specialty stores when they return home. By gaining exposure via experiential retail and destination marketing, such brands create word-of-mouth and social media anticipation that carries over to mainstream awareness. Thai vegan brands labeled around destination authenticity like "jasmine water from Chiang Mai," "coconut oil from Koh Samui", serve to further cement the connection between national identity, tourism allure, and plant‑based beauty trends, bolstering regional differentiation in the Thailand vegan cosmetics market growth.

Digital Retail Ecosystem, Eco-Conscious Millennials, and Influencer Synergy

The development of the vegan cosmetics industry in Thailand is highly underpinned by urban millennials and Gen Z consumers who are digitally native, green‑conscious, and socially aware. Shopee, Lazada, LINE and Instagram are key platforms for learning about new ethical beauty brands, frequently via influencer marketing and well‑curated digital pop‑ups. Thai influencers and beauty content creators showcase vegan skincare routines featuring coconut-based cleansers, herbal clay masks, and plant-derived sunscreen alternatives, sharing behind‑the‑scenes sourcing tales and ethical production messages. Brands emphasize clean formulations, eco-packaging solutions like biodegradable tubes or reusable glass jars, and Thai botanical sourcing as part of each product story. Social media efforts typically promote the union of Bangkok's contemporary beauty culture with rural wellness customs, presenting products as high‑quality, ethical, and culturally true. Digital retail infrastructure, eco‑conscious youth, and influencer narratives combined give rise to small Thai vegan cosmetics businesses to expand nationally and drive a larger shift towards plant‑based beauty in Thailand's multicultural cosmetic market.

Thailand Vegan Cosmetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Skin Care

- Hair Care

- Makeup

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes skin care, hair care, makeup, and others.

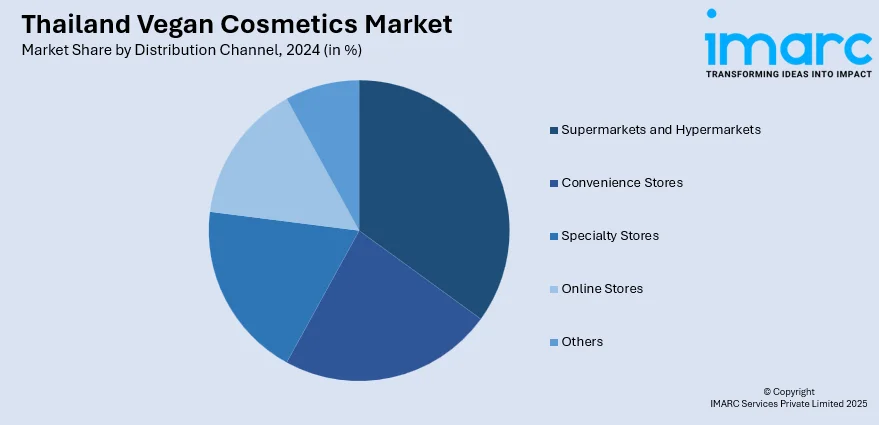

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Vegan Cosmetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Skin Care, Hair Care, Makeup, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand vegan cosmetics market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand vegan cosmetics market on the basis of product type?

- What is the breakup of the Thailand vegan cosmetics market on the basis of distribution channel?

- What is the breakup of the Thailand vegan cosmetics market on the basis of region?

- What are the various stages in the value chain of the Thailand vegan cosmetics market?

- What are the key driving factors and challenges in the Thailand vegan cosmetics market?

- What is the structure of the Thailand vegan cosmetics market and who are the key players?

- What is the degree of competition in the Thailand vegan cosmetics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand vegan cosmetics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand vegan cosmetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand vegan cosmetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)