Thailand Watch Market Size, Share, Trends and Forecast by Type, Price Range, Distribution Channel, End User, and Region, 2026-2034

Thailand Watch Market Overview:

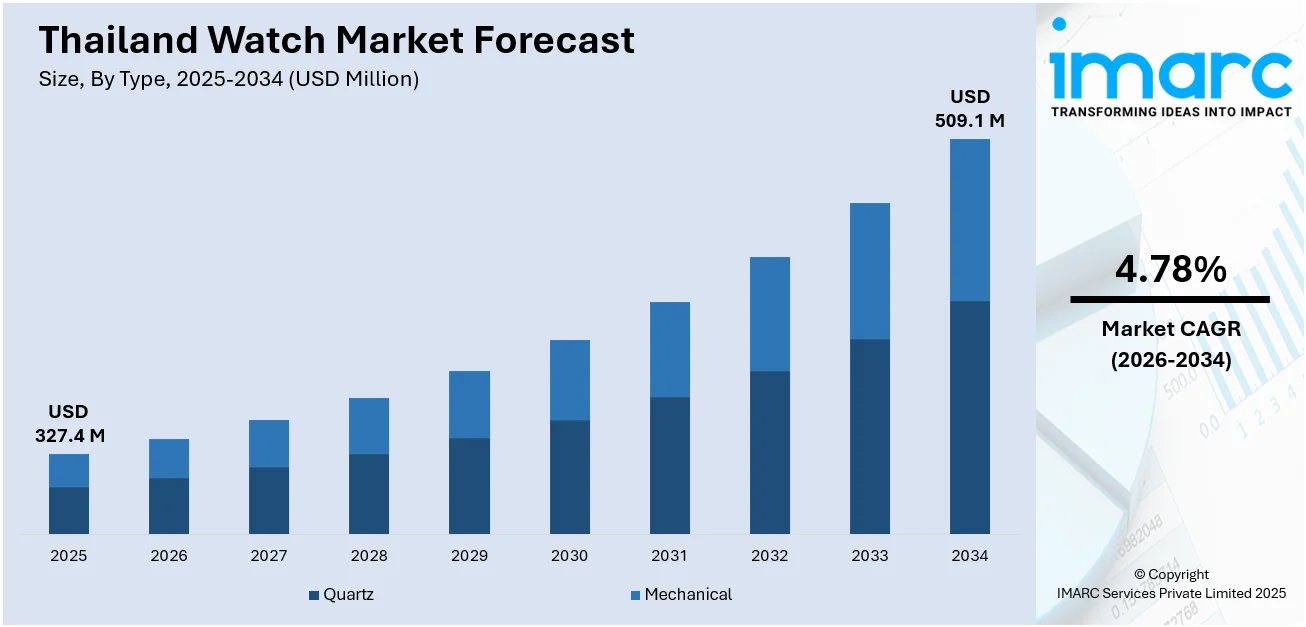

The Thailand watch market size reached USD 327.4 Million in 2025. The market is projected to reach USD 509.1 Million by 2034, exhibiting a growth rate (CAGR) of 4.78% during 2026-2034. The market is driven by rising disposable incomes, a growing middle-class population, and increasing demand for premium and smartwatches. Youth interest in fashion accessories and brand-consciousness further boost market growth. E-commerce platforms and social media influence are also expanding consumer reach and engagement. Local and international brands are capitalizing on personalization trends and heritage-inspired designs to gain traction in the competitive Thailand watch market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 327.4 Million |

| Market Forecast in 2034 | USD 509.1 Million |

| Market Growth Rate 2026-2034 | 4.78% |

Thailand Watch Market Trends:

Luxury Watch Retail Expansion

The high-end watches segment in Thailand is seeing significant growth, with the development of elite retail facilities dedicated to serving high-end consumers. One such instance is the launch of Timevallée at King Power Rangnam in March 2025, an upscale watches retail center that offers an unparalleled shopping experience. The new retail facility represents a prime index of Thailand's fast-growing demand for high-end watches. With the increasing number of affluent consumers in Thailand, especially in Bangkok, the market for luxury watches has risen sharply. Timevallée is likely to be a trendsetter for further luxury watch retail expansion. The personalized experience emphasis, including customized watch consultations and private showings, offered by the brand is ideal for the sophisticated buyer. Retail facilities like Timevallée accommodate a new breed of luxury consumers who not only place an emphasis on the product but also the experience and exclusivity that comes with it. Such retail developments are an example of the larger trend towards selective retail spaces and are a key driver of Thailand watch market growth.

To get more information on this market Request Sample

Sustainability Inspires Watch Design

Sustainability is increasingly becoming an integral value in the luxury watch industry, especially now that brands are starting to include eco-friendly materials in their products. One example is Patek Philippe's 2025 Grand Complications collection launched in April 2025, which will use environmentally friendly materials and innovative, energy-saving production methods. This reflects the global shift toward sustainability in the luxury industry. A part of this emerging trend, Thai consumers are now opting for watches that align with their green values, favoring brands that focus on sustainability in sourcing and production. Younger, environmentally aware consumers are getting more particular, expecting the environmental footprint of a product to be disclosed. Most watch brands now employ the use of recycled metals, biodegradable packages, and organic materials in their watches. This is exclusive to luxury segments and extends to mid-range watches, as sustainability also shapes a larger range of the market. In Thailand, with increasing environmental consciousness, this will be a major factor in future watch designs and hence a factor in Thailand watch market trends.

Rise of Private Watch Brands

Privately owned watch houses are fast taking center stage in Thailand's luxury watch sector, thanks to an increasing desire for exclusivity and bespoke craftsmanship. The "Big Four" of independent watchmaking, these watch houses specialize in limited-series collections and complex mechanical complications. Their popularity is particularly dominant among Thailand's emerging upper crust, who place high premium on luxury goods that celebrate individuality and prestige. With the growing number of affluent populations in the country, more consumers opt for exclusive watches instead of mass-produced luxury watches. Urban cities are particularly witnessing high demand for such exclusive watches, as status and personalization become key purchase drivers. Collectors and connoisseurs are increasingly fascinated by individual, hand-crafted watches with both artistic and technical brilliance. This change in consumer sentiment is transforming Thailand's luxury watch market, elevating private watchmakers as prime market players. In looking forward to 2025, this trend is likely to persist as private brands flourish on the need for quality, limited production, and the status symbol of having something uniquely unique.

Thailand Watch Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, price range, distribution channel, and end user.

Type Insights:

- Quartz

- Mechanical

The report has provided a detailed breakup and analysis of the market based on the type. This includes quartz and mechanical.

Price Range Insights:

- Low-Range

- Mid-Range

- Luxury

A detailed breakup and analysis of the market based on the price range have also been provided in the report. This includes low-range, mid-range, and luxury.

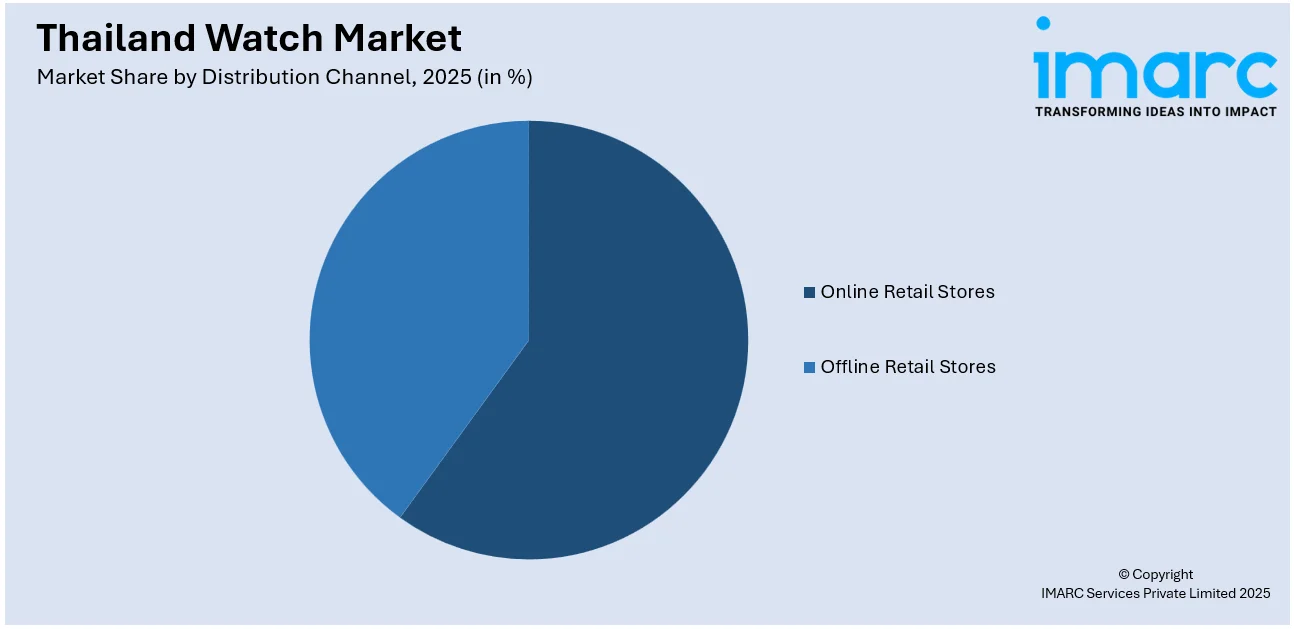

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online Retail Stores

- Offline Retail Stores

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online retail stores and offline retail stores.

End User Insights:

- Men

- Women

- Unisex

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes men, women, and unisex.

Regional Insights:

- Bangkok

- Eastern

- Northeastern

- Southern

- Northern

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Bangkok, Eastern, Northeastern, Southern, Northern, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Thailand Watch Market News:

- May 2025: Seiko made its year's signature watches official at the Seiko Watch Revelations 2025 event in Thailand, a landmark for the brand within the country. The event showcased Seiko's advancements in dive watch technology, aiming to engage Thailand's expanding luxury watch industry. Guests were treated to an early glimpse of Seiko's newest models, mirroring the brand's marriage of heritage and innovative design. This incident endorses Seiko's unwavering dedication to Thailand, again solidifying its footprint in the country's local watch sector.

- November 2024: Swiss luxury watches retailer TimeVallée opened its first Southeast Asian flagship boutique within King Power Rangnam in Bangkok. This 447-square-meter boutique boasts top brands such as Cartier, Jaeger-LeCoultre, and Vacheron Constantin, each being presented in individualistic settings to accentuate their craftsmanship. The boutique has a VIP salon called L'Atelier, providing customized services to collectors. This partnership with King Power represents an important milestone in taking TimeVallée's presence to greater heights in the region.

Thailand Watch Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Quartz, Mechanical |

| Price Ranges Covered | Low-Range, Mid-Range, Luxury |

| Distribution Channels Covered | Online Retail Stores, Offline Retail Stores |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | Bangkok, Eastern, Northeastern, Southern, Northern, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Thailand watch market performed so far and how will it perform in the coming years?

- What is the breakup of the Thailand watch market on the basis of type?

- What is the breakup of the Thailand watch market on the basis of price range?

- What is the breakup of the Thailand watch market on the basis of distribution channel?

- What is the breakup of the Thailand watch market on the basis of end user?

- What is the breakup of the Thailand watch market on the basis of the region?

- What are the various stages in the value chain of the Thailand watch market?

- What are the key driving factors and challenges in the Thailand watch market?

- What is the structure of the Thailand watch market and who are the key players?

- What is the degree of competition in the Thailand watch market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Thailand watch market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Thailand watch market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Thailand watch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the mark

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)